The commodities market involves buying and selling instruments such as gold, sugar, wheat, oil, hard metals and natural gas. The idea is to correctly hypothesize the rise or fall in price – leading you to make a profit from the trade.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Sound like something you are interested in? First, you will need to find a good commodity trading broker. The platform in question is going to provide you with access to this investment space.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

In this guide, we are also going to dive into what commodity trading is and how this asset class can be accessed online. In addition to the basics, we are going to shed some light on the benefits of commodity trading – as well as strategies, tips, and ultimately – a review of the best commodity trading brokers to consider.

What is Commodity Trading and how Does it Work?

Like any form of trading, commodity trading involves buying and selling assets. The hope is that you can make gains from the rising and falling price of the asset you are trading. This is done by correctly predicting the direction of the value – which is determined by the supply and demand of the market in question.

As you likely know, commodities are usually raw materials which are tangible and used to manufacture and operate other goods. Think along the lines of industrial and construction products such as steel and oil. Additionally, there are tradable materials used heavily in the electronics industry such as gold, silver, copper, and lithium.

In terms of ‘soft commodities’, you can trade everything from wheat and soy – to sugar, frozen orange juice, and even livestock. We are going to cover tradable commodities shortly, so stay right where you are.

So, how does commodity trading work? We think an example is a great way to explain the trading process of any asset.

With that in mind, please see below a practical example of a commodity trade. In our example, you are trading the most traded commodity in the world – gold.

- At $1,900 per ounce – you think gold is undervalued.

- With this in mind, you place a $1,000 buy order with your broker.

- Should the price of gold rise higher than $1,900 and you exit the trade – you profit.

Now, based on the premise that you believe the price of the asset is overvalued:

- With this in mind, you place a sell order with your broker.

- If you are correct and the price drops – you profit.

One of the best things about commodity trading online is that you can make money whether the asset goes up or down in value. Of course, you must first correctly guess the direction the asset is going in. This can be done by predicting where the market sentiment is on the asset.

- When the value of an asset is on a downward trajectory – this is indicative of a ‘bearish’ market.

- Should the price of the asset in question be on the rise – this is a characteristic of a ‘bullish’ market.

Moreover, online brokers offer leverage on commodity trading. The leverage you will be offered will depend on the country you reside in. To give you an example, in the UK and the EU leverage is capped at 1:10 on most commodities and 1:20 on gold. This means you can multiply your stake by 10 or 20 – call it a loan from your broker.

As we mentioned, all that you need to do is speculate on whether the asset value will rise or fall. Next, place the appropriate order and specify how much you wish to stake on the position.

Please find below another example of how commodity trading works:

- You open an account with a commodity trading brokerage firm.

- You deposit $1,000 into your new account.

- Next, you place a buy order of $200 on Brent crude oil – at $30 per barrel.

- 2 hours later Brent crude oil is valued at $35.

- This illustrates a price rise of 16.6%.

- You place a sell order to cash in your gains on the position.

- From your initial $200 stake, you made a profit of $33.20.

As our above example illustrates, you can enter or exit a trade at any time you wish. Whether that be going short and closing your trade with a buy order – or closing a buy order by creating a sell order.

Now that you have a firm grasp on what commodity trading involves, we can discuss the various ways in which these assets can be traded.

How can I Trade Commodities Online?

There is more than one way to indulge in commodity trading. In fact, there are several – none of which leads to you actually needing to store the physical asset in question.

Not having to take ownership and store tanks of oil, or bars of gold bullion gives you the advantage of being able to choose whichever instrument you want.

Let’s have a look at the most popular ways to trade commodities below.

Commodity ETFs

For those unaware, commodity ETFs enable you to invest in multiple assets – using one individual trade. Consequently, by investing in commodities via an ETF, you are investing in the future price of assets (such as oil or gold) in an indirect manner.

To give you an example, in the case of gold ETFs, your broker will buy and store physical gold (bullion). Subsequently, the investment value is going to rise and fall – in sync with the asset’s market value.

Commodity ETF investments are considered to be more beneficial to long-term investors. However, you can close your ETF position whenever you wish (within market hours).

Commodity CFDs

The most cost-efficient and simplest way to trade commodities is via ‘contracts for differences’ (CFDs). Put simply, a CFD is a financial instrument that has been generated by a brokerage firm. CFDs are committed to monitoring the value of the particular asset – and in real-time.

Let us offer a simple example of the workings of a CFD, using gold as our commodity:

- The price of gold is $1,870 per ounce.

