Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Decentralized finance is one of the emerging markets that is expected to have a substantial impact on the current financial landscape. It has the ability to shift the structure of existing banking systems and how they operate in the future.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

The term DeFi encompasses a whole new ecosystem of financial services that operate without any intermediaries – such as banks or clearing divisions. Instead, these platforms are powered by smart contracts.

In this guide, we will take a closer look at how DeFi can transform the financial space as we know it. We will also cover the features of some of the most successful DeFi apps that you can try today.

Nexo - Multi-Purpose Cryptocurrency Platform

What is Decentralized Finance?

Decentralized Finance, or ‘DeFi’ in short, is one of the rapidly growing sectors in the crypto space. Its goal is to recreate traditional financial services in a decentralized manner – using blockchain and smart contracts.

For example, today, you can find decentralized financing solutions that allow peer-to-peer lending and borrowing without having any intermediary at all – thanks to the blockchain protocol.

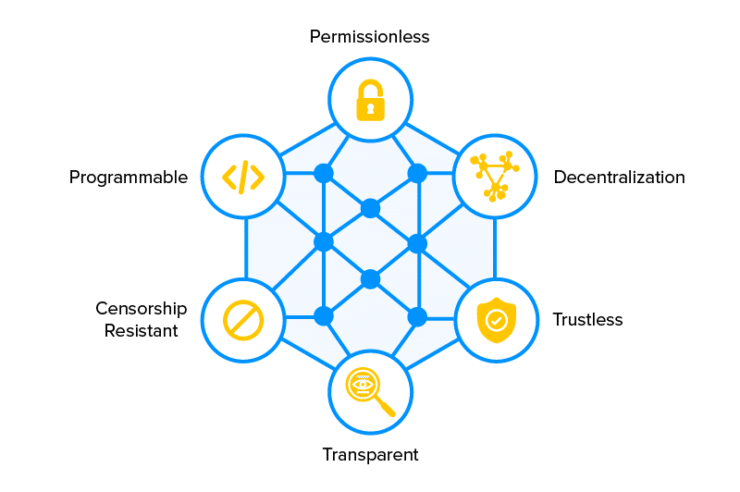

Unlike traditional centralized financial services, DeFi provides a permissionless, censorship-free, and open course framework.

The objective of DeFi is to deliver the same services as conventional financial systems – but in a simpler, transparent, and global manner. This will allow you to facilitate cheaper and faster financial transactions without any paperwork or minimum transaction amounts – along with added benefits of accountability and full transparency.

How Does Decentralized Finance Work?

The majority of DeFi projects are built on smart contract blockchains – such as the likes of Ethereum. For those unaware, ‘smart contracts’ are irrevocable computer programs deployed on a blockchain – which executes when a set of predefined instructions are met.

These smart contracts allow developers to bring in more functionalities to decentralized apps. Furthermore, DeFi projects heavily rely on stable coins such as Tether and USDC, as it is impractical to create contracts for financial services in other volatile cryptocurrencies.

Differences between DeFi and Traditional Financial Services

At its forefront, DeFi dApps have some distinctive features that make them more attractive compared to conventional financial institutions.

- Financial operations on these DeFi platforms are not managed by a central body. Instead, these functions are based on a set of rules written in smart contracts.

- Once these codes are deployed, DeFi apps can run themselves without needing much human intervention. The only need is for developers to ensure that the program runs smoothly – performing maintenance and fixing any bugs.

- The code used to build DeFi platforms is accessible to anyone on the blockchain to audit. This adds to its transparency, contributing towards building trustworthy relationships with customers.

- All transactions on DeFi are publicly accessible. However, names are pseudonymous – so that your identity will be protected.

- dApps are global, giving you access to the same services regardless of your location. Although local regulations will apply based on jurisdictions, a majority of apps are available to anyone via an internet connection.

- Perhaps, the most appealing aspect of DeFi is that it is permissionless to create as well as to participate in.

