Spread betting allows you to speculate on the future price of a financial instrument without actually taking ownership of the asset. Think along the lines of currencies, stocks, indices, gold, oil, and natural gas. In this sense, spread betting brokers operate much like CFD platforms.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

However, the overarching benefit of opting for spread betting over other investment products is that you will not need to pay tax on your gains. Moreover, spread betting brokers allow you to short assets, meaning that you can profit when the value of the asset goes down.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

With that said, we would suggest reading our in-depth guide before parting with your money. We explain the ins and out of what spread betting is, how it works, how profits and losses are calculated, and crucially – the best five platforms currently in the UK market.

EagleFX – Best Mobile Forex Trading Platform

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Low Spreads and Fast Order Speed

What is Spread Betting?

In its most basic form, spread betting is the process of speculating on the future direction of traditional financial assets such as stocks, commodities, and indices. In a similar nature to CFD (contracts-for-differences) products, you do not own the underlying asset when you engage in spread betting. On the contrary, you are merely speculating on which way the price of the asset will go in the open marketplace.

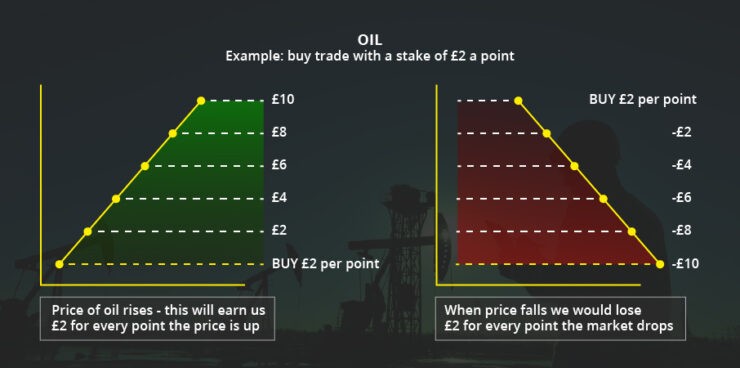

There is much to learn about spread betting, not least because it operates in a completely different manner to other investment products. First and foremost, profits and losses are determined by the number of ‘points’ that the asset moves in relation to the price you opened the trade at. These points are then multiplied by your stake.

On the flip side, spread betting is highly advantageous for a number of reasons. Unlike traditional assets, spread betting profits are not accustomed to capital gains tax. This means that you get to keep all of your profits, not least because HMRC views spread betting as gambling.

Furthermore, spread betting allows you to go ‘short’. For those unaware, this means that you are speculating on the value of your chosen asset to go down. This isn’t something that is not available in the traditional financial scene. It is also important to note that spread betting is not too dissimilar to margin trading, as you only need to put up a fraction of your total trade size.

Pros and Cons of Spread Betting Brokers

The Pros

- Access thousands of financial instruments at the click of a button

- Trade assets without ownership

- Ability to go long and short

- All spread betting profits are tax free

- Spreads and fees are much lower than traditional investment platforms

- Leverage allows you to trade with more money than you have in your account

- Heaps of leading spread betting brokers serving UK traders

The Cons

- High-risk investment class

- You can lose your entire account balance from a single trade

- More complicated than traditional asset classes

How Does Spread Betting Work?

Spread betting is a tough cookie to crack for those that are new to it. The overarching reason for this is the way that your trades are calculated. For example, not only do you need to understand the points system that spread betting brokers utilize, but you also need to understand how this relates to your stake. You also need to have a firm grasp of what ‘long’ and ‘short’ orders are, as well as how leverage can amplify your gains or losses.

As such, below we discuss some of the key factors that you need to understand before starting your spread betting journey.

🥇 Short vs Long

Unlike traditional online brokers, spread betting brokers give you the option of going long or short. If you were to go long, you are placing a buy order. In Layman’s terms, this means that you are speculating on the price of the asset going up.

For example, if you think that the price of Microsoft stocks are going to rise in the next few days, you would go long by placing a buy order. At the other end of the spectrum, those that go short are speculating that the price of the asset will go down.

As such, you would be placing a sell order. This allows you to make gains even when the wider markets are on the decline.

🥇 Leverage and Margin

When you use a conventional stock trading platform you are required to purchase shares outright. In other words, if you want to buy £500 worth of British American Tobacco shares, you would need to fund the full £500. This is in stark contrast to how spread betting sites work, as you are only required to put up a ‘margin’

For example, let’s say that you are trading a highly liquid asset class like the FTSE 100. As you do not actually own the underlying asset, spread betting platforms allow you to trade on margin. Sticking with the same example as above – and assuming that the broker requires a margin of 20%, this means that you would only be required to place your £500 British American Tobacco order with a margin of £100.

The specific margin required by the broker will not only vary depending on the platform, but also the asset class. For example, while highly liquid assets like forex and indices will require a very small margin percentage, other assets like cryptocurrencies will demand much more.

🥇 Bet Size and Points

When it comes to profits and losses at spread betting sites, this is based on a points system. If you’ve previously traded forex online, then this operates in a similar nature to ‘pips‘. As such, the amount you make or lose will depend on the number of points that an asset moves, and in which direction.

Let’s look at a quick example of how the points system works when spread betting.

- Let’s say that you are trading the S& P 500 index

- The price of the S&P 500 opens the day at 2,541 points

- At the close of trading, the S&P 500 is priced at 2,571 points

- The difference between the two prices is 30 points.

- We then need to multiply the points difference against our stake.

Let’s say that you staked £50 per point on the S&P 500. Only one of two outcomes are possible.

- If you went long, then you would have made £180 profit (30 points x £50)

- If you went short, you would have lost £180 (30 points x £50)

As a result, it’s super-important that you understand how your stakes relate to your potential profits or losses.

🥇 Spreads

So now that you know how stakes, profits, and loses are calculated in spread betting, you also need to have an understanding of what the spread is. In a nutshell, the spread is the difference between the buy and sell price of an asset, and it’s how spread betting brokers make money.

For example:

- Let’s say that the real-world price of gold in GBP is £30.5

- The buy price on gold is £31

- The sell price on gold is £30

- The difference between the two prices is 1, so the spread on gold is 1

The most important thing to remember is that the wider the spread, the more it costs you to trade. Similarly, tight spreads are more cost-effective. This is because you need to make gains of at least the spread in order to break even. In other words, when you place a buy order on gold, you are paying slightly more than its actual price.

As such, by paying £31 when the real price of gold in only £30.50, you are already at a disadvanced by 0.50 points. If you were then to sell your investment straight away, you would be making a loss of 0.50 for every £1 that you stake. This is the same with respect to sell orders, but in reverse.

🥇 Bet Duration

The bet duration in spread betting refers to the length of time your trade will remain open until it expires. This will vary depending on the specific asset you are trading, albeit, it will typically be in the form of one of two durations – a daily funded bet or a quarterly bet.

- Daily Funded Bet: A daily funded bet is suited to those of you that wish to engage in short-term trading. This is because your balance will be adjusted by the spread betting broker at the close of each day. While you are free to keep your position open for as long as you wish, funding costs will start to eat away at your profits, so do bear this in mind.

- Quarterly Bet: As the name suggests, a quarterly spread bet has a duration of three months. In most cases, the underlying asset will be represented by a futures contract. This is more suited for those of you that wish to engage in longer-term trading, not least because you’ll be able to keep your position open without getting hammered by funding costs.

Example of Vodaphone Spread Bet

So now that you have a firm understanding of the many terms that you need to be made aware of when spread betting, let’s look at a more comprehensive example.

- You are looking to trade Vodaphone shares, which trade on the London Stock Exchange

- The current market value of the shares is £119.94. As we discussed earlier, this would translate to 11994 points.

- The spread on Vodaphone stocks is 50 points. So, the ‘buy’ price is 12,044, and the ‘sell’ price is 11,944.

- You think that the price of Vodaphone shares are heavily overvalued, so you place a sell order at 11,944.

- You decide to place a stake of £2 per point.

- A few hours after placing your trade, Vodaphone shares are now priced at £117.94, which is 11,794 points.

- In order to lock in your gains, you need to place a ‘buy’ order to close the trade. Taking into account the spread of 50 points, this amounts to 11,844 points.

As per the example above, this is the result of your trade:

- You placed a sell order at 11,944 and then a buy order later in the day at 11,844

- The difference in points between the two prices is 100.

- Your stake was £2 per point, so we multiple that by 100 points

- Your total profit from the trade is £200

Risks of Spread Betting

While we have focused this page on the benefits of spread betting brokers in comparison to more traditional platforms, it is important to note that the risks are much higher. At the forefront of this is your ability to lose your entire margin. This will happen if your trade goes against you by more than you have in margin.

- So, let’s say that you are trading the FTSE 100, and your broker requires a margin of 20%. As per the per-point stake you opt for, the broker requires a total margin of £200 from you.

- You place a buy order of £10 per point, and the current price of the FTSE is 3,000 points. Later in the day, the FTSE goes down by 18 points, meaning you are staring at losses of £180 (18 points x £10).

- At this stage, the broker will send you a notification letting you know that your trade is at risk of being liquidated, meaning it will close automatically. If you do nothing and the FTSE goes down by a further 2 points, this means that your trade is £200 down. As this mirrors your £200 margin, the trade will be closed automatically and you will have lost the entire £200.

- Alternatively, if you put up an extra £100 in margin, your trade would not be liquidated as you have given yourself extra breathing space. This additional £100 amounts to a safety net of 10 more points, based on your stake of £10 per point.

Installing Stop-Loss and Take Profit Orders

As great as the risks are when spread betting, you can mitigate these risks considerably by installing a stop-loss order. Much like in the traditional financial markets, a stop-loss order allows you to specify the price that you wish the trade to be closed automatically. Whether you’re a newbie or seasoned trader, stop-loss are absolutely crucial if you are to avoid losing large amounts of money.

Here’s an example of how a stop-loss order can mitigate your losses when using a spread betting broker.

- You place a buy order on BP shares at 31,000 points, at a stake of £0.10 per point

- You don’t want to lose more than 10% of your margin, so you place a stop-loss order at 27,900 points (31,000 points less 10%)

- Later in the day, BP shares begin to tank on news of increased oil supplies in the Middle East.

- With BP shares going down to 24,800, you would have been staring at a total loss of 6,200 points, which at £0.10 per point, equates to £620

- However, as your stop-loss order was installed at 27,900 points, your loss was reduced to 3,100 points, or 10%. As such, you lose £310 instead of £620.

As important as it is to install stop-loss orders when using a spread betting broker, you should also consider adding a take-profit order. This works in exactly the same way as a stop-loss order, but in reverse. In other words, you get to stipulate the price that you would like to close the trade when you are in profit. This allows you to lock in your gains when you are away from your device.

Are Spread Betting Profits Tax Free?

In short, spread betting profits are 100% exempt from UK tax liabilities. This is highly beneficial, as all other investment gains are liable for tax. For example, dividends are liable for dividends tax, and selling a stock for more than you paid will result in capital gains tax.

However, as HMRC views spread betting as gambling (which arguably, it is), you will get to keep all of your profits without paying a cent of tax. With that being said, if you’re a non-UK trader and you’re using a UK spread betting broker, these rules might not remain constant.

This is especially the case if you are a US resident for tax purposes, so do check with a qualified specialist to get a definitive answer.

How to Choose a Spread Betting Broker?

So that you know the ins and outs of how spread betting sites work, you now need to start thinking about the broker that you wish to sign up with. Although the number of UK spread betting sites is minute in comparison to forex, CFD, and traditional online brokers, there are still heaps of platforms to choose from.

As such, we would suggest making the following considerations prior to joining a new spread betting broker.

✔️ Regulation

Before you even think about metrics like spreads, fees, and payment methods, you need to ensure that your chosen spread betting broker is regulated. Interestingly, although the UK defines spread betting in the same category as gambling, it isn’t regulated by UK watchdog the Gambling Commission.

Instead, the Financial Conduct Authority (FCA) is responsible for regulating spread betting brokers. As such, if your chosen broker doesn’t hold an FCA license, simply walk away.

✔️ Tradable Assets

You then need to start thinking about the types of assets that you wish to trade. Spread betting brokers typically gives you access to thousands of financial instruments across dozens of asset classes.

Think along the lines of stocks and shares, indices, energies, precious metals, futures, options, and even cryptocurrencies. You can check what assets are supported prior to opening an account.

✔️ Payment Methods

If you’re looking to make money when spread betting online, you’ll need to deposit real-world cash. The easiest way to get money into a spread betting broker is via a debit card, although bank transfers and e-wallets are sometimes supported, too.

Go with a broker that offers your preferred payment methods.

✔️ Spreads and Commissions

The size of the spread dictates how much you will indirectly pay to trade a particular asset. As such, be sure to check the average spreads offered by the broker on your preferred financial instrument.

Although most brokers allow you to trade commission-free, some will deduct a fee on profitable trades. Be sure to check this prior to signing up.

✔️ Bonuses

In a similar nature to online sportsbooks and casinos, spread betting brokers often give you a sign-up bonus. The bonus is offered as an incentive to those that are yet to open an account, and the funds are typically drip-fed as you reach certain trading milestones.

Ultimately, by choosing a spread betting site that offers sign-up bonuses to new customers, you’ll be able to boost your starting bankroll.

✔️ Customer Service

Don’t forget to explore what the customer service department is like at your chosen spread betting broker. Firstly, look to see what support channels are offered – such as live chat, telephone, and email. Secondly, assess what hours the customer support team works.

We prefer brokers that offer customer service on a 24/7 basis.

How to Join a Spread Betting Broker – Step-by-Step Tutorial

Like the sound of what spread betting offers for your long-term investing goals and want some guidance on how to get started? If so, follow the quickfire step-by-step guide outlined below.

Step 1: Choose a UK Spread Betting Broker

Your first port of call will be to choose a spread betting broker that best meets your trading needs. The most effective way of doing this is to review the section above – where we list the many metrics that you need to look out for prior to choosing a new platform.

If you don’t have time to perform your own research, we would suggest exploring the merits of the five spread betting brokers that we have recommended further down on this page. All of the brokers have been pre-vetted to ensure they meet our strict criteria.

Step 2: Open an Account

Once you’ve chosen a UK spread betting broker, you will then need to open an account. The process rarely takes more than five minutes and simply requires some personal information from you.

This includes your:

- Full Name

- Nationality

- Home Address

- Date of Birth

- Email Address

- Mobile Number

You will then be asked to answer some questions about your knowledge and prior experience of spread betting. This is to ensure you understand the risks before parting with your money.

Step 3: Verify Identity

In order to remain compliant with the FCA, all UK spread betting brokers are required to verify your identity. You don’t need to do it straight away, but it does need to be done within 72 hours of opening your account – or when you first make a withdrawal (whichever comes first).

All you need to do is upload a clear copy of your:

- Government-Issued ID (passport or driver’s license)

- Proof of Address (utility bill, bank account statement, etc.)

Step 4: Deposit Funds

You will now need to deposit some funds. The specific payment methods available to you will depend on your chosen spread betting broker. Nevertheless, this is likely to include one or more of the following:

- Debit Card

- Bank Account Transfer

- E-wallet (Paypal and/or Skrill)

Step 5: Place a Spread Betting Trade

You should now have a fully funded spread betting account that has been verified. As such, you are now ready to start trading!

- Choose which asset you wish to trade (for example Apple stocks)

- Decide whether you want to go long (buy order) or short (sell order)

- Determine your stake per point

- Set-up your stop-loss and take-profit orders

- Place your trade

Top 5 Spread Betting Brokers UK

Don’t have the required time to research a spread betting broker yourself? If so, below we have listed our top five spread betting sites currently active in the UK space.

1. IG –Best All-Round Spread Betting Broker

Launched way back in 1974, IG is one of the most trusted CFD, forex, and spread betting brokers in the online space. The platform offers more than 17,000 markets - subsequently covering every asset class imaginable.

This includes stocks, metals, indices, energies, interest rates, and more. Spreads are super-competitive too. For example, EUR/USD can be traded at a spread of just 0.75 pips. Spot gold is even cheaper at 0.3 pips.

You'll need to deposit at least £250 to get started at IG, which you can do via a debit/credit card or bank transfer. The platform is regulated by the FCA, as well as licensing bodies in Australia and Singapore.

- Established in 1974

- Super-tight spreads

- Spot gold trading at just 0.3 pips

- Minimum deposit quite high at £250

2. Spreadex – Spread Betting on Financial Markets & Sports

Spreadex gives you the best of both worlds. Not only can you place bets on financial markets, but sports too. Launched over 20 years ago and regulated by the FCA, Spreadex has amassed a formidable reputation in the spread betting scene.

The platform is jam-packed with educational and research tools, which is perfect if you're just starting out. You'll have access to more than 10,000 global markets, and leverage is offered to those that pass a credit check.

We also like the fact that you can deposit just £1 when you open your account. You can place bets from just 10p per stake, so the site is ideal if you want to start off with small amounts.

- 10,000+ financial markets

- Spread beting on sports

- Minimum deposit of just £1

- You will need to pass a credit check if applying leverage

No support for e-wallets

3. City Index – Best Spread Betting Trading Platform

With spread betting brokers offering tens of thousands of individual markets, you'll want to choose a provider that offers a top-notch trading platform. At the forefront of this is City Index. Whether you want to trade on your desktop, tablet, or mobile device - placing bets at City Index is super easy.

The platform offers more than 8,000 markets, with spreads starting at just 0.5 pips on major FX pairs. The platform is also generous in the margin department, with indices like the FTSE 100 and Germany 30 requiring a deposit of just 5%.

Minimum deposits start at £100, and you can choose from a debit/credit or local bank transfer. Finally, the customer service department at City Index is highly rated, with support happy to assist you in setting up bets.

- Top-notch customer support team

- Easy account opening process

- Excellent reputation in the traditional brokerage scene

- KYC process is a bit cumbersome

4. CMC Markets - Spread Betting Broker With Risk Management Tools

Launched in 1989, CMC Markets is an online CFD, forex, and spread betting broker. The company is listed on the London Stock Exchange, and it holds heaps of regulatory licenses.

Across thousands of financial instruments, CMC Markets supports indices, forex, cryptocurrencies, commodities, shares, ETFs, and even Treasury bonds. What we really like about the broker is that it offers advanced risk management tools.

This includes regular, trailing, and guaranteed stop-loss orders, as well as take-profit orders. As such, the platform allows you to mitigate the risks of your spread bets in an automated manner.

- Thousands of financial markets supported

- Risk-free demo accounts

- Listed on the London Stock Exchange

- More suited for advanced traders

5. FXCM– Best Low Stakes Spread Betting Broker

If you're still new to spread betting and wish to start off with super-low stakes, then it might be worth exploring the merits of FXCM. Crucially, the broker allows you to place bets at just 7p per point.

Once you begin to get more comfortable, the spread betting broker offers leverage of between 2:1 and 30:1 - depending on the asset. You will have the option of trading at the main FXCM website, or via its native mobile app.

When it comes to the spread, this varies quite considerably depending on the financial instrument. For example, you can get spreads of just 0.6 pips if trading the EUR/USD currency pair, but you'll pay much more on FTSE 100 stocks.

- Spreads from just 0.6 pips

- Leverage of between 2:1 and 30:1

- Low stakes of just 7p per point

- Selection of markets is quite small

Conclusion

In summary, spread betting is a great alternative to traditional forex, CFD, or stock broker platforms. Not only do you have the ability to place trades across thousands of assets at water-tight spreads, but all of your profits are tax free. Moreover, you also have the option of shorting an asset, meaning you can still make gains even when the markets are down.

However, spread betting is also super-risky, not least because you are engaging with leveraged financial derivatives. As such, always install sensible stop-loss orders to mitigate the risks of having your margin liquidated.

EagleFX – Best Mobile Forex Trading Platform

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Low Spreads and Fast Order Speed