Try CFD Trader, the most successful trading robot in 2019 and now 2020!

- 88% Highly Successful Win Rate!

- $/€/£ 250 Minimum Deposit

- Accepts Debit and Credit Cards

- Award Winning Platform!

Autotrading Robots – If you’re a seasoned investor with heaps of experience under your belt, then you’ll know first hand just how time-consuming day trading can be. Not only do you need to spend hours-on-end researching and analysing historical pricing trends, but you then need to sit at your computer manually trading your findings.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

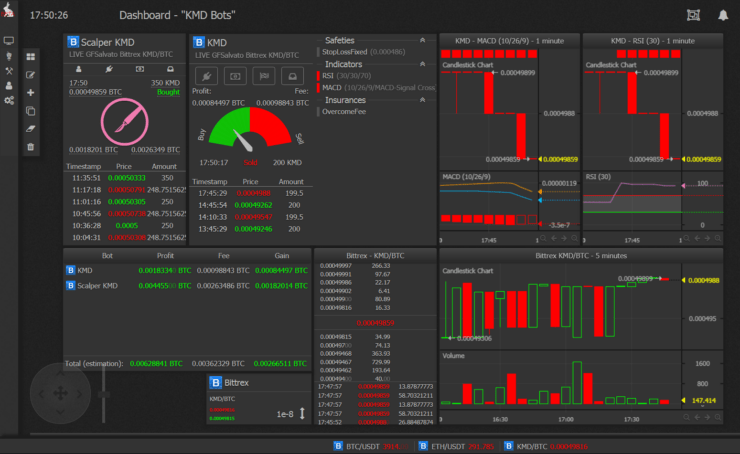

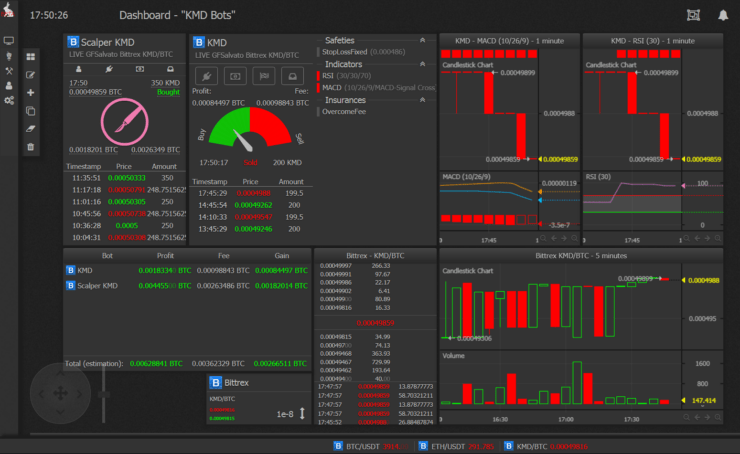

As a result, auto trading robots are becoming more and more widespread in the online trading space, not least because they do much of the hard work for you. However, it’s not a case of simply loading up your trading bot and allowing it to make consistent profits for you. On the contrary, the bot is only as good as the person that programmed it.

If you’re keen to learn the ins and outs of how automated trading works, be sure to read our in-depth guide on the Top Autotrading Robots 2023 – Which Trading Robot is Best? Within it, we cover what a trading bot is, how they work, what they can and can’t do, and crucially – the best trading robots that you should consider using.

EagleFX – Best Mobile Forex Trading Platform

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Low Spreads and Fast Order Speed

What is an Auto Trading Robot?

In its most basic form, an auto trading robot is a piece of software that has the capacity to make trades on your behalf. The underlying software is based on a ‘what-if algorithm’, meaning that it will perform trades when certain conditions are met. For example, if you wanted to purchase gold when it increased by 2% in a 24 hour period, an auto trading bot would be able to do this with ease.

Similarly, if you wanted to go short on Nike stocks when daily trading volumes dropped by 5%, once again – the best auto trading robots could do this as and when the pre-defined is triggered. The key point here is that auto trading robots are pre-programmed, so they can only perform trades when the what-if scenario has been met.