- Consequently, the CFD instrument matches this.

- If the value of gold increases or decreases by say 1%, the CFD will mirror this movement like-for-like.

As we said, the CFD is tasked with monitoring the real-world value of the commodity, so this is a super-easy way to trade any asset. There is no need at all for you to think about taking delivery of a tangible product. The same applies to commodities such as CFDs for cocoa, gas, oil etc.

Moreover, you simply need to try and speculate correctly on which direction the price of the commodity will go, put your feet up, and hope for the best. Well, not really, as the best commodity trading pros will always have an entry and exit plan in place. This might be through a 1:3 risk/reward strategy – which is executed by placing stop-loss and take-profit orders.

Nevertheless, in the case of gold, to own an ounce of the asset is going to cost you well over a thousand dollars. However, by trading gold via CFDs – you are able to invest a much smaller amount.

Commodity Futures

Commodity futures are sophisticated financial instruments. As the name suggests, futures enable you to trade based on the future value of the asset in question. Generally speaking, your commodity futures contract will only be active for around 3 months, before expiring.

That said, there are special cases where futures contracts run for longer than this timeframe. Regardless of the futures contract length, when the time comes for the expiry date – you are legally obligated to buy or sell the commodity.

It is for this reason that futures contracts are generally utilized by big financial companies. With that said, you don’t have to wait it out until the end of your futures contract. You may offload your commodity whenever you see fit.

Albeit, the only way to make a profit on your investment is to correctly speculate on the rise or fall of the contract value – before or by the expiry date.

Let’s give you an example:

- Let’s say the price of silver is $22.00 per troy ounce.

- You go into the trade on a long position.

- The silver contract closes at $25.50 – you make a profit.

- Alternatively, if the silver contract closes at $20.50 per troy ounce – you make a loss.

The good news is that you do not need to worry about futures contracts as a retail commodity trader. This is because CFDs work in exactly the same way – insofar that you can go long or short and even apply leverage. But, CFDs never expire, so you are never legally obliged to buy or sell the commodity in question!

Commodity Options

Commodity options are comparable to futures – as they are both sophisticated financial instruments. Although similar, there are obvious differences between the two. As we touched on, with commodity futures you are legally obliged to buy or sell the asset before or on the expiry date.

On the other hand, commodity options provide you with the right, but not the obligation to buy or sell the commodity. If your trade fails, all you stand to lose is the ‘premium’. Generally speaking, the premium (or price of the contract) can be up to 10% of the value of your options contract.

This means that you only need to risk 10% of the total contract value to access your desired commodity options market. In turn, if your trade is unsuccessful, this is all that you can lose financially.

When it comes to placing an order, you will use puts and calls. In a nutshell, if you think the price will fall – you’ll purchase puts. If on the other hand, you believe the price will rise – you’ll purchase calls.

Here is an example of a commodity options trade to clear the mist on this complex instrument:

- You decide to trade wheat, which is currently priced at $240 per bushel.

- The ‘strike price’ on your three-month options contract is $270.

- Your goal is to predict whether the wheat contract will close above or below the strike price.

- You have a feeling the price will rise – so you buy 100 call options.

- The premium on the position is $13.50.

- Your 100 contracts cost you $1,350 in total – which is the all-in premium paid to your chosen broker.

You can usually access the commodities markets by paying a modest premium, in this case, just 5% of the total strike price. If you predict correctly, you profit. If you predict incorrectly – you lose the cost of your premium only.

Now let’s continue the example to see what a winning trade would look like:

- A few days before the options expire, the price of wheat is $300.

- This is good news, as you went long on your options trade by purchasing calls at a strike price of $270.

- This means that you will make $30 per contract by offloading the options right now – which you do.

- But, you also need to subtract the premium that you paid, which was $13.50 per call option.

- That leaves us with a net profit of $16.50 per call.

- You purchased 100 calls in total, so your all-in profit on this commodity options trade is $1,650 (100 contracts x $16.50).

As you can see from the above, taking the options route allows you to target large profit margins, while at the same time keeping your potential losses to a minimum.

What Commodities am I Able to Trade?

When on your search for the best commodity trading broker, you will notice that tradable assets are separated into three main categories. Those categories are ‘metals’, ‘energies’, and ‘agricultural’.

Let’s give you a clearer idea of what these categories are made up of.

Metal Commodities

We all know what metal is, however, did you know that ‘precious’ metals like gold are often used by traders to hedge against inflation and economical turmoil? Tradable metals can include industrial products like lead, copper and recycled steel.

With that said, the most traded metals in the world are gold, silver, and platinum. When it comes to gold particularly – you will be rewarded with competitive spreads and great liquidity from most trading platforms.

We’ve spoken about the most well-known metals. Whilst not every broker will offer them, there are other markets, too.

Find below a list of other tradable metals:

- Lead.

- Copper.

- Molybdenum.

- Zinc.

- Cobalt.

- Aluminum.

- Aluminum alloy.

- Nickel.

- Molybdenum.

- Tin.

As noted, most brokers will stick to gold and silver in the metal department, as these possess the largest trading volumes.

Energy Commodities

As we touched on, commodities include energies such as coal, gas and oil. The latter will almost always be traded using US dollars and by the barrel.

- The US oil market is priced by the WTI Benchmark.

- The rest of the oil market uses the Brent Crude Oil Benchmark.

Like any other asset – the value of energies is dictated by the demand and supply of the market. Demand and supply can also shift due to events such as geopolitical unrest, as well as OPEC changing its supply levels. In other words, if OPEC made the decision to halt or slow the production of oil – the price would likely rise.

Please see below a list of tradable energies, bearing in mind that not every broker can offer access to the same markets:

- Brent crude oil.

- WTI crude oil.

- Sweet crude oil.

- Light crude oil.

- Ethanol.

- Gulf Coast gasoline.

- Natural gas.

- Propane.

- Heating oil.

- Uranium.

In terms of trading volume, activity in the energy department is dominated by oil and natural gas.

Agricultural Commodities

Agricultural commodities are traded globally and most are in high demand. However, at the risk of repeating ourselves, the value of any commodity will shift and change frequently. This is mainly due to the nature of supply and demand, and events which affect that.

- Corn.

- Soybeans.

- Wheat.

- Cocoa.

- Sugar.

- Coffee.

- Frozen concentrated orange juice.

Livestock and meat commodities include:

- Feeder Cattle.

- Live Cattle.

- Lean Hogs.

The majority of agricultural commodities will be quoted to you in US dollars. You may also notice that some trading platforms refer to commodities as ‘hard’ and ‘soft’.

- Soft commodities are used in reference to the agricultural side of things.

- Hard commodities include things like metals or oil – which need to be mined or extracted.

In terms of trading volume, agricultural commodities are nowhere near as popular as precious metals and energies. They do, however, still offer plenty of trading opportunities, so you shouldn’t necessarily discount them.

Benefits of Commodity Trading Online

The majority of people who are new to commodity trading choose to invest the traditional way – via a long-term ETF. However, there are heaps of advantages to trading on a short-term basis via an online commodity broker.

This includes the following:

Go Long and Short

One of the main advantages of commodity trading is having the ability to make gains from rising and falling asset prices. By that, we mean you have the option of going long or short. This is unlike buying traditional shares, whereby you only make a profit if the value of the company goes up.

As long as you predict correctly you can make gains either way. Let’s give you a simple example of going short:

- Demand for Brent crude oil falls.

- In the open market, this causes the price of Brent crude oil to go down.

- This is when you would short Brent oil by placing a sell order.

- If the price of Brent crude drops by 4% – you would make a 4% profit.

The best way to short-sell oil – and any commodity for that matter, is to use a CFD trading site.

Magnify Gains with Leverage

We covered leverage earlier, albeit briefly. Depending on your country of residence you should have no problem obtaining leverage when using a commodity trading site.

Let’s give you a practical example of commodity trade using leverage:

- Let’s say you place a short-sell order on silver at a stake of $30.

- In the coming days, the value of silver falls by 12%.

- This would normally indicate a profit of $3.60.

- With leverage of 1:10, your profit is magnified by 10 times.

- Your total gains on this trade is now $36.

It is absolutely crucial that you use leverage with caution. As much as leverage can increase your profits – it can also multiply your losses.

Granted, the bigger the risk, the bigger the potential reward can be. However, if you are a beginner we recommend trading within your budget to protect your capital.

Hedge Against Stock Markets

We touched on earlier that during economical hard times traders tend to diversify their portfolios to include commodities such as gold. In the midst of a financial crisis, for example, the value of gold will rise. Therefore it makes sense to use this precious metal to hedge against a stock market that is on a downward trajectory.

Stores of Value

Some precious metals are classed as ‘stores of value’. This means that assets such as silver and gold hold on to their value – and have done since the history of time.

As we noted, because of this, metals are a great way to provide yourself with a safety net against inflation and such like. If you would prefer to instead invest in stores of value, then you will need to do so via the aforementioned ETF route.

