Our emotions are powerful things – in life, and especially in trading. They can push us to make problem-solving decisions – or can cloud our judgment and lead us to make irrational choices.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

With this in mind, part 10 of this forex beginners course uncovers the mystery of trading psychology.

We talk about what trading psychology is, what emotions this includes, and some tips on how to use and control them when trading currencies from home.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

Trading Psychology – What Does it Mean?

The term trading psychology broadly refers to the emotional roller coaster experienced by people when buying and selling currencies. In other words, we are talking about your mindset and how that might affect you when forced to make choices on market sentiment and such.

This psychology can be a huge obstacle, especially to newbie traders, so understanding the difference between good and bad trading emotions is massively important. Having a bad experience or a huge loss can put some people off the marketplace for life.

This is just one of the reasons – as well as the basics like order types, fundamental and technical analysis – so it is crucial you understand how to handle your emotions. Acknowledging this might influence your decision-making process and will help you to recognize and control it – as it happens in real-time.

Trading Psychology Basics – Fear and Greed

This specific genre of trading psychology refers to two core emotions – ‘fear’ and ‘greed’. Whilst ‘hope’ can also be classed as a trading sentiment, today we focus on the two most debilitating of the trio.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

See below some examples of fear and greed – in the context of forex trading. This will give you an idea of when you might be experiencing these emotions – giving you a chance to rectify or keep an eye on things.

Symptoms of Forex Trading Greed

See below some of the main symptoms of forex trading greed.

This will help you keep a lid on the negative side of this trading emotion.

- A major symptom of greed to look out for is the temptation to apply too much leverage to your trade, without considering the consequences.

- Neglecting to stick to your forex trading plan to subsequently chase a supposed ‘safe venture’ could be a sign you are giving way to greed.

- You might ignore your risk/reward strategy and forget the importance of stop-loss and limits.

- A few good trades can fool you into a false sense of security, perhaps making you feel like you’ve nailed the market and are guaranteed success. The reality is it was probably a combination of focussed market analysis – and a bit of luck.

It is important to note that fear, hope, and greed for that matter aren’t always a hindrance. The latter can be seen as having an appetite for success, especially to begin with.

The problems start when you realize pure greed is driving your decisions and leading to you go off-plan and into irrational territory.

Symptoms of Forex Trading Fear

Next, let’s take a look at another common emotion experienced by currency traders – fear.

See below some of the telltale signs of a trader overcome with fear when buying and selling currencies:

- Fear can lead us to make rash decisions – cashing out on a position too early and missing out on some great gains.

- Some traders are so gripped with fear that they close a position before the stop-loss point has been reached. If you are realistic with your stop-loss and take-profit value, there should never be any need to close your position before they are actioned – as it defeats the point.

- You might also find that you are so fearful about missing out on the highest profit possible – that you hold on too long and miss your moment.

- Analysis paralysis is a real thing. Fear can lead even experienced traders to be too afraid to act on potentially profitable analysis after a bad run in this volatile marketplace.

The key is keeping negative trading emotions under wraps and understanding the difference between a healthy appetite for risk – and throwing everything you’ve learned out of the window for nothing. Next, we offer a handful of highly practical tips to guide you.

Trading Psychology: Practical Tips

When you are learning the ins and outs of the forex trading space, you will soon see that everyone has advice to dish out. The best thing to do is think only about yourself. After all, no one knows you better than you.

In other words, what works for one trader won’t necessarily feel comfortable for you. The easiest way to find your own path is to take it all in and think about what might work for you and your own personal goals.

Knowledge is power in trading. As such, you will see some practical tips surrounding trading psychology below.

Tip 1: Stick to Your Forex Trading Strategy

Trading psychology 101 is – never go off course once you have a trading system in place! We talked about trading strategies in part 9 of this course. As such, you no doubt have an idea of which plan might be most suited to your goals.

To refresh your mind, this could include:

- Bankroll Management: Whereby you only allocate a specific percentage of your trading capital – no matter how tempting the potential profits may seem.

- Risk Management: A huge part of this system is deciding on a risk/reward ratio you feel comfortable with and sticking to it. You should also include a stop-loss order – every single time.

- Scalp or Swing Trade: How much spare time do you have to dedicate to trading currencies? See part 9 for a recap on both scalping and swinging.

- Hands-Off Trading: The most popular ways to trade semi- passively are via forex signals, and copy or mirror trading. For anyone in need of a reminder – we talk about this in part 1 ‘Why Should You Trade Forex‘.

- Test Your Strategies For Free: As we mentioned, this can be done via a broker that offers a forex simulator.

Whatever forex strategy you decide on – you will be more successful at controlling your trading emotions if you create a plan that works for your goals. Don’t veer away from that system, no matter what!

Tip 2: Always Perform the Relevant Market Analysis

It’s no good jumping on the band waggon and trading a market you aren’t interested in, just because everyone else seems to be doing so. For instance, let’s say you have decided to stick to major and minor pairs for now – until you learn the ins and outs of forex trading.

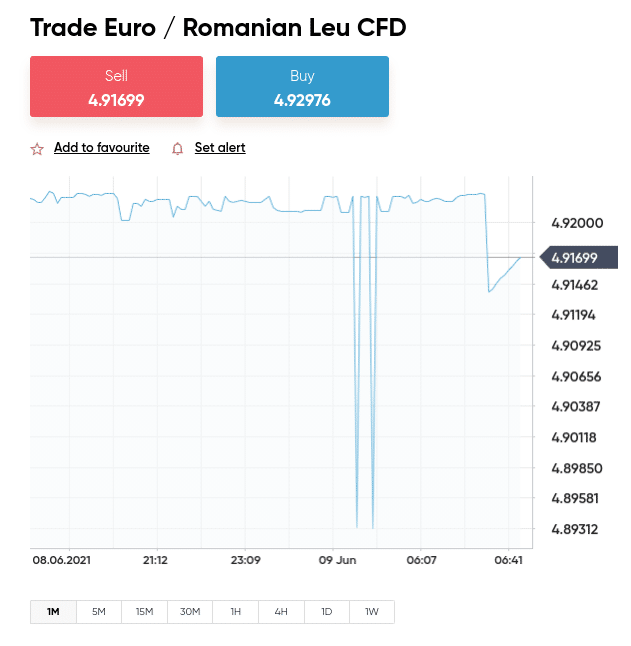

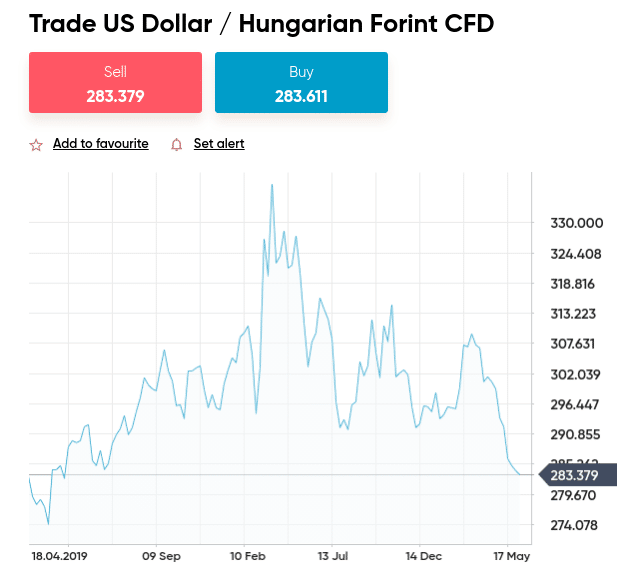

As such, you should only be looking at charts and indicators surrounding this category – or correlated markets. You could see people placing orders in their droves and consider trading an exotic currency pair like the below chart on EUR/RON.

Following the crowd might seem like a good idea at the time. However, without understanding the history of this politically volatile currency – you could find yourself out of your depth.

A perfect example of this would be in February 2020. The government at that time in Romania was the National Liberal Party, fronted by controversial leader Ludovic Orban. This party fell out of office after a dramatic vote of no confidence. In light of such uncertainty, this led to the country’s native currency (the leu) experiencing its lowest ever valuation.

