We commonly utilize margin accounts and leverage in forex trading. As a trader, this gives you more buying power when hitting the currency markets.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Using leverage can, however, be a risky business, so it’s important to educate yourself on the subject first. As such, in part 2 of our beginners forex course, we discuss the ins and outs of margin and leverage.

This includes what margin and leverage actually are, how to use each effectively, and the relationship between the two. Having a clearer understanding of this should aid you in avoiding margin calls, stop-outs, and ultimately liquidation.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

What is a Forex Margin?

This beginners forex course aims to cover all aspects of currency trading. As we said, margin and leverage are a good place to begin. This is because they shape how much you are able to stake, make, or lose.

When researching forex basics, you will have probably seen the term ‘trading on margin’ banded around. The ‘margin’ is like a security deposit you will pay to your broker. This is used to increase your purchasing power when dealing with currencies.

Like with any security deposit, this simply means that you are able to open a large position on your chosen forex pair, whilst only paying for a fraction of its value upfront. At this stage, we call this the ‘initial margin’.

The percentage or ratio you see next to a margin requirement is the amount you must pay upfront to enter the trading position.

See an example of how to calculate the required margin on your next FX position:

- Let’s say the margin ratio at the trading platform is 1:100, or 100%

- You want to go short with 1 standard lot on EUR/USD at a price of 1.2000

- The margin needed for this position is $1,200

The margin amount stipulated by the broker will depend on whether you are a retail or professional client, as well as the volatility and liquidity of the specific forex pair you are trading. Notably, major markets come with higher leverage limits than minors and exotics.

What are Margin Calls and Stop-Outs?

When trading currencies using margins and leverage – there is a maintenance level in place that includes a ‘margin call’, and a ‘stop-out’ point. The former is usually 100% and the latter 50%. This will help the broker decipher how much equity you need to open new (if any) positions.

The stop-out occurs after a margin call and means that your forex positions will be closed automatically. This will happen one by one until your account can cover the required amount. Some regulatory bodies, such as the FCA, introduced the stop-out level as an interventional measure to protect retail forex traders.

This is to prevent people from falling into too much debt with brokers. The stop-out usually occurs when your remaining equity is the equivalent of say 50% of the necessary margin. With that said, the point at which this happens depends on the brokerage account, jurisdiction, and forex market in question.

This is to prevent people from falling into too much debt with brokers. The stop-out usually occurs when your remaining equity is the equivalent of say 50% of the necessary margin. With that said, the point at which this happens depends on the brokerage account, jurisdiction, and forex market in question.

For instance, professional non-EU clients may not incur a margin call until their equity falls to 10%. Either way, the losing trade with the biggest value will be the first to be forcibly closed when the stop-out takes place.

What Triggers a Margin Call?

If the stated level is 100%, as most are – the broker will trigger the margin call when your remaining equity is the same as the margin required by the trading platform.

Let’s clear things up with another example:

- Let’s say you have $1,000 in equity

- You have 5 trades open – each one requires a $200 position margin

- As such, your margin requirement across all open positions is $1,000

- The stop-out percentage level is 50% of the margin

- Next, your trading account balance falls below $500

- Starting with the biggest value position from your losing trades – each will be closed automatically

- This will continue until your equity level rises to over 50% once more

Your positions may also be closed automatically by a stop-out if you are on a margin call during times of volatility. This could also come into play if your remaining equity falls beneath the margin level (say 100%) over a weekend.

Some platforms will also close your open trades if you are on a margin call consistently for a specified amount of time, say 24 or 48 hours. Each brokerage will stipulate different rules, so always check this out when you are researching a broker to access the currency markets.

How Will I Know When I am on a Margin Call?

The first thing to point out is that it is your responsibility as a forex trader to ensure you have an adequate amount of margin – to avoid a margin call in the first place. However, many trading platforms will send you some form of notification when your equity falls below a certain amount.

This guide found that the general rule of thumb is that between two to five days before, the brokerage will send you one or more warning emails to ‘meet the call’. This will occur before the brokerage begins closing your positions one by one at its discretion.

