Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

In a move signaling confidence in the UK economy, the Bank of England (BoE) has decided to increase the Bank Rate by 0.5% to 5%, marking the highest level seen in the past decade and a half.

The decision was made by a majority vote of 7-2 by the Monetary Policy Committee (MPC), with Swati Dhingra and Silvana Tenreyro dissenting in favor of maintaining rates at 4.5%. The MPC emphasized the need to closely monitor potential inflationary pressures in the economy, particularly in relation to labor market conditions, wage growth, and service price inflation. The committee expressed readiness for further monetary policy tightening if persistent pressures emerged.

Bank of England Expects Decline in Inflation in 2023

While the BoE expects a substantial decline in inflation this year, primarily attributed to lower energy prices, they project minimal change in the services Consumer Price Index (CPI) and a further drop in food price inflation over the coming months. These factors contribute to the BoE’s optimistic outlook on curbing inflation.

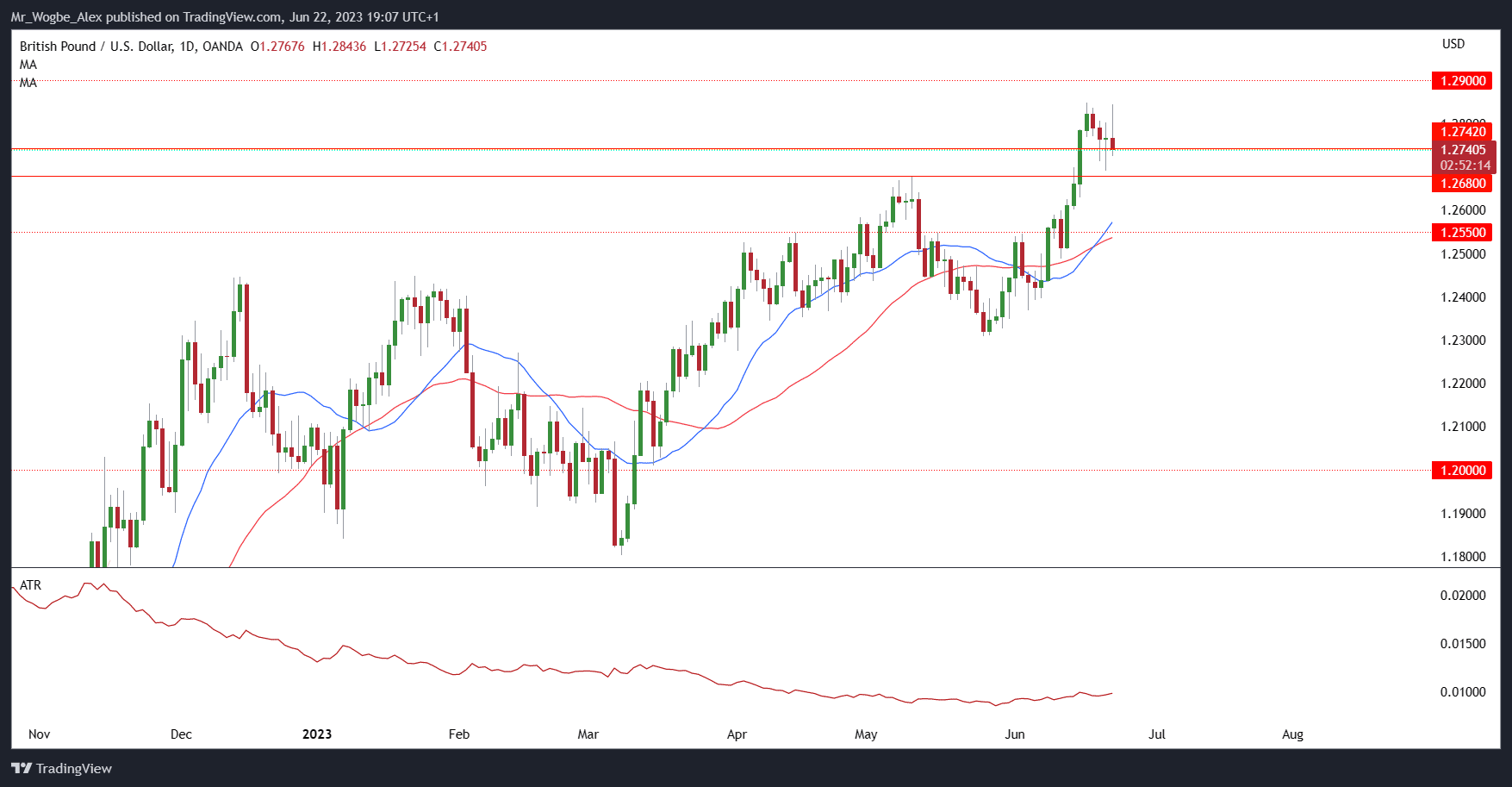

Reaction from the GBP/USD

The initial announcement led to a surge in the value of the British pound against the US dollar, with GBP/USD reaching a high of 1.2843. However, the currency has since retreated to pre-release levels, currently trading around 1.2740 amidst volatile market conditions. Short-term yields on UK government bonds experienced a slight decline initially but are expected to rebound and trend higher.

Analysis of retail trader data reveals that 36.68% of traders maintain net-long positions, with a short-to-long ratio of 1.73 to 1. Comparing the figures to the previous day and week, there has been a 5.89% increase in net-long traders compared to yesterday and a 7.29% increase compared to last week. Conversely, the number of net-short traders has decreased by 3.18% compared to yesterday and by 1.30% compared to last week.

You can purchase Lucky Block here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus