Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

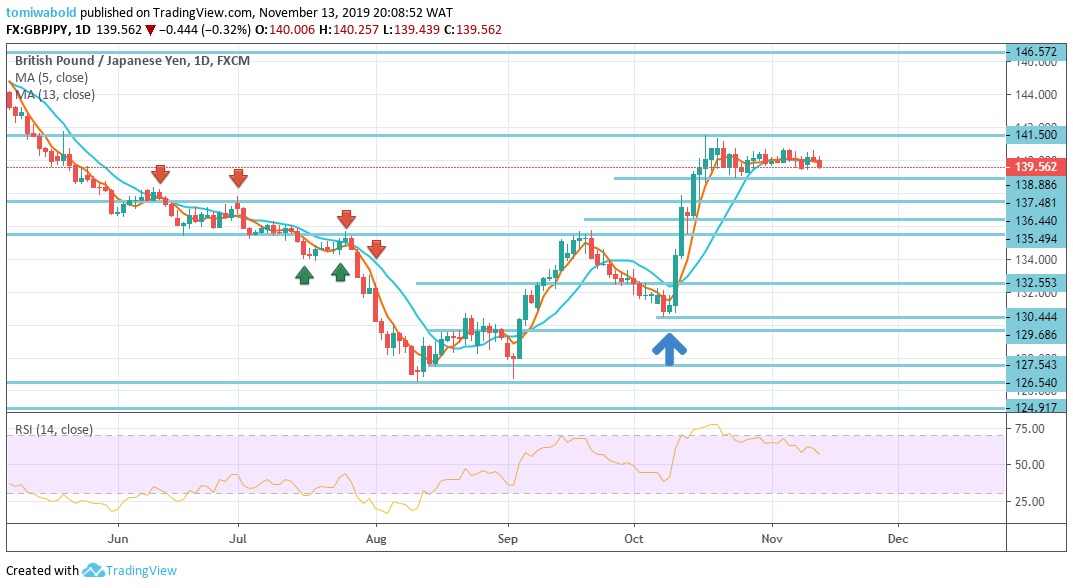

GBPJPY Price Analysis – November 13

GBPJPY is trending within the prior day’s range after its unable to build on its gains recent gains as the sellers tried to take advantage and may end the day below its opening price but in a lackluster momentum.

Key Levels

Resistance Levels: 148.66, 146.57, 141.50

Support Levels: 135.49, 130.44, 126.54

GBPJPY Long term Trend: Bullish

In the daily picture, the consolidating structure from the level at 126.54 (low) remains in a formative stage with the advance from the level at 130.44 as the second stage. However, a further advance may be recorded back to the level at 146.57/148.66 resistance.

Meanwhile, for the current scenario, solid resistance from here expects to restrain the upward advance. Although, this may stay as the favored scenario for as long as the level at 135.45 resistance turned support remains.

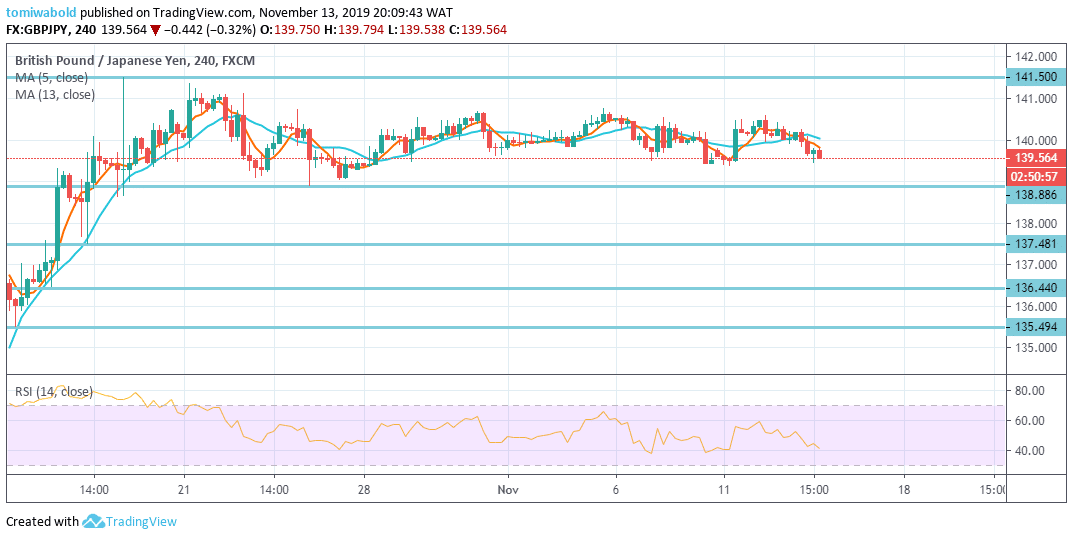

GBPJPY Short term Trend: Ranging

On the flip side of the 4-hour time frame, the intraday bias of the FX pair stays neutral as the consolidation from the level at 141.50 is extending. Whereas a deeper plunge here may not be out of consideration.

Nevertheless, the downward momentum may be contained above the level at 135.49 resistance turned support to bring about another bounce upside where the break of the level at 141.50 may reactivate the advance from the level at 126.54 towards the 148.66 key resistance.

Instrument: GBPJPY

Order: Buy

Entry price: 135.49

Stop: 130.44

Target: 146.57

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus