This guide reviews the best forex trading platforms in 2021 and 2023. We specifically talk about the importance of regulation, commissions, and tradable pairs – finishing with a simple walkthrough of how to sign up and start trading forex today.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

When trading a volatile asset such as forex, you will need a creditable broker to facilitate your access to this marketplace. Not to mention the added bonus of regulated platforms providing the option of leverage.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

There are hundreds of online forex brokers these days. Whether it’s lack of licensing, high fees, or a limited number of supported markets – it’s difficult to find a good all-rounder.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Forex Trading Platforms 2023 Reviewed

When researching the many brokers available in the online arena, we examine several key factors.

This includes:

- Fees and commissions

- Tier-1 regulatory standing

- Available forex pairs

- Trading tools on offer

- Platform usability and customer service

All of which we discuss in more detail after reviewing the best forex trading platforms in 2023 for your consideration.

1. AvaTrade – Best Forex Trading Platform With Plenty of Technical Analysis Tools

Like all of the other best forex trading platforms on our list, AvaTrade is regulated and offers heaps of assets. Available markets include stocks, cryptocurrencies, commodities, and forex. There are more than 50 different forex pairs to choose from at this platform, covering the aforementioned majors, minors, and exotics. Majors come with an average spread of 0.9 pips which is pretty competitive and all can be traded as CFDs, enabling short selling and potentially leverage.

AvaTrade is regulated across 6 jurisdictions. and authorized to operate in over 100 countries. As such, this forex trading platform offers multi-lingual support. Furthermore, the broker encourages people to trade with confidence by offering tools such as AvaProtect. This means that the broker will reimburse you for any losses made on trades when the end of your 'protected period' comes into play.

You can check out the details and fine print of this tool on the trading platform itself. When it comes to useful features it doesn't end there. This top-rated forex platform provides access to economic indicators and calculators, forex guides and tutorials, the 'rules' of buying and selling, technical strategies, and indicators. Moreover, if you want to use the native AvaTrade platform - there is no need to download software.

Instead, via your desktop browser, you can monitor your account, trade forex, and participate in social trading. The free demo account at AvaTrade comes loaded with $10,000 in virtual funds and can be used on both mobile and desktop. You can get started at AvaTrade with just $100 and fund your account with either a debit/credit card or a bank transfer. Furthermore, for new clients, AvaTrade is giving away a free forex trading strategies e-book!

- Achievable minimum deposit of $100

- Regulated in multiple countries

- Trade heaps of forex pairs commission-free

- Inactivity fees after 3 months no trading

2. Capital.com – Best Forex Trading Platform for Beginners

This newbie-friendly forex provider is packed to the rafters with CFDs across more than 3,000 different markets. This includes FX pairs from major currency sectors, such as GBP/USD, EUR/USD, and USD/JPY. You can also access exotics like AUD/TRY, ZAR/JPY, and MXN/JPY. We found that the pair USD/TRY comes with a competitive average spread of around 0.03 pips.

In fact, you will notice there is a good selection of exotics on offer here. Bear in mind due to the nature of the forex market, the price and spread of the respective pair will fluctuate almost constantly. Financial regulation comes from CySEC, FCA, ASIC, and NBRB so there is nothing to worry about with regard to safety. Furthermore, there is plenty of trading insight to be taken advantage of at Capital.com. This includes economic calendars, webinars, and various news and features.

You will also be able to utilize the 'Learn to Trade' suite, which is made up of trading lessons (including ones specific to forex), strategies, investment phycology, and a range of bite-sized trading tips. In particular, we like that the forex trading platform offers a free demo account. Like with the other forex trading platforms reviewed above, you are able to trade in real market conditions - but with demo funds.

There are 3 additional accounts available here, which include the 'Standard', 'Plus', and 'Premier'. Each comes with varying perks such as up to 1:30 leverage (location dependent), negative balance protection, advanced charts, a wide range of markets. The latter account is offered with premier events, exclusive webinars, and a dedicated account manager.

Signing up takes a matter of minutes, and the broker accepts payment types such as credit and debit cards, bank transfers, and e-wallets (depending on your jurisdiction). The minimum deposit at Capital.com is only $20 - which is perfect if this is your first time trading forex (minimum increased to $250 on bank wire deposits). Furthermore, you should find locating your desired currencies and placing orders a breeze as the site is so easy to navigate.

- Trade heaps of forex pairs commission-free

- Beginner friendly minimum deposit of $20

- Licenced and regulated by FCA, CySEC, ASIC, and NBRB

- Not enough fundamental analysis for seasoned forex traders

3. EightCap – Trade Over 500+ Assets Commission-Free

EightCap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100. You can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

How to Find the Best Trading Platforms?

With so many online forex providers promising the moon on a stick, it can be hard to know where to start in finding a decent platform. After all, each forex provider will offer a slightly different service, provide access to varying markets, and likely have different fee structures in place.

With that in mind, we didn’t stop at reviewing the best forex trading platforms for 2023. We’ve also included below a useful checklist of considerations to use when carrying out your own research!

Regulation, Licensing, and Safety

We touched on regulation throughout our best forex trading platform reviews. For those unaware, regulated online brokers must jump through hoops to obtain and hold onto licenses.

- Submit regular detailed audits.

- Keep clients’ funds in a separate tier-1 bank account.

- Maintain fee transparency.

- Follow customer due diligence and KYC (Know Your Customer) procedures.

- and more.

As such, it’s crucial to stick with regulated forex trading platforms that are licensed by one or more of the following bodies:

Regulatory bodies exist in many jurisdictions and are tasked with keeping the forex trading space clean and fair. The ones listed above are the most well-known in the industry.

Supported Forex Pairs

When looking for the best forex trading platforms, you need to think about which FX pairs will be supported. As we touched on, currencies are traded in pairs, which are separated into categories – majors, minors, and exotics.

For those who are new to the currency scene – the best forex trading platforms will offer access to the following categories.

Major Pairs

A key characteristic of major pairs is that they invariably include the US dollar, alongside another strong fiat currency such as Canadian or Australian dollars.

To give you a clearer idea of some major forex pairs, see below:

- GBP/USD (British pound)

- EUR/USD (Euro)

- NZD/USD (New Zealand dollar)

- AUD/USD (Australian dollar)

- USD/CAD (Canadian dollar)

- USD/JPY (Japanese yen)

Major forex pairs tend to come with the tightest spreads due to their high liquidity in the market. For this reason, beginners might be best to stick with this pair category. After all, it’s much less intimidating to try and catch gains from price fluctuations when volatility is on the low side.

Either way, the best forex trading platforms will provide access to all major currency pairs.

Minor Pairs

Another forex pair type worth considering for newbies is minor pairs. Unlike major currency pairs, this one never includes the US dollar. Instead, it will be made up of alternative strong fiat currencies.

To clear the mist, see some popular minor FX pairs below:

- EUR/GPB (euro/British pound)

- AUD/CAD (Australian dollar/Canadian dollar)

- EUR/AUD (euro/Australian dollar)

- GBP/JPY (British pounds/ Japanese yen)

- EUR/NZD (euro/New Zealand dollar)

- EUR/JPY (euro/Japanese yen)

Like major forex pairs, minors also come with tight spreads and high liquidity – although not as much. Our guide found that the best forex trading platforms offer all minor pairs.

Exotic Pairs

As the name suggests, exotic pairs are less liquid and much more volatile. As such, you will find that not every forex trading platform is able to offer them.

For those unaware, exotic pairs always include a strong fiat currency, as well as one emerging currency. For the latter, think along the lines of the Mexican peso or Turkish lira.

See a list of exotic pairs that might be on offer at the best forex trading platforms:

- TRY/JPY (Turkish lira/Japanese Yen)

- USD/HKD (US dollar/Hong Kong dollar)

- CHF/RUB (Swiss franc/Russian ruble)

- USD/DKK (US dollar/Danish krone)

- CHF/ZAR (Swiss franc/South African rand)

- USD/CZK (US dollar/Czech koruna)

Volatile exotic pairs produce plenty of profit potential and that’s exactly why some forex traders are attracted to them. Whilst spreads will be wider, the potential rewards often make this worthwhile. Again, if you are a beginner, it will be best to trade minor and major pairs until you find your feet.

Potential Fees

It’s crucial to be aware of any fees before signing up with a forex trading platform. See below the most commonly seen fees in this industry.

Spread

The spread, for those unaware, is the gap between the buy price of the currency pair and the sell price.

For newbies, see a quick example to clear the mist:

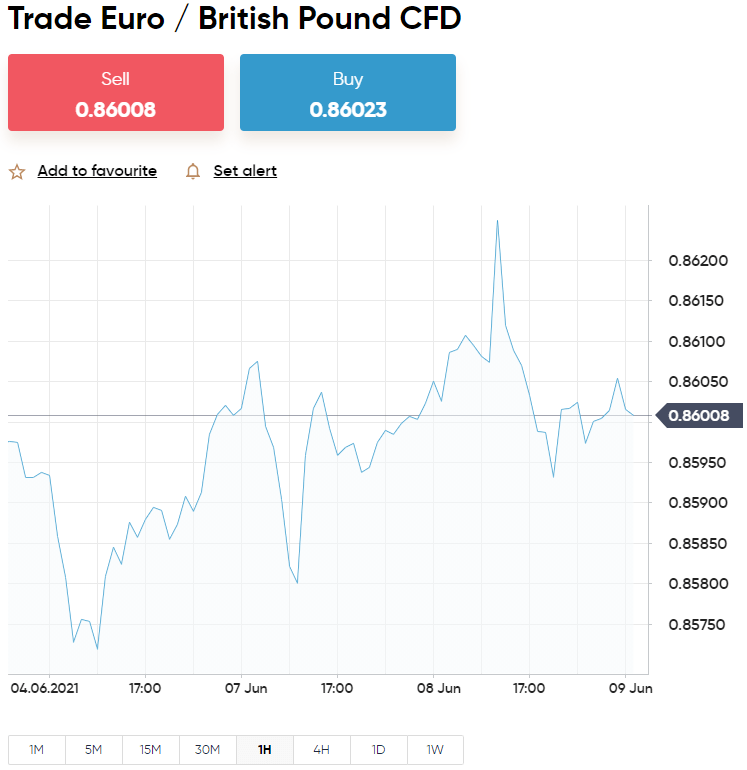

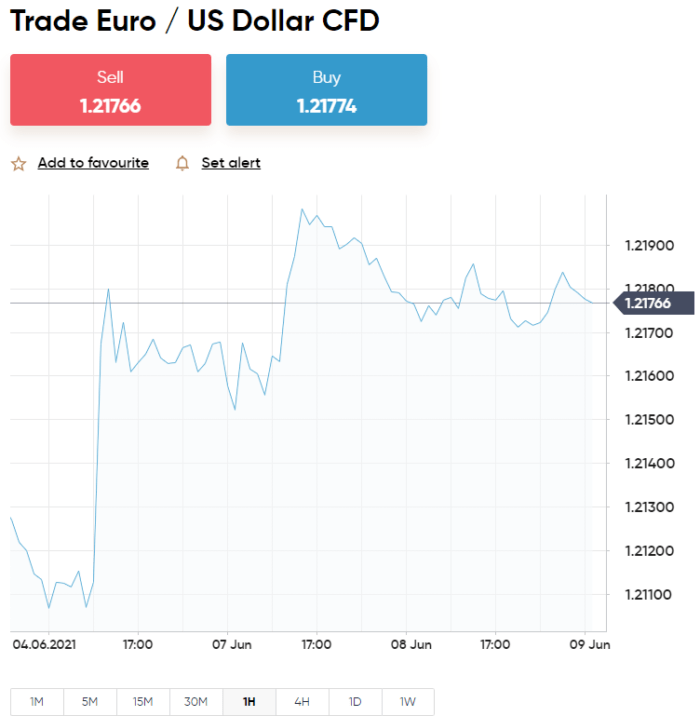

- Let’s say you are trading EUR/GBP

- The buy price is $0.86550

- The sell price is $0.86552

- This is a spread of 2 pips

Crucially, you are beginning this trade 2 pips in the red, as this is an indirect fee collected by the online broker. As such, anything over 2 pips will be an actual profit from the forex trade.

The best forex trading platforms, such as eToro, offer tight spreads of 1 pip or less on major and minor pairs – alongside a commission-free service!

Commissions

Many online brokers charge commissions for entering and exiting the market. As such, it’s a good idea to find forex trading platforms with low fees, as well as the aforementioned criteria.

Our guide found that the lion’s share of forex providers charge a variable commission fee. This is much more compatible with short-term currency traders.

See an example of a variable spread below:

- Let’s say the broker charges a 2% commission fee.

- You place a $1,000 buy order on USD/JPY.

- You must pay $20 to enter the FX position ($1,000 x 2%).

