Gold is one of the most volatile asset classes globally. Therefore, before you risk any of your hard-earned cash – you need to learn how to trade gold comprehensively.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In this guide, we cover everything from the basics of how to trade gold online, placing an order, strategies to consider, and how to manage your risks.

Furthermore, we review the 5 best brokers to trade gold online with, explore key metrics to finding a great platform, and conclude with an easy-follow walkthrough of how to get started today.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Understand the Basics of Trading Gold

Before you can learn how to trade gold effectively, you need to have a grasp of the basics. As such, let’s start with the fundamentals.

What Does a Gold Trade Entail?

When you trade gold, the aim is to correctly hypothesize about its rise or fall in value. To further explain, if you think that gold is undervalued and is about to see a price increase, you place a buy order with your online broker.

If you speculate correctly and gold does rise in value, you make a profit. Notably, you will notice that this asset is almost always quoted in US dollars or in rarer cases – another major fiat currency.

We talk about gold CFDs in more detail shortly. If you see yourself trading gold on a medium to long-term basis, you will want to avoid CFDs. This is because of the overnight financing fees that gold CFDs attract. Instead, you may want to access the gold markets via an ETF.

How to Trade Gold: Short-Term or Long-Term?

There are a few different ways in which you can trade and invest in gold.

For those unaware, see a brief explanation of the two most popular options below.

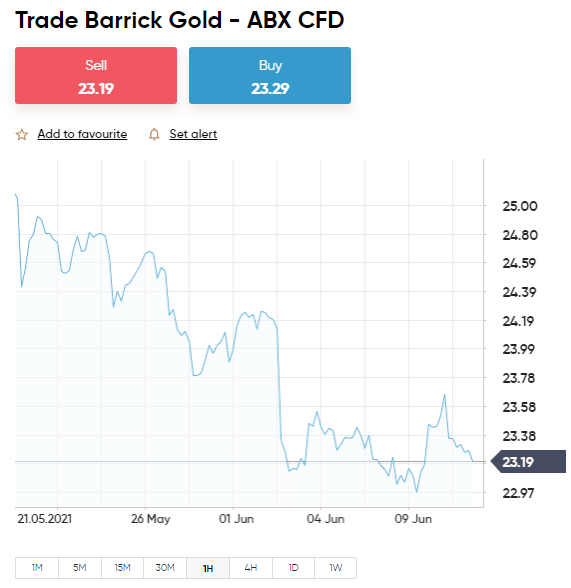

Gold CFDs

Undoubtedly the most popular way to trade gold is via CFDs. In case you are a complete novice, CFDs (Contracts for Difference) are financial instruments that enable you to trade the underlying asset – without having to own it. As such, you do not have to worry about transporting or storing bullions of gold.

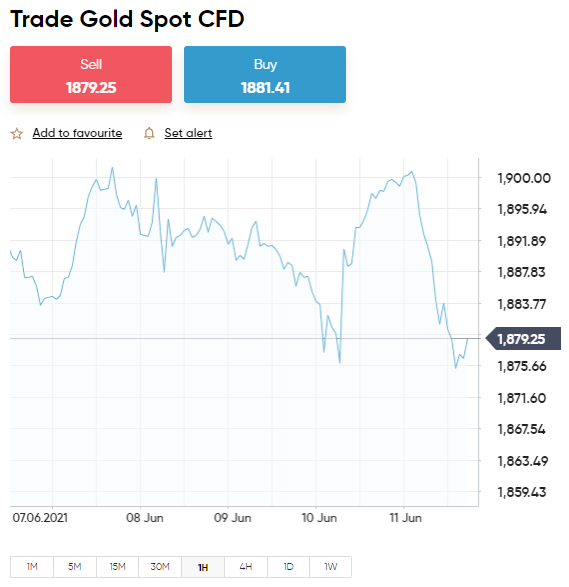

To clarify, unlike when trading stocks on an exchange, a gold CFD simply tracks the asset’s real-time price movements. This is done via a gold benchmark.

Furthermore, you can still make a profit from its rise or fall in value by ‘going short’. This means that if you believe the price of gold is going to fall in value – you can place a ‘sell’ order. If you are correct, you make a profit.

We have put together a simple example of how your next gold CFD trade might look.

- The price of gold – according to the LBMA Gold Price benchmark, is $1,835.59 per ounce

- As such, your gold CFD is also valued at $1,835.59 per ounce

- If you have a feeling the price of gold is going to increase – you place a buy order

- On the other hand, if you think the price of gold is going to fall – you need to place a sell order

- If gold rises or falls by say 4% and you predicted the direction correctly – you make a 4% profit (not including the spread which we cover later)

It’s important to be mindful of overnight financing fees that are attached to leveraged CFDs products. Crucially, for each day a leveraged or CFD trade is kept open, there will be a fee. The fee will depend on the broker and the amount of leverage you want.

Our Learn How to Trade Gold Guide found that eToro is a great option for gold CFDs – as the platform is commission-free. Plus, as you enter your details when creating your trading order, eToro clearly displays the daily and weekend overnight financing fee you will be expected to pay. Ergo, if you are not happy with the charge on display, you could perhaps lower your leverage or reduce your stake.

Gold ETFs

Gold ETFs (Exchange Traded Funds) are a superb option if you see yourself as a medium-long-term trader, and would like to invest in the asset indirectly. This is because these funds give you the exposure to the gold markets that you want – but without the need to own and store the underlying commodity.

A gold ETF will always aim to mirror the sentiment of gold in the general markets For example, the GLD (SPDR) ETF is the biggest physically-backed gold fund globally and trades on the stock exchange. If this has perked your interest, you may be pleased to know that the ETF is accessible via the social trading platform eToro, whereby you are able to buy the ETF commission-free. This means you can invest in the value of gold long-term without getting hammered by CFD fees.

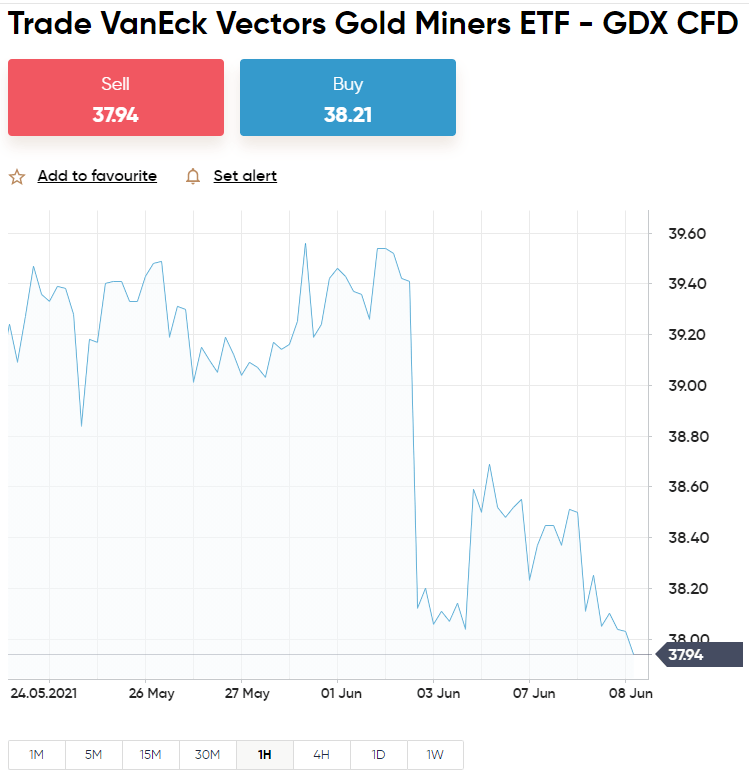

Another popular fund is the VanEck Vectors Gold Miners ETF. This fund concentrates on the NYSE Arca Gold Miners Index. However, there are a few other gold mining companies included. Of course, like any ETF, the price will be dictated by the supply and demand of the market.

As you can see, you can easily gain exposure to this highly traded commodity, without ever needing to worry about storage or logistics. The minimum investment on a gold ETF starts from $50 at eToro, and as we said, this online broker charges zero commission.

Part 2: Learn Gold Orders

Before you can learn how to trade gold to its fullest, you need to have a good grasp on placing gold orders.

After all, without an order in place, your broker isn’t going to have a clue what your sentiment towards this asset is – meaning whether you think the price will rise or fall. Let alone how much you want to stake.

Buy Orders and Sell Orders

Let’s start with the most simple of orders – buy and sell. These orders will be used no matter what asset you end up trading in the future. As such, it’s better to learn how to trade gold by starting with the basics.

We have mentioned that when trading CFDs you are able to go long or short on gold (or any asset). This means that you can potentially make a profit from both the rise and fall of the financial instrument.

See an example below:

- After performing some research, you suspect that gold is going to see a price increase – as such you place a buy order

- If all signs are pointing towards a decrease in the price of gold – place a sell order with your broker

It really is that easy!

However, please note the following:

- In the first scenario above, you entered the gold market with a buy order (believing the price will rise). As such, to exit your position – a sell order is needed

- As such, if you enter the gold market with a sell order (believing the price will fall), you must exit your position with a buy order

Market Orders and Limits Orders

Now that we have covered your basic entry into the gold market – we can talk about specifics. After all, it’s not just as simple as a buy or sell order. When you begin to learn how to trade gold, in a practical sense, you will see that the price of the asset fluctuates on a second by second basis.

As such, there are two additional orders to choose from when thinking about how to enter the market.

Market Order

The market order is the most rudimentary order. When electing to trade gold with a ‘market order’, you are instructing the provider to execute your order right away.

This order is fast and convenient for when you see a potentially profitable opportunity. However, you should note that there will be an ever so slight disparity between the price you are quoted, and the price you actually get.

For instance:

- You wish to place a buy order on gold, which is currently priced at $1,835.79

- You like this price so want your order actioned as a matter of urgency

- As such, you place a ‘market order’ and the broker executes this within seconds

- You have a look at your gold order and notice you entered the position at $1,835.58, instead of $1,835.79

As is clear from our above example, the difference in market price will be nothing significant. Ultimately, the slight rise or fall in value is completely unavoidable.

Limit Order

Once you have found your place in the gold trading scene, you will be more likely to utilize a ‘limit order’. This order allows you to take control of what price you enter the gold market.

For instance:

- For continuity, gold is valued at $1,835 per ounce

- Nevertheless, you don’t want to enter the market until a price of $1,945 has been reached

- As such, you should place a buy ‘limit order’ at $1,945

This order will remain as it is until either gold increases to $1,945, or you cancel it yourself.

Stop-Loss Orders and Take-Profit Orders

Now that we have delved into the inner workings of orders, in terms of entering the market – it’s time to talk about your exit strategy.

Below you will see an explanation of ‘stop-loss’ and ‘take-profit’ orders:

Stop-Loss Orders

A stop-loss order is a superb way to buy and sell gold – whilst adopting a risk-averse approach. As such, we advise utilizing a stop-loss order each and every time you trade gold.

So what exactly is a stop-loss order? As its namesake suggests, this order enables you to put a cork in your losses – to avoid losing a substantial amount on your trade. Put simply, you decide at what price you want to exit your gold position, and your broker will automatically action this order when that price is reached.

To clear the mist, please see an example below::

- You are looking to go long on gold – but don’t want to risk more than 2% of your initial stake

- With this in mind, you must place the stop-loss order 2% below the entry value

- In contrast, if you were looking to go short on gold, you must place your stop-loss order 2% above the entry value

Whichever way the trade goes, you know that your broker will automatically close your gold position – thus, preventing any losses beyond 2%.

See below one more example for clarity:

- You are trading gold which is priced at $1,835

- If you go long believing the hard metal will increase in value – your stop-loss order should be 2% below $1,835. As such, your stop-loss order should be placed at $1,799

- If you were going short, your stop-loss order would be placed at $1872 (2% above $1,835)

By placing a stop-loss order you are cutting out the need to keep abreast with the latest news. There will also be no need to perform technical analysis to try and time the markets.

Instead, the online broker will automatically stop your losses at the amount specified by you – in this case, 2%. As such, when you learn how to trade gold, it’s imperative you have a clear understanding of how each order can aid your trading endeavors.

Take-Profit Orders

By this point, you should have the following orders in place for your gold trade:

- Either a buy order or sell order – relevant to your prediction on the direction of the price

- Either a market order or limit order – relevant to whether you want the current price or a one specified by you

- A stop-loss order – relevant to the maximum amount of money you are willing to lose on your gold position

The next order to consider when looking to learn how to trade gold is the take-profit order. This is comparable to a stop-loss order, although notably, the result is the opposite.

In other words, instead of illustrating to your broker the value at which you want to limit your losses – a take-profit tells the provider what your profit target is.

To further illustrate:

- Your buy order on gold was actioned at a limit order value of $1,945

- You are looking to make 4% on this position – meaning the price of gold needs to see a price increase of 4%

- This means your take-profit order should be set at $2,023

If gold hits a price of $2,023, the online broker will close your position – locking in your 4% profit.

Part 3: Learn Gold Risk-Management

It is of the utmost importance that you take risk management into account when getting to grips with how to trade gold. This is because all traders and investors will experience a loss at some time or another.

However, by following a risk management strategy you can lessen the chances of any devastating losses. Consequently, looking after your capital with greater care and consideration for any possible outcome.

See below for some risk management strategies you might want to use when electing to learn how to trade gold.

Percentage-Based Gold Bankroll Management

Many new and seasoned ‘gold bugs’ opt to utilize a bankroll management system – which is usually based on a percentage. Put simply, think about the amount of money (in percentage terms) you want to risk on each trade, and place a limit on yourself.

Many people who trade gold tend to apply a 1% or 2% limit on all positions. As such, no matter how much money you have in your trading account at the time, you will never risk more than that specific percentage.

Your balance will fluctuate week on week, so you will need to recalculate your strategy each time you place an order. After all, you win some, you lose some.

For instance:

- Let’s say you have $2,000 in your account and decide on a 2% bankroll strategy. As such, you will not stake more than $40

- You’ve had a good week and your account balance is now $3,400. As such, you won’t risk more than $68 on any one position (2% of $3,400)

- Unfortunately, this is followed by a losing streak, leaving you with a balance of $1,800. As such, your maximum stake is now $36

Irrelevant to any surprise twists and turns – by utilizing such a bankroll management strategy, you are able to maintain a level of control over your gold trading account finances.

Trading Gold via a Risk and Reward Ratio

This brings us smoothly onto another commonly adopted strategy – ‘risk and reward ratio’. Again, this system is not just reserved for seasoned traders alone.

To clarify, when seeking to learn how to trade gold from the comfort of your home – you need to consider how much profit you want to target, and how much risk you can afford to take.

- Let’s say you decide to use a ratio of 1:3.

- This means that you are willing to risk $1, in the hope of making $3.

- So if your stake is $50, you hope to make $150.

Such risk-reward ratios can be realized by utilizing the aforementioned stop-loss and take-profit orders.

Gold Leverage

For the beginners out there, the simplest way to describe leverage is that it allows you to trade gold with more money than your brokerage account permits. A little bit like a loan so to speak.

Our Learn How to Trade Gold Guide found that the lion’s share of platforms will offer you leverage on this hard metal. This will usually be displayed as a multiple (such as x20), or a ratio (such as 1:20). Both mean the same thing, so if your leverage is 1:20 or x20 – your broker is giving you the opportunity to boost your stake 20 fold.

To clear the mist:

- You are willing to risk $1,000 from your trading account as you have a good feeling about the market sentiment on gold.

- You apply leverage of x20 – your position is now valued at $20,000

In a second scenario:

- You stake $2,500 from your account balance.

- You apply leverage of 1:10.

- As such, your position is now valued at $25,000

As you learn how to trade gold, it will become apparent that how much leverage you can get your hands on is dependant on various factors. One such factor to be mindful of is that in certain parts of the world, leverage is limited according to specific regulatory restrictions.

For instance, if you are based in the US, you will not be permitted to trade any CFDs or apply the leverage they invite. If you reside in Europe or the UK, leverage on gold will be capped at 1:20. As we explained, this means a $100 position becomes $2,000.

In some countries, trading platforms are not restricted at all and will offer as much as 1:1000. This is a huge boost to your profits if the trade goes your way. Importantly though, if you incorrectly predict the direction of gold’s price shift- you stand to lose your entire stake when your position is liquidated by the broker.

Let’s look at how leverage will affect a triumphant trade:

- You place a $500 buy order on the GDX Gold Miners ETF – which is priced at $34.89

- You apply 1:10 leverage

- Within hours the ETF has risen to $35.41 – that’s a 1.5% price increase

- Had you not applied leverage, your profit would be $7.50 – granted, this isn’t much to write home about

- However, by applying leverage of 1:10 – your gains have been amplified to $75!

As you can see, leverage is invaluable to people who need a boost to their daily profits. However, bear in mind what we said – had GDX instead fallen by 1.5%, your losses would also be magnified by 1:10.

Think about it this way, as your trade was worth $5,000 ($500 x 10), you have only actually put forward a margin of 10%. As such, if the Gold Miners ETF falls by 10% – you lose your $500 stake as the broker will liquidate your trade.

Part 4: Learn How to Analyze Gold Prices

By now you should have a firm grasp on the following key factors of how to trade gold:

- The fundamentals of trading gold

- Various gold orders

- How to incorporate risk management into your strategy

Next, we dive into the ins and outs of how to analyze gold prices

Fundamental Analysis in Gold

Fundamental analysis is essential when you learn how to trade gold. This type of analysis involves keeping abreast with any global news which might affect the general market sentiment and in turn – the price of gold.

Things to look out for include:

- A change in the value of the US dollar (inversely related to the value of gold)

- Political unrest

- Gold production increase or decrease

- Industrial and jewelry demand

- Exchange-Traded Funds demand

- Economic uncertainty

- Central bank reserves

If this sounds like too much to keep an eye on, fear not. There are heaps of subscription services you can sign up for, whereby any relevant updates will be sent to your inbox on a daily or weekly basis.

Technical Analysis in Gold

Technical analysis is not quite as simple, as this involves analyzing trends in the gold markets to try and stay ahead of the game. You will be looking over various price charts and indicators, for a clearer picture of market sentiment, depth, and volatility. Thus, enabling you to make better-informed decisions.

- Moving Average (MA)

- Relative Strength Index (RSI)

- Stochastics Oscillator

- Accumulation/Distribution Line

- MACD Indicator

- Average Directional Index

- Aroon Indicator

- On-Balance Volume

Gold Signals

If you are a newbie or lack the time to keep up to date with fundamental and technical analysis, you might want to learn how to trade gold alongside signals.

Comparable to trading tips, this cuts out the need to spend months or years learning how to read and understand historical price charts and such.

Gold signals offer potentially profitable trading suggestions, which invariably includes:

- Buy or Sell Order

- Limit Order Price

- Take-Profit Price

- Stop-Loss Price

As you can see, gold signals can be highly effective for both beginners and seasoned time-starved traders.

Part 5: Learn How to Choose a Gold Broker

If you want to learn how to trade gold from the cozy comfort of home – you need a good online broker. Without this connection, you won’t have access to the gold markets you want to trade.

Furthermore, the provider in question will be responsible for executing your gold orders – so you shouldn’t choose hastily. With that in mind, we have put together a list of important metrics to consider when looking for a broker to trade gold with.

Regulation

It’s no coincidence that regulation gets a mention first. The safest way to connect to the gold markets is via a reputable broker – holding a license from at least one financial authority.

All regulated gold platforms must abide by strict rules and procedures. – such as keeping clients’ funds in a segregated bank account to that of the company. Not to mention frequent audits, customer care requirements, and fee transparency.

Such regulation makes the gold trading space a safer place to be for all involved. After all, there are one too many shady brokers out there.

The most well known, not to mention respected, regulatory bodies are the FCA (UK), CySEC (Cyprus), ASIC (Australia), MAS (Singapore), and FINRA (US). The very best platforms will hold a license from one or more of these organizations.

Fees and Commissions

Whilst this one seems obvious, before signing up to a broker – you should check out what fees and commissions will be expected of you. For instance, some platforms charge you a variable fee for each and every gold trade.

- If your leveraged trade was worth $10,000, you would have to pay $40 to enter the market.

- If your position ballooned to $13,000 upon exiting your position, you will be liable to pay again – this time $52 (0.4% of $13,000).

You can now breathe a sigh of relief, as our How to Trade Gold Guide found that there are a good handful of brokers who charge zero commission. This includes social trading platform eToro and popular MT4 broker EightCap.

Spreads

The spread is unavoidable. In a nutshell, this is the difference between the ‘buy’ price and the ‘sell’ price of gold – or whatever asset you happen to be trading.

For instance:

- The buy price of gold is $1833

- The sell price of gold is $1830

- This shows a spread of 3 pips

This means that you are beginning your trade 3 pips in the red. As such, anything you make over 3 pips on this gold position will count as profit.

Payments

It’s also important to check which payment methods are accepted at your chosen gold brokerage. Whilst some are only compatible with bank transfers (which takes days to process), others accept a whole host of deposit types.

The fastest and most convenient are credit/debit cards, and e-wallets such as Neteller, PayPal, and Skrill. It’s also worth checking out how long the platform takes to process withdrawals, as each broker will differ. eToro accepts all of the above payment types and more. Furthermore, it only takes a matter of minutes to sign up and validate your ID.

Best Brokers to Trade Gold Online

Now that you have a clear idea of the fundamentals when it comes to learning how to trade gold, you will need to sign up to a great broker to access the markets.

To save you some leg work we have spent countless hours researching to bring you the best 5 brokers to trade gold online.

1. AvaTrade – Best Gold Broker With Heaps of Techincal Analysis Tools

AvaTrade has been around for over a decade and offers traders of all levels of experience a plethora of CFDs. This covers commodities such as gold, shares, indices, forex, cryptocurrencies, and ETFs. When it comes to its regulatory standing, this online broker gets a gold star. The platform holds licenses from multiple bodies from around the world - including the UK, the Virgin Islands, Australia, the EU, South Africa, Japan, and more.

As such, you know this gold provider takes compliance requirements and customer care very seriously. When it comes to trading tools, there is enough to go around whether you are a newbie or a seasoned trader. Our Learn How to Trade Gold Guide found that AvaTrade offers everything from trading portfolio simulations and demos, to economic indicators, a plethora of charts, and risk management tools. All of which can be accessed via the proprietary trading platform.

There is also an app available called 'AvaTradeGO', where you can buy and sell gold on the move. The app works with both iOS and Android phones, which covers most people. Furthermore, AvaTrade is also compatible with both MT4 and MT5, which as we mentioned, gives you access to heaps of useful trading features.

If you prefer this broker to eToro, but fancy the sociable aspect - AvaTrade works in conjunction with both 'DupliTrade' and 'Zulutrade'. For those unaware, both sites are third-party 'social trading' platforms that can be easily linked up to your brokerage account. Such places enable you to copy and share strategies on how to trade gold.

AvaTrade accepts various payment types, so you shouldn't have any issues finding your preferred method. The platform is compatible with credit and debit cards as well as wire transfers. There are also multiple e-wallets accepted but this depends on where you live. For instance, if you reside in the EU or Australia - you cannot fund your account with an e-wallet. You can start to trade gold here from just $100.

- Minumum deposit to trade gold just $100

- Regulated in multiple jurisdictions including the UK and Australia

- Plethora of assets to trade with zero commission

- Inactivity fees pricey

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade Gold Today – Walkthrough

Now that you have made it through Part 1 to 5 and had a look at our top 5 online brokers to trade gold – you can sign up!

We are going to use Capital.com as an example for this walkthrough. The platform is super user-friendly and commission-free. You will be trading gold in less than 10 minutes – thanks to automated ID validation used by the platform.

Step 1: Open an Account

To get the ball rolling, head over to the Capital.com website and click ‘Join Now’. You will be required to enter your details in the relevant boxes – such as your name, address, email, date of birth, and so on.

Step 2: Upload ID

Next, you will need to upload a clear copy of your government-issued ID – think passport or driver’s license. In terms of proof of address, simply provide a recent bank account statement or utility bill.

At Capital.com, you will be able to leave this part of the signing up process for now. However, it’s important to note that this will need to be completed before you can make a withdrawal (or deposit $2,250+)

Step 3: Deposit Some Trading Funds

You can now deposit some funds into your new account. Simply select your preference from the available payment methods.

As we touched on, at Capital.com you can choose from a multitude of payment types – from credit/debit cards to e-wallets. You may also use bank transfers to deposit trading funds. However, again – this is the slowest method to process.

Step 4: Start Trading Gold

That’s it, you can now trade gold on Capital.com! First, you need to place your order. As we covered orders in detail further up this Learn How to Trade Gold Guide – you can scroll up for a recap if you need to.

Many people start by practicing on a free demo account before diving in. This is a great way to get a feel for the trading platform, as well as try out risk-management strategies, gold price charts, and orders.

Once you have decided on each order – buy/sell, market/limit, stop-loss, and take-profit – you can press ‘Open Trade’.

At which point, Capital.com will execute your order according to the instructions in your order box. As such, it’s important to go over everything to make sure you are happy with your stake, etc.

Learn How to Trade Gold – The Verdict

That brings us to the end of this Learn How to Trade Gold Guide. The hope is by now you have much clear understanding of how to trade this precious commodity. As we said, it’s a good idea to have a clear trading plan in place. This should include risk management strategies, as well as practicing on free demo accounts to learn the ropes.

Online courses and books shouldn’t be sniffed at either. There are heaps of educational resources at your fingertips. Whatever your experience in this trading scene is – you are bound to find something that suits you.

Finally, by signing up with a regulated and resected online broker you can trade gold from the comfort of your own home, whenever the mood takes you. Newbie-friendly Capital.com is regulated by not one, but multiple regulatory bodies, including ASIC, FCA, CySEC, and NBRB. Not only that, but you can trade gold on a commission-free basis and look forward to tight spreads.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What was the highest ever price of gold?

Is it safe to trade gold online?

What can affect the price of gold?

Will I be able to make a profit trading gold?

Can you trade gold in the US?