The foreign exchange arena is the biggest and most active financial trading market on the planet. Being able to access the currency markets with low fees, various levels of volatility, and the ability to trade 24/7 is why millions of people around the world buy and sell forex pairs every day.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

So that begs the question – why should you trade forex?

In part 1 of this beginners forex course, we cover the key characteristics of why this marketplace is so desirable. This includes everything from trading hours and accessibility, to volatility, liquidity, and the ability to go long or short on your chosen FX pair.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

Why Should You Trade Forex?

The forex markets have an estimated daily turnover of more than $6.6 trillion, so it won’t surprise you to learn that it has a current value of around $2.4 quadrillion!

For those who don’t have time to read part 1 of this beginners forex course in full right now – many people flock to this asset class for the following reasons:

- Extended Trading Hours

- A Marketplace Accessible to Everyone

- Volatile and Liquid Trading Environment

- Mitigate Low Volatility With High Leverage

- Hedge Against Forex Losses

- Long or Short Your Chosen Forex Market

- Heaps of Technical Analysis Tools

- An Abundance of Trading Tools

- Trade Forex in Safe and Regulated Conditions

Are you still wondering why you should trade forex? Read on for more information on each benefit.

Extended Trading Hours

Part of the global attraction to the FX marketplace is its rolling trading hours. Essentially, as long as there is a forex market open – you can trade currencies.

This of course means no matter what time zone you live in, you are able to access a marketplace to buy and sell in. For beginners especially, forex trading hours can be confusing – particularly when the clocks go back or forward.

Next, this beginners forex course clears the mist on daylight saving time and when you can trade currencies.

Forex and Daylight Saving Hours

In excess of 70 countries observe daylight saving time (DST), and to confuse things even more – sometimes only a segment of the province does so.

For instance, in the US; American Samoa, the U.S. Virgin Islands, Hawaii, Guam, Puerto Rico, and the majority of Arizona do not change their clocks twice a year. Whereas the rest of the US does. Sounds confusing right? It really doesn’t have to be.

By conducting a simple internet search for ‘forex market hours‘ you should come across some FX time converter calculators. This quite literally saves you from having to work out which markets will be open where you live, and at what time.

Forex Market Hours – GMT

Being aware of forex market hours is important – as when one closes, another will be opening – meaning that you can always trade. With that said, there are certain times of the day when pairs are more volatile and liquid than others.

A perfect example of this is TOTH (Top Of The Hour). This refers to the final 5 minutes of every trading hour and is said to offer sharper price swings.

To give you an idea of when currency trading sessions open and close (based on GMT) – see below:

- There will always be an overlap between the opening and closing of markets to allow for 24/7 trading.

- At around 23:00 to 08:00, the trading week kick starts with the Asian (Tokyo) markets – with China, New Zealand, Australia and Russia very much active too.

- Next, the London and European markets come alive – usually between 07:00 and 16:00 officially.

- Many hours after the close of the Tokyo sessions – (around 12:00) the New York (North American) exchange springs into action, closing at about 20:00

- Sydney sessions begin around 20:00 as the New York exchange closes.

- Before Sydney shuts down at approximately 05.00 – the Asian markets open and the whole thing starts again.

As such, when you are studying this beginners forex course and wondering ‘why should you trade forex?’ – one of the main reasons to choose this asset over another is that the currency markets are open 24/7. It’s important to note that supply and demand will be affected at the weekends.

Not only that, but due to the fact most bank desks and large financial organizations close on a Sunday – excluding the Middle East – many platforms won’t allow trading on this day. This is because there is not enough liquidity. Plus, the lack of available counterparties leaves no room for the broker to hedge potential risk.

A Marketplace Accessible to Everyone

There was a time when the foreign exchange market seemed to be reserved for major players such as financial institutions, massive multinational firms, hedge fund managers, central and commercial banks, and insurance companies.

These days with an internet connection, a top-rated forex broker, and a comprehensive beginners course – you’re pretty much good to go. Of course, there is much more to it than that – but there is no denying that the FX marketplace has never been more accessible to your average Joe Trader!

It’s important to reiterate the importance of a broker here. The best thing you can do is carry out your own research and sign up with a well-known and regulated forex provider that offers its clients super low fees, an easy-to-use platform, and tons of forex markets to trade.

It’s important to reiterate the importance of a broker here. The best thing you can do is carry out your own research and sign up with a well-known and regulated forex provider that offers its clients super low fees, an easy-to-use platform, and tons of forex markets to trade.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Your chosen trading platform will be responsible for looking after your account funds, as well as executing orders and hopefully providing you with leverage too! As we said, without having an account with a broker – you won’t be able to enter the FX markets at all!

Volatile and Liquid Trading Environment

Throughout this beginners forex course – you will see many references to liquidity and volatility.

We talk about both below to clear any confusion about what each might mean for your forex trading experience.

Forex Liquidity

If an asset experiences high trading volumes, we describe it as ‘liquid’. This means there is lots of interest from traders in this particular marketplace.

The five most liquid forex pairs in the world are:

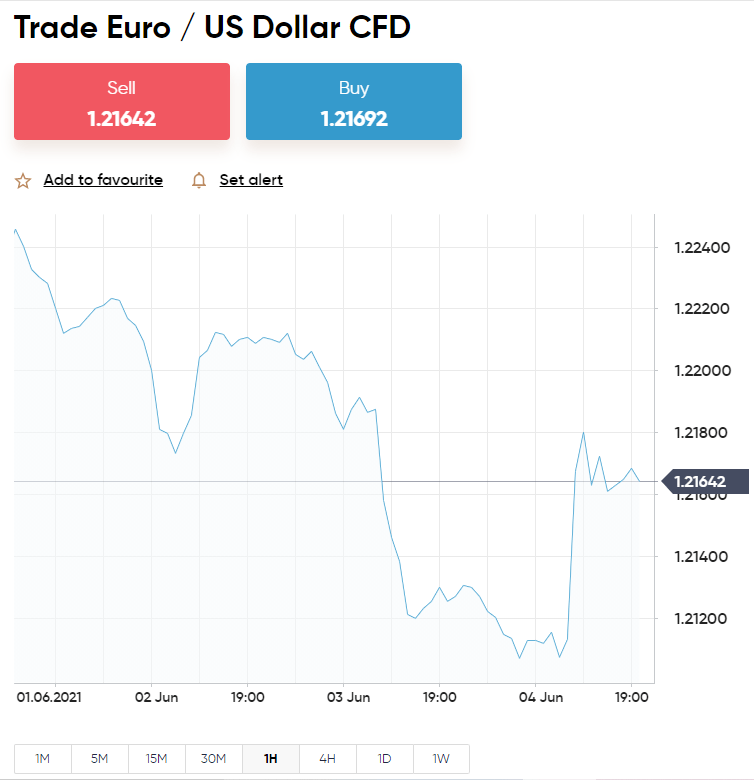

- EUR/USD – euros/US dollars

- USD/JPY – US dollars/Japanese yen

- GBP/USD – British pounds/US dollars

- AUD/USD – Australian dollars/US dollars

- USD/CAD – US dollars/Canadian dollars

When a forex pair is highly liquid, you are more likely to benefit from tight spreads. However, you will not experience as many sharp price spikes, so will likely make lower margins. With that said, there are plenty of strategies that are well suited to capitalizing on high liquidation.

We cover strategies in part 9 of this beginners forex course, titled ‘Trading Strategies and how to use Them’.

In this instalment, we talk about the most commonly adopted systems and how you can add them to your own master plan moving forward! One thing at a time – so back to the question of why should you trade forex – next we talk about volatility.

Forex Volatility

Consider that this asset’s infamous volatility can bring great rewards. This is of course if you are correct in your speculation on which direction the price will shift.

By carrying out some research and completing a beginners forex course – there is no reason why you can’t make some decent gains from steep increases or decreases in value when forex trading!

A word to the wise when it comes to volatility. To really reap the rewards of such drastic price movements – you really need to gain a crystal clear understanding of risk management.

