By this point, you will be all too aware of the complexities of trading currencies, and how important it is to enter the markets with a plan.

In part 9 of this beginners forex course, we talk you through some popular trading strategies and how to use them!

This includes everything from risk management and hedging – to swinging, scalping, and the best timeframes to use when analyzing the currencies markets for profitable trading opportunities.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

Trading Strategies and How to Use Them – Sneak Preview

You will see below a sneak preview of the best forex day trading strategies, all of which we explain how to use throughout part 9 of this course

- FX Strategy 1: Learn Bankroll Management

- FX Strategy 2: Understand Risk Management

- FX Strategy 3: Consider how Active You Want to be

- FX Strategy 4: Grasp how to Trend Trade Currencies

- FX Strategy 5: Try a Hands Off Trading Style

- FX Strategy 6: Hedging Against Inflation

- FX Strategy 7: Utilize Charting Timeframes

- FX Strategy 8: Take Your Strategy For A Test Run

You may choose to use more than one strategy in your forex trading plan. What works for you will depend on what kind of trader you wish to be, and how much time you have to dedicate to watching the markets and placing orders.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FX Strategy 1: Learn Bankroll Management

Bankroll management is a well-used trading strategy for obvious reasons. This will see you thinking about how much you are willing to allocate per trade. You can also consider what the reward might be for that level of risk – which we talk about next.

See an example below to clear the mist:

- Let’s say you have $10,000 in trading capital

- Thinking about risk per trade – you decide that you are willing to lose no more than 2% of your available capital on your hypothesis

- With a balance of $10,000 – this means you can open a trade with $200 of your account funds

Let’s look at how we manage bankroll when placing a forex order:

- You’ve decided not to risk more than 2% of your account balance

- Let’s say after a few bad months, you now have $8,000 in trading capital

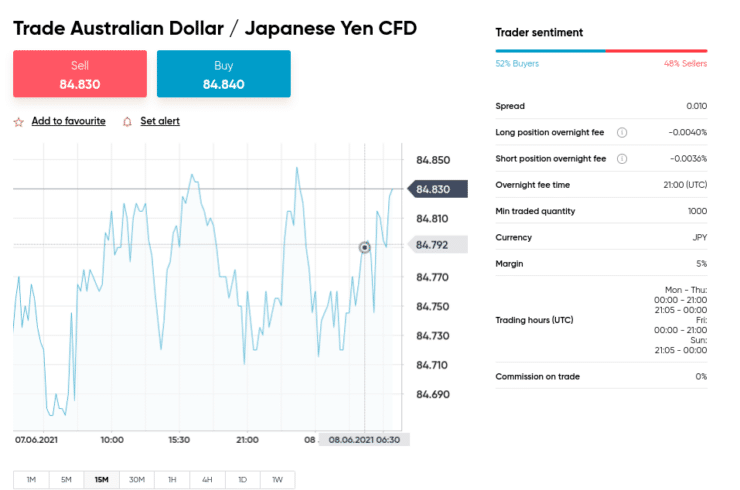

- You want to trade AUD/JPY

- According to your strategy, you cannot stake more than $160 of your own money ($8,000 x 2%)

- If you have a good run and end up with trading capital of say $12,000 – you can stake $240 on your next trade

- On the other end of the scale, if you have a more modest balance of $2,000 – you would never open a position using more than $40 of your own money

Crucially, this bankroll management strategy can easily be recalculated before every trade you enter – which makes it easy to keep up with for beginners.

FX Strategy 2: Understand Risk Management

The fluctuation of both volatility and liquidity can be a cause for concern for many beginners to forex trading. This is why one of the key strategies used is risk management. You can view this as a survival skill in this marketplace.

Even the most experienced currency traders experience slumps – so by managing your risk and reward, you are able to minimize the drawdown experienced from losing trades. It’s not easy to recover from a loss, but you can at least have control over the amount.

We mentioned in part 3 ‘Forex Trading Basics: Pips, Lots, and Orders‘, that a ‘stop-loss’ can be used to prevent your losses from getting out of control when trading currencies. We mentioned a commonly used risk/reward ratio is 1:4.

Today, let’s say you have decided on a risk management strategy that sees you risking no more than 1%, and having a reward of no less than 3%. This would be displayed as 1:3.

So, how do we take this onto the metaphorical trading floor?

See a quick recap below:

- Your risk management strategy will see you losing a maximum of 1% and gaining no less than 3%

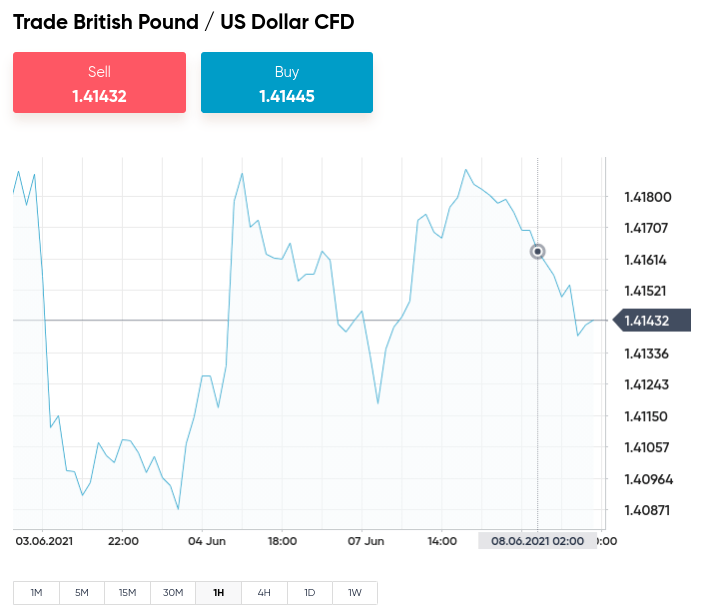

- You have $200 allocated to buy order on GBP/USD

- This pair is currently valued at $1.31

- To avoid losing more than 1% on this trade – you must set a stop-loss order at $1.29

- If you were short on GBP/USD with a sell order – your stop loss would be at $1.32

We also talked about take-profit orders in part 3. But to refresh your memory, this is where you can incorporate your risk/reward from both ends.

Your take profit will be set to 3% higher than the current FX price on a long order, and below it on a short. The trade will be closed automatically when either price has been reached by the pair.

FX Strategy 3: Consider How Active You Want to Be

When you are looking to trade any asset, the chances are you will have thought about how much time you can realistically dedicate to the project.

The answer you come up with will probably dictate which forex trading strategy you decide on – in terms of how often you can trade.

See below some of the most popular ways to trade currencies.

Beginners Forex: How to Scalp Trade

‘Scalping’ is a very common way to trade currencies – not least because the marketplace experiences frequent price fluctuations. This makes it very well suited to the strategy of opening and closing multiple positions in a single day. This might mean looking for gains that average say 5 pips, which doesn’t seem like much but adds up over the course of a trading session.

The idea is to profit from shifts in value caused by supply and demand. Some traders open just a handful of trades, whereas others might enter and exit the market hundreds of times. The term scalping is down to the nature of this strategy.

The fact that you are more concerned with profit frequency than volume makes this strategy perfect for keeping a check on your trading emotion – greed. We discuss this psychology in part 10 of this course, for those unaware of what it means.

The best time to scalp currencies depends on the asset. For instance, if you are trading a pair inclusive of the euro – you will be better catching the first hour of the London sessions – 08:00-09:00 GMT. Some of the most popular pairs to scalp include AUD/GBP, EUR/JPY, GBP/USD, EUR/USD, USD/CHF, AUD/JPY, and AUD/USD.

Whilst you should be looking for a certain amount of volatility, beginners might be best to avoid less predictable exotics pairs like BRL/USD and NOK/USD. Larger gaps in pricing are a regular occurrence with such volatility, so this amount can make sticking to a bankroll management strategy difficult.

Beginners Forex: How to Swing Trade

Much like with scalping, ‘swinging’ requires technical analysis and experience in charting. Instead of opening and closing multiple positions in one single day – you might maintain a position for a day – or even a week.

With that said, the idea is still the same – you are looking to make gains from the price shifts in the currency markets – of which there are many. To gain some insight into which way the pair may be headed, you will be better off looking at indicators such as moving averages, relative strength index, and stochastic oscillators.

Beginners Forex: How to Position Trade

In contrast to the aforementioned swing and scalp trading – position trading is somewhat of a medium-term strategy. We answered the question of what is fundamental analysis in part 5 of this guide. To recap – this involves following economic and financial news and report releases.

Another major difference with this strategy, compared with the previous two, is that you won’t be focused on short-term price spikes. Instead, you will look at the wider picture. In other words, rather than concentrating on historical price charts – you will be looking at political conditions, central bank monetary policies, interest rates, and so on.

If you don’t mind focussing on cyclical currency trends, which might see you trading the same pair for weeks at a time – this could be the strategy for you. It has to be said though that you will rarely make more than a hundred pips a time with position trading. Furthermore, you might only take a few positions in a 12 month period.

