As you have reached part 5 of this beginners forex course, you will be all too aware that investigation and fact-finding are a large part of trading currencies. The market can be unpredictable at the best of times, so by arming yourself with information you will make better choices.

So that begs the question – what is fundamental analysis? In a nutshell, this will see you studying real-world events that could directly, or indirectly affect or drive the value of a currency.

Today, we talk about what fundamental analysis is and why it is an important tool in helping you to predict the forex marketplace. We also discuss economic indicators and the best way to access the information required to inform yourself.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

What is Fundamental Analysis?

In part 4 of this course, ‘What is Technical Analysis?‘, we talked about the indicators and tools that are crucial for making those big decisions when trading currencies. This was all about price action, trends, and measuring market momentum and volatility.

Another important form of research needed is fundamental analysis. Instead of drawing charts and such, this will see you researching global news – looking out for economic, political, and social circumstances that might affect your forex trades.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is a Fundamental Economic Indicator in Forex?

A fundamental economic indicator when performing forex analysis refers to a way of measuring, analyzing, and predicting currency market movements by studying information.

See below a quick run-through of the most common forms of economic indicators for fundamental analysis, and what they mean:

- Political Unrest: War or unrest can make traders flock to a currency for its volatility, or bail out – thus making it rise or fall in value

- Interest: Central banks put interest rates up to restore balance. When rates are reduced, this can lead to increased demand – which can take us to increased inflation rates.

- Inflation: Inflation is a major contributing factor to shifts in the supply and demand of the currency markets. High inflation rates tend to make currencies lose value, and vice versa.

- Gross Domestic Product Report: This includes data and statistics from various regions such as the UK, EU, and the US. The goal is to give you a picture of the strength of the economy in question.

- Non-Farm Payroll Report: This shows US employment and wage data. The US dollar is the world’s reserve currency, so this indicator is one to watch.

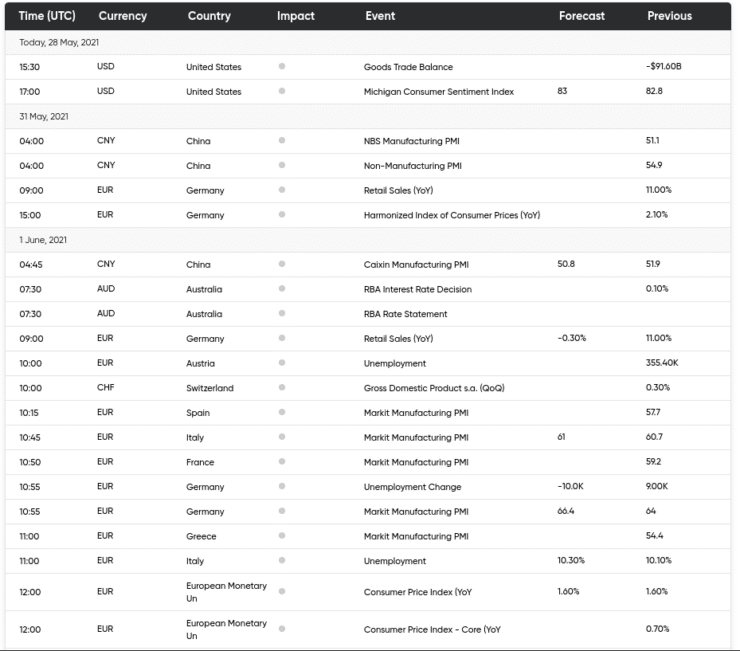

- Economic Calendars: You will find economic calendars for forex trading priceless. This tells you when every important financial news event that might affect the currency markets is going to happen.

The data included in such fundamental indicators cover global economy statistics. The idea of indicators is to measure the strength or growth of a currency to better gauge where you stand when trading it. We cover the above factors in more detail throughout this course.

Political Unrest and War

Political unrest or all-out war has a massive effect on the currency markets. As such, this is one of the key indicators of fundamental analysis. If you think about it this way – wars destroy lives, but they also damage infrastructure and can bring an economy to its knees.

This is where the forex markets can be affected, so see some examples below:

- In 2014, Russia invaded Crimea. This was a move that saw the Ukrainian hryvnia and Russian ruble fall in value by more than 50% against the US dollar within just one year.

- The euro had already taken a hit from the news of Brexit. It then declined to a 14 year low against the US dollar in 2016 – upon news of the successful election of Donald Trump. On the contrary, the US dollar soared as traders predicted a potential tax reform and spending spree.

- On the opposite end of the scale, in 2017, the leader of North Korea shot a missile into Japanese airspace. The Japanese yen only confirmed its status as a ‘safe haven’ currency, getting stronger in the days that followed.

- Another example is the controversial move for the United Kingdom to leave the EU back in 2016 – aptly named Brexit. Within 24 hours of that announcement, the British pound fell in value by over 10% against the US dollar and continued on a downhill trajectory for around 4 months.

As you can see, world news can make a big difference to the value of currencies. This is one of the many reasons that fundamental research can be just as crucial as technical analysis.

Economic Inflation and Interest Rates

In terms of indicators, economic inflation and interest rates are big players in fundamental analysis.

However, if you are new to trading currencies, you may not know what impact this has on the foreign exchange market.

Economic Inflation

A gallon of milk would cost around $0.36 in 1913, but today would be about $3.60. This is inflation in a nutshell. Of course, this price increase happened over the course of over a hundred years!

So, what exactly is inflation? The definition of this is a disproportionate increase in prices within an economy. As such, this has a knock-on effect on whatever FX pair you might be trading. Just to give you an example, if the UK comes out as having a super high rate of inflation – the British pound will probably take a hit in terms of its perceived value.

This is very damaging to the valuation of the market in question – but can be great for your profits if you time the market with the right order.

Measures of Inflation

There are 18 official measures of economic inflation, this includes but is not limited to:

- Producer Price Index (PPI)

- Forward Breakeven Inflation Rate

- Average Hourly Earnings (AHE)

- Import and Export Prices

- Consumer Price Index (CPI)

- Oil and Gold Prices

- Trade Weighted Exchange Rates

- Employment Cost Index (ECI)

Central banks use the aforementioned data to try to maintain a steady and healthy rate of inflation.

Economic Interest Rates

When performing fundamental analysis, being aware of any changes in interest rates is another important part of creating a bigger picture. Interest rates are decided by the big world banks and governments of the relevant countries and will be based on the aforementioned inflation or stability of the economy. As such, this has a huge impact on the currency markets.

- The interest rate will directly affect the supply and demand of the currency markets and affect general sentiment towards a currency.

- With that said, it’s important to know that there is little to no point in worrying about the current interest rate as the broker usually factors this into the quote.

- Monetary cycles and policies normally fluctuate in line with interest rates. This is something you can keep an eye on.

- If you notice this falling, for a prolonged period of time, it’s likely it will go into reverse at some point. This is useful information that can help you to make clear decisions when trading currencies.

As such, the interest rate gives you a better image of the perceived price of a forex pair because this is one of the main deciding factors. Central banks may increase the interest rate of a currency to slow down the rate of inflation and general growth.

The Interest Rate Differential Technique

The ‘Interest Rate Differential’, or IRD, will see you calculating the difference between the interest rate of two similar interest-bearing forex markets. This means that you might trade a currency with a high rate and one with a low one.

For example:

- Currency A has an interest rate of 4%

- Currency B has an interest rate of just 1%

- The interest rate differential here is 3%

At one point there was a huge disparity between the interest rate on emerging and developed economies. At this time, strong markets made sure their interest rates were lower than 0% – the hope being to encourage demand.

Meanwhile, in an attempt to stabilize the economy and limit the movement of assets from the country – emerging markets increased interest rates.

Gross Domestic Product Report

The ‘Gross Domestic Product Report’, or ‘GDP’ is a significant part of fundamental analysis in forex trading. This economic indicator is a huge data release that can heavily influence the currency markets.

The reason this is so important is that by studying the GDP, you will be able to better gauge potential economic growth and gain a bigger picture of its strength. Note that whilst a growth rate of say 4% would be high for a developed economy, emerging nations would be more like triple that, if not more.

You can easily draw a comparison between the current state of two similar markets by looking at these reports. To do this, you need to subtract one currency rate from another and see which one is ballooning at a faster rate.

If GDP data is low and showing little economic growth, before shooting up by the time of the next report, the chances are traders will begin to buy. This can lead to the currency in question going into the overbought territory after an initial rally.

The GDP reports that usually create the most volatility in the forex market are the quarterly offerings. You may decide to use this to your advantage. The biggest regions in the world report on their economic status, at least once per quarter.

See below a list of GDP Reports on a global scale:

- Europe Region – EU: Released every quarter, and year. This can affect the value of the euro.

- North America Region – The United States: Released every month, quarter, and year. This might have an impact on the US dollar.

- Europe Region – The United Kingdom: Released every month, quarter, and year. This can and will impact EUR/GBP.

- Oceania and Asia Region – Australia: This can affect the price of Australian and New Zealand dollars.

- Asia Region – China, Japan: Released every quarter, and year. This can have a knock-on effect on the value of the Japanese yen, Australian dollar, Chinese Yuan, and New Zealand Dollar.

As you can see, global GDP reports include some of the world’s most traded currencies. As such, it’s a super important form of fundamental analysis.

Non-Farm Payroll Report

When you are researching fundamental analysis as part of this beginners forex course you will come across the term ‘Non-Farm Payroll Report’, or ‘NFP’. This is one of the leading economic indicators used when trading currencies.

So, what is NFP? It actually gives an account of employment and unemployment data trends in the US. Employment matters when it comes to central banks and interest rates. As the same suggests, this doesn’t include farmers. It also leaves out statistics on non-profit and government employees, and private lodgings.

- Wage increases and decreases: Having access to hourly earnings will give you a better idea of how healthy the economy is. For instance, if the pay rate is falling this points towards lower consumer spending and diminishing prosperity. Whereas wage growth would show us a healthy economic climate.

- Unemployment statistics: The data revealed here will impact how the central bank of the United States views the state of the economy.

- Expanding sectors: If a sector shows itself to be growing by creating more jobs, or the opposite, an industry is giving rise to unemployment rates – this will be detailed in the NFP report.

The NFP’s release usually causes big waves in the FX markets, with some prices shifting by as much as 500 pips within minutes of its release As this employment-based report focuses on the US, it will be no surprise that its release to the public usually affects the USD market. This can have an influence on interest rates and can therefore create a shift in the value of the dollar.

When hourly wage rates and the NFP, in general, are perceived in a positive way – USD can put on a bullish display. The likelihood in this situation is that upon the NFP release any pair containing the US dollar can see a price shift. This could include USD/CHF, USD/JPY, GBP/USD, USD/EUR.

Fundamental Analysis: The Importance of Economic Calendars

An economic calendar gives you advanced notice about when key data is due for release. When we say ‘key data’ we mean the aforementioned NFP, GDP reports, and such. That is why it is so important that you get to grips with this trading indicator – and to get the most out of fundamental analysis.

For instance, people who don’t understand economic calendars often avoid trading on the first Friday of every month. Why? Because of concern over the volatility caused by the aforementioned non-farm payroll report.

If you get to grips with both technical and fundamental analysis as part of your trading system – you might just reap the rewards of such an unpredictable time. Not sure where to start? Next, we explain how to decipher economic calendars.

How to Read Economic Calendars

As we have made clear, data moves the markets, so for the latest financial releases and events, you need to have access to an economic calendar. This will be released to the general public on the first Friday of each trading month. As such, it’s important you know how to decipher this data.

See below how to read an economic calendar:

- If possible, customize the calendar to the specific timeframe you wish to view

- This is usually anywhere from the current day to yesterday, next week – and so on

- If permitted by the platform, you can change the time zone to where you live – if not there are plenty of online calculators for this purpose

- You might also be able to filter by region or zone – for example, EU, US, UK

- Next, simply study the list of events and open anything you think could influence the currency market you are trading

- This will give you a bigger picture of what you might be best buying and selling

To exploit movements in currency markets, you need to keep your eye on the ball at all times. This is why adding economic calendars to your list of trading arsenal is going to help you understand the wider sentiment.

It’s easy to add economic calendars to your forex trading system. For instance, you might elect to view one at the beginning of each week to see what events are coming up. Having your eyes open to fundamental events and forecasts can aid you in protecting open positions.

Alternatively, it may lead you to enter the market to take advantage of potentially profitable opportunities. How interactive, fast and up-to-date the calendar is will depend on the source you get it from. There are hundreds of forex-focused websites, brokers, third-party trading platforms, and apps dedicated to this form of fundamental analysis.

Fundamental Analysis: Where to Find Forex News

You have things like newspapers, subscription services, and heaps of online sources such as Yahoo Finance, Bloomberg, and Reuters Forex News.

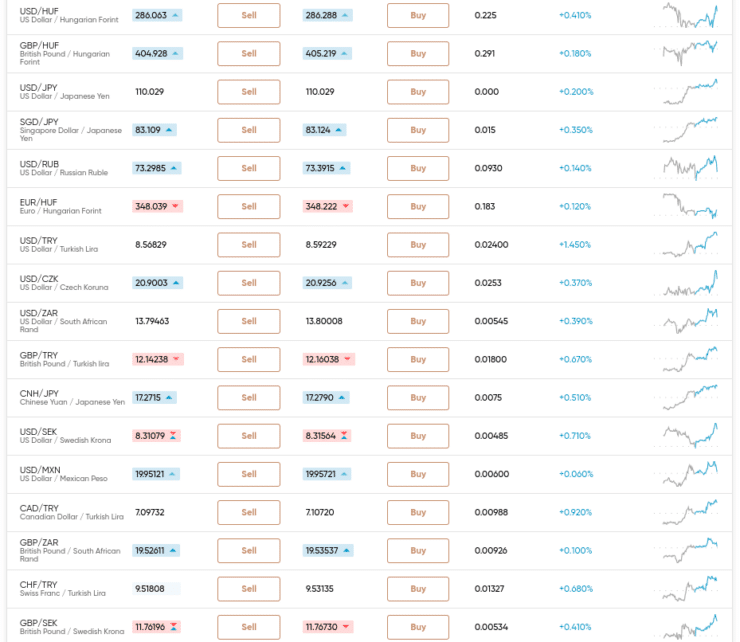

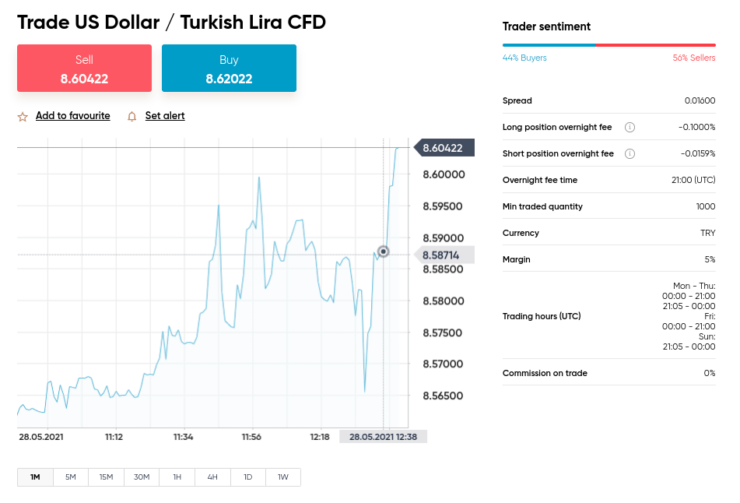

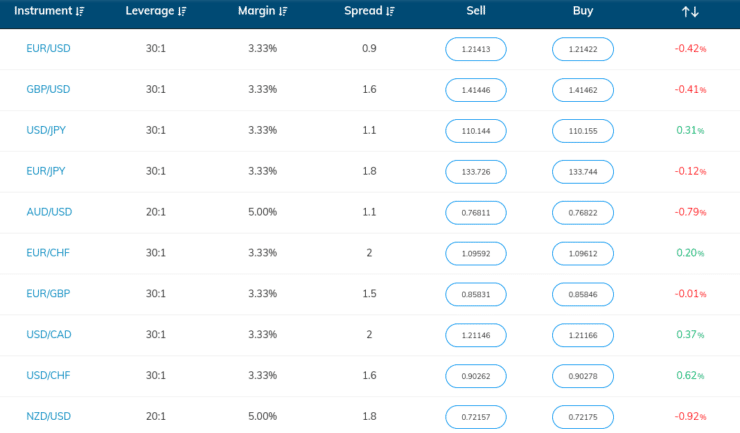

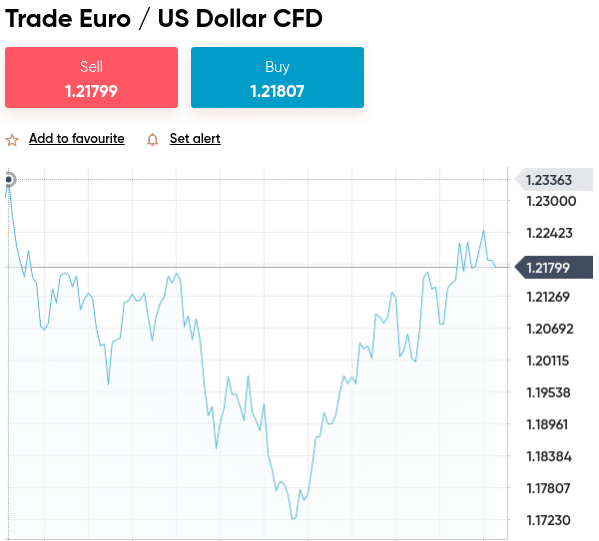

In addition to this, you will see below three commonly used platforms to access forex news and analysis.