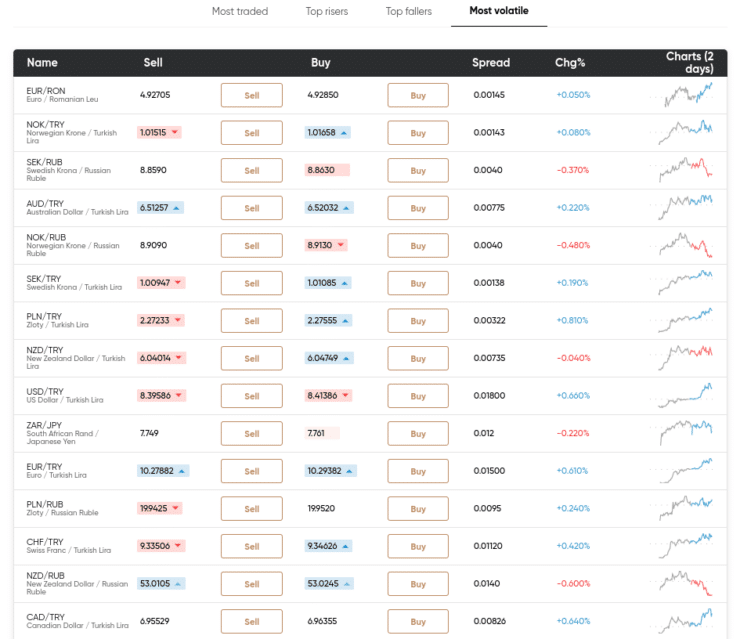

At the time of writing, some of the most volatile FX pairs are:

- USD/SEK – US dollars/Swedish krona

- USD/TRY – US dollars/Turkish lira

- USD/BRL – US dollars/Brazilian real

- USD/INR – US dollars/Indian rupee

- USD/DKK – US dollars/Danish krone

We mentioned practising risk management – you will find that orders such as stop-losses are invaluable when it comes to reducing your exposure to risk.

For anyone who has no experience with orders, not to worry. This beginners forex course covers orders in part 3. As we touched on, in part 9 we also divulge some trading strategies, some of which involve risk and bankroll management.

Mitigate low Volatility With High Leverage

As we said, high volatility is what gives us greater gains – when we get it right. On the other hand, low volatility and high liquidity offer more frequent profits. A great way to mitigate low volatility is by utilizing the leverage on offer with this marketplace.

Leverage is displayed as a ratio or a multiple but they offer the same result. For instance, if you see 1:30 on one platform and x30 on another – this means the same thing – you can boost your stake by up to 30 times.

For those who have no experience of using leverage, see an example below:

For those who have no experience of using leverage, see an example below:

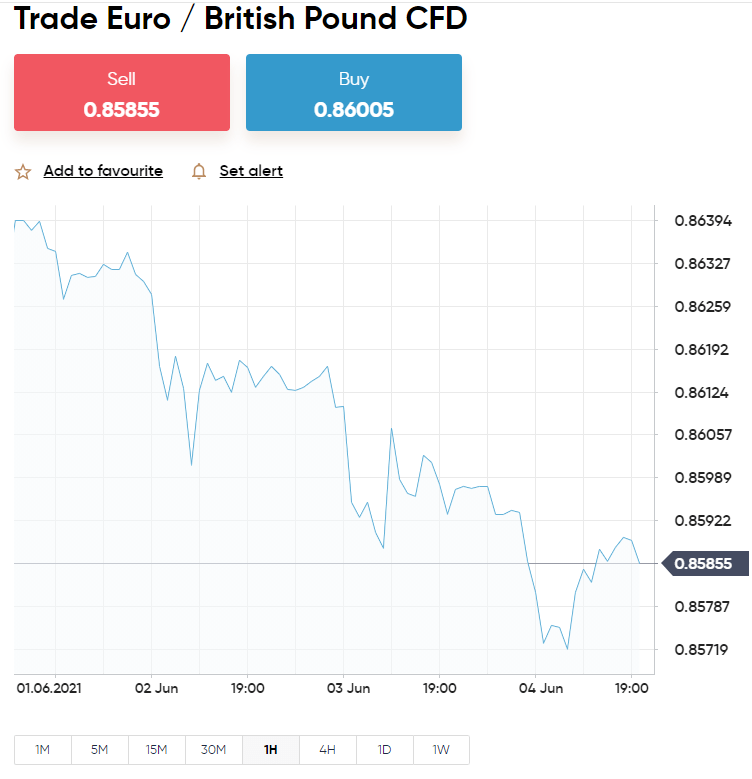

- You are trading EUR/GBP and think its price will rise

- As such, you allocate $100 to going long on the pair

- The trading platform is able to offer you x30 leverage

- Your EUR/GBP buy order is now valued at $3,000

- Hours later this FX pair increases by 4% – which means you predicted correctly

- 4% in gains on a stake of $100 would be $4 without leverage – which is nothing to write home about

- With x30 leverage? You have made a profit of $120!

It’s important to be aware that the ratio of leverage you can get your hands on will be dependent on a few factors. This includes which jurisdiction you fall under, which pair you are trading, and your level of experience.

We usually characterize professional traders as having an investment portfolio worth something like half a million dollars. There is generally a stipulation that to qualify, they must have worked in a professional role in the finance sector for a minimum of one year.

For example, some brokers will provide leverage up to 1:500, but this will depend on whether you qualify as a retail or pro trader. Most platforms provide various leverage options from x1 to x30 depending on the aforementioned information. You then have LonghornFX, where retail investors can trade currencies with leverage up to 1:500!

Hedge Against Forex Losses

We talked about volatility there, which brings us nicely onto hedging. This is an age-old technique used to reduce the risk involved in trading. One of the ways this can be achieved is by opening and closing several strategically correlated trades – such as EUR/USD and GBP/USD. You might go short on one pair and long on the other.

You could also go short on EUR/JPY and long on a pair like EUR/USD. This is because a loss incurred by one of these markets could be counterbalanced by the other. Another option is to hedge against forex with alternative markets – notably commodities like oil, and gold in particular.

An example of this is the inverse connection between USD/CAD and Brent crude oil. This means if the value of oil is falling, you can hedge against it with a buy order on the aforemntioned FX pair. We discuss trading commodities like gold and oil as part of your forex plan in part 7 of this beginners forex course.

Long or Short Your Chosen Forex Market

One of the best things about trading currencies is that you can go long or short your chosen forex market! For those unaware, this means that if all analysis indicates that the pair you are trading will see a fall in value – you can capitalize on its failure.

And course, if you think the opposite, you can go long on your position This paves the way to profit from both rising and falling currency prices.

We talk about orders in detail in part 3 of our guide, however, see a quick example below:

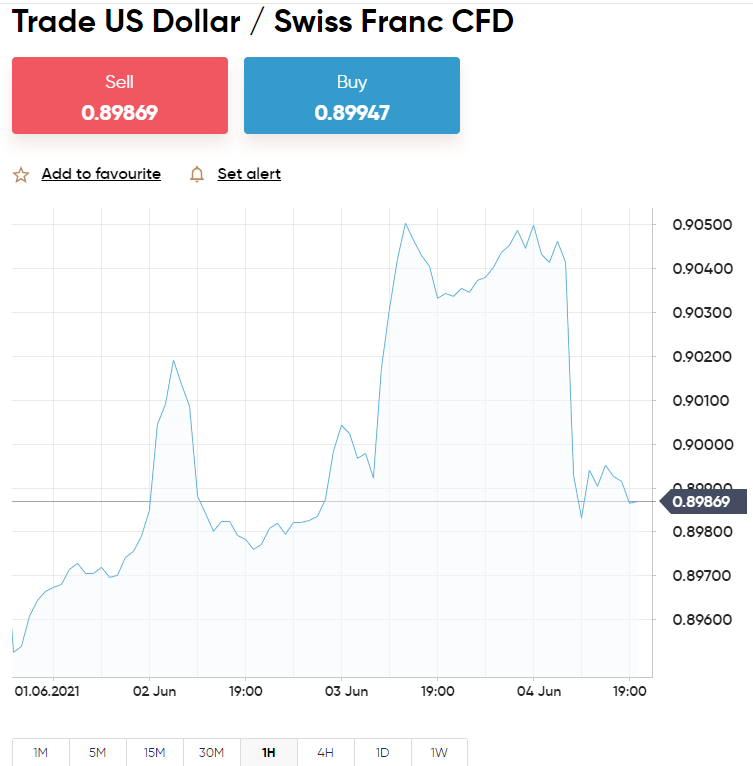

- You are trading US dollars against Swiss francs – displayed as USD/CHF

- If you think this pair will fall in value, you will want to ‘go short’

- This is accomplished by placing a sell order on USD/CHF via your brokerage

- Alternatively, if you feel like the FX pair is undervalued and will rise in value – a buy order will be placed at the trading platform

As you can see, this is a huge advantage over trading stocks in the traditional sense -where you can only make a profit if the asset is in high demand and therefore sees an increase in value.

Heaps of Technical Analysis

There is an abundance of technical analysis tools available for forex traders! We cover this subject in much more detail in part 4 of this beginners forex course.

However, going back to why should you trade forex, another reason is the sheer amount of data that can aid you when deciding on important trading decisions. With this in mind, we are going to cover in brief what you can access, within the remit of part 1 of this beginners forex course.