Commodity Trading Strategies

Irrelevant to what your skill level is when it comes to trading, we highly recommend thinking about your long-term financial goals. After all, the most successful commodity traders have a strong strategy in place, if not several.

By not rushing into trading blindly, you are going to give yourself the best possible start in your future trading endeavors. As such, we’ve put together a list of strategies for you to hopefully draw some inspiration from.

Fundamental Research

Whilst both are incredibly helpful for trying to predict market sentiment – ‘technical analysis’ and ‘fundamental analysis’ are two totally different things.

Let’s start with the fundamentals, which is the easiest of the two to master.

Fundamental trading entails keeping abreast of the latest economical and financial news. In fact, any news which you know will likely affect the supply and demand of your chosen commodity.

Put simply, if there is news of serious civil unrest or all-out war bubbling to the surface in the Middle East – this will directly affect the demand and supply of oil -and therefore the market price.

There are other places you can find this information, aside from the usual sources. Many investors subscribe to trading subscription services, meaning you receive updates via email (or mobile) which may be relevant to you.

You can also check out sources such as Yahoo Finance, which is completely free of charge. If you want to try out this free service simply select your chosen commodity on the site. After that, the subscription service will forward you real-time notifications of the relevant news stories.

Technical Analysis

Whilst fundamental analysis is fairly easy to grasp – technical analysis can take years to fully understand. There are hundreds of price charts and technical indicators accessible to commodity traders. By trying to gain a firm understanding of just a few basic tools, you stand a better chase at speculating on the rise of fall of an asset’s value.

For instance, historical price charts are great for seeing the highs and lows of a commodity. Then there are heaps of tools indicating trends, and the underbought or overbought status of an asset. Studying technical analysis helps traders decide when to enter or exit a position – and when to hold on. This is why swing traders thrive off the information technical analysis offers.

This makes sense when you consider that the aim of swing trading is to ride the trend, holding positions for days or even weeks at a time. If you are planning to stick to short-term trading – such as day trading, then reading charts is an absolute must. The reason for this is that when day trading you are aiming to open and close multiple positions throughout the day.

As such, fundamental news is slightly irrelevant – at least in the short-term. This commodity day trading strategy is used with the view of making gains from small-scale price shifts – and of course, trying to time the market in order to make a decent profit.

Resistance and Support Levels

Resistance and support levels are used in the trading world over. The support level is known as the ‘price point’ – this tends to prevent any further fall in value. The resistance level prevents the upward trend from rising any further. Of course, there is no guarantee that the support or resistance line will not be broken. It’s just that historically, these levels have been defended time and time again.

Any major rise or fall in the value of an asset can have a big effect on the economy as a whole. If gold was experiencing an upward price trend, and the resistance level is close – the likelihood is that the upward trend will go into reverse.

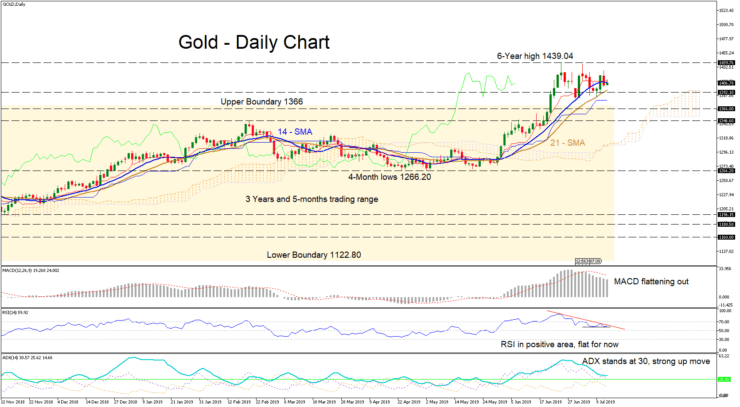

Below you will see an example of support and resistance levels when trading gold:

As noted above, it is highly probable that at some point the resistance and support levels will be broken. With that in mind, you should create stop-loss orders to limit any potential losses. Once you have entered your stop-loss value – your broker will execute it, at the predetermined price stipulated in your order.

Commodities Trading: The Risks

We’ve discussed the benefits of commodity trading. Now in the name of fairness, we are going to talk about the risks too.

Often Highly Volatile

Commodities, especially crude oil and gold, tend to be highly volatile assets when compared with the likes of blue-chip stocks and shares. Many traders love a volatile market. After all, the more volatile a market is – the bigger the gains can be if the trade goes as expected.

If you are new to the world of commodity trading, high volatility might not be the best idea for you to start with. Whilst you will no doubt experience highs, the lows can be very damaging to the health of your trading account. This is especially the case if you’ve still got your training wheels on.

Not Income Generating

When investing in traditional stocks (think the likes of IBM and Nike) – investors are usually given payments in the form of dividends. When it comes to bonds – the payment comes in the shape of coupons.

Commodities, however, do not provide any form of income. You will only make some real money when you make a profit from correctly predicting the rise or fall in the price of the commodity.

Amplify Losses With Leverage

We’ve already told you about the benefits of applying leverage to commodity trades. We also warned you to tread with caution due to the magnifying of potential losses.

How much leverage your broker can offer you will depend on your location. Many regulated brokers are limited by how much leverage they can offer clients due to the regulatory body ruling the trading platform.

In the UK and EU, clients are limited to 1:20 on gold, and 1:10 for most other commodities. Some overseas brokers might offer up to 1:100 leverage but will likely be without a license.

With all that said, understanding leverage as you now do – so long as you are mindful of losses as well as profits you should be fine. We recommend always including risk management into your own personal trading strategy and utilising stop-loss and take-profit orders.

Commodities Markets can be Limited

In terms of stocks, there are tens of thousands and you will generally have access to a variety of markets globally. When it comes to commodities, you might find that some brokers offer you silver, gold, oil and natural gas only. The next one you come across might only offer gold and Brent crude oil.

Trading platforms offering every commodity under the sun are seldom seen. This limited selection of tradable commodities can lead to overexposure in that particular market.

Best Commodity Trading Tips

Please find below five tips regularly used by seasoned commodity traders. This will ensure that you give yourself the best chance possible of getting your commodity trading endeavours off on the right foot from the very get go!

1. Utilise Online Commodity Trading Courses

By performing a simple search on the internet you will see that there are heaps of commodity trading-specific online courses out there. Not only can you learn from the comfort of your own home, but courses can aid you in understanding the fundamentals of trading before risking capital.

The best way to achieve this is to select a course aimed at people who are new to the trading space.

2. Read Commodity Trading Books

As well as the aforementioned online trading courses, there are hundreds of commodity trading books in circulation. Most books these days come in both physical form and digital. Whatever your preference, you should be able to find one you like.

To help you along, we have listed 6 commodity-specific books below:

- Commodities For Dummies – by Amine Bouchentouf.

- Higher Probability Commodity Trading: A Comprehensive Guide to Commodity Market Analysis, Strategy Development, and Risk Management Techniques Aimed at Favorably Shifting the Odds of Success – by Carley Garner.

- Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market – by Carley Garner and Paul Brittain.

- The Little Book of Commodity Investing – by John Stephenson.

- Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market – by Jim Rogers.

- A Trader’s First Book on Commodities: An Introduction to the World’s Fastest-Growing Market – Carly Garner.

There are tonnes more. It’s also a good idea to check out some reviews to see whether other traders found the book helpful. Whilst you are at it, have a look for technical and fundamental analysis books for beginners – learning this aspect of trading is invaluable.

3. Try out a Demo Account.

If your broker provides a demo account you should grab it with both hands. Demo accounts are used by all kinds of traders, from seasoned pros in the space, to new arrivals. When utilizing a demo account, you will be able to trade commodities in an arena which fully mirrors real market conditions.

You will also be given a wad of paper funds or demo money. This means that you can hone in on your commodity trading skills for free. Moreover, you should be able to switch over to a live account using real money whenever you feel ready.

4. Use Risk Management Strategies

We have talked about strategies and risks extensively throughout this guide – so you understand the importance of taking care of your capital. When practising risk management there are a few things you can utilize as part of your strategy:

- Manage your bankroll: Lots of traders limit the stake size to a specific amount and stick to that as part of their bigger trading strategy. To give you an example, you might only ever stake 1% of your total trading account.

- Be careful with leverage: We’ve already touched on leverage a few times. Be careful with it. We don’t recommend trading on margin until you’ve learned the ropes.

- Use stop-loss orders: We recommend always using stop-loss orders when trading any asset. This is your damage limitation. If you say you don’t want to lose more than 1.2% of your initial stake – placing a stop-loss order at that price will prevent you from ever losing more than 1.2%.

- Try a take-profit order: Using take-profit orders is like using stop-loss orders, only the opposite result. If you want gains of no less than 2%, your take-loss order should reflect that. That way, your trade will be closed when it is 2% in the green.