With this in mind, most forex beginners opt for scalping and swinging. This enables you to be more active in currency markets. Leaving you to make the most of the liquidity and volatility that makes it attractive to so many traders.

FX Strategy 4: Grasp How to Trend Trade Currencies

There is a saying in the forex trading space – ‘the trend is your friend’. Whilst that is not always the case – as all trends must come to an end – many beginners opt to use this strategy. The reason for this is that if you time it correctly – there are attractive gains to be made.

This strategy relies heavily on the trend indicators and charts we have mentioned through this 10 part course. As we said, which timeframe you use will depend on whether you are scalping, swinging, or position trading. We talk about this more shortly.

A great way to check a long-term price trend is with an exponential and simple moving average. You can also try to predict changes in the direction of a pair this way. As we said before, this allows you to place an order based on data rather than pure trader speculation.

The main goal isn’t to look for your entry into or exit from the market. Instead, you are trying to trade the trend. This means that instead of awaiting a correction – you will be focused on going in the same direction as the market. This could see you waiting for it to change direction first and can be risky for beginners that have yet to fully grasp analysis.

FX Strategy 5: Try a Hands Off Trading Style

Where some traders want to steer their own forex ship – others either lack the time or skills to dedicate enough time to it.

We briefly touched on the abundance of forex trading tools available in part 1 of this course ‘Why Should you Trade Forex?‘. However, as these are tried and tested strategies – we can now go into each feature with more detail.

Forex Trading Signals

Forex signals are gaining popularity amongst new and experienced traders alike. This will see you choosing and signing up with a provider you like the look of and receiving trading tips.

So, how does it work? Speaking for our service specifically, we have a team of seasoned pros for the task at hand. Each is well versed in the currency markets and knowledgeable about how to perform in-depth and advanced analysis. We analyze heaps of data to bring your attention to profitable trading opportunities.

To give you a clear idea of what should be included in the best forex trading signals, see an example below:

- Trading Instrument: USD/JPY

- Order Type: Buy/Long

- Entry Price: 110.66

- Stop Loss Value: 110.30

- Take Profit Value: 111.29

As you can imagine, this dramatically cuts out the time needed to perform research in order to gain an idea of where the wider market stands with your chosen pair! In a nutshell – someone else carries out the technical analysis and charting side of it – so you don’t have to worry about it.

Furthermore, we put the same amount of effort into researching the currency markets for our free service as we do for our premium plan and thus – will not hold back information. The only difference is the number of signals received in a trading week. You might find when shopping around that some platforms withhold some elements of the signal, only revealing it for a fee.

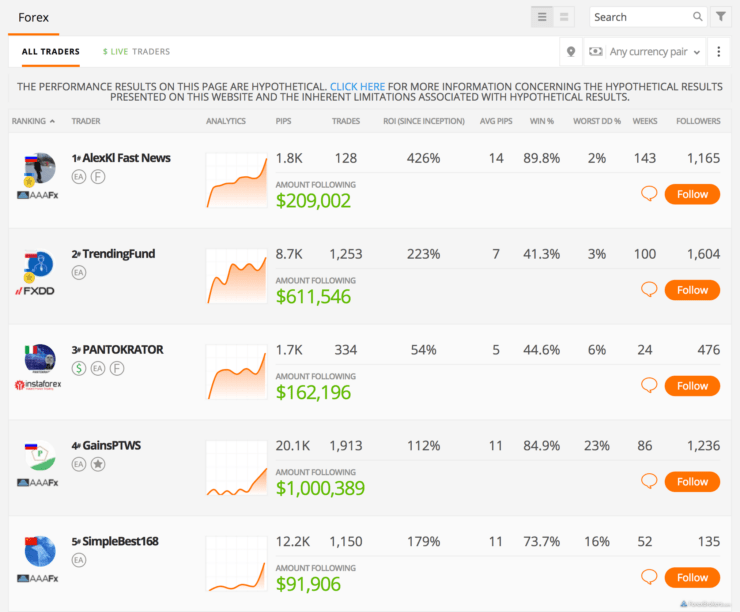

Forex Mirror Trading

You may have heard of ‘mirror trading’, otherwise referred to as ‘copy trading’. This is a big phenomenon in the forex world. and we covered this feature briefly in part 1 of this course. Essentially, you are able to skip the majority of the learning process (if you wish) and mirror someone else – crucially, with experience!

As you will invest a certain amount in the copy trader, everything they trade will be reflected in your portfolio – only a smaller portion. This means you can easily take a hands-off approach to trade forex, without blowing your trading balance.

See an example below:

- Let’s say you allocate $1,000 to mirror trader ‘JoeFX007’

- JoeFX007 has trading capital totaling $10,000

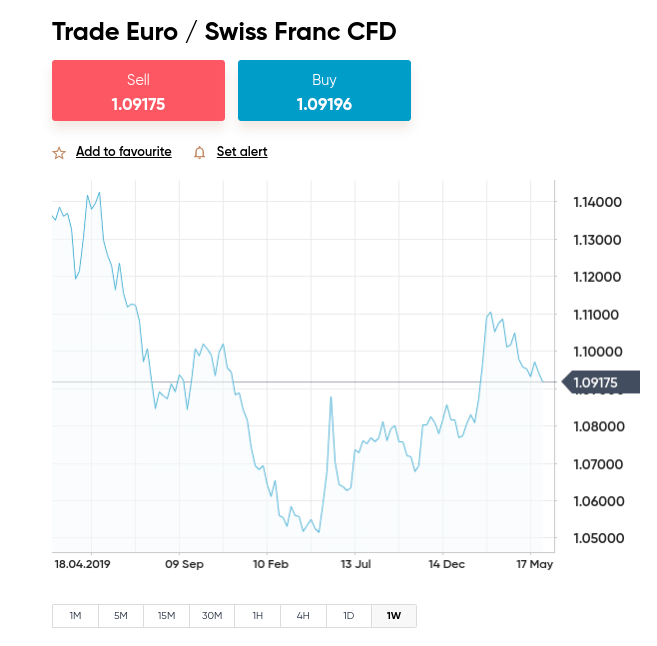

- Next, this mirror trader creates a sell order on EUR/CHF – using 2% of their balance – equating to $200

- As such, you are also short on EUR/CHF

- However, you only have $20 allocated to this short order – because you invested $1,000

If you would still like to learn forex, you can use this strategy to pick up tips and tricks. The reason is that most of the mirror trading services offer access to tons of data including investment history, what kind of assets the pro prefers, and how successful they have been doing so.

If this sounds like something you are keen to try, it’s a good idea to ensure your chosen online broker can facilitate this feature. We looked into this and found that AvaTrade offers a few different options for mirror trading. First, you can use the AvaSocial app, the broker’s own social trading platform.

This enables you to ‘like’, ‘follow’, and ‘copy’ fellow currency traders – without lifting a finger. Other options supported by AvaTrade are third-party providers like ZuluTrade, DupliTrade, and Mirror Trader. The forex broker is also partnered with automated trading platform MetaTrader 4 and 5 for passive alternatives such as forex EAs

FX Strategy 6: Hedge Against Inflation

Hedging can be used in many ways. For example, if the market you are trading is facing problems due to inflation – you might look to trade a negatively correlating currency or a commodity such as gold.

We talked about this in part 7 of this course – ‘Trading commodities: Oil and Gold‘ if you need to refresh your memory on the subject. This is a tried and tested strategy in the currency trading space.

Having a clear understanding of how currencies and commodities are negatively and positively related to each other enables you to offset unwanted exposure.

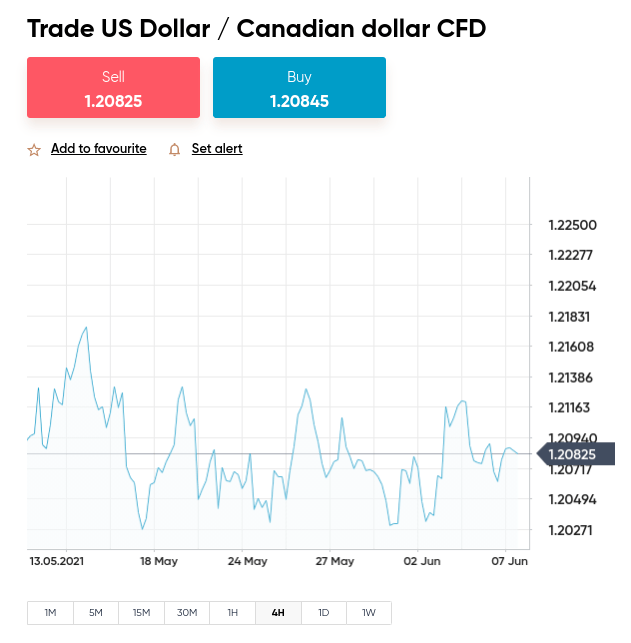

FX Strategy 7: Utilize Charting Timeframes

As we touched on in part 8 of this course ‘An Introduction to Charting‘ – you can adapt charts and indicators to suit yourself. This can be achieved by setting your own timeframe – preferably more than one.