Had your strategy involved viewing technical and fundamental analysis on exotics such as this – key macro-economic indicators would have drawn your attention to this. In other words – if your system entails concentrating on major and minor pairs – stick to that.

If you feel you might want to dip your toe into the world of emerging market trading – concentrate on that specifically. It’s better to be the master of a small number of markets than try to take on everything at once – especially for newbies.

Tip 3: Make Use of Your Bankroll Management Knowledge

We talked about bankroll and risk management in part 9 of this course – ‘Trading Strategies and How to Use Them‘. This is a vital part of not succumbing to the detrimental side of trading psychology. As such, we will briefly recap on this subject, explaining why it is still relevant in part 10.

As we’ve said, trading emotions can get the better of us and lead us to make rash decisions – like blowing the contents of our trading account on a ‘sure thing’. One of the best ways to avoid negative greed is to stick with the aforementioned tailormade bankroll management strategy you created yourself.

Whilst this can be reviewed at times – it shouldn’t be a rash and in-the-moment thought process when adjustments are made. Your bankroll management might include controlling how much you are willing to allocate to each position, as we talk about this in tip 6 shortly. As well as stop-loss orders to control risk – you might also set a monthly limit of loss.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

This means you might set your loss limit to say 5% of your portfolio – over the month. When your account equity falls to 5% less than it was at the previous month – you will have a break from trading and not place any further orders until the following 4 week period begins.

Tip 4: Utilize Automatic Trading Orders

We discussed orders in part 3 of this beginner’s course – ‘Forex Trading Basics: Pips, Lots and Orders‘. With that said, you can use some of these orders to ensure you enter and exit a trade without needing to worry about trading emotions!

You are probably wondering how this correlates with psychology? As we said in part 3 – stop-loss orders prevent your losses from going further than you can afford. Whereas take-profit orders lock in your profits from a trade – without the need for you to research and time the market.

This is because these orders are automatic. Meaning, when the price specified by you has been reached – the trading platform will automatically close this position. As such, there should be no sign of fear. Your decision was made at the time of placing your order – and you know you will not lose more than the amount specified at that time.

Tip 5: Keep a Forex Trading Journal

Keeping a journal is a free forex trading system to keep a running commentary on your endeavors. This will include what strategies you are using, which markets you are trading, and everything in between.

See below for an idea of what you might include in your forex trading journal:

- Before each position you take – make a note of your feelings toward the choices you have made.

- You should also explain to your future self how you reached that conclusion. For instance, you might have been alerted to a major change in inflation and reacted to that information – write that down.

- You should also note any technical indicators and charts you used to predict the market – as well as all timeframes viewed and any noteworthy price action on the pair.

- Write down every single detail of the order you place. This should include the date, time, pair, entry position size, which order was used to open the trade, stop-loss, take-profit, and leverage.

- Include any economic changes or market tendencies you notice.

- Jot down the date and time the trade was closed, as well as any profits or losses.

- If you close too early and that turns out to be a mistake – make a note of the circumstances surrounding your decision, and what you might have done differently.

- Alternatively, if you think you may have held onto your position for too long and missed the mark – make a log of what happened before, during, and after you exited the market.

Hindsight usually means we now understand what we weren’t able to see at the time. This is made so much easier when keeping a journal as it’s all there in black and white to review. As such, it can prevent us from making the same error of judgment time and time again.

It might be that you read your diary and realize you keep letting fear get the better of you and closing too early. You might notice greed is leading you to keep a position open for too long. When trading forex, the historic price information can tell us heaps about what might happen in the future.

As such, the past actions noted in your diary can teach you a great deal too. When logging your trading activity, you will notice that some events or details that seemed insignificant at the time, will in fact aid you in evaluating your decisions objectively in the future.

Tip 6: Mitigate Risk to Control Trading Fear

Spotting noteworthy daily price action data and world events when currency trading can induce fear in the best of us. This is usually a result of anxiety surrounding when the best time to enter or exit a trade might be – given the most recent developments.

This is especially the case for beginners! With this in mind, you can look back at some of the takeaways offered during this course. One of the main ways to mitigate risk and keep fear under control is to take your preconceived idea of your risk level – and split it in half.

For instance, let’s say you have decided you can handle risking 2% on each trade. If you are still feeling out of your depth, perhaps in the early stages of trading you might look to knock your position allocation down to 1% or even 0.5%. Of course, this can be easily readjusted when you feel more confident in your decisions.

Last but by no means least, you can lessen the trading psychology emotion of fear by taking a break when you feel like you are on a losing streak. If you don’t want to stay out of the game for too long – you could think about cutting your position size even further. Increasing again when you feel more self-assured.

Tip 7: Be Pragmatic With Trading Expectations

It’s absolutely crucial that you begin your forex trading experience by learning to be pragmatic with your expectations. The chances are that on your journey as a newbie you have seen numerous trading platforms promising wealth. This usually includes promises of being able to quit your day job and make a living as a currency trader full time.

The truth is, there are no guarantees. As such, these promises are almost certainly unfounded. Knowing this is going to help you reign in those trading emotions we talked about. It’s unhealthy to hold such high expectations of trading in a market that can be so volatile and unpredictable. Even the most seasoned pros experience their fair share of losing trades. The point is you must learn from them.

So, instead of pinning your hopes on making a profit from every position and feeling like a failure when you don’t – consider preparing yourself for the reality of a loss. We have talked about the many ways you can do this throughout this beginners forex course. This can include the aforementioned stop-loss and take-profit orders – or as we stated in tip 3 – start with small stakes whilst honing in on your timing skills.

Tip 8: How Trading Psychology Manifests Itself on Charts

We have talked about the importance of charts throughout parts 4, 5, and 8. In the final leg of this beginners forex course – let’s talk about how trading psychology manifests itself in the patterns and charts used in technical analysis.

Trading psychology shows itself as support and resistance, as well as momentum and volume.

For instance:

- Let’s say that there are more bulls than there are bears – you will know this because the resistance will break.

- In contrast, if this bounces – it’s likely that bears are outnumbering bulls.

- If you see a steady support level – decreases in value were likely a knock-on effect of widespread profit-taking.

- If the support level breaks – this shows us that long traders are beginning to cash out, and short-sellers are beginning to saturate the market.

Volume, momentum, and oscillating trend focussed indicators will be helpful in gauging the general mood of the market towards a pair – especially when you see divergences. We talked about indicators and all forms of technical analysis in part 4 of this course if you need a recap.

Tip 9: Build on Your Forex Trading Experience

Building on your forex experience will afford you the confidence to know the difference between positive trading emotions and negative. There are options with how you go about this.

If you feel confident enough to hit the currency markets but are nervous about your understanding of the analysis you carried out – you might start with smaller stakes. This way you are able to lessen the financial blow if you haven’t quite got it right this time.

Another avenue to explore is to build on your forex trading experience by placing orders on a free demo account. This way you are able to test your knowledge and skills in a completely risk-averse manner.

Why? Because, instead of using your own capital – you will allocate paper trading funds to the position. We talked about this strategy in part 9 of this course. This means you are able to build on your experience and learn from mistakes without financial concern – you could even build this into your strategy!

Trading Psychology: Full Conclusion

Having reached part 10 of this course – you will hopefully have a much clearer understanding of forex trading basics such as pips, lots, orders, and pairs. We have also covered leverage, margin, technical and fundamental analysis, and charting in great detail.

By this stage, you should be all too familiar with the many strategies used by forex traders to keep them on the straight and narrow. When it comes to trading psychology particularly, you can keep your emotions in check by being strict with the rules you impose on yourself. This includes not giving in to the temptation greed might encourage.

A great way to avoid entering or exiting the markets at the wrong time due to crippling fear is to always manage your risk and reward with automated orders – such as a stop-loss and take-profit. This way, the position will be closed before you either lose too much or miss out on your desired profit percentage.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

FAQs

What is psychology in forex trading?

How can I master forex trading psychology?

How does greed affect forex traders?

How does fear affect forex traders?

What type of trading is better suited to forex beginners?