In Chapter 11 – Learn 2 Trade in Relation to Stocks and Commodities and Trading with MetaTrader you will learn about the relationship between stocks, indices, and commodities to the learn 2 trade market. In addition, you will learn how to master the MetaTrader platform.

- Chapter 11 – Forex in Relation to Stocks and Commodities and Trading with MetaTrader

- Stocks, Learn 2 Trade and Commodities – Long Relationship

- Learn 2 Trade Signals – Follow live market updates

- What Not To Do

- Master the World of Forex – “MetaTrader” trading platform

Chapter 11 – Learn 2 Trade in Relation to Stocks and Commodities and Trading with MetaTrader

In Chapter 11 – Learn 2 Trade in Relation to Stocks and Commodities and Trading with MetaTrader you will learn about the relationship between stocks, indices, and commodities to the Learn 2 Trade market. In addition, you will learn how to master the MetaTrader platform.

- Stocks, Learn 2 Trade and Commodities – Long relationship…

- Learn 2 Trade Signals – Following market alerts

- What not to do

- Master the world of Forex: “MetaTrader”

Stocks, Learn 2 Trade and Commodities – Long Relationship

Be honest. You didn’t really think that there was no relation between the Learn 2 Trade market, stocks and commodities, right? Of course they are related. There is a strong interaction between these three markets. The Canadian Dollar is highly correlated to oil prices, since Canada contains the third largest oil reserves in the world. Look at the charts below… when oil goes up, USD/CAD goes down during the trading session on Monday, 13 April 2020.

USD/CAD declined

While WTI (West Texas Intermediate) oil surged

Let’s try to understand these relations: when a certain market exchange, in NY, London or any other market rallies, it used to mean that the economy in this particular market is growing. It obviously has implications – more external investors from other countries want to enter this market and invest in a growing economy which opens up new potential horizons. It leads to more intense usage of the national currency, and to increased demand for the currency as a result. This is how Learn 2 Trade comes into the picture!

That used to be the story until the 2008 global financial crisis. Now, things have distorted a little. It just means that there is more monetary or fiscal stimulus coming up, such as a decline in the interest rates. That means that more cheap money will be around in the real economy, so obviously, some of this money ends up on stocks, therefore the indices of the stock markets go up. That has been the story from these last eight years.

The biggest and most influential stock markets in the world:

| Stock Market | Description |

| DOW

USA |

One of the two premier stock indexes in the U.S.A., The Dow Jones Industrial Average measures the trading performances of the top 30 publicly traded companies. The DOW is highly influenced by market sentiment, economic and political events.

Players: McDonald’s, Intel, AT&T, etc… |

| NASDAQ

USA |

The largest electronic trading market in the U.S. with approximately 3,700 electronic listings. The NASDAQ has the largest trading volume among the stock markets of the world.

Players: Apple, Microsoft, Amazon, etc… |

| S&P500

USA |

Its full name is the Standard & Poor 500. An index of the 500 largest American companies. Considered as a good barometer for the American economy. The S&P500 is the second most traded index in the U.S. after the Dow. |

| DAX

Germany |

Germany’s stock market index. Consists of the top 30 stocks traded on the Frankfurt Stock Exchange. The DAX is the most traded index in the Eurozone, being the most popular index in Europe. This is no surprise, given that Germany is the largest economy in the Eurozone.

Key players: BMW, Deutsche Bank, etc… |

| Nikkei

Japan |

Reflects the overall market conditions in Japan by tracking the top 225 companies in the Japanese market.

Key players: Fuji, Toyota, etc… |

| FTSE (“Footsie”)

UK |

The Footsie index tracks the performance of the most highly valued UK companies listed on the London Stock Exchange. As in other markets, there are a few versions, depending on the size of the index (FTSE 100 for example). |

| DJ EURO STOXX 50

Europe |

The Eurozone’s leading index. Its full name is the Dow Jones Euro Stoxx 50 index. Tracks 50 top stocks from 12 euro member countries |

| Hang Seng

Hong Kong |

Hong Kong’s stock market index. Tracks the performance of the Hong Kong stock market by monitoring the price changes of the overall stocks included in this index. Organized by Hang Seng Bank’s HIS services. |

In many cases, the American and Japanese stock market exchanges behave similarly. The performance of one strongly reflects on the other.

The performance of the DAX tends to closely match the performance of the EUR. We can predict trends in the EUR according to the general direction of the DAX.

As mentioned above, the more money in the economy the higher the value of indices and, obviously, the cheaper the currency. So, the correlation between the currencies and the respective stock indexes is close to -1 as of 2016 – almost perfect negative correlation.

Trading commodities on your platforms:

Many platforms allow you to also trade commodities like oil, gold, and silver. If you are interested in trading commodities there are several things you should keep in mind:

Goods and commodities are traded according to the stability of the local and global markets. To see this for yourself check out what happened to the price of Gas during the revolutions of the Arab Spring at the beginning of 2011 – prices rose to new historical records!

If you want to trade commodities it is really important to follow major events around the world and to do some fundamental analysis! Events can have a major impact on the prices of these goods.

Another event? Oil prices hit rock bottom during several months at the beginning of 2016. The reason? The global economy has been slowing down since 2014. In early 2016, two more events added fuel to the fire; the US economy has led the recovery but having difficulties due to the winter season (among other reasons), and the Chinese stock market was rapidly losing value. The consequence? The market felt that the oil demand would decrease and everyone accelerated selling oil. It reached below $30/barrel in early 2016.

Example: Gold is protected from inflation. Therefore, when concern about rising inflation in a specific market occurs, gold often gets stronger! Likewise, gold and silver are highly influenced by political instability. If South Africa is having political problems, gold’s price would probably rise dramatically (South Africa is a major gold exporter). But fundamental analysis isn’t enough. That is why we also use technical indicators. The use of such indicators for the goods and commodities markets is identical to their use in the Learn 2 Trade market. You should know that strategies like Swing, Breakouts, Day Trading, etc. apply to these markets also.

The value of certain commodities, such as precious metals, occasionally rises when other large markets lose value. For example, in the last decade, while both the global economy and most major currencies have weakened, more and more traders have turned to commodities investments, which means a negative correlation between the commodities and the indexes is formed.

But not for long. That lasted until the US economy and the rest of the global economy began the second downturn in a decade. The demand for commodities fell, so the correlation between the global economy and commodities turned positive again. As soon as you heard negative news from a large global economy, the commodities would drop like a stone, apart from gold which is a safe haven commodity.

Important: The average length of trends in commodities markets are usually much longer than in Learn 2 Trade markets. As a result, trading these goods can offer a great long-term investment. Rallies are often long and massive. Therefore, when a trend breaks, it probably indicates a long-term change is coming our way. You can use technical indicators like Fibonacci, RSI and the rest to help spot these trends.

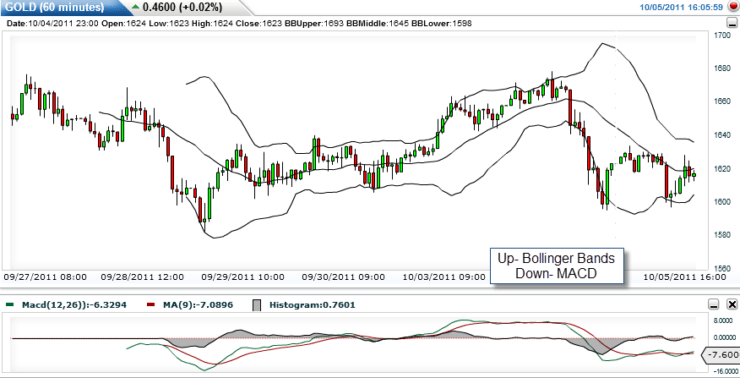

Gold charts look like this:

The high liquidity of the gold chart makes it an attractive investment alternative, even for intraday trades.

Many traders from all over the world have discovered the commodities markets through their trading platforms. These markets have become ever more popular during the last few years, for several reasons: massive volume and high volatility thanks to a range of events which have had a huge impact on these markets; simplicity and convenience of the brokers’ platforms; more educated traders; and the numerous headlines that these have grabbed in the media.

These recommended brokers offer full services for commodities trading with excellent terms.

Learn 2 Trade Signals – Follow live market updates

A Learn 2 Trade signal is an online trading alert on the currency pairs, indicating fresh trading opportunities.

Signals services allow you to follow and copy trading actions and executions from experienced and successful traders. The providers of these alerts services spot opportunities by using technical tools as well as fundamentals. Alerts are provided either by analysts who perform their moves in real time or by automated systems, like robots, which analyze the market by using sophisticated algorithms. A signal’s quality depends on its success percentage, the simplicity of performance, system efficiency and speed. Learn 2 Trade signals can be provided via websites, Email, SMS or by Tweet.

Who are these services recommended for? Following alerts can be a terrific trading strategy if you:

- Lack the time or energy to trade for yourself and maintain your trades

- Look for extra income from as little effort as possible

- Want to open more than one or two positions simultaneously (it can be a great idea to open a couple of positions based on market alerts, side by side with your own trading positions)

How do market alerts work?

To learn what a good live Learn 2 Trade signal includes take a look at how FX Leaders’ free signals are provided:

- The pair – the relevant currency pair.

- Action – trading signal, telling you to buy or sell the pair.

- Optional ‘Stop Loss’ and ‘Take Profit’ orders – traders using alerts are strongly advised to use Stop Loss orders when opening positions. All of FX Leaders’ trading alerts are provided with Stop Loss and Take Profit orders.

- Status – the status of the alert signal. Active means an open signal. As long as an alert is active, traders are advised to follow it and enter the market.

- Comments – appear whenever there is a live update regarding the signal.

- Trade Now – go to the trading platform and open a position.

Follow the experts … for free!

FX Leaders alerts are completely FREE!

In our Learn 2 Trade signals alert page you can find daily live market updates, suggesting trading strategies on indices, commodities and currency pairs!

What Not To Do

We’ve prepared for you a list of “7 Learn 2 Trade commandments”. Follow them carefully in order to trade like the pros:

- Don’t trade by blindly following other traders’ opinions or analyses unless you understand the reasons behind their opinions and agree with them. Trust your judgments

- Don’t change your strategy in the middle of open positions. Do not reset your Stop Loss points. Don’t let your emotions and fear of failure control your decisions

- Remember to treat trading as a business. Don’t be smug, too enthusiastic or careless. Act Responsibly!

- Enter trades only if you find good enough reasons that support your decisions. Don’t open positions just “for fun”, or out of boredom. Learn 2 Trade is not supposed to provide you with entertainment. If there is too much emotion involved, then you’re probably not trading right. Learn 2 Trade is not supposed to be exciting like gambling.

- Don’t be too hasty to exit a trade. Neither when winning, or losing. Stick to your plan, close positions only when you feel that the market is behaving opposite to your earlier assumptions

- Don’t use high leverage. Also, remember that the level of leverage must affect where you place your Stop Loss, placing it too close to your entrance price while using leverage can easily erase your position

- Don’t try to run too fast! Learn 2 Trade involves risk, but it isn’t Bellagio’s casino! Practice a little first, get to know your platform, don’t open too many positions at the same time, and be careful not to put your entire capital on the line for a single position.

Master the World of Learn 2 Trade – “MetaTrader” trading platform

Metatrader4 and MetaTrader5 (MT4 and MT5) are the most popular trading platforms in the world of Learn 2 Trade. They are very simple and convenient platforms to use. Many brokers (in fact the most of them) offer Metatrader platforms alongside their own branded platform. However, there are a few world class brokers who have developed their own unique trading platforms, like the extremely popular eToro.com.

MT5 version is the latest version to come to market, although MT4 is still quite popular.

The MT4 Platform has some excellent features:

- It allows you either to look at one chart on the screen or at a number of different charts at the same time.

- It allows you to navigate between a large number of accounts and positions fast, with no mishaps, in case you have more than one open trade.

- The toolbox includes lots of technical indicators, categorized by type (we recommend not to use most of these, which is why we concentrate only on our favorites in this course).

- Entry and exit executions are very clear and the platform responds quickly to your orders.

- A whole section of the market analysis, with calendar and price quotes on all pairs.

- It takes 10-20 minutes to download the MT4/5 software and it serves as a handy extra tool for training.

That is what it looks like:

Congratulations! You completed Learn 2 Trade’ Learn 2 Trade Trading Course.

Now you are ready to turn trading opportunities into big profits!

Join thousands of Learn 2 Trade around the world, who began their Learn 2 Trade trading career with Learn 2 Trade Learn 2 Trade Trading Course.

JIt’s time to implement all you learned, and start taking your first steps in the market. You are welcome to join the tens of thousands of members in our popular online Learn 2 Trade portal – https://learn2.trade.com You will find all kinds of trading tips and help, including free Learn 2 Trade signals.

Read the most up-to-date analysis on Learn 2 Trade, commodities, indices and cryptocurrency trading here.