Accessing the forex markets can be extremely intimidating for the uninitiated. This online trading space is notoriously volatile and prices can shift by hundreds of pips in one trading day.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

As such, more and more newbies are searching for the best automated forex trading platforms in their droves. If this sounds like something you might be interested in – there are various ways to access these markets passively.

In this guide, we review the 5 best automated forex trading platforms in 2023. We also detail what to look for when conducting your own research and include a walkthrough of how to get started today.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Automated Forex Trading Platforms 2023 – Full Breakdown

We talk about the key metrics to consider when searching for the best automated forex trading platforms shortly.

However, we’ve saved you some time by have reviewing the best brokers currently offering automated forex trading tools.

1. AvaTrade – Best Automated Forex Trading Platform With Plethora of Technical Analysis Tools

AvaTrade is another top-rated and MT4 friendly broker on our list that allows you to connect your account to the third-party platform for automated forex trading. Regulation at this provider comes from six different jurisdictions including Australia, South Africa and Japan to name a few.

There are over 50 forex markets at AvaTrade, including GBP/USD, USD/JPY, NZD/USD, AUD/CHF, USD/NOK, USD/ZAR, GBP/ILS, and heaps more. All come with competitive spreads. If you wish you can hook your account up to AvaTrade and allow an MT4 forex EA to scan and trade the markets for you 24 hours a day, 7 days per week.

To allow the robot to do this, you must first sign up with AvaTrade and link your account. Then you can select an EA and give MT4 permission to trade currencies automatically on your behalf. If you are a little apprehensive about using automated forex trading software, you can try it on a free demo account whilst you find your feet.

AvaTrade offers access to both copy trading and forex robots. The AvaSocial app is free to download and enables you to select and automatically copy expert forex traders of your choosing. You can also connect third-party app DupliTrade to your trading account and MT5 to copy trade and follow strategies and signals.

Finally, you have ZuluTrade, which enables you to trade forex automatically and you can follow as many traders as you like. This is great for lowering the volatility of automated forex trading. At the platform itself, you will find heaps of trading tools such as an educational suite, trading and economic calendars, tutorials, indicators and more.

This online broker offers access to commodities, cryptocurrencies, stocks, and more, plus you can get started at with a deposit of just $100. AvaTrade accepts multiple payment types, including credit and debit cards, bank transfers, and e-wallets like Boleto and Skrill.

- Minimum deposit for forex automated trading just $100

- Regulated in heaps of jurisdictions including Australia, Japan, EU, and South Africa

- 0% commission to trade forex

- Admin fee charged after 12 months inactivity

2. Capital.com – Best Beginner Friendly Automated Forex Trading Platform - Deposit From $20

The FCA, CySEC, ASIC, and NBRB regulate Capital.com. As such, the it must abide by a strict set of rules to keep its platform clean and safe from crime. This CFD platform enables automated forex trading via the aforementioned third-party trading provider MT4.

We found an abundance of forex pairs with tight spreads at this CFD brokerage. This is inclusive of majors, minors, and exotics. To give you an idea of what to expect, pairs include GBP/USD, USD/JPY, AUD/CAD, CNH/HKD, EUR/RON, CHF/RUB, GBP/TRY, AUD/JPY and heaps more.

As we mentioned, Capital.com is partnered with MT4, which is great for accessing the very best in technical analysis and algorithmic forex trading. This comes in the form of EAs that can scan the markets and also personalized robots if you want more involvement in the decision-making process.

Other key benefits of connecting your Capital.com account with MT4 to perform automated forex trading include the 'guardian angel' tool. This offers personalized feedback, 85 custom indicators, 30 technical indicators, 24 analytical objects, and more. You can also practice using forex EAs with a free demo account.

Capital.com also offers access to commodities, indices, cryptocurrencies and shares - with zero commission fees. We found heaps of accepted payment types here - including credit and debit cards, bank transfers, and e-wallets such as Skrill. The minimum deposit to start your automated forex trading endeavors is just $20!

- Compatible with MT4 for commission-free automated forex trading

- Minumum deposit a beginner-friendly $20

- Licensed by regulatory bodies CySEC, FCA, ASIC, and NBRB

- No fundamental analysis at Capital.com

LonghornFX is a user-friendly trading platform that covers dozens of cryptocurrency and forex pairs. You can also trade stock CFDs and multiple indices. You will be able to trade with leverage of up to 1:500 at LonghornFX - irrespective of whether you are a retail or professional client.

In terms of fees, you will benefit from competitive variable spreads throughout the trading day. After all, LonghornFX is an ECN broker - so you will get the tightest buy/sell prices available in the industry. Commissions will vary depending on the asset but typically amount to $7 per $100,000 traded.

We like the fact that LonghornFX processes withdrawal requests on a same-day basis. Plus, the broker offers full support for MT4. The platform can be accessed online, via desktop software, or through a mobile app.

- ECN broker with super tight-spreads

- High leverage of 1:500

- Same-day withdrawals

- Platform prefers BTC deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Automated Forex Trading: Best Options to Consider

As we mentioned earlier, there is heaps to think about when looking for the best automated forex trading platform for your needs. We cover key metrics next.

First, the most obvious thing to consider is – would you would like to trade forex whilst adopting a completely hands-off approach? Alternatively, you might prefer to have to have some input in the decision-making process?

You will see some popular automated forex trading options below to help you make your decision.

Fully Automated Forex Trading

There are a few ways to partake in fully automated forex trading, one of which is direct via a broker such as eToro. As noted, this platform has a built-in Copy Trader feature. This allows you to copy the trades and strategies of successful forex traders.

eToro isn’t your only option to copy a seasoned forex trader, but it is one of the best-rated of its kind. When it comes to choosing a Copy Trader to mirror, you can view and filter a plethora of data to help you choose the right person for you.

To give you an idea, you can filter your search for a Copy Trader by the following:

- A specific time period – covering from the last month to 2 years previous

- Trading performance – low, medium or high return

- Risk score between 1 and 10 – 10 is the highest risk

- AUM (Assets Under Management) – total cash equity

- Number of people copying the trader – Low: 5-100, Medium: 100-500, High: 500 or over

- Asset allocation – such as forex, commodities, crypto, stock, ETFs and more

- Weeks active – Low: 0-25, Medium: 25-50, High: 50 or over

As you can see, you will have plenty to choose from when deciding which investor to copy.

To clear the mist, let’s offer a practical example of how the Copy Trader feature works at eToro:

- Let’s say you have chosen a Copy Trader with a risk rating of 5 – who focuses on forex

- You invest $1,000 in this Copy Trader

- The Copy trader goes short on USD/TRY with 2% of their own funds

- Your own portfolio reflects this – showing that you have $20 allocated to the sell order on USD/TRY

- Next, the Copy Trader goes long on EUR/USD with 3% of their balance

- As such, you have $30 allocated to the EUR/USD buy order

- Later, the Copy Trader closes their USD/TRY position with a buy order and makes a 10% profit

- Again, your portfolio mirrors this trade in proportion to your investment

- You have made gains by going short on USD/TRY – without lifting a finger

Once you have chosen someone to copy, the Copy Trader feature allows you to trade forex 100% passively. If you like the idea of a fully managed portfolio – check out the CopyPortfolio tool at eToro. This enables you to copy several traders or markets at once.

Semi-Automated Forex Trading

Some people would rather have more of a say in where their trading funds will be allocated. One of the most popular ways to do this is to go with a semi-automated option of forex trading signals.

As we touched on in our broker reviews, forex trading signals are like tips. One of the most popular ways to receive these suggestions is by connecting your broker account to a third-party trading platform such as MT4/5, or via the free messaging app Telegram.

Let’s look at what’s included in a Learn 2 Trade forex signal with an example:

- Market: USD/JPY

- Order: Buy

- Limit Value: 109.70

- Stop-Loss Value: 108.60

- Take-Profit Value: 112.99

- Risk-Reward: 1:3

As you can see, we always incorporate an entry price for every signal, as well as a risk-reward ratio in the shape of stop-loss and take-profit orders. Our team of seasoned forex traders and analysts opt for quality over quantity with a risk to reward ratio of 1:3.

One of the major benefits of this way of automated forex trading is that there is no need to perform the in-depth technical analysis necessary to predict the currency markets! Signal providers like us do that part for you and simply send you the results.

You can either create an order with your broker by entering the key metrics included in the tip, or you can leave it and wait for the next. It’s always best to take the service for a test run yourself. As signals aren’t for everyone – we offer a 30-day money-back guarantee with all premium accounts.

Automated Forex Trading: EAs

We touched on forex EAs (Expert Advisors) throughout our broker reviews. Sometimes referred to as FX robots, or forex bots – this offers you a third automated trading option. The easiest way to deploy a bot to trade currencies on your behalf is by signing up with a trading platform that is compatible with MT4.

As we said, MT4 is a third-party trading platform that is packed with technical analysis tools, educational content, signals, and EAs. So how does a forex robot work? It’s actually best described as downloadable software that works on an algorithm. This is based upon predetermined market conditions installed in the file.

