Whether it’s Canada’s position as the fourth-largest oil exporter in the world, or Australia’s major gold, iron, and coal production – being aware of the correlation between a country’s resources and forex markets can help you greatly when trading currencies.

In part 7 of this beginner’s forex course, we talk about trading two major commodities – oil and gold.

We start by delving into the basics such as commodity categories, before moving onto the correlation between oil, gold, and currencies. Additionally, we cover various other relevant markets and offer a few tips and examples along the way.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

Trading Commodities: Oil & Gold – The Basics

In part 6 of this course ‘Major and Minor Pairs: What to Look Out for‘, we touched on the subject of commodity currencies. We briefly explained that exporting economies, such as Australia, are heavily correlated with commodity prices – and vice versa.

We have used gold as both a currency and a commodity for many years, and along with oil, it is one of the most valuable in the world. As such, both are now used as strategic forex trading vehicles.

Getting to Grips with Commodity Types: Hard vs Soft

As is the case with currency pairs, we split commodities into different categories. This can be a broad spectrum, for instance – energies, metals, meat, agriculture, and livestock.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

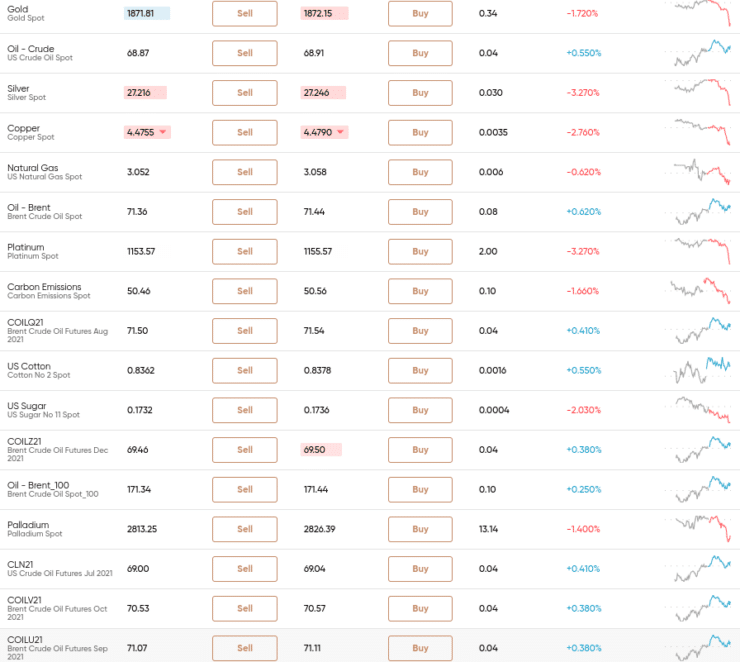

However, today we are going to break this down into ‘hard’ and ‘soft’ commodities. See below for an idea of which products fall into each category.

Hard Commodities

A hard commodity is usually described as a product that must be extracted from unprocessed material, or mined from the ground. Historically, this category is affected more by geopolitical tensions and access to resources.

To give you a clearer idea, you will see some of the most traded hard commodities listed below:

- Brent crude oil

- WTI crude oil

- Gold

- Silver

- Copper

- Palladium

- Iron

- Aluminium

- Steel

- Zinc

- Nickel

Interestingly, although oil and gold are more commonly traded – copper is often used as a barometer of the economic environment in question.

In fact, many traders refer to this commodity as ‘Dr Copper’. This is because it is a metal used in the commercial construction and house building industries. As such, it makes sense that this asset can give us a clue about how strong a particular economy is. If the demand is low, the chances are the market is not as strong as it was.

If copper, oil, gold, or any other commodity is falling in value or demand – this can and will have a knock-on effect on the forex markets. We talk about this in more detail throughout.

Soft Commodities

Soft commodities make up some of the oldest traded goods in the world. This category is one that has been farmed or grown. Furthermore, these are usually raw products – used for making textiles and food.

See below some of the most popular soft commodities to trade:

- Corn

- Milk

- Soybeans

- Cocoa/Cocoa beans

- Wheat

- Coffee

- Sugar

- Cotton

- Pork

As you can see, soft commodities are mainly made up of agricultural products and food. There is a monthly report made public every month called ‘World Agriculture Supply Demand Estimate (WASDE)’.

The US Department of Agriculture releases this report – which quite literally shows us the bigger picture on the demand and supply of soft commodities. As USD is the world’s reserve currency – this is something to keep an eye on in the context of forex trading.

The Correlation of Oil and Forex

Known as ‘black gold’ – oil is one of the most in-demand commodities on the planet. It’s used to make plastics, lubricants, diesel, petrol, and more. As we’ve said, you can use this valuable metal as a forex trading vehicle! The fact is that when you are performing analysis – there is more than just currencies to think about.

These areas, amongst others, mine and export this precious commodity to the rest of the world. As such, price action on either oil or an oil-rich market can have a positive or negative impact on the price of the country’s currency.

For example, it’s commonly believed that the oil surge in 2007 and 2008 was partly a result of a rise in world income rates. On the other hand, the following financial crisis had a domino effect on the value of oil – causing it to collapse.

The US Dollar (USD) and Oil

The connection between US dollars and oil is a fairly simple one to explain. This is because when people trade barrels of oil, no matter where it happens in the world, the contract is always quoted in US dollars.

This means that every single up or downtick in oil will trigger a market realignment on US dollars. This will also affect a range of forex cross pairs, or minors. We talked about the matter of forex pairs in part 6 if you need a recap.

- Historically, when the US dollar appreciates – the global demand for oil falls

- Ergo, if the US dollar weakens – the price of oil rises

- This means the two have a strong negative correlation

Fundamental analysis is key when it comes to being aware of this information as and when it happens. We covered this in part 5 of this course – ‘What is Fundamental Analysis?‘.