Due to the complexities of how auto trading robots work, it’s probably best that we give you a quick example before moving on.

Auto Trading Robot Example

Let’s say that you want to trade GBP/USD. Known as ‘The Cable’ this multi-trillion pound trading pair operates on a 24/7 basis. As such, you want your personal trading strategy operational around the clock to ensure you don’t miss a potential opportunity.

- GBP/USD is currently in a consolidation period and trading between 1.42 and 1.44.

- You program your bot to go long on GBP/USD if the price breaks past 1.45, and go short if it breaches 1.41.

- You have also instructed the bot to close your respective buy/sell order if it makes a profit of 3%.

- During the night when you are asleep, GBP/USD hits 1.45, so the bot places a buy order.

- A few hours later, GBP/USD then increases by 4%, before retracing back down.

- However, as your bot was programmed to close the order when a 3% profit was realized, you locked-in your profit automatically.

As you can see from the above example, you were able to perform multiple trades based on multiple potential scenarios without lifting a finger. Instead, the bot performed autonomously, based on the conditions you instructed it to follow.

What are the Pros and Cons of Auto Trading Robots?

The Pros The Cons

What are the Benefits of Using an Auto Trading Robot?

Whether you’re an old-school trader that is used to placing buy and sell orders manually, or you’ve never placed a single trade in your life – auto trading robots offer a number of benefits.

This includes:

🥇 24/7 Trading

The human body is only capable of so much. In the context of online trading, we only have the capacity to trade for a certain amount of time before fatigue kicks in. And what happens when fatigue makes an appearance? We make irrational mistakes that ultimately – will result in a loss of money.

With that being said, auto trading robots are merely pre-programmed software, meaning that they have the capacity to trade 24 hours per day, 7 days per week. This allows you to utilize your proven trading strategies around the clock – even when you’re sleeping.

🥇 Access Global Marketplaces

Following on from the above example of being able to trade on a 24/7 basis, auto trading robots also allow you to access global markets that fall outside of your local timezone. For example, let’s say that you’re based in the UK, but you wish to actively trade the Tokyo Stock Exchange (TSE).

Ordinarily, you would need to trade during the night, not least because the TSE is 9 hours ahead of the UK. Once again, this can impact your ability to trade to the best of your abilities, as you’ll likely suffer the effects of trading during the night. However, by using an auto trading robot, you can trade any marketplace that you wish – irrespective of the timezone.

🥇 Trade Multiple Markets Simultaneously

Trading can be an extremely tough cookie to crack. When you’re in the midst of a trading opportunity, you are required to devote all of your time and energy to the trade in question. As such, you can only trade a single asset at any given time. Sure, you can attempt to trade multiple assets simultaneously, but this is unlikely to yield favourable results in the long run.

With that being said, the best auto trading robots allow you to trade multiple markets simultaneously without compromising on effectiveness. For example, your robot can trade GBP/USD and EUR/USD at the same time, not least because it will only perform trades based on the pre-defined conditions it has been instructed to follow.

🥇 Outperform the Capacity of the Human Brain

The human brain is only capable of considering a certain number of potential scenarios at any given time. This became evident in the 1990s when an IMB-backed algorithm managed to beat world chess champion Garry Kasparov. The overarching concept is that algorithms have the capacity to generate thousands, if not millions of scenarios per second.

🥇 Emotion-Free

One of the biggest barriers facing newbie traders is the emotional rollercoaster of gains and losses. Regardless of the investor’s experience in the space, traders will always, and we mean always, encounter losing trades. However, those that have made a successful career of trading online know how to deal with losses.

On the contrary, inexperienced traders often become overly emotional when trades do does not go their way. As such, this can lead to irrational behaviour and thus – placing high-risk trades to win the money back. This is something that you can avoid in its entirety by using an auto trading robot, not least because it operates on software – and not human emotion.

How Does an Auto Trading Robot Work?

If you’ve never used an auto trading robot before, then it’s likely that you’re somewhat perplexed as to how it all works. While the specifics might vary from robot-to-robot, below we have outlined the main steps involved when using an automated bot.

Step 1: Choose an Auto Trading Robot

First and foremost, you will need to find an auto trading robot that meets your individual needs. For example, you need to consider what assets you wish to use your robot on (for example, cryptocurrencies, CFDs or forex), as well as the specific trading platform.

Step 2: Choose Your Markets

The bot can trade any marketplace of your choosing – as long as it is supported by the underlying provider. For example, if you are using a Bitcoin trading bot, it’s likely that you will only be able to trade cryptocurrency pairs. Similarly, if you’re using a specialist forex robot, you’ll only be able to trade traditional forex pairs like GBP/USD.

Step 3: Program Your Robot

You will now need to program your auto trading robot to mirror your personal trading strategies. Don’t worry, there is no requirement to have any experience of coding whatsoever. On the contrary, most automated trading providers allow you to program your bot through a simple drag-and-drop process. This allows you to install pre-defined conditions that you wish your trading bot to follow.

For example, let’s say that you’re interested in using your robot to trade oil. As per your in-depth research, you discover a number of patterns that you believe represents a good trading opportunity. As such, you might program your auto trading robot to do the following:

🥇 If the price of oil increases by 2% in the space of 4 hours, place a £200 buy order. If the price then increases by a further 1% – close the order with a guaranteed profit. Similarly, if the price retracts by 0.5% from the opening price, close the order at a small loss.

🥇 If the price of oil decreases by 2% in the space of 4 hours, place a £200 sell order. If the price then decreases by a further 1% – close the order with a guaranteed profit. Similarly, if the price recovers by 0.5% from the opening price, close the order at a small loss.

Step 4: Test the Auto Trading Robot Out

Without a doubt, one of the most important stages of the auto trading robot process is to test the software out before going live. After all, the robot will be placing trades on your behalf with real money, so you need to ensure that is has been programmed correctly. If it isn’t, your bot will end up buying and selling assets in a different manner than you had hoped for – which could be catastrophic.

As a result, you need to test the bot out in demo mode before sending it out in the wild. The best auto trading robot providers offer an in-house testing arena. You get to replicate real-world trading conditions without risking your money and crucially – see how your robot performs. If you find that the robot is not performing well, you can go back to the drawing board by making some tweaks to the underlying software.

Step 5: Connect Your Robot With a Trading Platform

Once you have gone through the process of building and testing your auto trading robot, you then need to connect it with your chosen trading platform. In most cases, you will need to head over to the settings area of the platform and copy your unique API code.

Next, you’ll need to paste the API code into your auto trading robot platform. Essentially, this provides authorization that you are happy for the automated robot to perform trades on your behalf.

Step 6: Assess Your Robot’s Performance

Once your auto trading robot is implementing your pre-defined trading strategies in a real-world setting, you then need to evaluate its results. This is important, as there is no guarantee that the robot will make consistent profits on an indefinite basis.

How to Find the Best Auto Trading Robots?

The auto trading robot space is now home to hundreds, if not thousands of providers. While choice is always a good thing for the consumer, this does make it somewhat challenging to know which robot to go with. Crucially, you need to assess what it is that you are looking to achieve from an automated robot, as no-two traders are the same.

As such, we have listed some of the most important factors that you need to consider before using a new auto trading robot.

✔️ Tradable Assets

First and foremost, you need to assess what assets you are looking to use your auto trading robot on. Don’t forget, the robot is only as good as the underlying software it has been programmed to follow, so you should stick with assets that you understand well.

For example, if you come from a forex trading background, choose a robot that allows you to trade multiple currency pairs. Similarly, if you’re keen to trade cryptocurrencies in an autonomous manner, then stick with a Bitcoin auto trading robot.

✔️ Compatible Trading Platforms

In the vast majority of cases, the auto trading robot provider will not give you direct access to the financial markets. Instead, you will be required to use your trading robot on an external platform.

As such, you need to assess where you will be able to use your trading bot before signing up. You don’t want to be left in a position where the robot is only supported by trading platforms that do not meet your individual requirements.

✔️ User-Friendliness

Unless you come from a coding background, it’s crucial that you choose an auto trading robot that is tailored to newbies. In fact, we prefer providers that allow you to set your pre-defined trading conditions via a drag-and-drop process.

✔️ Market Orders

You also need to explore what market orders your auto trading robot will be able to place on your behalf. The overarching benefit of using a bot is that it can perform sophisticated trades that are beyond the realms of the human brain. As such, you’ll want access to heaps of market orders.

This should include the likes of stop-loss orders, guaranteed stop-loss orders, trailing orders, take-profit orders, and more. It is also notable if the auto trading robot can engage in dollar-cost averaging. This is where it can place buy orders during a bear market, subsequently allowing you to purchase the asset at a discounted price.

✔️ Price

Auto trading robot developers are in the business of making money. As such, it’s all-but-certain that you will need to pay a fee to use the trading bot. In some cases, this will be a one-off flat fee. Once you’ve made the purchase, you can then use the robot as and when you see fit.

Nevertheless – regardless of whether the provider implements a flat-fee or monthly subscription, make sure that the price offers value for money.

✔️ Payments

Following on from the above section on pricing, you also need to consider how you are going to pay for your auto trading robot. For example, if using a robot Bitcoin trading platform, then it’s likely that you will need to pay your fees in cryptocurrency.

Alternatively, if you’re looking to obtain a trading robot that can access traditional forex and CFD markets, then supported payment methods might include a debit/credit card, bank transfer, or e-wallet.

✔️ Testing

One of the most important factors that you need to consider before purchasing an auto trading robot is whether or not the provider offers an in-house testing facility. As we mentioned earlier, this is absolutely crucial, as you need to assess whether the robot is ready to trade with real money.

If it isn’t, then you’ll have the opportunity to make the necessary tweaks and improvements. Upon testing the robot again, you can then decide whether you’re ready to send it into the wild. As such, only choose an auto trading robot provider that allows you to test the software out in demo mode.

✔️ Public Reviews

It’s super-difficult to know whether or not an auto trading robot is worth buying until you actually test it out. In this sense, it’s always notable if the provider offers a free trial of some sort. If it doesn’t, then you should perform some research to see how previous users rate the provider.

The internet is jam-packed with specific trading robot reviews, so be sure to explore what’s available in the public domain before proceeding.

✔️ Customer Support

Finally, you also need to assess what customer support is like at your chosen auto trading robot platform. After all, there might come a time where you need assistance, so choose a provider that offers support on a 24/7 basis.

In an ideal world, this will come in the form of live chat and telephone support, as you’ll be able to get assistance in real-time.

Best Trading Robot 2022 – Top Auto Trading Platforms

If you’ve read our guide up to this point, you should now have a firm idea of what an auto trading robot is, and whether or not the technology is likely to meet your long-term investing goals. If you do like the sound of what a robot offers, you now need to choose a provider that meets your needs.

If you don’t have the required time to perform your own due diligence, below we have listed our top 3 auto trading robots of 2022.

1.CFD Trader – Become Financially Independent With Online Trading Become Financially Independent With Online Trading

If you are reading this, it means we still have some spots left. That means you’ll have a shot at making the fastest gains you’ll ever see, and collecting profits of €261, €7,541 and even up to €67,454 trade after trade. And you can get started as soon as you enter your name, email, password, and phone number in the secure at the top of this page.

And all it takes is a minimum of €250 to get started. You can also withdraw your capital whenever you want because you will already have an established deposit account!

- Direct free access to the #1 best CFD broker of UK

- One free 1on1 coaching call within the first 48 hours of signing-up

- A personal mentor that will help you week after week

2. Bitcoin Pro – Best AI Trading Platform for Forex and CFDs

Bitcoin Pro is the latest robot that has gone viral online with users alleging that it’s highly profitable. This robot can supposedly make up to $1k per day from an initial capital investment of less than $500. Some users allege making up to $2k in the first 24 hours of trading. But is Bitcoin Pro legit and is it possible to earn the alleged profits?