- In stark contrast to the financial systems today, you don’t have to pass through gatekeepers. You will be interacting directly with smart contracts via digital wallets.

In addition to the above characteristics, DeFi can also offer you a flexible user experience. Smart contracts make it possible for you to develop a third-party interface or build one of your own.

Consider DeFi as an open, global alternative to every financial service available to use today – from loans, savings accounts, insurance funds, and more.

What are the Common use Cases of DeFi?

From what we have seen, DeFi has the potential to disrupt the finance space by designing an entirely new line of products and services.

Of course, the technology is still in its early phases of development – but it is showing great promise in almost every regard. DeFi apps are already changing how people handle and manage their assets.

Here are some of the most notable use cases of DeFi:

- Open lending and borrowing platforms

- Decentralized exchanges

- Decentralized insurance

- Trading derivatives

- Staking of assets

Best Decentralized Finance Apps

Are you intrigued with the whole concept of decentralized finance? If so, there are a number of popular DeFi dApps that you can try today. All you need is a cryptocurrency wallet to get started!

1. Nexo – Instant Cryptocurrency Lending and Staking

Nexo is a decentralized financial platform that gives you access to instant crypto loans, as well as allowing you to earn interest on your digital assets.

This blockchain company – launched in 2017 – is 100% automated. Meaning, you can deposit your assets, withdraw loans, and pay them back all on your own.

NEXO Token

Nexo has come up with a reward system for its customers, devised through the utilities of its NEXO token.

Owning a NEXO token can give you access to the following benefits on the platform:

- The NEXO Token is the world’s first complaint coin that pays 30% of its profits as dividends to holders.

- NEXO Tokens allow you to get a 25% higher interest rate on the assets in your Nexo savings account.

- These tokens enable you to receive up to a 50% discount on the accrued interest on your crypto loans.

NEXO Tokens can be purchased either at the Nexo platform or at one of many supported cryptocurrency exchanges. Note that in order for you to access these benefits, the tokens you own have to be held in the Nexo digital wallet.

Nexo Products

Here are some of Nexo’s most notable products:

Instant Crypto Loans

With Nexo, you can gain access to instant crypto-backed loans – without having to give up ownership of the assets. The collateral which you provide can be in the form of cryptocurrencies such as Bitcoin, Ethereum, or stable coins.

The process is entirely automated and secure. All you need to do is deposit the supported assets into your Nexo wallet. A credit line will become instantly available to you – without you having to complete any credit checks. How much you can borrow will depend on the value of your assets.

You can choose to withdraw the cash or stable coins to your personal account or Nexo debit card. You will be liable to pay interest only on the cash you withdraw. There is no fixed repayment period for crypto loans on Nexo. You can open as many as you want, for a duration of up to one year. The interest rates start at 5.9%.

Earn Interest on your Investments

Nexo offers a cryptocurrency savings account, where you can earn interest on stablecoins, crypto assets, as well as some fiat currencies – such as EUR, GBP, and USD.

The interest you receive is based on the type of asset you deposit, as well as the number of NEXO tokens you own. This will be paid to you every 24 hours. Currently, the interest rates vary from 5% to 10%.

Nexo Card

Global payment cards are another application of DeFi that gives you worldwide access to your credit line. This way – there is no need for you to withdraw your loan to a private account. Instead, you can load it directly to the Nexo card and start using it right away.

Exchange

Nexo has also launched a decentralized exchange that allows you to swap over 100 cryptocurrency and fiat pairs.

Fees

Nexo does not charge you any fees to access its services, except for the interest rates on your crypto loans.

Safety

There is a reason why Nexo is a well-rounded and often preferred option among decentralized financial platforms. The team has gone to great lengths to ensure that there is no stone unturned when it comes to safety.

Nexo is a regulated, custodial platform that offers wallet services through its longstanding partner – BitGo. The company provides Nexo with cold storage, class III vaults, as well as a certified custodianship program.

In addition, Nexo also works with Ledger Vault to ensure the safety of your assets on the platform. Combined with these, Nexo’s services are currently covered with an insurance of $375 million.

All in all, Nexo offers a credible opportunity for long-term investors looking to leverage their crypto assets to build wealth. In return, you gain access to a safe and insured way to earn high-interest on your idle assets.

2. BlockFi – Crypto-Backed Loans and Interest Accounts

BlockFi is another DeFi solution that allows you to grow your cryptocurrency investments. Founded in late 2017, this US-based company provides financial services to both individuals and businesses worldwide.

BlockFi Products

Here are some of BlockFi’s most notable products:

BlockFi Interest Account

Similar to Nexo, BlockFi also allows you to earn interest on your cryptocurrency holdings. The maximum interest rate you can earn is 8.6% APY – which is accrued daily but credited to you on a monthly basis.

In the backend, BlockFi lends your crypto funds to corporate borrowers and individuals. The platform then collects interests – which it, in turn, it pays to users. There is no minimum deposit or balance required to earn compound interest.

BlockFi Loans

BlockFi also allows its users to deposit cryptocurrencies as collateral. This enables you to borrow as much as 50% value of the collateral in US dollars. You can get access to cash without the need to sell your digital assets or trade them.

However, the process is not entirely automated. In order to gain access to loans, you will first have to complete a KYC/AML process for identity verification purposes. Once you apply for a loan, The BlockFi team will review your application and give you a response within one business day.

The loan, if approved, will arrive in your BlockFi account within a few hours. The loan offer will include all important information including details of how the amount was calculated.

The interest rates on your loan will be calculated based on your credit score, loan amount, and location – which can be as low as 4.5%.

No Fee Crypto Trading Services

Finally, BlockFi provides trading services without charging you any extra fees. BlockFi’s dedicated exchange allows you to buy, sell and swap cryptocurrencies instantly. The trades are executed immediately, and the digital assets will be reflected in your BlockFi interest account – ready for interest accrual.

BlockFi Fees

In addition to interest rates, BlockFi also charges you an origination fee of 2% on your crypto-backed loans. There is also a withdrawal fee that varies depending on the digital coin you are withdrawing.

BlockFi Safety

BlockFi assets are held by the Gemini Trust Company, which also runs one of the largest cryptocurrency exchanges and is regulated by the New York Department of Financial Services. It keeps 95% of assets in cold storage and the rest in hot wallets which are insured by Aeon.

However, in May 2020, BlockFi experienced a security breach. Although no funds or assets were stolen, the personal information of some users was compromised. The platform also has a few new features lined up, such as a Bitcoin rewards Credit Card.

To conclude, BlockFi presents itself as a great alternative for traditional financial services. The platform is transparent about how it uses your deposits – by lending it only to established borrowers. However, you will note that the platform supports only ten cryptocurrencies at present – which might put you at a disadvantage.

3. Crypto.com – A One-Stop-shop Cryptocurrency Platform

Crypto.com is a well-established cryptocurrency platform that was founded in 2016. It permits you to store, transfer, and exchange over 90+ cryptocurrencies and over 20 fiat currencies.

CRO Token

Following the path of many DeFi platforms out there, Crypto.com has also launched a native token that powers its ecosystem. Known as the CRO Token, it offers different levels of utility across the platform.

Similar to Nexo, Crypto.com also has a tier-based user account system – depending on the number of CRO Tokens you hold. The more you have in possession, the better benefits you will be able to access.

This DeFi platform has developed the Crypto.com Chain, which is a public blockchain that enables transactions with minimal fees. The products of the DeFi provider are divided into three different categories – trading, payments, and financial services.

Crypto.com Products

Here are some of Crypto.com’s most notable products:

Crypto Earn

The Crypto Earn feature enables you to grow your digital assets by accruing interest on them. The platform currently offers support for over 30 cryptocurrencies and stable coins as a deposit method.

At the moment, there are three holding term options – one-month fixed term, three-month fixed term, and flexible holding term.

The interest you receive will depend on a variety of factors – ranging from the asset you are depositing, the amount of CRO Tokens you have staked, as well as the duration of the holding. As you can imagine, if you have more CRO Tokens – you will be able to receive higher interest rates.

Currently, the annual interest rates vary from 1% to a maximum of 8.5%. The interest will be calculated every 24 hours and will be deposited into your account every seven days.

Crypto Credit

Crypto.com also allows you to monetize your digital assets without having to relinquish your ownership of them. This is achieved through credit lines backed by cryptocurrencies.

You can borrow up to 50% of the value of your digital assets – by collateralizing one of the 12 supported cryptocurrencies on the platform. You are also in charge of when you want to pay back the loan – as there is no fixed schedule for repayment.

The minimum rate charged is 8% and can go higher depending on your collateral. You can also enjoy lower annual interest rates if you stake CRO Tokens.

Crypto.com Visa Card

This is a prepaid card that functions the same as a bank debit card. Instead of linking to your bank account, the Visa card will be linked to Crypto.com. You can top up your account using debit/credit cards, bank transfers, or cryptocurrencies.

There is a range of different cards that you can order. This gives you access to a reward system based on the number of CRO Tokens you hold.

Crypto.com Pay

Another interesting product offered by Crypto.com is the mobile QR code payment solution. This is a service primarily for merchants – allowing them to add a cryptocurrency payment method to their platforms.

Crypto.com Exchange

Crypto.com also has a cryptocurrency platform that enables easy exchange of digital assets. The platform offers support for spot trading, margin trading, as well as derivatives trading.

Crypto.com Fees

The platform has a complex trading fee structure based on maker and taker fees – depending on your 30-day volume. Apart from this, you will also have to pay a withdrawal fee, which is based on the respective cryptocurrency.

Crypto.com Safety

This DeFi platform is based in Hong Kong and has partnered with Ledger Vault for the protection of your digital assets. If you are a US resident, your funds are also insured by the FDIC, up to $250,000.

To sum up, Crypto.com gives you access to a variety of products and services that can cover all your cryptocurrency needs. However, there is little to no desktop platform access. Almost all operations are carried out through its mobile app. While some might find it as the easier alternative, others may view this as a drawback.

4. Celsius – Cryptocurrency Interest Platform

Celsius Network is a DeFi platform that grants you up to 17.78% interest on your crypto assets annually. The company was founded in 2017 and is based in the US.

CEL Tokens

The native token of Celsius – CEL has a number of planned utilities within the platform’s ecosystem. For instance, it can get you priority for loans, give you access to better earning rates, reduced loan rates, as well as premium support.

Celsius categorizes its users into four different loyalty levels – based on your CEL holdings. There are four different tiers, each offering you ascending reward rates.

Celsius Products

Here are some of Celsius’s most notable products:

Earn Crypto

Staking crypto on Celcius can give you access to higher interest returns on your assets. You can simply transfer your digital coins to the Celsius wallet to start earning rewards almost immediately.

The actual interest payments are calculated weekly on every Friday and deposited to your account every Monday. There is no fixed term for these deposits, and you are free to withdraw your principal and interest any time you please.

As we mentioned earlier, you can get as much as 17.78% annually – given that you have sufficient CEL holdings on the platform.

Borrow Crypto

Cryptocurrency lending is another functionality that has been made easier by Celsius. If you own any cryptocurrencies, you can use them as collateral to get a loan – in the form of cash or other coins.

Depending on the loyalty tier you belong to, the interest on your loan could go as low as 1%. The entire process is automated and can be completed without any credit checks.

The term lengths of the loan can be anywhere between six months and 3 years. The platform currently offers crypto-backed loans against 25 cryptocurrencies.

CelPay

CelPay is a payment system that allows you to send cryptocurrencies to anyone – even those who do not have a crypto wallet. The app will generate a link that gives the recipient access to a CelPay wallet that holds the coins you sent.

All you need is their contact details, such as an email address or phone number, to notify them of the transaction.

Celsius Fees

There are absolutely no fees on Celsius – not in terms of withdrawal fees, origination fees, or deposit fees. The interest will be directly deposited into your account – allowing your capital to compound over time. You only have to concern yourself with the loan repayments – should you use Celsius to borrow funds.

Celsius Safety

Celsius is a custodial platform – meaning it takes hold of your digital assets for safekeeping. That said, in case any damages occur, the company claims that it will use its balance sheet to cover losses. In addition, Foreblocks and PrimeTrust also provide insurance for digital assets held on the platform.

Overall, Celsius is an extremely successful cryptocurrency lending platform. Although it might not have the savvy features as the other platforms listed here – what it offers is notable.

5. Gemini – Decentralized Cryptocurrency Exchange

Gemini is a cryptocurrency exchange best-known for being founded by the Winklevoss twins. The company has a great reputation for compliance and security with American regulatory bodies.

GUSD

Gemini has its very own stable coin – called the Gemini Dollar, or the GUSD. It is convertible to exactly $1, meaning it is a 1:1 USD-backed coin.

It is a fully programmable token, which can be created or exchanged on the Gemini platform.

Gemini Products

Here are some of Gemini’s most notable products:

Gemini Exchange

Gemini is primarily a cryptocurrency exchange. It is impressively beginner-friendly and allows you to buy and sell crypto instantly at the market rate. There is also an ‘Automatic Buy’ feature that lets you schedule your crypto purchases.

For more experienced investors, Gemini also has a professional trading platform called ActiveTrader. It comes loaded with features such as candlestick charts and different order types.

Gemini Earn

Gemini Earn allows you to get up to 7.4% returns on your cryptocurrency deposits. The interest is paid daily and is directly added to your Gemini Earn account – meaning you have the ability to benefit from compounding growth.

Gemini Pay

Gemini Pay is a mobile app that allows you to purchase items online using cryptocurrencies. The platform is in the process of adding more retailers in order to expand the utility of the app. You can also use the app to make payments with GUSD. Gemini Pay does not charge you any additional fees to process transactions.

Gemini Fees

Traders on the exchange will have to pay a 0.50% convenience fee on all transactions. This is on top of a trading commission, which is set at a minimum of 1.49%. Advanced traders get a better deal at 0.35% per trade.

Gemini Safety

As a registered New York Trust Company, Gemini showcases plenty of security certifications. The firm is subject to cybersecurity regulations – set by the DFS. It is also the world’s first custodian to complete both SOC 1 and SOC 2 Type 2 exams, along with an ISO 27001 certification.

Gemini undeniably provides outstanding security and compliance, especially for US customers. Although fees might be on the higher end – it might be worth it considering that the platform comes packed with features and offers better protection for your funds.

Risks of Decentralized Apps

As with any financial instrument, there are some risks involved with the crypto industry and in association – with DeFi as well. Direct access to capital makes it a target for security threats.

That said, the DeFi industry is well aware of the risks and is working towards developing apps that can overcome these challenges. For instance, DeFi applications could benefit from more comprehensive checks to ensure that transactions are processed to the correct addresses. This will offer an additional layer of trust among customers.

In the past, DeFi projects have also been targets of security breaches – which emphasizes the growing need for safety in the industry. After all, only a fraction of existing platforms are regulated. There will be an increasing need for compliance as the sector grows.

Most importantly, as the DeFi systems are still under development, there is always the risk of potential failure. However, platforms and companies are working hard to achieve these last few steps towards the goal of large-scale adoption of decentralized finances – using insurance funds, as well as smart contracts.

Conclusion

Decentralized Finance opens doors for exciting opportunities for investors. From exchanges to insurance to staking solutions – there is a DeFi platform that can address your needs.

However, bear in mind that not every DeFi platform is secured or is tested efficiently. If you want to get a taste of the action, it will be best to stick to regulated platforms such as Nexo that has a longstanding reputation in the industry.

Nevertheless, make sure that you perform your due diligence before investing your assets in any DeFi solution.

Nexo - Multi-Purpose Cryptocurrency Platform