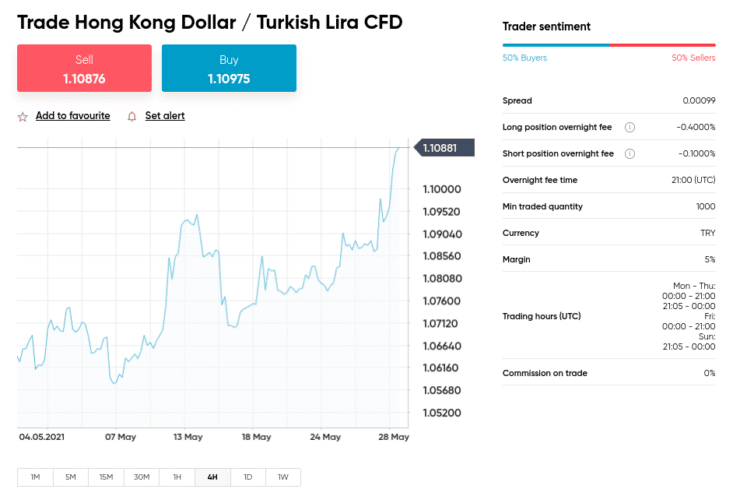

At a Forex Trading Platform

We mentioned the range of indicators you can use when trading forex, to gain some insight into the strength of the economy behind the currency.

The best forex brokers will provide you with access to trading tools. One that springs to mind is the previously mentioned economic calendars. Top-rated brokers AvaTrade and Capital.com both provide access to economic calendars at the click of a button.

If you trade via a broker that is partnered with third party trading platform MetaTrader 4 (such as the two just mentioned), you can access macroeconomic indicators.

This also includes the latest financial news and weekly forecasts. All of which are invaluable for monitoring anything which might affect the price of your chosen currency.

Long Established News Sources and Real-Time Data Feeds

It’s no secret that in forex trading, fundamental news moves currency pairs. As such, you could consider adding real-time data feeds to your fundamental analysis routine.

You will find millions of results by conducting a simple internet search. Some of the long-established financial news sources include Yahoo Finance, Routers Forex News, Bloomberg Terminal, and The Wall Street Journal.

Social Trading Platforms

You shouldn’t rely on just one source of information when trading currencies, so it is always wise to perform plenty of research. With that said, there are some social trading platforms out there that can offer you insight from real traders just like you.

For instance, over at top-rated brokerage AvaTrade, you can expose yourself to the forex markets and practice fundamental analysis with a free demo account via MT4 or MT5. As we said, here you will also find economic indicators and calendars.

You can also download a free app called AvaSocial which allows you to see the live feed of fellow currency traders. These real people often share important updates and theories with followers. You can also follow and copy a seasoned trader this way.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Quantitative Vs Qualitative Fundamental Analysis

Other terms you may see when researching fundamental analysis are ‘quantitative’ and ‘qualitative’.

Let’s differentiate between the two.

- Quantitative Fundamental Analysis: Put simply, this sees traders concentrating more on facts, statistics, and probabilities. This enables you to remove much of the emotion from trading – leaving you to focus on making informed choices based on data you have studied, rather than ‘a feeling’

- Qualitative Fundamental Analysis: This sees you researching everything that cannot be measured with mathematics – such as trends or the feeling on an economy according to the media. Essentially, anything you feel could influence one currency’s relationship with another

You can practice both quantitative and qualitative fundamental analysis when trying to predict the direction of your chosen currency pair.

What is Fundamental Analysis?: Full Conclusion

Knowledge is king in the forex space, so by adding fundamental analysis to your trading toolkit – you will be giving yourself the best start possible. As we’ve covered in part 5 of this beginners forex course – fundamental analysis entails keeping abreast with the latest financial news.

This will also see you checking economic calendars for the latest and up-and-coming global events – looking for anything that may affect the currency markets. This can include changes in unemployment figures, interest rates, and an increase or decrease in hourly wages. All of which are likely to affect at least one economy.

By being aware of global events and which economies could be facing problems – you will be able to make informed decisions on when to enter or exit the market you are trading. You can access various forms of fundamental analysis tools via online brokers partnered with MetaTrader 4 and 5.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

FAQs

What is fundamental analysis in forex trading?

Where can I access fundamental analysis?

What are the different types of fundamental analysis?

What is an economic calendar in forex trading?

How can I learn fundamental analysis?