The British pound is proving its mettle as it wraps up a positive week, flexing its muscles against a range of G7 currencies. With a bounce in its step, the cable surged approximately 2 cents higher, leaving onlookers impressed. Meanwhile, GBP/JPY has also seen a considerable boost of around 2.5 yen, while EUR/GBP has taken a tumble of nearly one euro. It seems the pound has chosen the spotlight, outshining its peers with its robust performance.

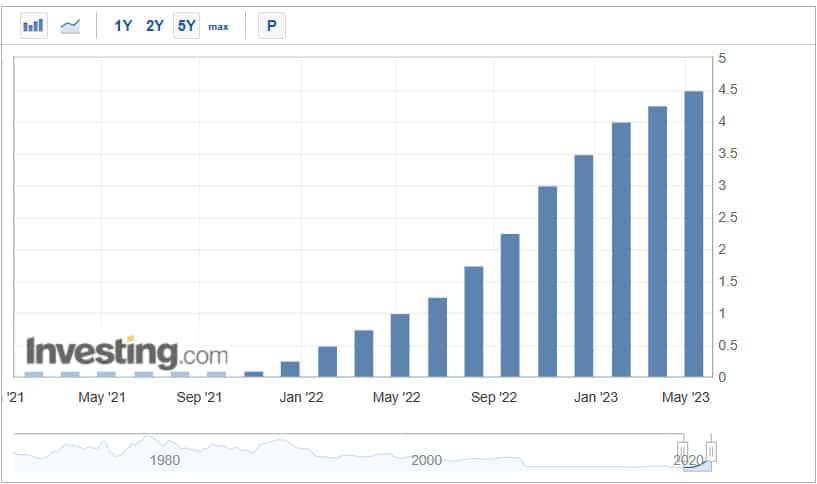

This show of strength is primarily attributed to mounting expectations that the Bank of England may have to adopt a more assertive stance in the face of rising inflation. As the heat of inflation lingers, market pundits anticipate that the Bank of England might hike interest rates more aggressively in the coming months.

A Robust Event Calendar Awaits the British Pound this Week

In the week ahead, traders and analysts are bracing themselves for a bustling economic data and event calendar. Looking at the releases from the UK, US, and Eurozone, it becomes evident that GBP/USD and EUR/GBP might experience a healthy dose of volatility. The US Federal Reserve and European Central Bank are set to announce their policy decisions right in the middle of the week, injecting some much-needed excitement into the mix.

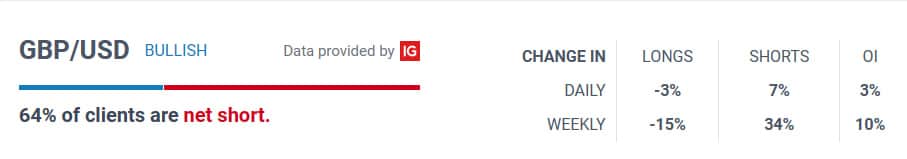

Meanwhile, retail trader data unveils some interesting tidbits about the current market sentiment. According to the data, a noteworthy 36.30% of traders have taken a net-long position, with the short-to-long ratio sitting at 1.75 to 1.

However, it seems that the number of net-long traders has taken a dip of 23.70% from the previous day and 9.07% from the previous week, according to data from DailyFX. On the flip side, the number of net-short traders has witnessed a meteoric rise of 43.64% since yesterday and a commendable 12.00% surge compared to the previous week.

The fact that traders are leaning towards a net-short position gives us reason to believe that GBP/USD prices may have room to rise. The sentiment has grown even more bearish than both yesterday and last week, strengthening our bullish contrarian trading bias for GBP/USD.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.