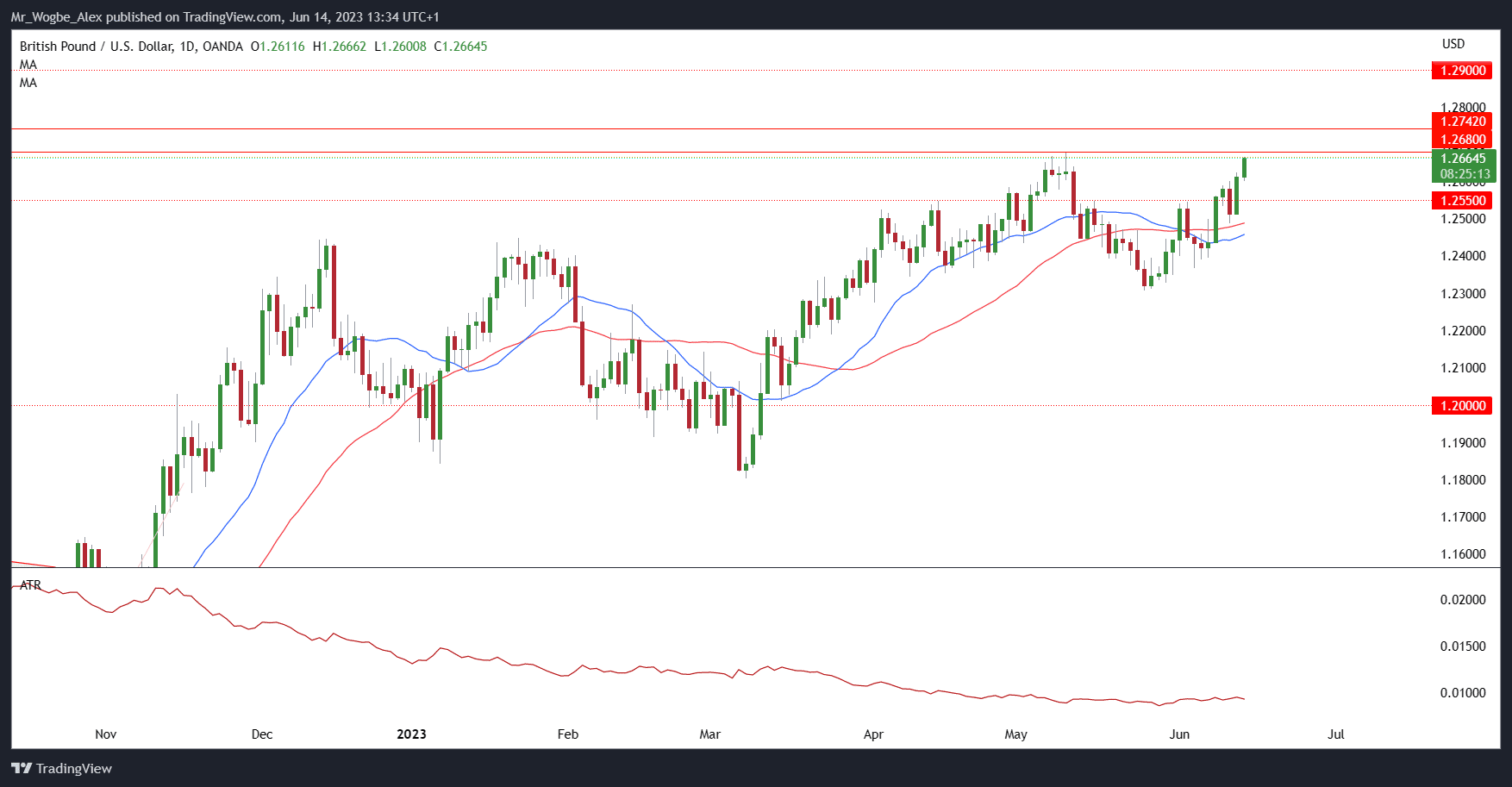

In the latest economic report, the focus is on the UK Gross Domestic Product (GDP), which has brought the British pound back into the spotlight as the GBP/USD pair edges closer to retesting the critical 1.2800 resistance. Yesterday’s positive close was attributed to the UK GDP figures aligning with expectations across most metrics. However, concerns remain as overall growth appears to be stagnating, particularly in the industrial and manufacturing sectors.

The report reveals that monthly GDP experienced a 0.2% increase in April, following a decline of 0.3% in March. Moreover, GDP grew by 0.1% for the three months ending in April. Encouragingly, the services sector displayed improvement, rising by 0.3% after a previous fall of 0.5% in March.

source: tradingeconomics.com

Pound Gets Short-Term Boost

This data provides a short-term boost for the British pound. However, weaknesses in the industrial and manufacturing sectors raise concerns about the sustainability of UK growth. These shortcomings warrant attention, as they could have implications for the economy in the future.

The Chancellor of the Exchequer, Jeremy Hunt, responded to the robust economic data by emphasizing the need for low inflation to sustain high growth. Hunt expressed the government’s commitment to halving the inflation rate this year. Similarly, Bank of England Governors Andrew Bailey and Dhingra reiterated the importance of addressing inflation concerns.

BoE Rate Hike Expectations Adjusted

Yesterday’s jobs data prompted a significant change in the Bank of England’s rate hike expectations. The peak rate for 2023 is now projected at approximately 5.77%, representing an increase of around 30 basis points from the previous estimate of 5.48%. This revision signifies the central bank’s heightened focus on tackling inflation.

Finally, the UK 2-year gilt yield has reached levels not seen since 2008, surpassing the period surrounding former Prime Minister Liz Truss. This development raises concerns about defined benefit (DB) pension schemes, as the value of these schemes traditionally moves inversely to gilt yields.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.