- Upon cashing out, the USD/JPY trade is worth $1,400.

- You must pay a 2% commission again to close your trade – this equates to $28 ($1,400 x 2%).

- In total, you paid $48 to enter and exit this trade.

Fees can soon nibble away at your gains, and the only thing better than a variable commission fee is none at all. As such, at our top-rated forex trading platform eToro, you would have saved $48 on this trade – as the broker charges no commission.

Other Fees

Other fees to be mindful of at the best forex trading platforms include:

- Overnight Financing: For those of you interested in forex CFDs, you will be liable for overnight financing fees (also called swap/rollover fees). This is a daily fee charged for each day you leave a trade open. eToro clearly shows how much the daily fee will be on every order form. The amount you pay depends on the pair being traded and the size of the stake/leverage. This rate will be slightly higher on a weekend.

- Platform Fees: Whilst all brokers are different, some may charge platform fees. For this reason, it’s crucial that you check the fee structure at any forex trading platform you are thinking of joining. Some may charge a monthly or annual fee based on your invested capital – whilst others charge nothing to look after your account.

- Deposit/Withdrawal: Another potential charge to be aware of is deposit and withdrawal fees, which again, can soon add up. Some forex providers charge for both deposits and withdrawals, so always check with the broker in question.

As you can see, fees and commissions can be complex to understand – so it’s best to choose a forex trading platform that is transparent on what it charges.

Platforms and Usability

The majority of forex brokers allow you to buy and sell via its proprietary web-platform. Such websites are usually designed to be easy to use for beginners.

If you are somewhat of a seasoned forex trader, you will likely need more in terms of technical analysis and trading tools. The best forex trading platforms will also be compatible with third-party software = such as MT4/5 or cTrader.

If you are not keen on the idea of spending months learning technical analysis or downloading MT4 software, you might want to try the Copy Trader feature at eToro. We talk about this passive way to trade forex shortly.

If you are not keen on the idea of spending months learning technical analysis or downloading MT4 software, you might want to try the Copy Trader feature at eToro. We talk about this passive way to trade forex shortly.

Platform Tools and Features

The tools and features offered by the best forex trading platforms will be easy to use and aid your decision-making process.

See below some of the best and most useful.

Social and Copy Trading

There are features offered by some online brokers which enhance your profit-making potential and allow you to trade passively. We touched on social and copy trading in our forex trading platform reviews.

eToro is a social trading platform that allows you to ‘like’, ‘follow’, and ‘comment’ on fellow forex traders’ posts. The broker’s stand-out feature is arguably the Copy Trader tool. Simply, find a forex trader you like by researching the data and information available to you. This includes preferred assets, historical trading data, risk level, etc.

Next, select an amount of money to invest. Then, whatever currencies they buy or sell will be shown in your own portfolio – correlating to the amount you invested.

For example:

- You invest $1,000 in your chosen Copy Trader

- The forex pro stakes 2% of their portfolio into USD/HKD, and 3% into NZD/USD

- As such, 5% of your own portfolio is also staked on these two pairs

- If the seasoned trader cashes out on NZD/USD – so will you

- If this resulted in a 10% profit – you would have made the same – at an amount proportionate to what you invested!

As you can see, this is a great wait to gain access to the currency markets, without having to learn the ins and outs of technical analysis yourself!

Leverage

As you likely know, leverage gives you the opportunity to trade with more than your account allows. If or how much leverage you will be offered depends on various factors, such as where you live, which asset or pair you are trading, and the size of your stake.

See further information below:

- If you are from the US, you can trade major forex pairs with leverage of up to 1:50

- In Australia, parts of Europe, and the UK – leverage will be offered up to 1:30 on major FX pairs and 1:20 on minor pairs.

- Leverage can be displayed as a ratio or a multiple such as 1:2 or x2, 1:10 or x10, 1:20 or x20, and so on

- Leverage of 1:30 means that you could potentially boost a $100 stake on a major pair to up to $3,000

- As such, a $100 stake on a minor or exotic pair could be ballooned up to $2,000, by adding 1:20 leverage

By boosting your position with leverage, you are in turn magnifying profits if the trade is successful. This also means that if the currency pair goes in the other direction, your losses will also be amplified. With that said, you should exercise caution when applying leverage at your chosen forex trading platform.

Technical Indicators

When looking for the best forex trading platforms – it’s suggested to see what technical indicators (if any) will be available to you.

Without indicators and charts showing you trends and price shifts of past and present – you might as well just throw a dart. This is because technical indicators enable you to make informed decisions about which direction a pair could be headed.

Partaking in technical analysis will see you studying volume, liquidity, volatility, price trends, and more alongside chart drawing tools. As we mentioned, some of the best forex trading platforms allow you to link your account to MT4 and access heaps of tools, indicators, and charts.

Deposits, Withdrawals, and Payments

If you have a specific payment method in mind, you should check what the provider in question accepts. For instance, many traditional-style online brokers only accept bank transfers.

Notably, though, bank transfers can take between 2 days and a week to clear in your trading account, and therefore this will delay your endeavors by some time. The best forex trading platforms accept fast and modern payment methods such as credit and debit cards, and e-wallets.

eToro accepts all of the above, which includes PayPal, Skrill, and Neteller. This broker does charge an exchange fee if you are not funding your account using US dollars. However, this is a mere 0.5%, and it’s worth remembering that the provider offers 0% commission on all forex trades!

Educational Resources

If you are an experienced trader and already know the ins and outs of this industry, then you might want to skip educational resources. However, for newbies, such material is an invaluable part of learning the ropes.

Each broker will differ. However, each of the best forex trading platforms that made our list offer some sort of educational content – aimed at helping inexperienced forex traders.

Getting Started With a Forex Trading Platform – Walkthrough

As soon as you have decided which forex trading platform is best suited to your own needs – you can get started.

For this walkthrough, we are showing you how to join Capital.com

– as the platform allows you to trade dozens of forex pairs commission-free.

Step 1: Register an Account

Head over to Capital.com and click ‘Trade Now’. Fill in your name and other details – as indicated in the sign-up box.

This can be done either on your mobile device or via the main desktop website.

Step 2: Verify Your Identity

As per KYC, you will need to verify who you are. Capital.com

accepts a driving license or passport as photo identification. When it comes to proof of address, you can use a recent utility bill or official bank statement – either a scanned or digital copy is fine, as long as it’s clear.

You may leave the uploading of documents until further down the line. However, please note this must be completed before you can make a withdrawal request (or deposit more than $2,250).

Step 3: Make a Deposit

Making a deposit at Capital.com is easy, as there is a variety of payment types to choose from.

This includes:

- Mastercard

- Visa

- Maestro

- Skrill

- Neteller

- PayPal

- Bank Transfer

Simply enter the amount you wish to deposit into your account and select your chosen payment method from what’s available to you.

Step 4: Search for a Forex Pair

Now that your account has been confirmed and been funded you can find a forex pair to trade.

Start typing whatever pair you want to trade in the search box – and click ‘Trade’ when you see it. In our example, we want to trade the euro against the Australian dollar.

If you are yet to decide, click on ‘Trade Markets’ on the left-hand side, followed by ‘currencies’. At which point all available forex markets will be displayed on your screen.

Step 5: Place a Trade

After clicking ‘Trade’ beside your chosen currency pair, an order box will appear.

The first thing to do is decide between a buy and sell order. If you think the exchange rate will rise – choose to buy. Alternatively, if you want to go short – choose to sell.

Best Trading Platforms – The Verdict?

With attractive trading hours and high liquidity, it’s no surprise that trillions of dollars worth of forex changes hands every single day. As such, there are hundreds of online brokers jostling for the top position in the space.

The best forex trading platforms will be regulated, offer tight spreads on heaps of currencies, and have a user-friendly website. Capital.com

passes with flying colors in this respect. The broker is regulated by the FCA, ASIC, CySEC, and NBRB and provides access to over 50 forex pairs with competitive spreads.

This respected broker charges ZERO commission and offers features such as Copy Trading, as well as useful educational content for beginners. Get started in less than 10 minutes and try out the free forex demo account with $100,000 virtual funds!

To support your first steps when trading with a broker try signing up with a free forex signals service. This will provide you with information on when a good trading opportunity arises without being an expert in technical analysis. You can join the best forex signals telegram through our website for free.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is the best forex trading platform for beginners?

Can I get rich from trading forex?

What is the best all-round forex trading platform?

What metrics do I need to check when choosing a forex trading platform?

Can I begin forex trading with $100?

Read more related Articles:

Forex Trading for Beginners: How to Trade Forex and Find the Best Platform 2023