Are you an absolute beginner in the world of online trading? Or are you well versed with trading, but just a novice with forex? Either way, it’s important to learn the market inside out.

Forex Course & Signals

1 - month

Subscription

Up To 20 Signals Daily

Up To 20 Signals Daily Copy Trading

Copy Trading Up to 81% Success Rate

Up to 81% Success Rate 24/5 Forex Trading

24/5 Forex Trading 10 Minute Setup

10 Minute Setupmonth

3 - month

Subscription

Up To 20 Signals Daily

Up To 20 Signals Daily Copy Trading

Copy Trading Up to 81% Success Rate

Up to 81% Success Rate 24/5 Forex Trading

24/5 Forex Trading 10 Minute Setup

10 Minute Setupmonth

Most popular

Most popular

6 - month

Subscription

Up To 20 Signals Daily

Up To 20 Signals Daily Copy Trading

Copy Trading Up to 81% Success Rate

Up to 81% Success Rate 24/5 Forex Trading

24/5 Forex Trading 10 Minute Setup

10 Minute Setupmonth

Lifetime Subscription

Up To 20 Signals Daily

Up To 20 Signals Daily Copy Trading

Copy Trading Up to 81% Success Rate

Up to 81% Success Rate 24/5 Forex Trading

24/5 Forex Trading 10 Minute Setup

10 Minute SetupThis forex trading course 2023 will tell you everything you need to know to get started.

First, we break through the jargon, explaining the basics of this highly liquid marketplace. Additionally, we cover trading orders, analysis tools, and strategies, as well as explain how to find a suitable forex broker.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

What is Forex Trading?

Most of us have inadvertently traded forex before. After all, we exchange one currency for another when going on vacation. For those unaware – forex is the name for the foreign exchange market. This is the buying and selling of currencies on a huge global scale.

The leading participants of this marketplace are global corporations, fund managers, central banks and financial institutions. Then you have professional investors with huge account balances, and retail clients – your average Joe Trader.

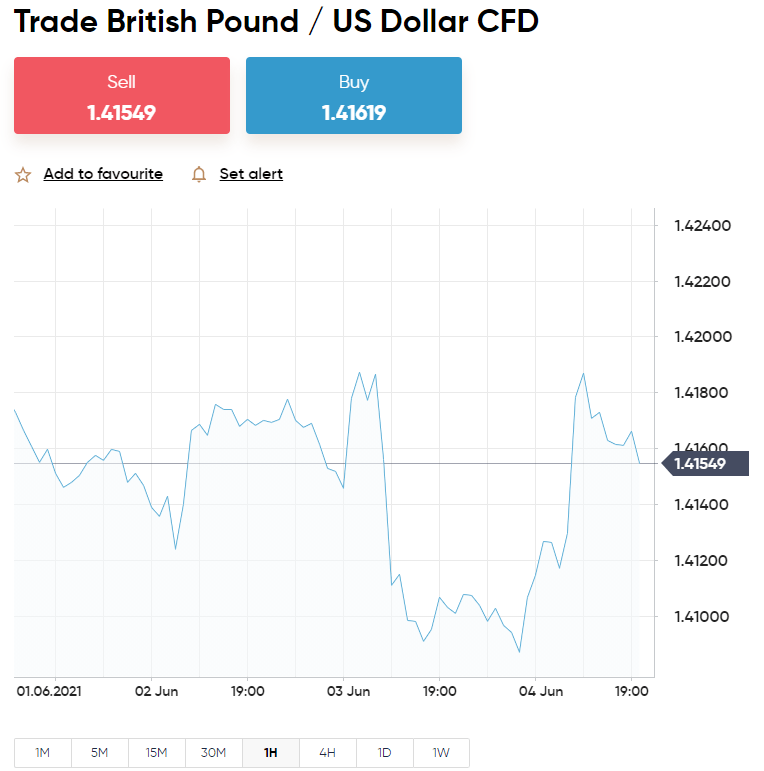

Ultimately, the idea is to take advantage of price movements by correctly speculating on the direction of the exchange value between two currencies – known as a pair. For example, if GBP/EUR is priced at 1.1760 – which is the exchange rate between the British pound and euro – you need to predict whether this will rise or fall.

Forex Trading: Breaking Through the Jargon

Now that you grasp the basics of forex trading – we can break through the jargon. It’s important you understand the terminology used. This is because when you join the best forex broker to facilitate your entry into the market, you will see this language used across most platforms.