Understanding that this is a super useful strategy to add to your trading arsenal – we talk about this in more detail in the sections below.

What Timeframe Should I Use When Charting?

Generally speaking, we think of trading timeframes as short, medium, and long-term. When it comes to forex charting, as discussed in part 8 of this course, you can use all three if you wish.

There are heaps of advantages to swapping and changing between different lengths of time when trading currencies. Because this market is so liquid, you are able to view a plethora of information in a series of short or long time frames.

It’s also super effective due to the fact this marketplace never sleeps. If you feel like swinging might be for you, you will find swapping between various sessions such as US, Asian, and European is going to offer you differing market conditions.

For instance, you might look for trending markets during the US and Europe crossover hour. Alternatively, you might look for ranging assets when the Tokyo sessions are in action.

To give you an indication of what timeframes you might use when putting your technical analysis knowledge to good use – see below.

Swing Trading Timeframes

We have explained what swing trading is. However, you may be interested to know that this strategy tends to require both a longer and shorter trend time frame.

With that said, it’s important to never solely rely on one timeframe – nor should you count on the data of a single indicator. This could mislead you into thinking a trend reversal is around the corner and making an error. That’s why seasoned traders use both long and short chart analysis to get a clearer picture.

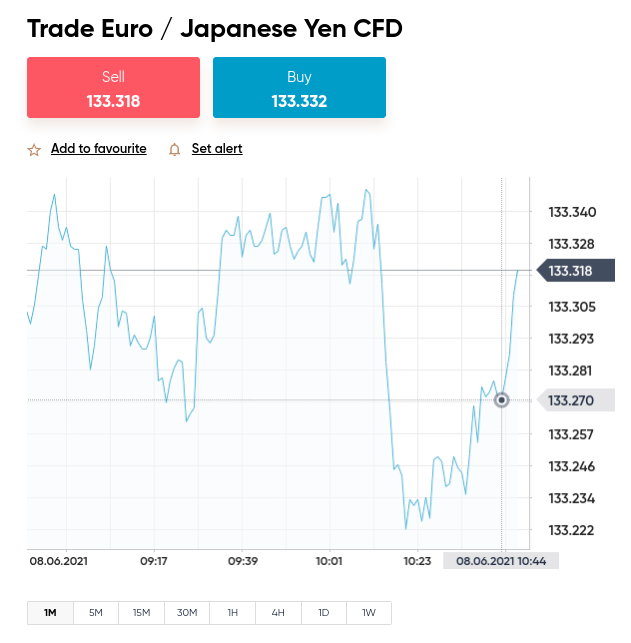

Scalping Timeframes

As you now know, scalping involves placing multiple orders in a single day. As such, some scalpers look at a time frame of 1 hour, with a trigger timeframe of 15 minutes.

The most common strategy is to analyze 1 and 5-minute time frames on your chosen FX pair. As you can see below – we have chosen to look at a 1-minute chart on EUR/JPY.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FX Strategy 8: Take Your Strategy for a Test Run

Much of what we’ve covered in this beginners forex course so far can be taken for a test run – trading strategies are no different. This is achieved by using a forex simulator, otherwise called a demo account.

Online trading platforms such as AvaTrade and Capital.com offer free trading accounts with thousands of dollars worth of paper funds to strategize. Still a bit intimidated by the complexities of the technical analysis – as discussed in part 4?

If so, you can also utilize a demo facility to practice reading indicators, charting, and trying out forex signals. Even though we are referring to a free trading account – it is still important to choose one with a license, rather than a rogue online broker.

Trading Strategies and How to use Them – Full Conclusion

That brings us to the end of part 9 of this beginner’s forex course. By now you should have a much better understanding of pairs, margin, leverage, orders, pips, technical and fundamental analysis, charting, and strategies.

One of the best places to start when creating a strategy is to gain a clear understanding of what your trading capital is, how much you are willing to risk and what reward you might expect to receive. Short-term systems like scalping and swinging lend themselves well to a risk-averse strategy as you will be looking to make small but frequent trades.

As well as considering how often you wish to trade currencies, you might want to try a system that takes a hands-off approach to trade such as forex signals or mirroring another trader with more experience. You might also keep a trading journal to keep track of which strategies you may want to use time and time again.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99