However, before we get started, it is essential to note that any form of margin trading involves significant risk. Consequently, there is a chance of losing the invested capital when trading with Bitcoin Pro. InsideBitcoins cannot stress enough on the need to only trade with what you can afford to lose.

A deposit of $250 is always the right place to start for beginners. You can always upgrade your account by ploughing back all your earnings. Read this review to the end or visit Bitcoin Pro website through the link in the table below.

- 88% Claimed Win Rate - Appears to be legit

- $/£ 250 Min Deposit

- Accepts Debit and Credit Card

3. Cryptohopper – Best Bitcoin Trading Robot for Beginners

If you're looking to access the multi-billion pound cryptocurrency trading scene, why not utilize a Bitcoin trading robot? One of the most reputable providers in this respect is that of Cryptohopper. Launched in 2017, Cryptohopper is an auto trading robot that is tailored to both newbies and seasoned investors. You can build your own trading strategies via the drag-and-drop mechanism, which covers key variables such as trailing stop-loss orders and consolidation period trading.

If you're yet to possess any proven trading strategies of your own, Cryptohopper also allows you to purchase pre-packaged strategies from its online marketplace. On top of supporting more than 75 cryptocurrency trading pairs, the provider also offers that all-important testing facility. As such, you can test your Cryptohopper robot out before risking your own funds. Although the trading robot will set you back $19, $49, or $99 per month - this is a small price to pay for the many features that Cryptohopper offers.

- Supports more than 75 cryptocurrency trading pairs

- Fully-fledged demo facility

- Perfect for both beginners and seasoned traders

- Cryptocurrency trading only - no CFDs or forex

- Best plan costs $99 per month

4. 3Commas – Best Auto Trading Robot App

If you like to have the option of being able to facilitate your auto trading needs while out of the house, it is well worth considering the merits of 3Commas. On top of offering a platform for desktop users, 3Commas also comes with a fully-fledged trading robot app. This is ideal if you want to view how your robot is performing in the markets when you are on the road. Moreover, the 3Commas mobile app also allows you to tweak your robot to mirror current market conditions.

Much like Cryptohopper, 3Commas is only suitable for trading cryptocurrency pairs, so if you're looking to access forex and/or CFDs, you're out of luck. Nevertheless, 3Commas allows you to build a personalized trading strategy with ease, or you can purchase a pre-programmed strategy. The robot is compatible with heaps of leading cryptocurrency exchanges, which includes the likes of Binance, Kucoin, Bitfinex, BitMex, and Bitstamp.

- Lots of market orders supported

- Compatible with most leading cryptocurrency exchanges

- Build your own personalized trading strategies

- The bot design protocol is best suited for advanced traders

5. Odin Forex Robot – Best Forex Auto Trading Robot

If you're looking to obtain an auto robot that is suitable for forex trading, then we would suggest checking out Odin Forex Robot. The bot is compatible with the industry-leading MT4 trading platform - which is hosted by thousands of forex brokers in the space.

The bot supports 20 different forex pairs, which includes the likes of GBP/USD and EUR/USD. Everything is fully automated once you set up your pre-defined trading conditions. This can include a system that utilizes Fibonacci Levels, as well as trends and retracements. Moreover, Odin Forex Robot costs just $129, so there's no requirement to sign up to a monthly subscription.

- Compatible with MT4 trading platforms

- Leading forex auto trading bot

- Supports 20 different forex pairs

- The provider uses hyperbole when discussing the bot's historical performance

- Best plan costs $99 per month

Conclusion

In summary, autotrading robots allow you to trade in an autonamous manner. This ensures that you are able to trade effectively on a 24/7 basis. With that said, choosing the right trading bot is crucial if you are to make consistent gains in the long run. By reading our guide in full, we hope you now have the tools to do this.

Trade with a Global Market Leader in Forex Trading

- Over 4,500 markets including FX, shares, cryptos, indices and commodities

- Access shares on companies like Amazon with commissions from 0.08%

- Earn rebates on monthly trade volume when you qualify for Active Trader

- Lowest trading costs for popular crypto markets*