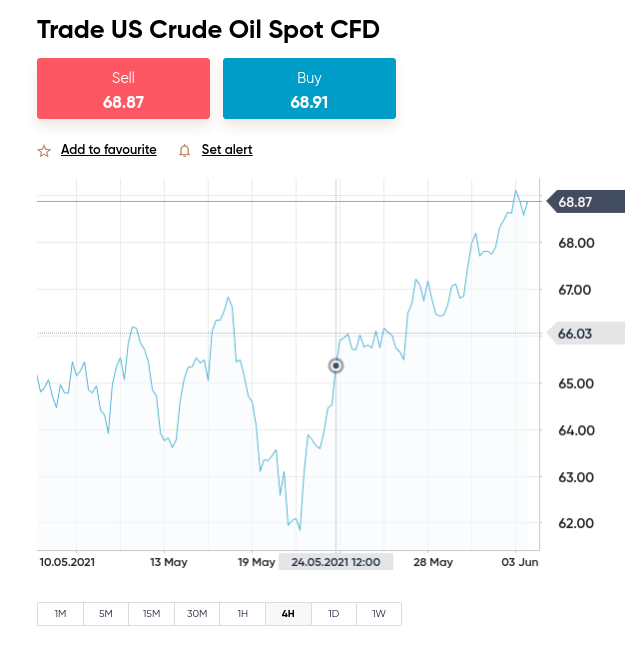

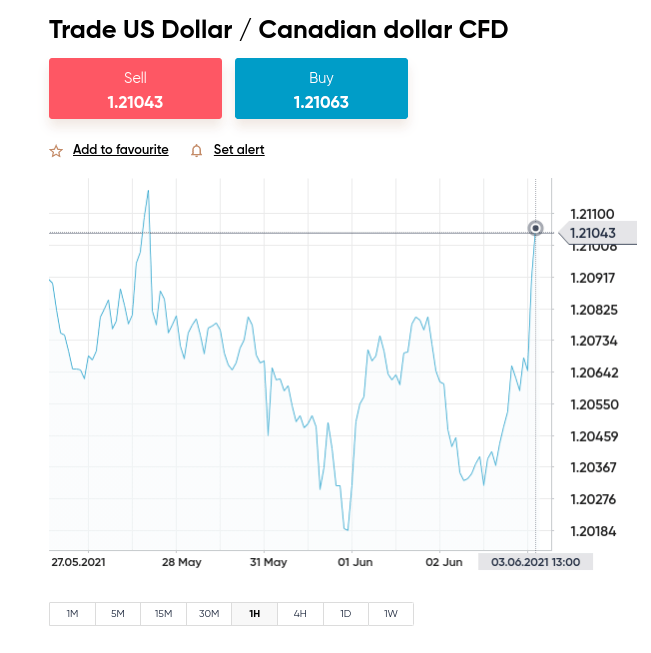

The Canadian Dollar (CAD) and Oil

The Canadian dollar and oil are well connected. In fact, the country is a net oil exporter. For those unaware, this means it exports more than it brings in due to its abundance of natural resources. This country collects the majority of its US dollars via the sale of oil.

- Forex pair USD/CAD has a negative correlation with oil.

- The CAD/USD is positively correlated with oil.

On a side note, because Japan is heavily reliant on oil imports – the pair CAD/JPY (Canadian dollars/Japanese yen) has a positive correlation with this commodity.

The general pattern goes – when oil prices rise, more JPY is sold in exchange for Canadian dollars. As such, when oil is on the rise, the chances are the pair CAD/JPY will too. The Japanese yen is highly sensitive to fluctuations in commodity prices.

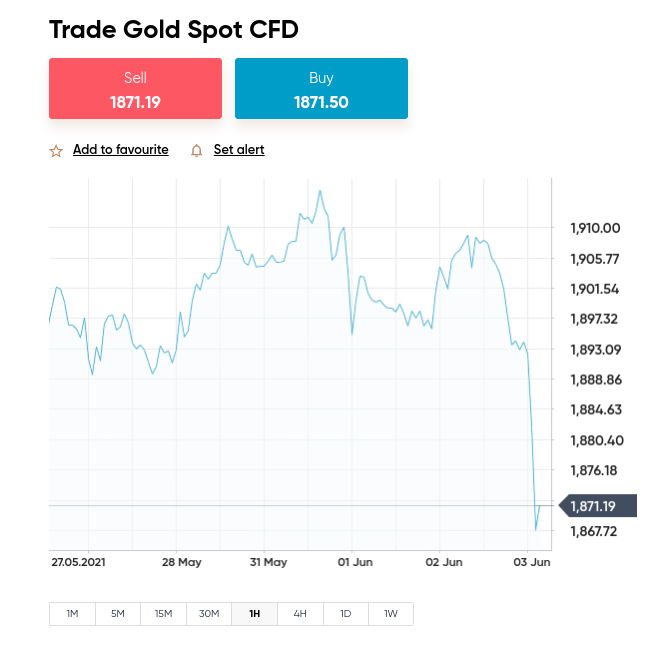

The Correlation of Gold and Forex

People have used gold as a store of value for thousands of years. This is largely because it doesn’t deteriorate over time and is such a malleable and attractive metal.

Although this valuable commodity is not used as a currency in developed economies these days – it is still one of the most traded assets globally. All gold bought and sold globally is denominated in US dollars, apart from on rare occasions.

Central banks such as the E.C.B (Eurozone) and the Federal Reserve (US) store vast amounts of gold in reserve. The former has been known to launch its gold reserves into the market, in an attempt to plateau the euro against the US dollar

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

See below some key facts about the inverse relationship between gold and the US dollar:

- Traditionally, traders use gold to hedge against US dollar weakness

- This is because if the price of gold increases, the US dollar usually decreases

- As such, if gold falls in value – the US dollar is usually on the up

- Traders are also able to check the price fluctuations of gold against the dollar by tracking the pair XAU/USD (gold/US dollars)

This also has a strong influence on the value of forex markets, whether that’s just the country supplying it, or on negative/positive correlating currencies. This makes gold an important market indicator for various pairs.

Why does this matter to you as a forex trader? Let’s say you are trading British pounds, but it’s facing devaluation thanks to a recent trade deficit. You might counteract this with a rising commodity such as gold.

As such, if gold was falling, you may look to a negatively correlated currency pair to hedge against this. Australian and Canadian dollars, on the other hand, have a positive correlation with gold. We talk about that next.

The Australian Dollar (AUD) and Gold

Back over to Australia – this country is a relatively large gold exporter. As such, its value is heavily influenced by domestic production.

Major pair AUD/USD has a positive correlation with gold – a relationship which historically has been at around 80%.

This means:

- When the price of gold falls – it’s likely AUD/USD will too

- As such, if gold is on the rise – this pair will probably face a decline

This kind of insight is priceless when trading currencies, as the correlation level will depend on various factors. As we mentioned in part 6, you can check this information using a correlation indicator, which can be found online.

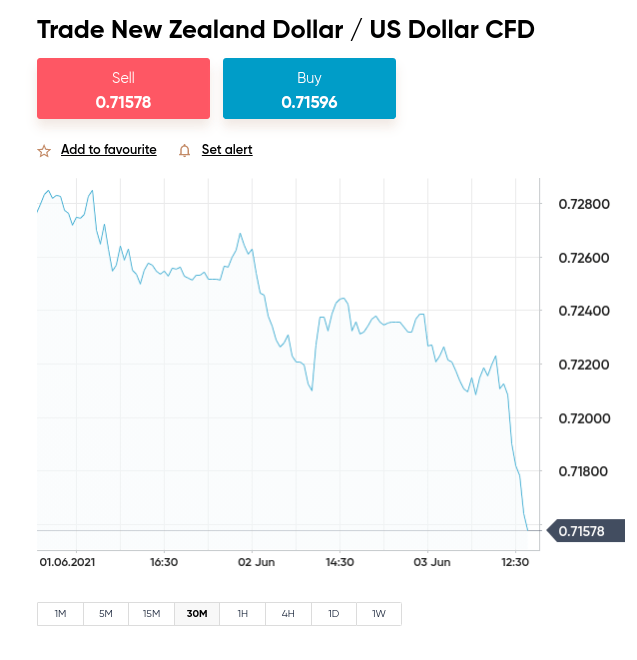

The New Zealand Dollar (NZD) and Gold

New Zealand and Australia are closely connected as neighbours and as such – trading partners. As such, it’s probably no surprise that the health of NZD can be measured to a certain extent by AUD.

- If Australia’s economy experiences highs and lows – New Zealand usually feels the impact of this

- As such, if Australia’s relationship with the US or its production of gold changes – both NZD/USD and AUD/USD will be susceptible to fluctuations in price

Again, although gold and currency relationships can alter over time. Knowing which countries import and export certain goods can put you in good stead for offsetting your risk. It’s always wise to conduct plenty of analysis before assuming that currencies or commodities are still correlated.

To do this, you can study the rate between the importer and exporter in question, to help you gain an understanding of its correlation with the commodity in question. This can be achieved by using the aforementioned indicator, covering your chosen timeframe.

The period you choose will depend on your trading strategy. You might wish to profit from the small fluctuations of two highly correlated assets. If this is the case, keep an eye on the level of correlation. If it is getting weaker, the chances are it may be deteriorating and no longer of any use to you.

The Swiss Franc (CHF) and Gold

As we mentioned in part 6 of this course, safe haven currencies are the ones traders flock to in times of uncertainty. This includes the Swiss franc, US dollar, and Japanese yen.

Over in Switzerland, trading USD/CHF is a common way to offset the rising or falling gold market. This is because the two have an inverse relationship – otherwise called a negative correlation.

To further clarify:

- If the value of gold falls – USD/CHF is likely to increase in price

- If gold increases – USD/CHF will probably face a decline in value

A large portion of the country’s economic strength is backed by its huge gold reserves, which is why the Swiss franc moves with and not against gold. Although there are never any guarantees when trading, you can use a currency’s historical behaviour to your advantage in future positions.

Less Liquid Trading Commodity Economies

We have talked about the most liquid commodity currencies, so now we are going to divulge some of the lesser traded exotic economies.

The Brazilian Real (BRL)

Brazil is a country rich in natural resources, in terms of commodities. As such, the price of this asset class will make a difference to the market value of the Brazilian real.

See another example of how commodities and currencies correlate:

- During the bull market in 2002 – the Brazilian real experienced a sharp rise in value

- This price went on to double in the six years that followed

- Everything slowed down for this currency during the global financial crisis of 2008

- However, after another bullish period in the commodities sector in 2011 – the market hit new highs

Since this time, the Brazilian real has sharply fallen in value once more. With that said, the aforementioned example should illustrate just how important it is to be aware of the connection between forex and specific commodity markets! .

Aside from China and Australia, Brazil is the third-biggest producer of bauxite. For those unaware, this is a sedimentary rock with high levels of aluminium – making Brazil one of the biggest producers of this commodity. This country also produces iron ore (used to manufacture steel) and crude oil.

Brazil is also one of the world’s leading producers and exporters of sugar cane, coffee beans, and soybeans. As these are agricultural commodities – even news of severe weather conditions can affect the value of relevant currencies and products.

For instance, in 2014, Brazil experienced the worst drought in a century, with well over 50% of the country affected. What happened next? The price of coffee increased two-fold. Two years later, BRL faced a loss of value against the USD totalling 38%.

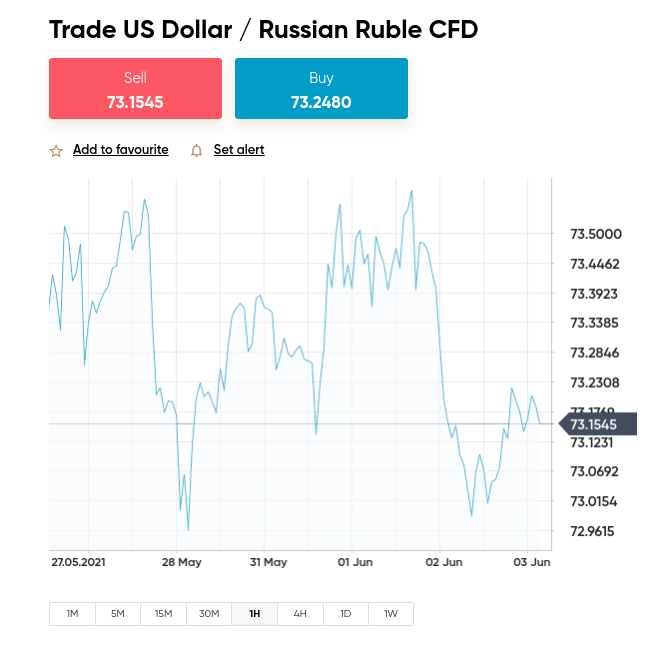

The Russian Ruble (RUB)

Another currency that is sensitive to changes in commodities is the Russian ruble. The country is not nearly as diversified as say Australia, Canada, or Brazil – as 50% of Russia’s exports are oil and gas.

Crucially, the Russian ruble has a positive correlation with oil. In 2014, the price of crude oil fell rapidly – and so the Russian ruble followed suit

With that said, other factors do come into play, such as policy uncertainty, and risk-factor. The risk of volatility is still considered to be high with this market. Ergo, if oil prices soar, it doesn’t necessarily mean that the ruble will too.

The Saudi Riyal (SAR)

Saudi Arabia’s oil reserves are said to be the second-largest globally. The industry is under the control of Saudi Aramco – which is now a publicly traded stock. Importantly, the country’s currency – the Saudi riyal (SAR), is pegged to the US dollar.

For those unaware, when a market is ‘pegged’ to the US dollar, this means that the central bank of the country in question keeps its currency exchange rate fixed. In other words, as US dollars rise and fall in value, as will the Saudi riyal – so this is valuable information.

The Saudi riyal was pegged to the US dollar back in the 1970s when the world saw its first major oil crisis. This saw Saudi Arabia enforcing an oil embargo on the US. Months later, the commodity was still priced highly, which put pressure on US finances externally.

As such, a deal was struck, ensuring that proceeds of oil purchases by the US would be used for investment purposes. This meant the Saudi government had to put that money back into US treasuries.

Let’s take a look at how the Saudi riyal can be affected by US interest rates:

- In 2007, following the great recession, the U.S. Federal Reserve decided to cut interest rates

- Through fear of hyperinflation, the Saudi Central Bank decided not to follow suit

- The Saudi riyal temporarily increased to its highest value in 20 years

- This currency has since returned back to its pegged rate against the US dollar

- 1 U.S. Dollar equals 3.75 Saudi Arabian riyals

Now, let’s see what effect oil has on the Saudi riyal:

- A few years ago, Saudi Arabia took part in a price war over oil

- This led to Saudi Aramco increasing the country’s production rate of oil to record highs to maintain dominance in the market

- This led to the price of oil falling

As is clear, price action in either oil or the US dollar will affect this commodity currency – either negatively or positively. This can be caused by anything from the distribution of resources, political uncertainty, or even market psychology. We talk about the latter in part 10 of this course.

The Venezuela Bolivar (VEF)

Venezuela used to be known as a ‘petrostate’, meaning it was home to one of the world’s biggest oil reserves and heavily relied on money made from its export. Corruption, minority elitism, and weak political institutions are often associated with petrostates. Needless to say, this country has rapidly moved into economic decline and fallen victim to hyperinflation.

Following the decision for the country’s president to widen his grip of power, Venezuela’s political regime has led many countries to sanction the South American nation. One of the most publicized sanctions is that of the US – whereby a freeze on transactions and a ban on government assets within the US were enforced.

Other emerging commodity currencies include the Peruvian sol (PEN) – which relies heavily on copper exports. Then there is the Columbian peso (COP). This economy is positively correlated with the oil markets on a global scale. As such, if you were to trade USD/PEN or USD/COP – any change in the value of oil will be of interest to you. If oil falls in value, these pairs are also likely to decline.

The South African Rand (ZAR)

Whilst not officially a commodity currency – the South African rand is strongly connected to commodities. The country produces platinum, iron ore, diamonds, and gold – thus, commodity exports play a huge role in the health of its economy.

We mentioned that not all correlations remain the same. USD/ZAR has regularly displayed a positive correlation with price trends of gold historically. However, in the time covering 2011 to around 2016, the price of the bullion declined. In contrast, during this time, the South African rand rallied.

These days, this currency is still connected to gold, due to its reliance on exportation. With that said, ever since the 1960s – global uncertainty, economic fragility, and an unsteady political environment have caused the South African rand to depreciate significantly.

Trading Commodities: Oil and Gold – Timing it Correctly

When you are performing technical and fundamental analysis on your chosen forex pair, the whole point is to think about the best way to catch profits from it’s price spikes.

Consider this checklist when planning your forex market entry or exit point:

- Is the currency you want to trade and the respective commodity still correlated? If so, for what length of time?

- Is the correlation negative or positive?

- Are there divergences? You can use this to take the position in the direction of a trend, trading with the currency, commodity – or both

When you enter or exit a position for potential gains – it is all about timing and marrying that with your strategy. For instance, if you are chasing sharp price spikes – the best time to trade gold is between the hours of 7 am and 5 pm GMT. On the other hand, the most liquid time for oil is from 1 pm to 6.30 pm.

Trading Commodities: Oil and Gold – How to Trade

If you are looking to hedge against the market’s anticipated depreciation of the US dollar – you might decide to take advantage of its negative correlation with gold. Of course, this is just one example of hedging.

If you wish to trade either gold or oil at your chosen brokerage:

- Search for ‘gold’ or ‘oil’ – click trade to place an order on your desired type

- Decide whether to go long with a buy order, or short with a sell order – depending on your own analysis

- Apply leverage if desired and decide how much you wish to stake on your prediction

- Confirm your order and watch the markets

We talked about orders in part 3 and the same principle applies to both currencies and commodities. As we’ve said, depending on the forex pair, this could see you going long on one asset class and short on the other. This will help you to manage your risk exposure.

Trading Commodities: Oil and Gold – Full Conclusion

By the end of part 7 of this course, you will be all too aware that a positive or negative correlation between commodity currencies is not a permanent relationship and will vary depending on various other factors.

With that said – having your eyes open to the relationship between forex and commodities – and vice versa is extremely valuable. For instance, when the value of oil takes a turn for the worst, the nations that rely on exporting this asset will usually see a decline in the value of their own currency.

This is something you can use to your advantage if you also add technical and fundamental analysis to your trading strategy. Traditionally, gold has been used to hedge against US inflation. You can also hedge two forex markets with a negative correlation. For instance, placing a sell order on USD/CHF and a buy on EUR/USD.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99