- Stick to standard market hours: Although gold and other such commodities can be traded in the global markets 24 hours a day and 7 days a week – we say stick to standard market hours. You should find that by trading between Monday and Friday, you will benefit from high spreads and high liquidity. It’s also a good way for beginners to avoid growing trading costs and a highly volatile market.

Hopefully, by following the commodity trading tips outlined above, you’ll slowly but surely build your skills in the space.

Best Commodity Trading Brokers 2023

At this point in our guide, we hope you feel confident enough to go forth and conquer the commodity markets. There will be hundreds of brokers online all vying for your custom.

To help you cut the wheat from the chaff, we have put together a list of the best commodity trading brokers right now. Each trading platform that made our list is reputable and fully licensed and regulated.

1. AVATrade – Commodity CFDs With Tight Spreads

AvaTrade has been offering financial services to traders for over a decade. The broker is licensed by a handful of regulatory bodies, such as the British Virgin Islands, Australia, Japan, UAE, and South Africa. This is great news for traders as regulation creates a safer and fairer environment for all involved.

Compliance requirements include financial reporting, client fund segregation, and security - so you can be sure you are in safe hands. This brokerage firm offers a plethora of CFDs such as cryptocurrencies and forex. Moreover, you can trade commodity CFDs like metals, energies, and agricultural assets such as cocoa and sugar.

The trading platform offers leveraged commodity CFDs of 1:100 for commodities like oil, 1:200 on gold, and 1:50 on things like gas, copper, platinum, and cocoa. You will, however, once again be capped by ESMA limits if you are based in the UK or Europe.

In terms of spreads - our best commodity trading brokers review found AvaTrade to be super competitive. To give you an example, at the time of writing - crude oil is at 0.03%, gold CFDs are 0.34%, and silver is at 0.029%.

If you like to trade commodities on the go, then you can take full advantage of AvaTrade’s very own app, named ‘AvaTradeGO’. The app allows you to deposit funds into your account and place orders with ease - all you need is an internet connection.

Avatrade is compatible with crowd-pleasing third-party trading platform MetaTrader4, which provides you with heaps of tools, charts, and educational content. As we said earlier you can also use an automated trading bot via this platform.

The broker offers a free demo account, which we think is a huge bonus. If you feel confident enough to start trading with real cash right away, you can start trading your commodity of choice from $100.

- Leverage offered on commodity CFDs

- Beneficial ‘AvaTradeGO’ app

- AvaTradeGO app

- $100 admin fee after 1 year inactivity

2. Capital.com – Variety of Commission-Free Commodities

Capital.com is another commission-free platform making our list of the best commodity trading brokers in the online space. The trading platform is super user friendly and was clearly designed with both newbie and experienced traders in mind.

You can expect market-leading spreads from this brokerage firm, as well as the aforementioned 0% commission - and 100% transparency when it comes to fees. When signing up to this provider you are protected by regulatory bodies, FCA, CySEC, ASIC, and NBRB.

If you are a trading novice, or just need a little more help and guidance, you will find a plethora of trading guides, online courses, and even an educational app. Capital.com offers more than 3,000 tradable financial instruments and promises super-fast order execution.

To give you an example of the competitive spreads offered by Capital.com, today Brent crude oil comes out at just 0.10%, gold is at 0.64%, and US crude oil is around 0.04%. However, spreads, like the value of the asset, will fluctuate throughout each day.

If you want to get an idea of what spread to expect on other commodities then head over to the fee section of the website. There you will be able to use the search function to look for the specific financial instrument you want to trade.

The trading platform enables commodity CFDs, meaning you can trade without needing to own the physical asset. With CFDs comes the opportunity to amplify your gains with leverage, and this will be capped as per ESMA standards.

- Regulated by FCA, CySEC, ASIC, and NBRB

- Trade commodities commission-free

- Super educational content

- $250 minimum deposit on bank wires

Commodity Trading Brokers – The Conclusion

The popularity of commodity trading grows year on year. This is largely due to the flexibility of this type of asset offers. You are able to go both long and short on a trade, meaning you can make gains from the asset losing value as well as rising in price.

Not only that – you can trade the price of an asset like silver or gold through heaps of instruments – such as CFDs, futures, options, ETFs, and more.

By now you are probably eager to get started with your commodity trading endeavors. Broker platforms – such as the ones we have listed, offer a variety of tradable commodities in a user-friendly way.

Not only are you able to trade commodities like oil and natural gas in a short-term manner. But, by trading commodities via an ETF, you can invest in your asset of choice in the long-term too.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts