Pips in Forex? everyone has a different style of trading. After all, there are literally hundreds of different strategies, concepts and tips and tricks out there to consider.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

If you have ever heard the terms ‘pips’ and ‘pipettes’ thrown around, but are not entirely sure what they are -then look no further. We have got you covered.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

It is really important when trading forex to have an understanding of how exchange rates shift, and how this is measured and illustrated to you as a trader.

This is where pips and spreads come in. With that in mind, today we are focusing on one of the most important factors in forex trading, and that is forex pips.

We have put together a comprehensive guide on forex pips, covering everything from what they are, how to calculate them, how pipettes work and much more.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What’s Exactly a Pip?

The term ‘pip’ is something you will see and hear a lot in the world of forex trading.

Pips used to stand for either ‘price interest point’ or ‘percentage in point’. But, things have changed a little since the origin of the pip. You will have no doubt heard people referring to ‘points’, ‘pipettes’, and ‘lots’ as well, but more on that later on.

In the early days, the pip stood for the smallest increase that a forex price would shift. Nowadays, the ways in which brokers and traders price things are much more of a precise technique. Forex is moving with the times.

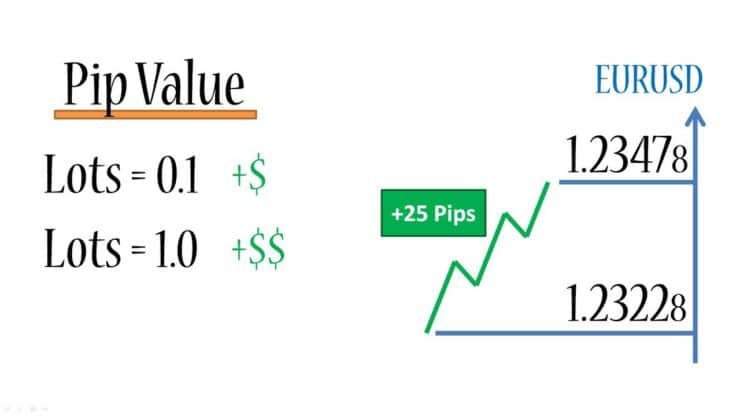

Customarily forex prices used to be quoted to four decimal places, with one pip being the last decimal place quoted (so a one-point movement). This used to be an illustration of the smallest movement or way of measuring.

An example: if the GBP/USD moves from 1.1040 to 1.1041, the change in the value here is the equivalent of 1 pip.

This has all changed a bit in recent years, as the pip is not always the last decimal place in the quotation anymore. This is because some forex prices include an additional decimal place.

Despite these changes, the pip is still the consistent value. Every platform and brokerage firm use it. It is an important standardized measure allowing traders to communicate their terms in a more simple and effective manner.

The pip is the gem in the crown jewels of currency trading insight, as it gels the framework together.

Essentially, without this standardized value across the board, it would be a bit like comparing apples to bananas. As such, it would be a lot more complicated for traders to discuss terms without such a common unit.

Using Your Wisdom in Forex Trading

It is important to remember that when you want to purchase a currency you must buy at an ‘ask’ price and sell at the ‘bid’ price. This is just one of the reasons that understanding the pip is important to your forex trading endeavours.

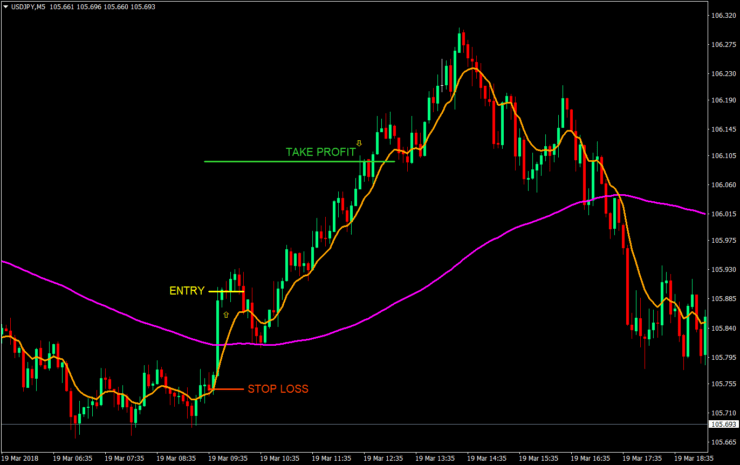

Let’s imagine that your trading system needs for you to make a profit of 25 pips and a maximum loss of 10 pips via a stop loss. There are only 2 ways in which this is possible:

- You can add your take profit value to that of your open value and deduct your stop loss value, all from the same level. This is going to decrease the chances of you reaching your stop loss, whilst also reducing the risk of your profit being eaten away at.

- Another option is to subtract the spread from your take profit as well as your stop loss. This means that you have an equal chance of reaching your stop loss and take profit. But, it is worth bearing in mind that this is likely to improve your take profit gains. At the same time, you could increase the losses when it comes to your stop loss.

Considering and understanding the spreads on offer will give you a greater chance of success in the forex market. We cover this much more later on.

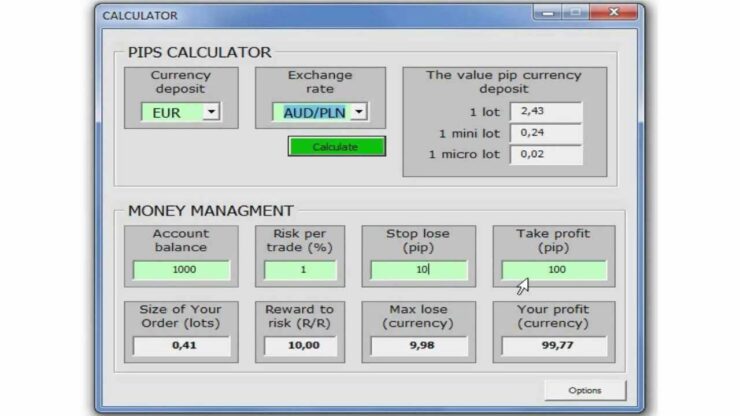

Calculations of Pip Value

Due to the fact that each individual pip will have its own price value, you need to calculate the value of a pip for the specific currency pair.

Do you really need to have in-depth knowledge on calculating the value of a pip? Well, no not particularly. Generally speaking, your broker will automatically display the value of the pip corresponding to the currency of your account.

- Let’s say you want to trade the currency pair GBP/USD.

- You buy 1 lot. 1 lot would be worth 100,000 GBP, and the value of one pip is 0.0001 for GBP/USD.

- This means the currency value of 1 pip for 1 lot would be 100,000 x 0.0001 = 10 US dollars.

- So you know that the profit or loss for this forex currency pair would be valued at 10 US dollars for each pip.

As each currency pair has its own pip value we are going to have a look at quotes with both four and two decimal places in a little more detail.

To make things easier we are going to use the GBP/USD and USD/JPY.

- The rate of the currency pair GBP/USD is 1.2675.

- This means that 1 GBP equates to 1.2675 USD.

- Now in order to calculate the pip value when it comes to the base value (in this case GBP), you have to multiply the shift in value in the second currency (in this case USD) with the exchange rate.

Here is how this will look: 0.0001*(1 / 1.2675 =0.0000788955).

Now you need to multiply that number by the number of units in the position that you want to buy.

So, let’s say your lot size is 200,000. This means one pip change will cost you £15.77.

- If the currency pair USD/JPY rate stands at 106.76, we can confidently say that 1 USD equates to 106.76 Yen.

- Now instead of using four decimal places to calculate the pip, we are going to use two.

In this case, the calculation looks like this: 0.01*(1/106.76)=0.000093668.

So, let’s say that your lot size is 200,000. Using the same calculation method, a change of 1 pip is going to cost you $18.73. So, there you have it – in this scenario that would be your approximate single pip value.

Please take note that because the rate of currencies is in a constant state of fluctuation, any value stated here has to be counted as an approximation of value. As such, there is also a constant fluctuation in the value of the single pip.

As we said, remember that if you ever want to know your pip value you can find it on your trading platform. You do not have to recalculate every time there is a shift in price. But it is still helpful to have a grasp on how you can calculate it.

Now you are armed with heaps of useful information with regards to what pips are. You have a good idea of the effects it can have on your forex trades.

As far as making forex trading decisions, pips play an important part in the outcome of each trade. As such, it is important to learn as much as you can along the way.

Pip Forex Irregularities and Pipettes

Essentially, a ‘pipette’ is the equivalent of 1/10th of a standard pip. Pipettes are often called ‘Fractional Pips’. As we have said, the vast majority of price quotations you receive from your forex broker are going to be using four decimal points.

However, some brokers quote pipettes when the currency pair in question goes outside the normal 2 and 4 decimal places. In some cases, they might have 3 and 5 places instead. The main reason for this is that there are huge differences in value. A great example of this exception to the rule is a currency pair which includes the Japanese Yen.

- Let’s imagine that GBP/USD is priced at 1.2675.

- Now, the currency pair USD/JPY will be depicted as 106.76.

- As you can, see there is a stark difference in value between the two pairs.

Using this example, for 1 GBP you can get nearly $1.30. For 1 USD, you can get nearly 107 Japanese Yens. Where you see the second pair has only two numbers after the decimal point, the pip in this pair is shown by the second number.

So as we touched on earlier, the pip used to be the smallest measuring unit across the board, but that is no longer the case.

As technology has advanced and trading online is more popular than it has ever been, there was a bit of a shakeup. Your quotations will now be a lot more precise and incorporate 5th and 3rd decimal places as well. This is considerate to the pairs containing 4 and 2.

Not to confuse you, but the foundation of a pip still stands. So, if your quote has 4 decimal places, the pip is the 4th number. If your quotation has two places, the pip is the second number (after the decimal point). Like we have said, there are various names for pipettes such as ‘points’ and ‘fractional pips’.

Whatever your broker calls them, they are important for examining micro shifts in currency pairs. They are also useful for placing miniature trades which is a method that ‘scalpers’ commonly use.

Forex pips: what Does Each Number in a Forex Quotation Mean?

To help clear the forex pips mist further, we have included a brief explanation of what each number on your forex quote represents.

To make things easy, let’s say your quotation is 1.23456:

- 1 = 10,000 pips.

- 2 = 2,000 pips.

- 3 = 300 pips.

- 4 = 40 pips.

- 5 = 5 pips.

- 6 = 0.6 pips.

While the above example is arbitrary, hopefully, it helps you understand what each number in a forex quotation means.

Forex Trading Pips Examples

To make things easier, a lot of traders count a single pip trade as ten units (base currency). But, as you can tell from our examples above there is is only an approximation of 10.

During the course of this guide, we are going to use the same examples of currency pairs and rates. It makes it much easier to understand with a level of fluidity and familiarity.

- Currency pair GBP/USD: Let us imagine that you have bought USD 100,000, using the rate in the example of 1.2675.

- We now know that the investment was £126,750.

- Now let’s say the rate rises in the next few hours to 1.2689, which is 14 pips more than when you started.

Should you decide to close your trade now, your gains will be 14 multiplied by the pip value calculated above (£15.77). This equals £220.78.

- Currency pair USD/JPY: So now you are selling 1 singular lot of USD/JPY at 106.76.

- One lot is the equivalent of $100k, which is 10,676,000 Japanese Yen.

- In this case, as the price is going against you, you might decide to give up at 106.82 JPY.

- The only way you can get your $100,000 back to you is to pay the new rate which is 10,676,112.38.

- The difference in pips being 112.38.

Again, you can see that counting pips is a very useful way to predetermine losses or gains.

Forex Pairs Volatility

We have addressed the importance of pips in forex trading. When it comes to the volatility of forex pairs, this is often depicted by how many pips a particular currency pair moves in a day.

Cross pairs tend to experience bigger pip movements when compared to major pairs (throughout a day). This can be credited to fairly low liquidity.

The pip volatility of currency pairs is largely thanks to liquidity, given that a small number of buyers and sellers can have an encouraging effect on volatility. So exotic pairs like USD/MXN and EUR/HUF move hundreds and thousands of pips every single day.

Many forex traders swear by championing volatile currency pairs because of the many trading opportunities they create on a regular basis.

Forex Pips and Spreads

As we have explained what a pip is in the sections above, it is probably a good idea to mention how the spread also needs to be considered. In a nutshell, the spread is the difference between the bid price and ask price of each currency from a pair. This is measured in pips, the star of today’s page.

When you have completed a trading transaction you will see a loss (this is the spread). The reason is that you have bought a currency pair at a higher price than the price on the market.

The difference between the market price and your price is essentially the broker gets fee. This can be classed as a commission fee of sorts.

Below we list some examples of a forex spread – with a clear calculation so that you can see how to assess it in terms of pips:

- Spread on EUR/USD (4 decimal points): As an example, let’s say the bid price is 1.4100 and the ask price is 1.4104. The spread here is 1.4104 – 1.4100 = 0.0004 or 4 pips.

- Spread on USD/JPY (2 decimal points): In this example, let’s say the bid price is 114.11 and the ask price is 114.17. The spread here is 114.17 – 114.11 = 0.06 or 6 pips.

- Spread on GBP/USD (5 decimal places): This time the bid price is 1.41004 and the ask price is 1.41023. The spread here is 1.41023 – 1.41004 = 0.0019 or 1.9 pips. Alternatively, 19 fractional pips.

- Spread on USD/JPY(3 decimal places): In this example, the bid price is 86.770 and the ask price is 86.782. The spread here is 86.782 – 86.770 = 0.012 or 1.2 pips. Alternatively, 12 fractional pips.

Now let’s imagine the lot is 100,000 and you want to calculate the cost of a spread. Using the first example here you would calculate 4 (pips) x 100,000 x 5 = $200.

Calculating the spread when forex trading is going to be a big part of your long-term strategy. As such, this is where your knowledge of pips and spreads is going to be most useful.

There are a few different types of spreads that forex traders commonly use:

- Fixed: The bid and ask price spread stays consistent regardless of the market conditions.

- Variable: This type of spread is sometimes referred to as ‘floating’. This means the price of the currency will shift with the fluctuations in the market. At a time when the market is inactive then the spread will be low. On the flip side, when the market is active the spread will be high.

- Fixed with an extension: One portion will be predecided and the dealer will decide the other side. For example, let’s say the dealer decides the selling price of a certain currency based on the buying price. Should the buying price be on the high side the dealer might choose to sell that currency but add an additional 5%.

Note that a high buying price might leave you with losses at the start of your trade. But these losses are usually recovered as time goes on.

The market situation can be altered by all sorts of things like political unrest or a financial crisis. As such, it is a good idea to follow the financial news when trading forex.

Ultimately, understanding the spread is going to help you to spot which brokers offer the lowest spreads in the forex market.

Forex Strategies Using Pips

Many traders start out by skipping the educational bits and diving right into the lion’s den. The problem with this is that nine times out of ten, you will need to go full circle and do some research on these things.

Trading strategies are really useful for both beginners and experienced professional traders. And what better way to start creating a strategy than to be armed with information on the subject. After all, your strategy is going to help you to determine when you should open, close and hold positions in the market.

Pips are considered pretty easy to keep an eye on these days and traders now have a plethora of strategies centered around getting a specific number of pips. For example, the goal could be to get 10 pips per day.

The amount of pips required in these strategies varies a lot and can be anything from ten to a hundred pips, each with a different time frame. The aim of these trading strategies is to be in receipt of gains which are the equivalent of the specific number of pips (over that time period).

By now we are all too aware of what a pip is in forex, and we are aware that currency pairs which are in demand are the most liquid pairs. So as an example, a liquid pair like GBP/USD is more likely to be a part of a trader’s pip strategy, where the trader might aim for 50 pips per day.

When you are working out your profit potential, it is always advisable to make calculating your risks a priority. For example, if your plan is to gain 12 pips, you might just decide to not go any further than another 5.

In this case, you should set up a stop-loss order to ensure that as soon as the price goes past your predetermined pip value. That means your stop-loss will be automatically put into play.

MetaTrader 4 and Forex Pips

MetaTrader 4 is the most widely popular forex trading platform in the space. With this in mind, it is important for us to quickly discuss how the platform works in relation to pips.

What you need to do is:

- In the order window, navigate your way to the ‘modify order’ section of the platform.

- Now you can select your cut off points with regards to take-profit and stop-loss that you want to be automatically executed.

Of course, take-profit orders work in a similar way to a stop-loss order. This is because you will be automatically closing your position as soon as the predetermined level has been hit.

Moreover, the ‘level’ in Laymen’s terms is referring to price values. These are going to draw a line through the chart at a particular point. Given that levels use points instead of pips, you should find your new-found knowledge on pipettes useful.

One MetaTrader 4, a point equals 1/10th of 1 pip. So, should you decide to select 20 points, your level will be 2 pips from the initial rate. On top of outlining the level on that chart, MetaTrader 4 will illustrate the rate at that distance. The idea is to help you better understand any pending orders and avoid trading anxiety.

Best Forex Brokers to Utilize a Pip-Based Strategy

If you have read our guide on forex pips all of the way through, you should now have a firm understanding of what the phenomenon means. If so – and you want to try our a pip-based strategy right now, below you will find a list of the best forex brokers to do this with.

1. AVATrade – 2 x $200 Forex Welcome Bonuses (Regulation approves a bonus permission)

AvaTrade is a highly trusted online CFD platform that offers forex, indices, stocks, cryptocurrencies, and much more. It hosts heaps of trading tools, features, and technical indicators - and you will also have access to MT4. Minimum deposits start at $100, and most new account registrations come with a forex welcome bonus.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before you get the bonus

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Forex Pips: To Conclude

We have really gone to town on explaining what forex pips are and how useful they are to traders. As we have said, pips are minuscule, but that does not mean they do not pack a punch. In fact, many traders believe that pips are one of the biggest parts of forex trading as a whole.

Each shift in the last decimal point is going to add together and impact those huge profit gains, or big losses. Studying these seemingly insignificant changes in price teamed with following the financial news, viewing charts, and sticking to a trading plan is going to enrich your forex trading experience.

Why not try out a pip-based strategy yourself? Much like all trading strategies, this is usually more effective when used alongside other techniques.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

Forex Pips: FAQ

What's a pip?

What is a spread in forex?

What is an example of a pip?

What is a fractional pip?

Are all currencies measured using 4 decimal places?