To clear the mist:

- Unlike human forex traders, a programmed EA system can scan the currency markets for trading opportunities 24/7

- This includes reading and processing technical data such as support/resistance indicators, trends, moving averages, and various price charts and timeframes.

The thing to remember is that forex EAs cannot recognize major news events that might seriously affect the currency markets. Furthermore, many can only execute forex orders on a specific pair, rather than being able to expose you to multiple currency markets. Finally, forex EAs do come at a cost, so make sure you can test the service before fully committing to the provider.

How to Select the Best Automated Forex Trading Platform?

You will need to ensure that your chosen broker can offer you the automated forex trading tool you want to access. Furthermore, do your homework and make sure the forex trading platform ticks the following important checklist boxes:

What Markets are Available?

Whilst it’s obvious that you want to trade currencies via the automated forex trading platform you choose – you would be wise to check how many FX pairs the provider offers.

For instance, you might find an easy-to-navigate platform with super low fees – but then learn it only offers major forex pairs. The trading signal, EA, or Copy Trader service you opt for will need to access a wide range of FX markets. This stops you from being overly exposed to just one or two core currencies.

Top-rated automated forex trading platform eToro has 4.5 million seasoned investors to choose from within its Copy Trader feature, and 49 popular currency pairs to boot. As such, you have access to the most diverse range of forex pairs – covering majors, minors, and exotics.

What Fees Will you be Liable for?

No two automated forex trading platforms are the same. As such, the fees you are expected to pay will vary from broker to broker.

To give you an indication of what you might be liable for, see below:

- Revenue Share Fees: This is a fee sometimes charged by automated forex trading platforms. You will pay a percentage of the gains you receive off the back of your Copy Trader investment. eToro does not charge this fee to copy an individual.

- Subscription Fees: If you decide to take the route of forex trading signals there will usually be a monthly subscription charge payable. At Learn 2 Trade we offer both free and premium forex trading signals with a 30-day moneyback guarantee.

- Commission/Trading Fees: Trading fees are not uncommon with online brokers. Some platforms charge a fee for both your entry into and exit from the currency markets – automated or not. This can eat away at your profits. All the automated forex trading platforms we reviewed in this guide offer commission-free automated trading.

- EA Software Fee: EAs don’t come for free, so the provider will generally expect you to pay a one-off charge to purchase the automated forex trading software. Some platforms also offer a money-back guarantee if you don’t like it.

With all of this in mind, make sure you know about any fees that might be expected of you. You should research this before diving in and signing up with an automated forex trading platform.

Can you Verify the Automated Forex Trading Platform’s Claims?

It’s important to perform some due diligence when electing to sign up with an automated forex trading platform. This will help you clarify whether the claims match the results. The most convenient ways to do this are via a free demo account or taking advantage of a money-back guarantee.

You can also research the relevant data yourself – to back up any claims made by the platform or Copy Trader. For instance, at eToro, you can access heaps of important information based on the seasoned investors’ performance.

Another way to check important data related to automated forex trading is to use the online social community platform MyFXBooks. The aforementioned site is partnered with over 100 online brokers. This enables traders to register and find heaps of performance-related information.

You can also analyze and verify your trading account using the many tools available – showing losses and gains, curves, and winning trades.

Is the Automated Forex Trading Platform Regulated?

Regulation is one of the most important things to think about when searching for a suitable automated forex trading platform. However, it’s important to note that EA and signal providers are not legally required to hold a license.

With that said, you can still start off on the right foot by only signing up with a regulated broker to facilitate your automated forex trading journey. Regulatory bodies impose many rules on financial service providers.

This includes keeping your money in a separate bank account to the company, following KYC procedures, anti-money laundering checks, submitting regular and detailed audits, and much more. eToro is regulated by the FCA, ASIC, and CySEC – which is why we think its Copy Trading tool is the best option in the market if you seek an automated forex strategy.

Can you Practice Automated Forex Trading for Free?

As we said earlier, a free demo account can be a good way to substantiate the automated forex trading platform’s claims. Not all providers are able to offer this facility so check before signing up.

eToro will give you a free demo account with $100,000 in paper funds to practice with. This means you can try out the Copy Trader feature to get to grips with how it works. You can also easily put trading signals to the test this way.

For instance, let’s say you sign up for our trading signals and have 30 days to request a refund – if you are not happy. You can head over to regulated broker eToro and place each order suggested by our signals into your demo account.