Margin Calls: Which Course of Action Should be Taken?

You have options when you find yourself on a margin call – you can either begin manually closing positions or make a deposit. Either way, you must meet the maintenance margin level requirement before you can place any more orders to trade forex.

So, what happens if you can’t fulfil a margin call? There is not much more you can do at this stage. Your positions will be closed without your permission, at the discretion of the broker. Some might even charge you commission for closing your trades. As we said, the platform will usually warn you before it gets to this stage.

What is Leverage?

Leverage is comparable to credit or a loan from your chosen online broker. This means that you can open a much bigger position than your trading capital allows. In other words – you can enter the market using very little of your own money.

Let’s offer a simple example of how leveraged forex trading works:

Let’s offer a simple example of how leveraged forex trading works:

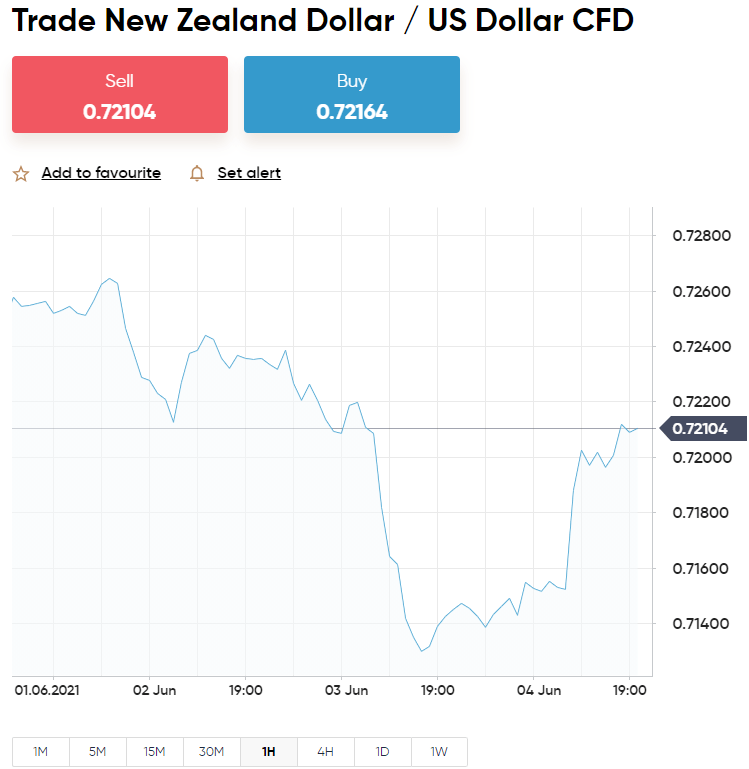

- You have $500 left in your account and want to allocate it to a buy order on NZD/USD

- You apply leverage of 1:20 – boosting your long position to $10,000

- NZD/USD rises by 12% – your hypothesis was correct

- If you hadn’t used leverage when entering the market, your profit would be $60

- Because you leveraged your position by 1:20, you made gains of $1,200

As such can see from the example above, you were able to boost your profits by 20 times – as per your leverage ratio of 1:20.

Leverage Ratios Explained

Much like with margin requirements, leverage will vary from platform to platform.

You will see this displayed as a ratio such as:

- 1:2, 1:5, 1:10, 1:20, 1:30, 1:50

- Or, sometimes in multiples like this; x2, x5, x10, x20, x30, x50

The amounts listed above are the most commonly seen leverage ratios at regulated trading platforms. You will have access to a higher amount on major currency positions than on minors and exotics.

So, what does the leverage ratio mean for your forex trading position?

- 1:2 – a $100 stake becomes $200

- 1:5 – $100 is boosted to $500

- 1:20 – $100 permits a $2,000 position

- 1:30 magnifies $100 to $3,000 – and so forth

Some regulatory bodies, tasked with keeping online brokers in check, limit the amount of leverage allowed. For example, top-rated trading platform eToro allows retail clients upto 1:30 for major FX pairs, and 1:20 for minors and exotics.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

The European Securities and Markets Authority (ESMA), amongst other organizations, dictates these limits. As we said, 1:30 means you can trade markets like EUR/USD with up to 30 times more than what you have.

