Results

Amount at Risk

0Position Size (units)

0Standard Lots

0Mini Lots

0Micro Lots

0

These days, calculating your desired position size in the currency markets doesn’t have to be a headache!

Based on information such as your thirst for risk, chosen forex market, and stop-loss percentage – our position size calculator will do it all for you!

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

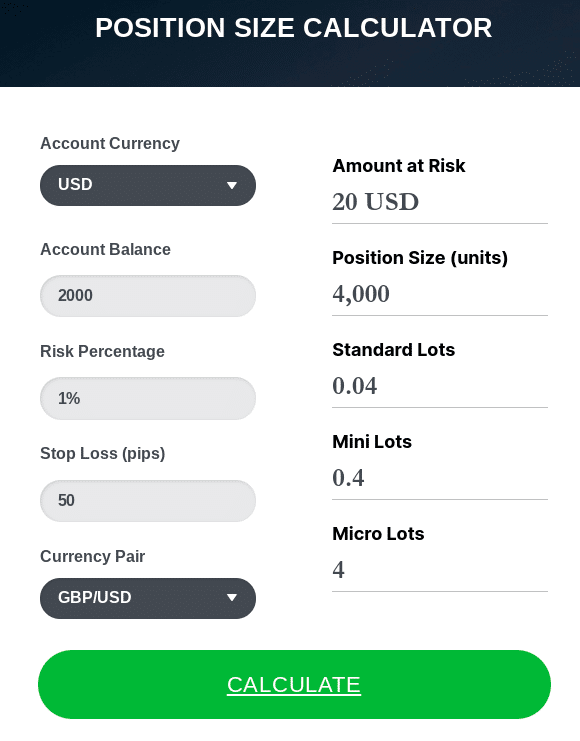

How to Use the Position Size Calculator: 6 Simple Steps

So, see below a quick-fire guide of how to use the Learn 2 Trade position size calculator. This will help you to meticulously plan your next entry into the forex markets!

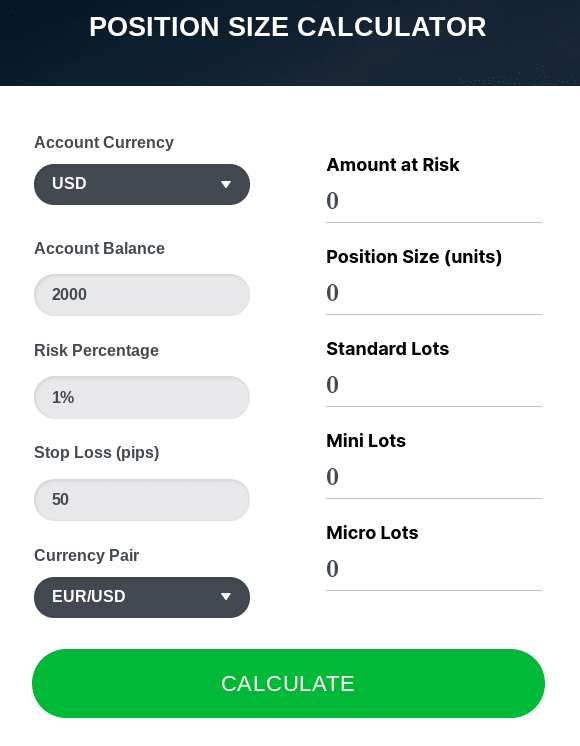

Step 1: Select Account Currency

The first thing to do is enter the currency that your account is denominated. Here we are using a USD trading account.

Step 2: Enter Account Balance

Then, input the balance amount in the relevant box – this means how much money you currently have in your trading account.

Step 3: Enter Risk Percentage

Think about how much of your initial stake you are willing to risk on the currency trade.

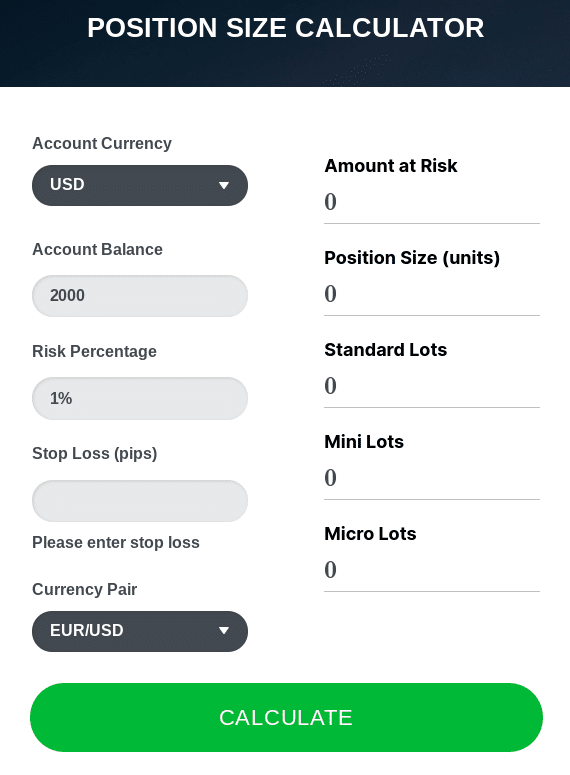

Step 4: Enter Stop-Loss

We want to set our stop-loss to 50 pips, as you can see below.

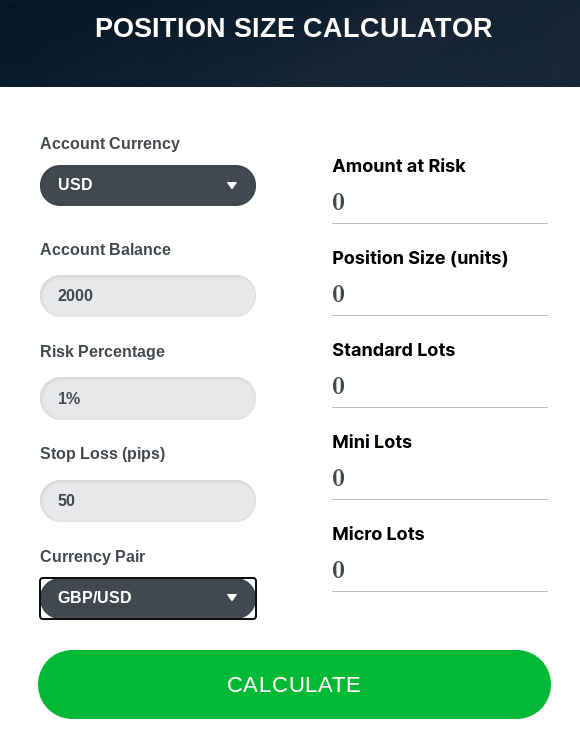

Step 5: Select Your Chosen FX Pair

Here, we are trading GBP against USD, so have selected this pair from the long list available.

Step 6: Calculate Your Position Size

As you can see, it really couldn’t be easier to work out your position size when using this calculator.

After clicking ‘Calculate’ you will see a proportionate trade size worked out for you, to make your trading decisions stress-free.