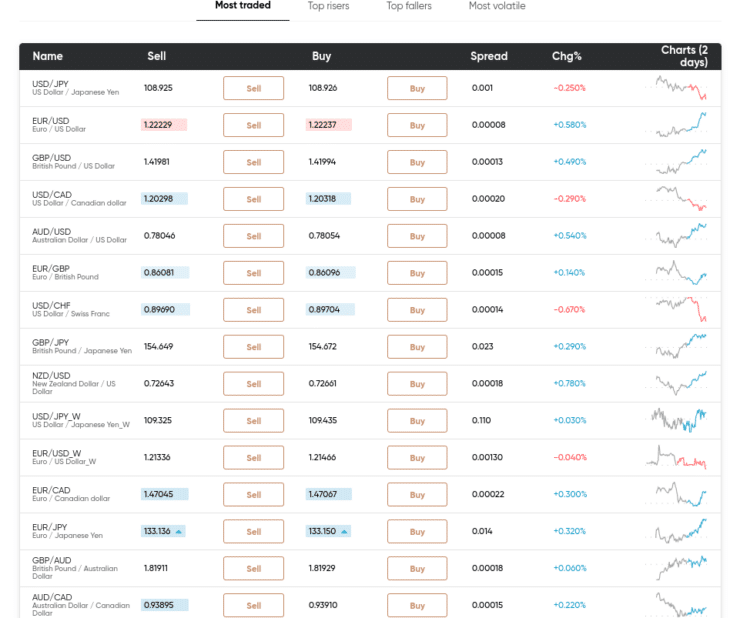

FX Pairs

For those unaware – currencies are traded as a pair – one against the other. The first currency is known as the ‘base’, and the second (the benchmark) is the ‘quote’ currency.

For instance:

- Euros against US dollars will appear like this – EUR/USD

- Here EUR is the base currency, and USD is the quote

- The forex quotation will include a buy price and a sell price

- For example – the buy price at $1.2216 and the sell price at $1.2215

Now, let’s look at the categories you will be able to trade:

- Minor Forex Trading: Don’t be fooled by the name if you are looking at trading minor pairs. Although less liquid than majors (up next), these pairs still contain two strong currency markets. Examples of currencies you will see include euros, Japanese yen, and British pounds. Crucially minor forex trading pairs never include US dollars. One of the most traded minors is EUR/GBP.

- Major Forex Trading: Onto a pair category that always includes US dollars. You will trade the rate of USD against another robust economy – such as one of the aforementioned minors. The most traded major pair in the world is EUR/USD. As such, you will usually get tight spreads and high leverage with this market.

- Exotic/Cross Forex Trading: Exotics, or crosses, include an emerging market such as the Israeli new shekel, Mexican peso, South African rand, Turkish lira, Czech koruna, Danish krone, Swedish krona, Russian ruble, Norwegian krone, and Polish złoty (to name a handful). This type of pair will also be inclusive of a strong currency such as US dollars, euros, or British pounds. One of the most traded exotics is EUR/TRY, followed by GBP/ZAR.

If you are wondering what this means for your experience when forex trading, let’s clarify:

- Minors also offer liquidity, albeit less than majors. Depending on the pair, this type will have wider spreads and steeper price spikes. Fluctuations like this can be great for making slightly bigger gains – if timed correctly.

- Majors are the most traded currencies globally, so offer the tightest spreads and highest liquidity. This is often one of the less risky options for newbies as there is less worry about market volatility.

- Exotics, or currency crosses, are often less mainstream and therefore will have wider spreads and much less liquidity than minors or majors.

As you can see, there is much to consider when the time comes to choose a forex pair to trade. For instance, thinking of scalping? The volatile nature of exotics might just be what you need.

On the other hand, you might feel the spread is too wide to make it a viable option. As such, spending some researching which FX pairs are best suited for your financial goals and tolerance for risk!

Pips and Spread

We have talked about the spread a few times so far – let’s divulge what it is exactly. This indirect fee is quoted in pips (Points in Percentage).

We mentioned earlier that brokers will show you a buy and sell price. In our example, we were trading euros against US dollars. Let’s see the spread on that earlier quotation to clear the mist:

- You want to trade EUR/USD, so head over to your chosen forex brokerage

- You are quoted -a sell price of $1.2215 and a buy price of $1.2216

- The spread on this trade is 1 pip

- If you make gains of say 3 pips on this trade – 2 pips is profit and 1 is taken by the trading platform

You will find that not only do different forex pair types come with different spreads – but this also depends on your chosen brokerage! For instance, one of the key considerations for us when reviewing platforms is tight spreads and low fees.

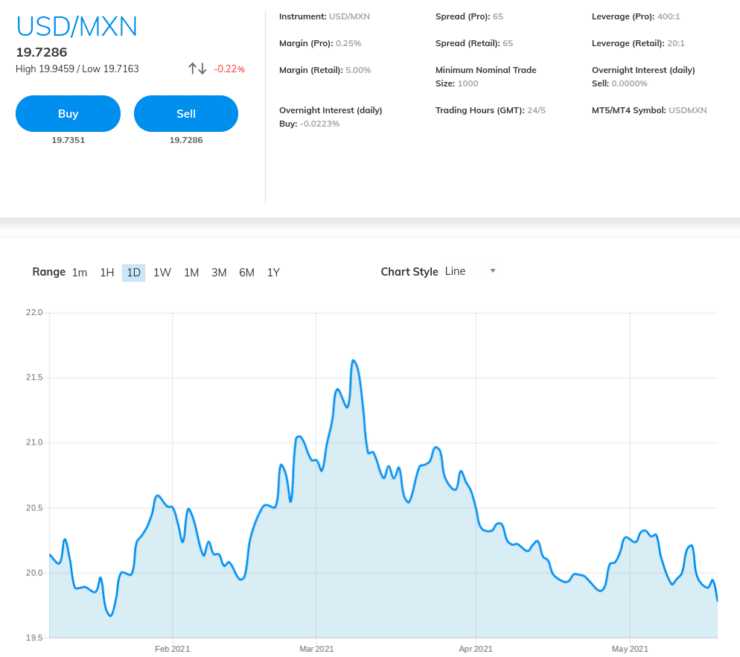

The average spread you should expect to pay on a major pair like EUR/USD is around 1 pip. A minor pair like EUR/JPY is usually around 2 or 3 pips, and an exotic pair such as MXN/USD can be as much as 60 pips. With the latter, remember the spread will be wider – but if you time the market correctly the reward could be even greater.

Margin and Leverage

Put simply, the ‘margin’ stipulated by your forex trading broker refers to the minimum amount the platform requires you to put into the position. This is comparable to a security deposit, rather than a transaction fee.

The trading platform simply holds onto the margin whilst your trade is open. This is related to leverage – but is most certainly not the same thing. Instead of a deposit, leverage is more like a loan from your broker. This means you are able to enter the market with a higher valued position than your account permits!

See a brief example of leverage used when forex trading below:

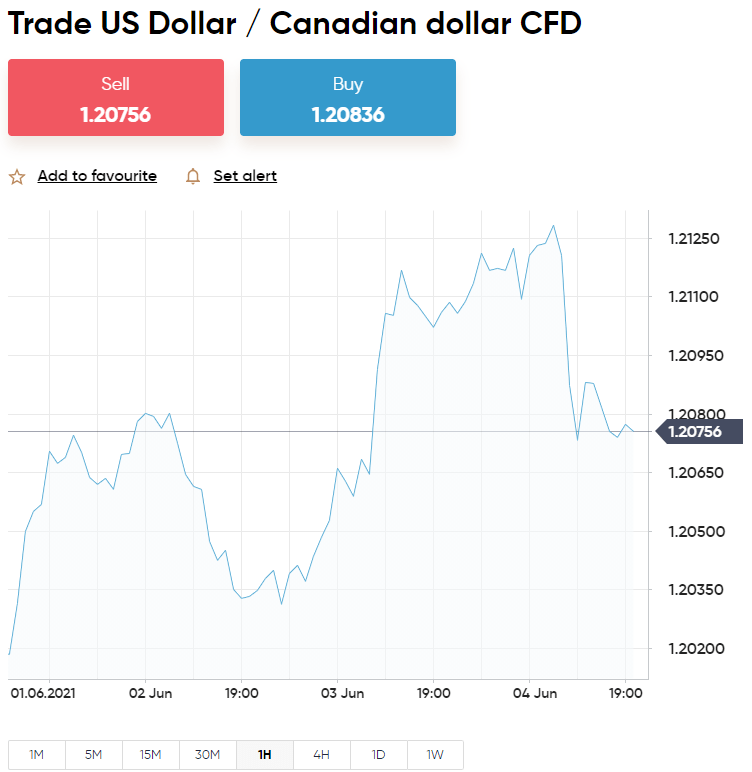

- Let’s say you are trading Australian dollars against New Zealand dollars

- You allocate $100 to an AUD/NZD buy order

- The forex trading broker offers 1:20 leverage

- This boosts your long order to $2,000 ($100 x 20)

- AUD/NZD rises in value by 11% – you were right to go long

- Your gains without leverage would be $11

- With a leverage ratio of 1:20, you made $220!

A word to the wise – tread carefully with leverage. If you are incorrect with your prediction, the trading platform can action a margin call. If so, this can liquidate your position.

Another thing to note about leverage is that although there are so-called high leverage brokers – the amount you can access may be restricted. This is something you will need to check yourself.

To give you an example, if you live in the US, you can trade forex with leverage of up to 1:50 via a regulated broker. If you live in the EU, you will be capped at 1:30 on majors, and 1:20 on minors and cross pairs. Some countries have no restrictions at all – so you might find that your broker offers leverage in excess of 1:500.

Learn Forex Trading Order

A major part of a forex trading course is to have a firm grasp on orders – and what purpose they serve.

Buy vs Sell

To enter your chosen currency market, you need to choose between a buy and sell order.

- Buy Order: You think the FX pair will see a price increase and would like to profit from that – this is when you place a buy order to ‘go long’.

- Sell Order: Research tells you that this pair is probably going to fall in price – to make gains from this, place a sell order to ‘go short’

If you enter the forex trading market with a buy order, you must place a sell order to exit. And the same, vice versa.

Market Vs Limit

The next decision you will make is between a ‘market’ and a ‘limit’ order. This is more about the price at which you enter your desired market.

See a simple example below of each so that you can put this forex trading course to good use:

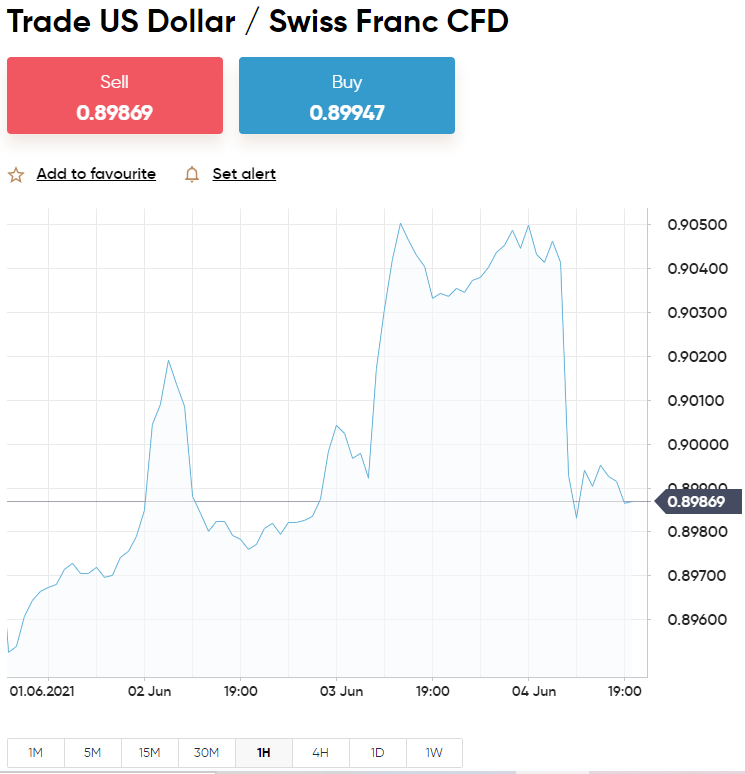

- Market Order: Let’s say you are trading USD/CHF, priced at 0.8974. You think this is good value so place a market order immediately. The forex trading broker will action this for you at the current price (or next best). There is usually a slight disparity between the number you see when placing the trade and the price you get. This is unavoidable due to supply and demand and will rarely make much difference. In this example, you might get a price of 0.8975 upon having your trade executed.

- Limit Order: Imagine you are looking to trade USD/CHF, but are not interested in opening the position until it rises by 4% to a value of 0.9332. As such, you set your limit order to 0.9332 and the broker will action this position only when the pair hits this price.

As you can see, the market order simply illustrates to the broker that you want to enter the currency trade right away. The limit order, on the other hand, will remain in place until this specific price is reached – or you close it manually.

Stop-Loss and Take Profit

At this point of our forex trading course, your entry into the foreign currency markets is covered. Next, we can move onto defining your thirst for risk and locking down your gains with a stop-loss and take-profit order. Whilst both are optional, they are highly practical.

Put simply, either the stop-loss or take-profit order will be actioned at a specific price point chosen by you. This will close your trade automatically. Which one is executed depends on the direction of the currency pair in question. In other words, whether or not you predicted the market correctly.

Let’s offer an example of how both can be used when forex trading:

- Stop-Loss Order: You work out how much you can afford to risk and for what reward – settling on a ratio of 1:3. As such, if you are going long with a buy order – you will place the stop loss order 1% below the entry price. Whereas if you are short with a sell order, the stop-loss will need to be set to 1% above.

- Take-Profit Order: Using the above risk-reward ratio, you will need to set the take-profit value to 3% above the entry price on a buy order. This will need to be placed 3% below it for a sell order.

You do not need to watch the market when using these price-specific orders, as the forex trading platform does it for you. All that remains to be seen is whether your prediction is correct and you come away with a 1% loss, or 3% gains!

Forex Trading: Predicting Future Price Trajectories

One of the most important elements of any forex trading course is learning how to predict the future price trajectories of the currency markets. After all, the whole point of trading any asset is to try to make a profit.

See below the two most powerful tools to get the best out of any forex trading course.

Technical Analysis: Charts and Indicators

Technical analysis comes in a few different forms – most notably, price charts and indicators. The idea is to study trends and price movements that are illustrated as patterns. You can adapt this form of research to cover various timeframes – which can be anywhere from minutes to years.

- Relative Strength Index: Used to measure the momentum of a pair. This will show you a recent price shift and will indicate whether a market is heading towards the overbought or oversold territory.

- Stochastic: This is also a momentum indicator and is helpful for spotting trend reversal. As such, it can also illustrate overbought and oversold markets.

- Pivot Point: This is a good indicator for identifying potential forex pivots. This means you may gain insight into a turning point whereby a bullish or bearish market sentiment is on the horizon.

- Parabolic SAR: This is a price chart that displays dots underneath or on top of the asset’s price – depending on sentiment. If a trend is on the up, you will see dots below the price line – thus, if they are above this represents a downward trend.

- Fibonacci: This particular indicator shows us support and resistance levels. You might look to monitor these levels when you are searching for price swings to take advantage of. Fibonacci retracements and ratios are also used along with other indicators to look for long-term trends.

- Average True Range: This is an indicator that concentrates on volatility – meaning it shows you how much the market tends to move within a specific timeframe. You might find this useful for figuring out where to place a stop-loss order. Low-average range signals usually point towards lower market volatility.

- Moving Averages: This is one of the most commonly used technical indicators for forex traders of all skill sets. Moving averages focus on historical price data. For this reason, it’s known as a ‘lagging indicator’. You can look at data in many different time periods – the most common are 15, 50, 100, and 200 days.

- Moving Average Convergence Divergence: The MACD is known as a momentum indicator. It monitors trends by illustrating the connection between the two moving averages of a forex pair. This also determines whether a currency pair is overbought or oversold.

- Bollinger Bands: The ability to spot when a market might be bearish or bullish can make this a useful indicator of when to exit or enter a trade.

- Ichimoku Kinko Hyo (Ichimoku Cloud): This indicator illustrates future support and resistance, price momentum, trend direction, and trading signals. Ichimoku cloud is very versatile and allows you to use any timeframe. This is best used when there is a clear trend.

As you can see, there are heaps of technical indicators and charts to help you to predict market sentiment. Furthermore, you can use many of them in conjunction with one another for maximum effect.

Fundamental Analysis: News and Economics

Fundamental analysis is a much simpler concept that doesn’t involve reading charts. When forex trading, this will see you keeping up to date with the latest news and understanding what’s happening in the global economy.

See below some big events that could affect the market sentiment on the forex pair you are trading:

- War

- Political uncertainty

- Civil unrest

- A change in economic status – growth or decline

- Natural disasters

- Rising or falling interest rates

If you are worried about the amount of dedication needed to perform technical and fundamental analysis, you could consider a news subscription service. Alternatively, perhaps a passive form of trading might be suitable while you learn the ropes. We talk about this shortly.

Strategies for Forex Trading

By this stage in our forex trading course, you are likely feeling much more confident to conquer the currency markets. Before diving in, it’s important to think about your goals, how much time you have to spare, and what kind of trader you want to be.

See below the two most popular forex strategies, to give you an idea of what each entails.

Scalp Forex Trading

Scalping might suit you if you have enough free time to continuously watch the markets and making frequent trading decisions. This will see you entering and exiting multiple currency trades in a single day – making small but regular gains along the way.

Swing Forex Trading

In contrast to scalping, this particular strategy might mean keeping your position open for several days. In some cases, perhaps even weeks.

This is a strategy that heavily relies on technical and fundamental analysis to spot profitable opportunities. As we said, this is the only hands-on way to know when to enter or exit the markets.

Play a Passive Role in Forex Trading

A key strategy used by many when finding their feet is to play a passive role in forex trading! This might include forex robots, or EAs as they are otherwise known – scanning the markets for opportunities so that you don’t have to. Note though, this will see you handing over permission for the software to place orders for you by using your trading balance.

If you don’t have the time to concern yourself with performing analysis, but don’t want a completely hands-off approach – you can see what automated forex trading platforms have to offer. These days you don’t have to spend months or years learning to read price charts, as there are alternatives – such as forex signals. This would see you signing up for signals that are like trading order suggestions.

Here at Learn 2 Trade, we include the FX pair, whether to go long or short, an entry price, and a stop-loss and take-profit value. This way, our expert forex traders perform advanced technical analysis on your behalf. You just have to decide whether to place the order or not.

Another passive way to take part in forex trading is to use the eToro Copy Trader feature. This entails choosing a person to copy, making the minimum investment required, and then sitting back and doing nothing.! To be clear – there is plenty of data available to help you make your decision and you can un-copy that trader whenever you like. Whatever they buy or sell you will see in your own portfolio. We provide further explanation in our eToro review shortly.

How to Find a Forex Trading Broker: Checklist

To find the best forex trading broker that can give you access to this market, you need to do some independent research. This is an important part of our forex trading course – as the broker sits between you are your chosen currency pairs.

To help you along the way, you will see a useful checklist below.

Approval of Financial Authorities

Financial authorities, or regulatory bodies, are an integral part of keeping the currency markets clean from shady brokers.

The biggest regulators in this industry are:

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

- CySEC – Cyprus Securities and Exchange Commission

- FSCA – Financial Services Conduct Authority of South Africa

- MiFID – Markets in Financial Instruments Directive

- NFA – National Futures Association

There are more, but these are the most commonly used. These organizations have the power to enforce rules on brokers such as keeping client money in a separate bank account, submitting detailed audits, and displaying compliance with KYC rules.

As such, it’s important to look out for the regulatory status of any forex trading platform before signing up.

Number of FX Markets to Trade

Another important consideration is how many currency markets you will have access to via the brokerage. This forex trading course found that some platforms are only able to offer popular pairings – while others offer a wide range of exotics.

Low Commissions and Spread

The fewer fees you have to pay to your forex trading broker, the better it will be for your long-term profits. We explained what the spread is and that the tighter it is the better. All of the platforms we review later in this forex trading course are able to offer competitive spreads across most assets.

When it comes to commission, this can vary by some distance too. Whilst one brokerage may charge you a fixed amount or variable fee on every trade – others charge nothing. As such, it’s important to do your homework.

Useful Tools and Features

The type of tools and features you need depends on what kind of forex trader you see yourself as. For instance, you might want an all bells and whistles type of broker. Alternatively, you might be happy with a simple interface, provided you can use a forex simulator for risk-free strategizing.

As we mentioned earlier, required features could include the ability to use a forex robot or trading signals With this in mind, it is important to be aware of what each broker can offer.

Best Forex Trading Brokers Rundown 2023

In this part of our forex trading course, we review the brokers of 2023. Each broker offers an abundance of forex markets, tools, and features, and everything listed on the above checklist.

1. AvaTrade – Best All-Round Forex Trading Broker

AvaTrade has a lot to offer for forex traders at all levels of experience. You can access tons of currencies here including majors, minors, and exotics. This forex trading course found emerging markets to include the Swedish krona, Israeli new shekel, South African rand, Turkish lira, Chilean peso, Norwegian krone, Russian ruble, Mexican peso, and others. You can add leverage up to 1:500 - but this will depend on your location and trading status (professional or retail).

This brokerage doesn't charge any commission to trade, and we found that spreads are competitive across most assets. AvaTrade supports forex EAs if you would like to try fully automated trading. You can also link your account to MT4 for a plethora of price charts and indicators - including many we listed earlier. You may also use this platform to get your hands on a demo account with $100k in paper funds.

There is an educational suite at AvaTrade to help you brush up on your skills. This covers trading videos, rules, economic indicators, strategies, ebooks, and technical strategies. For more advanced traders, you can see economic calendars, earnings reports, and various other options. This broker is compatible with various platforms, not limited to MT4. This includes MT5, AvaTradeGo, and AvaSocial.

The latter allows you to enter and exit the markets passively by mirroring the orders of a seasoned pro, and you can also 'like, 'follow' and 'comment'. Many people enjoy social trading for the ability to strategize with one another. You can add funds to your account using credit and debit cards, bank transfers, or e-wallets like WebMoney, Skrill, or Neteller. The minimum deposit is $100, and this broker is heavily regulated by six jurisdictions.

- Commission-free forex trading from $100

- Regulated by 6 regulatory bodies

- Tons of forex markets and access to MT4 for technical analysis

- Admin fee charged after 12 months

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

2. VantageFX – Best Beginner-Friendly Forex Trading Broker - Deposit Only $50

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

VantageFX is well respected in the brokerage scene and we found its native trading platform easy to use. You will have access to tons of markets here, including minor, major, and exotic currency pairs. Emerging economies comprise the Romanian leu, Polish złoty, Turkish lira, South African rand, Mexican peso, Russian ruble, Swedish krona, Norwegian krone, Israeli new shekel, and others.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. LonghornFX – Best Forex Trading Platform for High Leverage

If after taking this forex trading course you want to hit the markets with high leverage - LonghornFX is likely going to be the best option. This brokerage provides access to various assets including minor, major, and exotic pairs. Developing currencies include the Mexican peso, Turkish lira, Russian ruble, Swedish krona, Danish krone, Norwegian krone, Israeli new shekel, Polish złoty, Czech koruna, and more.

This online broker will offer you leverage of up to 1:500 - even if you are a retail investor. This forex trading course found that both commission fees and spreads are on the low side here. Furthermore, you can access thousands of trading tools on MT4 by hooking your LonghornFX account up to the third-party platform - after signing up.

When you've connected your account to MT4, you can access a forex trading facility loaded with paper funds. This will aim to mirror real-world trading conditions and sentiment and will not cost you a cent to use. As you can imagine, this makes it helpful for getting to grips with the complexities of the foreign exchange marketplace.

LonghornFX is a little different from the other trading platforms on our list - as it not only accepts Bitcoin deposits but prefers them. You may also use a credit and debit card or bank transfer. This forex trading course also found that there is no minimum deposit stipulated, however, the recommendation is $10.

- Forex trading with up to 1:500 leverage, competitive spreads and low commission fees

- Connect your broker account to MT4 for technical analysis

- Super fast withdrawals guaranteed

- Platform favors Bitcoin deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Forex Trading Course: Put Your Knowledge to Good Use Today!

By this point in our forex trading course, you are probably keen to sign up with a broker, to afford you access to your preferred currency pair.

We are using Capital.com for the purposes of this 5 step walkthrough. The platform is easy to get around, offers tight spreads, and makes placing orders stress-free.

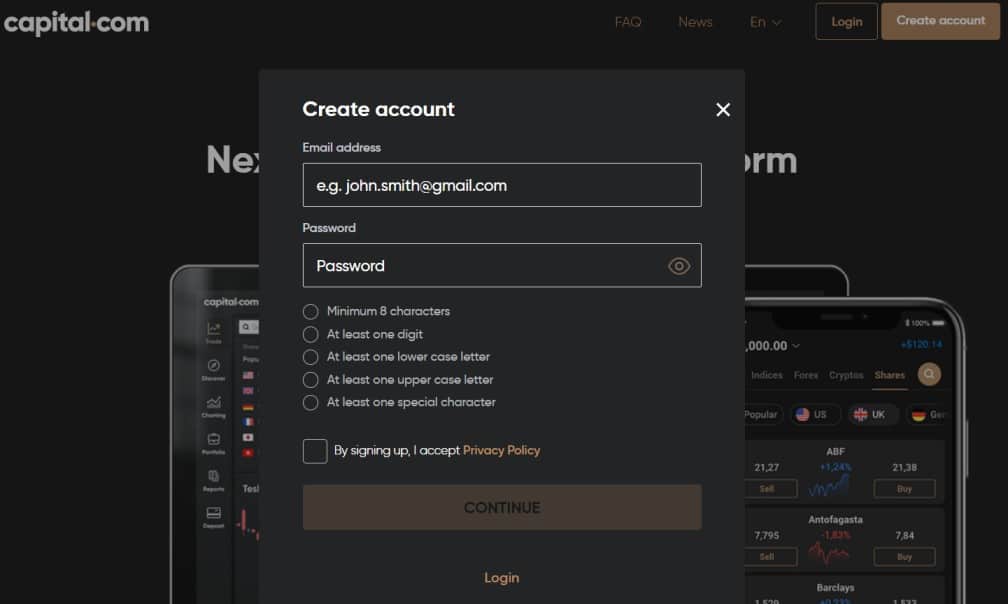

Step 1: Head Over to Capital.com

Once you’ve arrived at Capital.com you can click ‘Create account’ and a sign-up form will appear.