We talk about specific leverage restrictions in the next section.

Leverage Restrictions

Some brokers can offer clients as much as 1:500 in leverage or even 1:2000. This will depend on your jurisdiction, trading experience, the asset you are placing an order on, and the value of your stake.

To give you some idea of the maximum amount of leverage you might be able to access, as a retail investor – see a list below:

- Singapore: Monetary Authority of Singapore (MAS) – 1:20

- UK and Europe: the Financial Conduct Authority (FCA) – 1:30

- Australia: Australian Securities and Investments Commission (ASIC) – 1:30

- Cyprus: Cyprus Securities and Exchange Commission (CySEC) – 1:30

- Dubai and UAE: Dubai Financial Services Authority (DFSA) – 1:50

- Canada: Investment Industry Regulatory Organization of Canada (IIROC) – 1:50

- United States: The Commodity Futures Trading Commission (CFTC) – 1:50

- New Zealand: The Financial Market Authority (FMA) – 1:500

- South Africa: Financial Services Conduct Authority of South Africa (FSCA) – 1:2000

As you can see, there is quite a lot of disparity between jurisdictions. With that said, if you are looking for more leverage than your country of residence allows – forex broker LonghornFX can provide you with up to 1:500 – even as a retail client.

You will sometimes find that a broker is regulated in more than one jurisdiction. For instance, top-rated platform AvaTrade is licensed in six – including Australia and South Africa. eToro complies with the FCA, ASIC, and CySEC.

Notably, offshore regulators are able to offer much more leverage. However, using leverage of say 1:2000 is highly risky when trading currencies. Furthermore, it’s important to enter the currency markets with a forex trading system. Any seasoned trader will tell you that this should include bankroll and risk management. We talk about strategies and how to use them in part 9 of this beginners forex course .

What is the Correlation Between Margin and Leverage?

Newbie traders sometimes assume that margin and leverage are interchangeable. Whilst they both essentially allude to the same thing, they come from a different standpoint. The two have an inverse relationship, so you can’t access the latter without the former.

This calculation shows the correlation between margin and leverage:

- Let’s say the margin needed is 3.33% – the leverage is 1:30 (100 ÷ 3 = 33.33)

See below some common margin percentages and leverage ratios:

- 1:500 leverage = 0.20% required margin

- 1:400 leverage = 0.25% required margin

- 1:200 leverage = 0.50% required margin

- 1:100 leverage =1% required margin

- 1:50 leverage = 2% required margin

- 1:30 leverage = 3.33% required margin

- 1:20 leverage = 5% required margin

In a nutshell – the margin you pay deciphers how much you can multiply your trade by with leverage. If you think about it, when you get a loan, the amount you pay in terms of a deposit will decide how much credit you can get your hands on.

How to Calculate Your Equity

A good place to start with forex trading basics such as margin and leverage is to calculate your total equity.

If you are unaware of how to work out your equity, see below:

- The collective unrealized losses and gains within your open trades + your available trading funds = your total equity

This will give you a better idea of where you stand, enabling you to gauge whether you might need to reassess your strategy – to avoid a margin call.

Margin and Leverage: Professional Vs Retail Clients

Largely due to rules and regulation – every licensed forex broker you come across will need to know whether you are a ‘retail’ or ‘professional’ trader.

It is important to know which camp your fall into. This will affect how much leverage you can access, and what margin percentage you will need to put in.

What is a Retail Trader?

For those unaware, a retail client is your average Joe Trader, using their own account to buy and sell currencies for themselves. This is the complete opposite of major market players such as large institutions, central banks, and hedge fund managers.

Retail traders can access fractional trading. As you may know, a standard lot in currency trading is 100,000. However, some brokers also support fractional forex lots like mini, micro, and nano.

Regulated trading platforms AvaTrade support micro forex lots (0.01). We talk about pips, lots, and orders in part 3 of this course.

What is a Professional Trader?

A professional trader is someone who makes multiple large-scale transactions in the currency markets, on a regular basis. It’s also widely accepted that to qualify as a pro you must have no less than half a million in liquid assets. This doesn’t include your house.

Professional forex traders will be able to access a higher amount of leverage and need a lower margin percentage than retail clients.

See an example below, imagining that your broker falls under FCA ruling:

- Instead of being capped at 1:30 on majors, professionals with high trading volumes can access as much as 1:500 – with a margin of only 0.2%

- Professional clients may also be able to use leverage up to 1:25 on exotics, with a margin of 4%

Professional traders also have to provide supporting documentation to prove various things such as the aforementioned financial standing. This also includes obtaining a supporting letter confirming an executive role in the financial sector – covering at least 12 months.

Margin and Leverage Pros and Cons

There are many misunderstood practicalities of forex trading basics – margin and leverage. It’s really important to have a crystal clear understanding of the risks and rewards before diving in.

With this in mind, we have included some pros and cons below.

Pros

Below you will find a list of the biggest benefits of margin and leverage in forex trading:

- Boost Your Trade Stake: Using leverage to magnify your position is an obvious plus point. For instance, you might be interested in scalping a popular major such as GBP/USD but only have $50. If you leverage your trade by x30. you could place an order worth $1,500 if permitted by your broker.

- Low Volatility in the Market: Let’s say you are looking to trade AUD/CHF which is one of the least volatile FX pairs. The market rarely moves by more than a couple of percentage points per month. As less volatility means lower profits, this is a good way to counteract the lack of sharp price fluctuations.

- Hedge Forex: As we touched on in part 1 of this course – why should you trade forex? – you can use currencies for hedging purposes. This might see you placing leveraged positions with small stakes on conflicting pairs, or taking a short and long position on markets that are highly correlated.

- Develop Your Trading Strategy: Having a strategy in place is a core forex trading basic. As such, having access to varying ratios of leverage can be really useful for creating and adapting your plan for this highly liquid marketplace. You might try using high leverage such as 1:30 in small volumes, or the opposite – low leverage trading at high volumes. Some people prefer to keep the ratio to a maximum limit of 1:10 or 1:20.

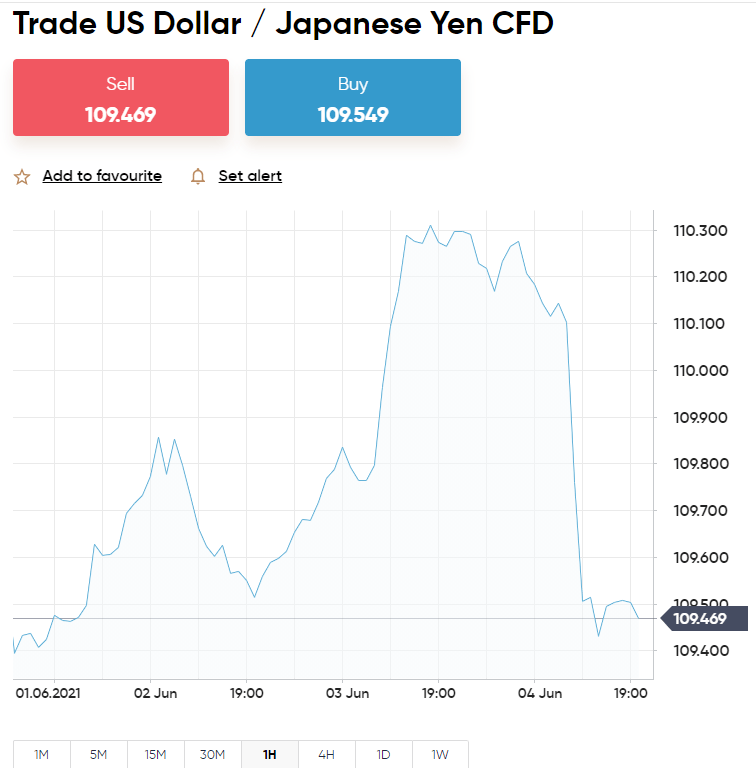

- Grow Your Account Balance: If the market goes the way you think it will, you can really grow your account balance with leverage. A $100 USD/JPY position can become a $3,000 one with the click of a button. This of course means that if things do go your way – any profits from the trade are also multiplied by 30.

As you can see, there are heaps of pros when using leverage for forex trading. In fact, it is arguably more suited to the buying and selling of currencies than any other, because of the high liquidity it experiences. When the markets are less volatile, traders can still capitalize on small price movements. Crucially, with a small amount of capital.

Cons

To enter the currency markets with realistic expectations, you will see the cons of margin and leverage trading below:

- Losses are Multiplied: Leverage can make you some great gains, provided you do your homework and the markets perform as you expect. The opposite end of the scale is that if your prediction is wrong – it will magnify your losses.

- The Risk of a Margin Call: The higher the leverage is – the more you face the possibility of getting a margin call. Or even worse, a stop-out – closing your existing trades one by one, often at a cost or loss to yourself.

- Larger Trading Positions can be Stressful for Newbies: It’s great having the option of margin trading with leverage. However, beginners can find the prospect of larger positions and seemingly boosted price fluctuations overwhelming. The pressure of making tough choices to avoid going into the red can force newbies to make rash decisions. Ultimately, this can lead to spot trading emotions.

Whilst the fear of a margin call and such can be daunting, there are some forex secrets you can adopt as part of your trading strategy to keep you on the right track.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

For instance, think about your risk/reward ratio and apply this to every trade. This means how much can you afford to risk, and what reward you would expect to see? We cover strategies in part 9 of this course.

How to use Leverage Safely

As you are now all too aware, using leverage doesn’t come without its risks. There is every chance that the price of the pair will go in the opposite direction to what you thought, leaving leverage to magnify your losses.

Of course, there is also the added danger of being put onto a margin call. One of the safest ways you can use leverage is to limit the amount you use. By maintaining low levels you will be better equipped to handle a trade that doesn’t go as expected!

When trying to excise caution, a good place to start is understanding margin requirements, leverage, margin calls, and stop-outs – how they work and what it means for your account. If leverage-based speculation is part of your strategy, another way to use it safely is to maintain realistic expectations.

When trying to excise caution, a good place to start is understanding margin requirements, leverage, margin calls, and stop-outs – how they work and what it means for your account. If leverage-based speculation is part of your strategy, another way to use it safely is to maintain realistic expectations.

For instance, you might elect to never use more than 1:2 leverage no matter what pair you trade.

See an example of the effect that high leverage can have on your losses:

- You are trading EUR/CHF and have $100 to allocate to a sell order

- You apply 1:30 leverage, boosting your position to $3,000

- Unfortunately for you, EUR/CHF rises in price by 9% – meaning you were incorrect.

- This leverage has magnified your losses from this trade to $270

- Had you only used 1:2 leverage your losses would be a more manageable $18

As you can see, leverage can also amplify your losses in a heartbeat, so always consider both sides of the coin and be realistic with the potential result. For instance, as we’ve alluded to – rushing in with the highest available leverage isn’t necessarily the best option.

Forex Trading Basics: Margin and Leverage: Full Conclusion

That’s the end of part 2 of our beginners forex course. In this segment, we’ve covered the ins and outs of margin and leverage. As we explained, both have an inverse relationship. As such, you must pay the margin – which is like a security deposit – before you can open a position in the currency markets. Once you have paid the margin required, you will be able to add leverage to your trade, as a loan from the broker.

For instance, if the trading platform offers you 1:20 leverage, a margin of 5% is required to enter the market. If it is 1:30, the trading platform will need a down payment of 3.33%. The bottom line is that margin and leverage are a lifeline to most forex traders. It enables us to open a position much higher than our account allows and also magnifies gains.

Always be careful with the amount you apply and only do so via a trusted brokerage. This has never been easier – as there are hundreds of providers offering access to a vast variety of markets. Just some of the best trading platforms offering leverage are AvaTrade, and Capital.com – all with low fees and heaps of assets. You then have LonghornFX – which will give retail clients as much as 1:500.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99