Studying technical analysis is a trading discipline used by millions. Just  some of the charts and indicators used by currency traders include:

some of the charts and indicators used by currency traders include:

- MACD

- Average True Range

- Moving Averages

- Ichimoku Kinko Hyo

Relative Strength Index - Stochastic

- Fibonacci

- Bollinger Bands

Whilst some perform a similar task, you can also combine multiple charts and indicators to give you a clearer insight into the current sentiment of your chosen currency pair.

You can also see information related to previous price swings, trends and support, and resistance levels. To brush up on your technical analysis skills, stick with us for part 4 of this beginners forex course.

An Abundance of Forex Trading Tools

Some of the most commonly used trading tools today lean toward a more laid-back approach to entering and exiting the currency markets. There are hundreds, if not thousands of indicators and price charts available to help you hypothesize about what might happen with an FX pairs value.

The problem is, some beginners are eager to get started and don’t have the time needed to understand such data. Moreover, even some seasoned traders are looking to passively trade currencies, to avoid having to keep one eye on the markets at all times.

Copy Trader Feature

Copy Trading is a feature offered by top-rated broker eToro. You can invest in a pro forex trader based on specific criteria laid out by you. You will mimic every decision they make without so much as touching your phone screen.

This means that if they go short on AUD/USD, you will see a sell order on the same pair in your account eToro account. Importantly, this will be in proportion to the amount you invested. This is a popular way to earn while you learn and we talk about this in more detail in part 9 of this beginners forex course.

Forex Trading Signals

You could compare forex signals to a ‘hint’ landing in your inbox – detailing what order you might place for a profitable trade. This usually includes the FX pair and whether to place a buy or sell, as well as values to enter for a limit, stop-loss, and take-profit orders.

This is not an entirely passive way to trade, as you still need to decide whether to take this insight over to your trading platform and place the order.

- Here at Learn 2 Trade, we offer free forex signals – which will get you 3 suggestions per week.

- Or, you might try our premium signals – which will get you 3-5 suggestions per day. This comes with a 30-day money-back guarantee.

You could really make the most of trading signals by taking them over to a forex simulator, like the ones found at the respected social trading platform eToro. You will be given a free demo account with $100,000 in virtual equity to practice with and come up with a trading plan. You can then move over to your real account to trade with actual money.

Automated Forex Robot

Some automated trading platforms support forex robots (sometimes called EAs or FX bots). This is a type of system that can scour the currency markets 24/7 to identify opportunities in the financial markets.

The results will either be sent to you as trading signals – or will be automatically turned into orders to enter the market without you having to do anything. Some providers allow you to customize your bot. These systems are unpredictable though, so do your homework.

Heavily regulated brokerage AvaTrade supports EAs via MT4 and offers 55 different FX markets commission-free! For more information about any of the trading tools mentioned here today, you can refer to part 9 of this beginners forex course.

Trade Forex in Safe and Regulated Conditions

Unlike cryptocurrencies, the forex industry is heavily regulated. Regulation in this space distinguishes a shady broker from a legitimate one that complies with rules surrounding fair and transparent trading conditions.

The most commonly used regulatory bodies and authorities, in no particular order, are as follows:

- CySEC – Cyprus

- FCA – UK

- ASIC – Australia

- FSCA – South Africa

- CFTC – US

- NFA – US

Rules are enforced on forex platforms to keep traders safe. This includes segregation of client funds, adhering to KYC (Know Your Customer) standards, and sending frequent company audits.

Many bodies, such as ASIC, stipulate that a brokerage must have a certain amount of its own capital in the bank – before providing a financial service to members of the trading public.

Why Should you Trade Forex? – The Bottom Line

Why should you trade forex? As this guide has covered, there are numerous reasons why it’s beneficial to exchange currencies! This includes everything from 24/7 trading conditions, dozens of supported pairs, high levels of liquidity, low fees, and tight spreads.

Many forex speculators will deploy trading tools and strategies when trading this asset. You might try to earn while you learn by taking forex trading signals for a test drive – entering each suggestion at your chosen broker. Another option is to use an FX robot or even the Capital.com Copy Trading tool – which you wish to access the forex markets passively.

Once again, one of the major draws of trading forex is the low fees and leverage it invites. You can also have a go at making gains from a currency’s predicted decline in price. This is achieved by placing a sell order to short it – then, creating a buy order to cash out when you foresee a profit.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!