If you are interested in trading, the chances are that you have already come across the term CFDs in the financial space. However, more often than not, CFD trading is explained using complex terms that make it confusing to the untrained eye.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

That is why we have curated a guide that will help you understand what CFDs are and how they can be advantageous to your trading goals.

In the simplest terms, CFDs allow you to trade an asset without taking ownership. Instead, you will only be speculating on the future price of the security in question.

In this Learn How to Trade CFDs Guide, we discuss all you need to know about this financial instrument and how you can trade them online.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Understand the Basics of How to Trade CFDs

CFDs are, in fact, quite simple to trade once you know how this asset works. As such, we will start at the fundamentals.

What are CFDs?

CFDs are a popular type of derivative trading. In its most basic form, a Contract for Difference is a financial instrument that mirrors the market price of an asset. It allows you to trade securities without having to own them.

When trading CFDs, you are predicting whether the value of the asset will go up or down in the market. You do not have to buy the asset in order to benefit from its future price movement.

CFDs are widely used in the trading sector, especially because they can represent practically any security. Be it equities, commodities, or cryptocurrencies – you will be able to find CFDs for any asset class.

However, if you trade oil using CFDs, you do not have to worry about storage or even ownership. On the contrary, you only have to concern yourself with the future price shift of the asset. As long as the market moves as per your prediction – you will make a profit.

Here are a few practical examples to clear the mist.

Example 1:

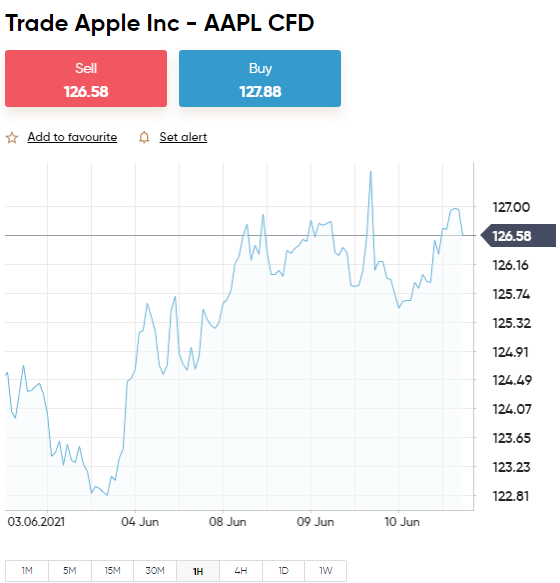

- Let us say that you want to trade Apple stocks.

- You believe that the price of Apple (AAPL) shares is about to rise in the next few hours.

- You place a buy order for Apple CFDs at $139 per share.

- Later in the day, the price of Apple shares rises to $150 per share.

- Pleased with your profits, you decide to sell your Apple CFDs.

- The trade leaves you with a profit of $11 per share CFD.

In this case, since you are only looking to place trades in the short-term, purchasing the shares does not make sense. If you did, you would the share dealing fees applicable would make the trade unviable.

Ultimately, by trading through CFDs, you can make a profit on the future price of Apple without taking ownership of the shares Now, let’s take a look at another example. Only this time, we’ll see how you can benefit from the falling asset prices by trading CFDs.

Example 2:

- Let us say you want to trade gold.

- The price of gold stands at $1,500 per ounce.

- You expect the price of gold to drop in the next few days.

- Hence, you place a ‘sell order’ on a gold CFD.

- Two days later, the price of gold goes down to $1,400 per ounce.

- You set up a buy order to close the position and thus – lock in your profit.

In this case, your profit is $100 per ounce. This type of trading – where you profit from the decreasing prices of a CFD asset – is called ‘going short.’

As you can see, trading CFDs makes it possible for you to take advantage of both the rising and falling prices of a security.

CFD Tradable Markets

If you can trade an asset in the conventional financial markets, it is possible to trade them using CFDs as well. This is primarily because CFDs merely reflect the real-world value of an asset.

For instance, say you are interested in copper CFDs. If the price of the copper increases by 2% in the market, so will the price of the copper CFDs.

Here is a list of all the major CFD asset classes available in the market today:

- Stocks

- Indices

- Hard metals

- Energies

- Agricultural Products

- Options

- Futures

- Cryptocurrencies

- And More!

Benefits of Trading CFDs

If you are new to CFDs, let us tell you what the advantages of trading this financial instrument are.

No Need to Own the Asset

As we emphasized earlier, the main advantage of CFDs is that you do not have to own the asset. Rather, you will be trading a contract that tracks the value of the financial security.

It gives you the opportunity to profit from price shifts in the market without taking possession of the asset in its physical form.

Access to Leverage

CFDs enable you to place trades with more funds than you have in your account via leverage. This means that you only have to deposit a fraction of your trade’s full value in order to enter the position.

CFDs enable you to get your hands on higher leverage compared to traditional trading. In some markets, you can leverage up to 1:500 times on CFDs. This means that for every $500 in trading capital, you would only need to have an available balance of $1.

As you can see, leveraging on CFDs can also be extremely risky, and therefore – is subject to heavy regulation. We will discuss more on CFD leverage later in this guide.

Profit From Both Bull and Bear Markets

CFD trading enables you to open trades in both rising and falling markets – giving you the capability to capitalize on any direction the market takes. If you think the price of the asset is going to rise – you can place a buy order and close it with a sell order.

On the flip side, if you expect that the price of an asset is about to drop – you can place a sell order first. You can then place a buy order to exit the trade. In effect, CFDs allow you access to added flexibility and pursue more trading opportunities.

Lower Trading Fees and Commissions

When compared to traditional markets, online brokerage platforms offer CFDs at relatively lower trading fees. In many cases, there is no trading commission associated with CFDs, so you only have to factor in the spread. However, in case you keep open a position overnight, you will also be liable to pay a ‘swap fee’.

Drawbacks of Trading CFDs

Although there are many benefits of trading CFDs, certain drawbacks are also present.

No Entitlement to Investor Rights

While the lack of ownership can be advantageous in many ways, CFD trading also comes with a cost. For instance, when you invest in a company’s shares, you are entitled to dividends.

But if you are trading stocks through CFDs, you will have no right to receive any payments. This is because you are not taking ownership of the assets- hence making CFDs a less robust long-term investment prospect.

Not Suitable for Long Term Trading

As we pointed out above, CFDs also invite swap fees (also called ‘overnight financing’). That is – for every night you keep a trade open, you will be liable to pay your broker an overnight fee.

Part 2: Learn CFD Orders

One of the most important aspects while learning how to trade CFDs is to understand the different order types and knowing how to use them effectively.

A trading order is used to communicate your position to the broker. Instead of waiting to see which direction the market moves, you can leave your instructions with your chosen platform via trading orders.

Your broker will execute them based on your specified criteria. No matter what market you are trading, using the correct order type will ensure that CFD positions are executed in a timely manner and at the price you want.

The following are the most commonly used types of orders when trading CFDs.

Buy and Sell Orders

Buy and sell orders are the most basic and straightforward types of orders you will place. It is mandatory to use both these orders, regardless of which security you are trading.

In a nutshell:

- If you speculate that the price of a CFD is about to rise – you will open the trade with a buy order and close it with a sell order.

- If you speculate that the value of a CFD is about to fall – you will open the trade with a sell order and close with a buy order.

Market Orders and Limits Orders

When a trader places a buy or sell order on a CFD, the broker will ask you whether you want to place a market order or a limit order.

Here is a short explanation of what each order means:

Market Order

A market order tells the broker to immediately execute the CFD order at the current market price. This order allows you to capitalize on a trading opportunity as soon as it comes to fruition.

In a fast-moving market, the actual price at the time of placing the order and the price at the execution point might vary a little.

Let us elaborate with an example.

- Let us say that HSBC shares are currently priced at $30.00.

- You want to enter the market at this price, so you place a trade instantly.

- Hence, you create a ‘market order’ on HSBC CFDs.

- When the order is executed, you might note that instead of $30, the order was placed at $30.10.

As in the above example, the variation is small enough to ignore and does not affect your profit potential in any way. When it comes to market orders, the speed of executing the order takes priority over the price of the security.

On the other hand, if you want to ensure that you lock-in a specific price, you will have to go for a limit-order – which we cover below.

Limit Order

Limit orders are used to set the price at which you want the order to be executed.

For instance, in the above example, if you had used a limit order – it would work like this:

- Suppose HSBC shares are priced at $30.00.

- You want to enter the market on HSBC CFDs – but only when the price of the stock hits $32.00 per share.

- Therefore – you place a limit order at $32.00.

- Your broker will carry out the order if and when the price of HSBC shares increases to $32.00.

If the price does not hit your specified level, the order will remain pending until you cancel it yourself.

Stop-Loss Orders and Take-Profit Orders

When you learn how to trade CFDs for the first time, it is important to ensure that you have command over your positions. As such, you cannot enter a trade without having any idea of what profit you are trying to achieve.

This is where you use ‘stop-loss’ and ‘take profit’ orders.

Stop-Loss Orders

A stop-loss order is one of the most important tools that can help reduce your chances of encountering large losses when trading CFDs. In its most basic form, a stop-loss order is used to exit a trade when the price reaches a certain point. It allows you to limit your potential losses by automatically closing your position when your specified price is triggered.

For example:

- Let’s say you want to go long on silver – meaning that you think the price of the metal will rise in the short-term.

- Hence, you place a buy order on silver CFDs at a value of $1,000.

- Meanwhile, you don’t want to risk losing more than 5% of your trade amount.

- As such, you create a stop-loss order at $950.

- Unfortunately, the price of silver goes down – against your prediction.

- In this case, your trade will be closed automatically when the price of silver hits $950 – as per the stop-loss order you placed.

On the flip side, if you wanted to go short on silver – you will place a stop-loss order at 5% above the entry price. In this case – at $1,050.

A stop-loss order can be extremely useful in reducing your exposure to losses. It also allows you to automate the process without having to manually close the trade if your initial speculation goes wrong.

Take-Profit Orders

Although it might seem that you should leave profitable traders open indefinitely, in a volatile market, the trade can go against you in a matter of seconds. This is why seasoned CFD traders will look to lock-in their profits automatically.

A take-profit order can come in handy for this purpose – by setting a profit target. This will allow the broker to close the trade automatically once your trade has achieved the specified profit.

For instance,

- Let us say that the price of silver stands at $1,000.

- You place a buy order on silver CFDs – expecting that the price to increase in the next few hours.

- You want to attain a profit of 5% on this CFD trade.

- Hence, you set up a take-profit order at $1,050.

When and if the price of silver increases to $1,050, the trade will be automatically closed while securing your 5% profit.

In most cases, traders place a take-profit and stop-loss order on each and every CFD trade. This allows the broker to close the trades automatically on your behalf – regardless of which direction the market moves.

Part 3: Learn CFD Risk-Management

It goes without saying that every CFD trade involves a certain amount of risk. It is not possible to evade risk altogether, no matter which market you are trading.

Instead, what you can do is employ effective ‘risk management strategies to limit your potential losses. In simple terms, these are precautionary measures you take in order to keep your trading decisions objective and protect your trading capital in the long run.

Below are some of the widely used risk management strategies that you can use while learning how to trade CFDs as a beginner.

Percentage-Based CFD Bankroll Management

One of the basic approaches to managing risk is to rely on a bankroll protection strategy. Meaning – you will limit the amount of money you risk on a single trade. This is often calculated as a percentage of your available trading funds.

- For instance, say you have a strategy in place that limits all your positions to 2% of your trading balance

- In other words, you will not risk losing more than 2% of your available capital on one CFD trade.

- It does not matter how confident you are about the market – the maximum you will stake on a single trade will always remain at 2%.

Consequently, you will have to adjust your bankroll management strategy in accordance with your available funds.

Consider this example:

- Suppose you have $2,000 available in your trading account.

- You use a bankroll management strategy that lets you stake up to 2% on a CFD trade.

- Meaning, the maximum stake you can risk on a single CFD trade is $40.

- Now, after a couple of weeks, you have $5,000 in your trading account.

- In this case, you can increase your stake to 2% of $5,000 – which is $100.

However, if you have had a bad month, and your trading funds go down to $1,000 – you will only stake up to $20.

Trading CFDs via a Risk and Reward Ratio

Alongside a bankroll management strategy, you can also base your trading decisions on a risk-reward ratio. In this case, you are defining your goals on how much profit you want to attain and what you are willing to risk to achieve this.

Let us explain better with an example:

- Suppose you have established a risk-reward ratio of 1:2 on all your CFD trades.

- This implies that for every $1 you risk, you want to secure a profit of $2.

- So if you are staking $500 on a trade, you are hoping to earn at least $1,000 as profit.

The calculation here is quite straightforward and suitable for both experienced traders and newbies alike. Once you have arrived upon a risk-reward ratio that aligns with your financial goals, you can use stop-loss and take-profit orders to ensure its execution.

CFD Leverage

In its most basic terms, leverage gives you the ability to trade a large position with a fraction of the required capital. In short-term trading, you might open several positions within a day. As such, you need sufficient bankroll to fund your trades.

With leverage, it is possible to trade with more funds than you have – by borrowing the rest from your online broker. In theory, leveraging only reduces the amount of money you put up on a trade.

The concept can be a little challenging to understand, so we have prepared a simple example for you.

- Say that you want to trade 100 shares of IBM stock at $120 per CFD share.

- Ordinarily, this would require you to stake $12,000.

- But if you apply leverage of 1:10, you only need to put up $1,200 from your side.

- The next day, the price of IBM shares increases by 10%.

- Since you applied leverage – the profit will be $1,200.

- However, without leverage – your profit will only amount to $120.

As you can see, you will be able to make a profit for the entire amount you traded, not only on your contribution. On the flip side, if the price of IBM shares happened to go down, your losses would also have been magnified.

For this reason, CFD trading with leverage is regarded as highly risky. In fact, in several countries, particularly in the US, it is not permitted to trade CFDs or benefit from leverage. Similarly, in the UK, leveraging is accessible for CFD assets other than cryptocurrencies.

At the other end of the scale, in some countries, leverage on CFD assets is unregulated. As such, it is likely that you will find offshore brokers offering leverage as high as 1:1000 on CFD positions.

As you know by now, such a large amount of leverage will significantly increase your losses should the trade go against you. Moreover, the chances are that the platform offering such exponential leverage limits does not hold any licenses from a regulatory body – and so are best avoided.

Part 4: Learn How to Analyze CFD Prices

By now, you should have a firm grasp on the steps involved in CFD trading – including how you can place orders and how you can mitigate risk. However, these are not sufficient in making data-driven trading decisions.

This is why you need to research the CFD asset you are trading and make informed choices. There are a number of ways for you to analyze the market of the underlying asset you are trading.

Here is a quick glance at some of these research methods.

Fundamental Analysis in CFDs

As we covered earlier, you can use CFDs to trade virtually any asset available. No matter which asset you choose, you will have to perform fundamental analysis to know about the factors that drive its price.

This includes examining the social, economic, and financial landscape that contribute to the price movements of the asset. For instance, if you are trading stock CFDs, you need to be aware of the company’s financial standing, its internal affairs, its sector, and other economic and political data that can affect the firm’s reputation.

On the other hand, when trading crypto CFDs, you will also have to look into blockchain developments and digital currency regulations. The list of considerations will vary from one asset to another, and so you will have to do your analysis accordingly.

Understandably, it might seem nearly impossible to keep track of all these aspects when you are trading. However, these days you can sign up for a subscription service to receive regular updates on assets you are interested in. This cuts out the need for you to manually check the financial news throughout the day.

Technical Analysis in CFDs

While fundamental research focuses on influential factors, technical analysis relies purely on the historical performance data of an asset.

This is done using a set of charts, graphs, and technical indicators that studies an asset and subsequently predict its future price based on the information available. You can work with dozens of trading indicators online – from the MACD, ADI, RSI, and more.

You can choose an indicator based on your trading strategy. For instance, price action traders largely depend on candlestick charts, whereas scalping traders might rely on a combination of technical indicators like Moving Averages and the Relative Strength Index.

Trading Signals

If you are relatively new to trading, there is a steep learning curve before you get confident in your analysis. It can take months to gain a thorough understanding of the different concepts and plan your CFD trades accordingly.

The best alternative here is to use trading signals. Such services use a predetermined criterion that involves a combination of technical and fundamental analysis to send you trading triggers.

For instance, the best trading signal services will provide you with the following information:

- Which CFD asset to trade

- Whether you should place a buy or sell order.

- The entry price to place the trade.

- Take-profit price

- Stop-loss price

If you rely on a trading signal, you do have to spend hours researching the market. Instead, you can place orders based on the respective trigger – thus saving a significant amount of time. We at Learn 2 Trade specialize in trading signals that target the forex, crypto, and CFD arenas – should this be something you are interested in!

Part 5: Learn How to Choose a CFD Broker

Now that you know what CFD trading entails, you need to find a suitable online broker. Remember, no two brokers offer the same service.

Even if the broker supports your chosen CFD assets, you also need to consider fees, commissions, payments, regulation, and more. As such, you will need to first do your homework in choosing the best broker for you.

We suggest that you evaluate the following factors prior to making your decision.

Regulation

Perhaps, the most important metric that you need to consider is whether the broker holds a valid license from a respectable financial authority. The most popular regulatory bodies in the CFD trading space are the FCA in the UK, ASIC in Australia, MAS in Singapore, and CySEC in Cyprus.

CFD trading, in particular, can be risky. It is thus crucial that you entrust your funds only with a broker who puts their customers’ interests as a priority.

- If your broker is regulated, it guarantees that they are following the guidelines implemented by the regulatory body in question.

- This includes keeping clients’ funds in separate bank accounts, transparency in fees, and regular auditing.

As we cover shortly, our top-rated CFD trading site eToro is regulated by three of the above financial bodies – so you can trade safely at all times.

Trading Fees and Commissions

The second most important factor that needs to be considered is what CFD trading fees are involved. After all, brokerage platforms charge fees to facilitate and execute positions on your behalf.

Below are the main fees that you will see on a CFD trading platform.

Commissions

Broker commissions are charged in percentage terms and will vary based on the size of your trade.

- For instance, suppose your broker stipulates a commission of 0.9% on CFD trades.

- Meaning – you will have to pay 0.9% of the stake when you open a position.

- You will have to pay 0.9% again when you close it.

However, today, you can easily find online brokers who charge 0% in commission. For your reference, we have added a list of brokers that offer zero-commission CFD trading further down on this page.

Spreads

In trading, the spread is defined as the difference between the buy and sell prices of an asset. Similar to commissions, the spread is usually assessed in terms of percentages – unless you’re trading forex – where it’s calculated in PIPs.

Nevertheless, even when brokers do not charge commissions, they almost always charge spreads. You, therefore, want to choose a CFD trading site that offers tight spreads so that you can trade in a cost-effective manner.

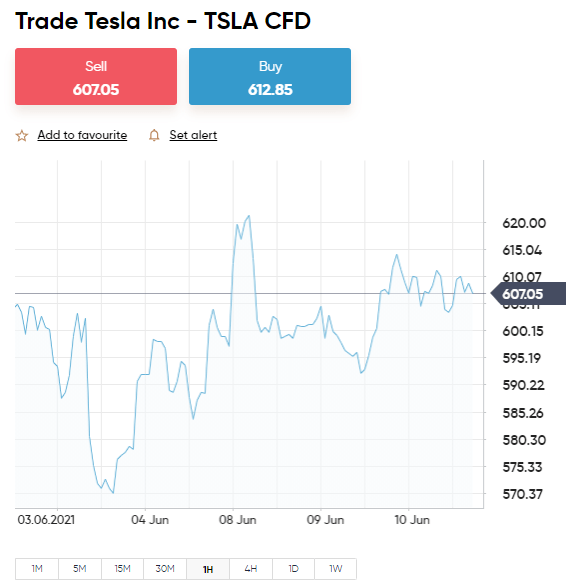

Take a look at this example:

- Let us say the buying price of TESLA stock CFDs is $400 per share.

- The selling price of the CFDs stands at $410.

- The percentage difference on this CFD market is 2.4% – meaning the spread is 2.4%.

On this trade, you will have to make a profit of at least 2.4% to make it to the break-even point. Your profit will be accounted only for any gains that come after this 2.4% mark.

Payment Methods

The best brokers in the CFD space will have multiple payment methods for you to choose from. The most common types of payment methods offered include bank transfers, debit cards, credit cards, and third-party wallets such as PayPal.

Best Brokers to Trade CFDs Online

If you are looking to get started with a CFD trade right now, then save time by choosing one of the brokers listed below. We reviewed them based on the criteria discussed above, so you can rest assured that you are using a top-rated platform.

Here is our selection of the best online brokers to trade CFDs with in 2023.

1. AvaTrade – Best Trading Platform With Heaps of Techincal Analysis Tools

AvaTrade has a long-standing reputation that now spans over a decade in the online trading arena. The platform holds numerous regulatory licenses - allowing jurisdiction in a number of countries, including the UK, Australia, Japan, South Africa, the European Union, and more.

AvaTrade was also one of the first brokerage platforms to offer CFDs in the online space. Depending on your country, you will also be able to obtain high leverage limits. Further, the platform also offers a treasure trove of technical tools at your disposal.

Apart from MT4 and MT5, the brokerage also has a native trading platform that can be accessed online or via the AvaTradeGO app. Additionally, the platform is also compatible with Zulutrade and Duplitrade.

- Reasonable minimum deposit of $100

- Regulated in multiple countries

- Heaps of commission-free assets to trade

- Inactivity fees considered high

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade CFD Today – Walkthrough

So now you have made your decision on which brokerage platform you want to sign up with, the only step left is to create an account. In doing so, you can start pursuing your CFD trading goals.

We have created a simple step-by-step walkthrough on how you can start trading CFD instruments in minutes. As one of our top-rated platforms, we will use Capital.com as our reference to guide you through the 10-minute process.

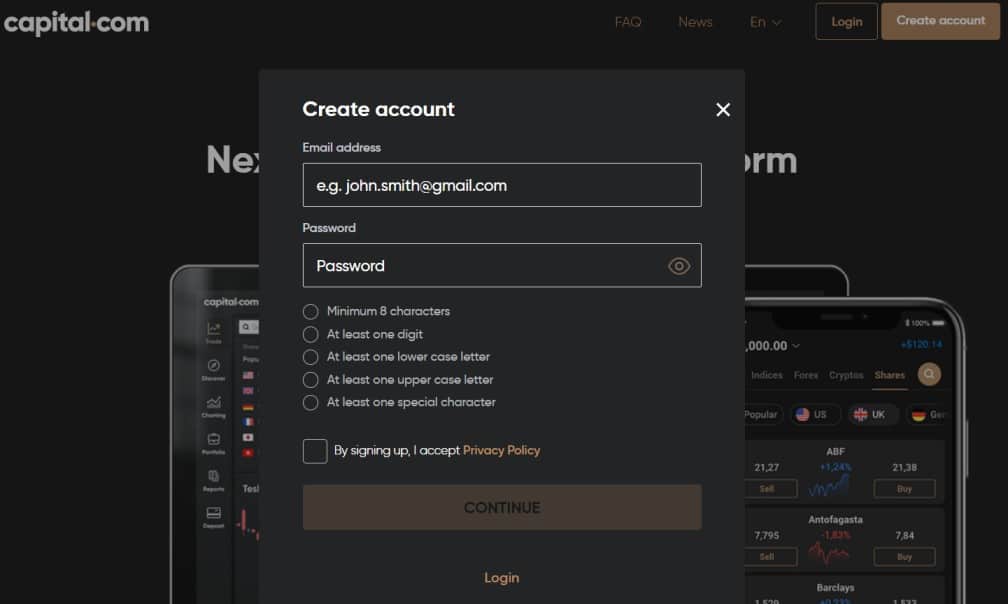

Step 1: Open an Account

Head over to the homepage of Capital.com, and find the ‘Create account’ button. When the registration page is loaded, you can enter your personal information that includes your full name, date of birth, home address, email, etc.

Step 2: Upload ID

All regulated brokers like Capital.com comply with KYC rules. As such, you will be asked to provide a copy of your government-issued ID – such as a passport or driver’s license.

Step 3: Deposit Some Trading Funds

In order to start trading CFDs, you need to add money to your account. Choose between a bank transfer, credit/debit card, or an e-wallet. Once again, the minimum deposit amount is $200.

Step 4: Start Trading CFDs

Now, all that is left is to place your first CFD trading order. When you have chosen the market you want to trade, you can find it by using the search facility at the top of the page.

Once you feel confident about your order – click on ‘Open trade’. You have now placed your first commission-free CFD trade on Capital.com!

Learn How to Trade CFDs – The Verdict

If you have stuck with our Learn How to Trade CFDs Guide all of the way through – you should now have a basic understanding of what this asset class is are and how you can trade it. With the right set of trading orders and risk management strategies, there is plenty of profit potential in the CFD trading space.

That said, it is vital that you find the right online broker to aid in your CFD endeavors. Consider the research you put in to find the best-suited online broker for your skill-set.

A CFD platform like Capital.com can is one such provider worth exploring. You can trade thousands of CFDs without paying a single cent in commission. Plus, it takes minutes to open an account and you can even automate your CFD positions through the Copy Trading tool!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

How safe is it to trade CFDs online?

What factors determine the price of CFDs?

Can I make profits by trading CFDs?

How much money can I make by trading CFDs?

Can you trade CFDs in the US?