Enter your name and other information required – click ‘Create Account’ when you are happy to proceed with setting up your account.

Step 2: Complete KYC

Wait for your email confirmation and go to your account page using the link to complete your profile. As Capital.com is regulated, you will be asked to validate your ID by sending a copy of your passport or driving license.

To confirm your address, you can use a utility bill or digital/scanned bank statement. If you fail to complete this step you can still place orders but cannot make a withdrawal or deposit more than $2,250.

Step 3: Add Funds to Your Account

Now you can pick a payment type, enter an amount, and click ‘Deposit’.

If you are looking to take what you’ve learned from this forex trading course over to a demo account, you don’t have to deposit funds straight away.

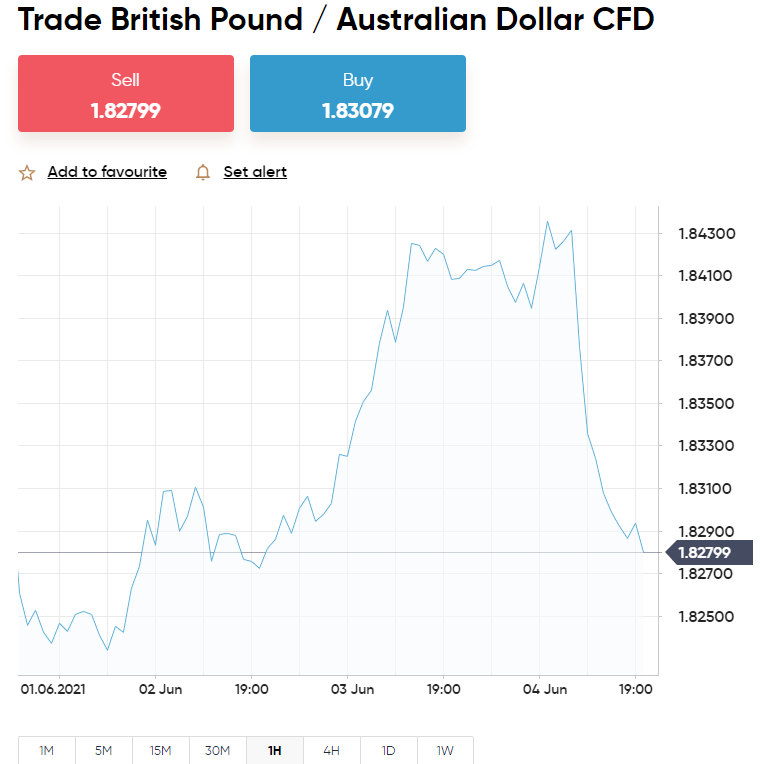

Step 4: Find a Forex Pair to Trade

To find a forex pair to trade you can click ‘Trade Markets’ to see all assets available – or you can use the search box.

Here we entered GBP for inspiration and decided on British pounds against Australian dollars (GBP/AUD). When you have chosen a forex pair to trade – click ‘Trade’ to place an order.

Step 5: Place a Forex Trading Order

Here we are placing a buy order on GBP/AUD. Do not forget to enter the monetary amount and a stop-loss and take-profit value.

Forex Trading Course 2023: To Summarize

This forex trading course has covered the bare basics such as pairs, order types, and spreads. It’s wise to include stop-loss and take-profit orders on every position you take in the currency market – to protect yourself from the unknown.

Another helpful strategy is to consider how actively you want to trade. For instance, would it suit you more to take up scalping – looking for multiple opportunities throughout a trading day? Or perhaps you lack the time to be so active in the markets so would sooner try a passive trading method like forex signals or Copy Trading?

Think, about your personal forex trading goals and enter with a strategy. We’ve also talked about the importance of finding a good brokerage to provide access to your chosen market. We found the top brokers in the space to be AvaTrade, Capital.com and LonghornFX. All offer heaps of currencies, low to no commissions, tight spreads, and helpful features.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

Can I get rich forex trading?

Am I able to start forex trading with $100?

Can I try forex trading free of charge?

What is the most liquid forex pair?

Can I teach myself forex trading?