Then you tally up your gains and losses at the end and cancel your subscription if you aren’t happy. This is a tried and tested way to practice automated forex trading platforms for free without risking your capital. You can also try out EAs in demo mode at MT4.

Start Automated Forex Trading Today in 5 Steps

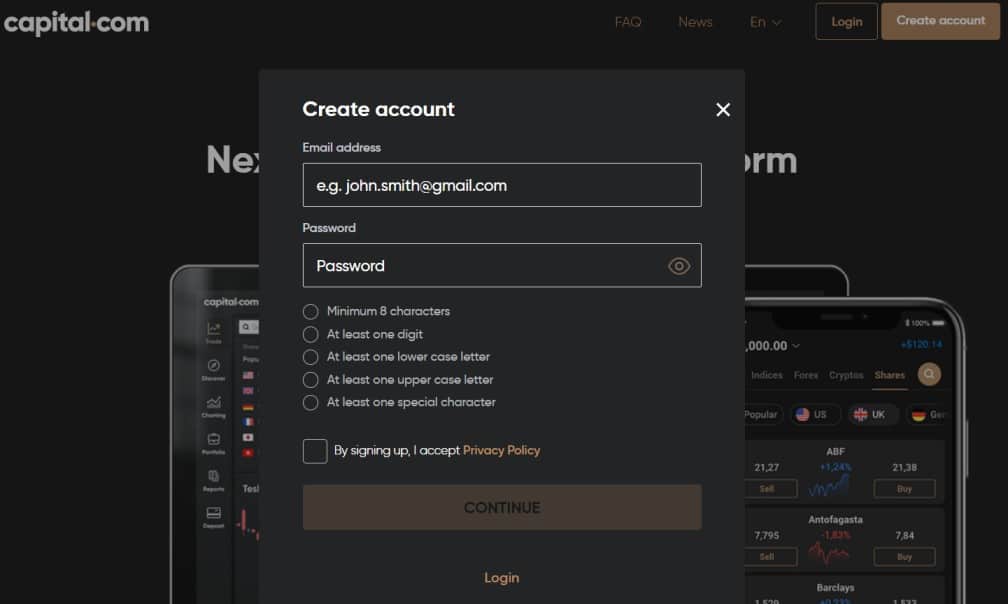

To get started with your automated forex trading adventures, you need to sign up with a trusted brokerage. For this walkthrough, we are going to use the best automated forex trading platform in the market – Capital.com.

Step 1: Sign up With an Automated Forex Trading Platform

The end-to-end sign-up at Capital.com takes less than 10 minutes. Head over to the official site and click ‘Create account’.

Enter some basic information about who you are, such as your full name, address, and date of birth.

Step 2: Upload ID

Capital.com is legally required to identify who you are, so you will need to upload a copy of your photo ID. This can be a passport or driving license. To validate your address, you can use an official letter dated within the last 3 months. This can be a bank statement or utility bill.

Step 3: Deposit Money into Your Account

You can now find your Capital.com account. Enter the amount you wish to deposit and select from the payment methods available.

Capital.com supports credit and debit cards, bank transfers, and e-wallets such as Skrill, PayPal, and Neteller. Please note, there is a 0.5% FX fee for non-USD deposits. However, this is countered by the fact Capital.com does not charge any trading commissions!

Step 4: Find Automated Forex Trading Feature

Head to your account and look for ‘Copy People’. You can do this via your ‘Real’ or ‘Virtual’ Portfolio.

Next, as we talked about earlier, you can filter the results to suit your personal preferences. For example, if you are looking for an expert forex trader with a risk rating of less than 3/10 – reflect this in your search parameters.

Step 5: Begin Automated Forex Trading

Review all the key data in front of you, and then click ‘Copy’ to begin your investment in a Copy Trader.

Note that if you want to just copy all future trades and not the individual’s current portfolio – make sure you un-check ‘Copy Open Trades’. Otherwise, you will also mirror all existing positions. The choice is yours.

Next, enter the amount you wish to invest and click ‘Copy’ again to confirm your investment!

Best Automated Forex Trading Platforms: The Bottom Line

It’s well known how important technical and fundamental analysis is when forex trading. Without it, we may as well throw a dice. The best automated forex trading platforms offer a safe and passive way to trade currencies and are suited for people of all levels of experience.

After much research, we found that the best automated forex trading platform is Capital.com. Regulated by the FCA, ASIC, CySEC, and NBRB this top-rated broker offers an automated feature called Copy Trader. You will have thousands of expert forex traders to choose from and won’t pay a single cent in commission or fees!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts