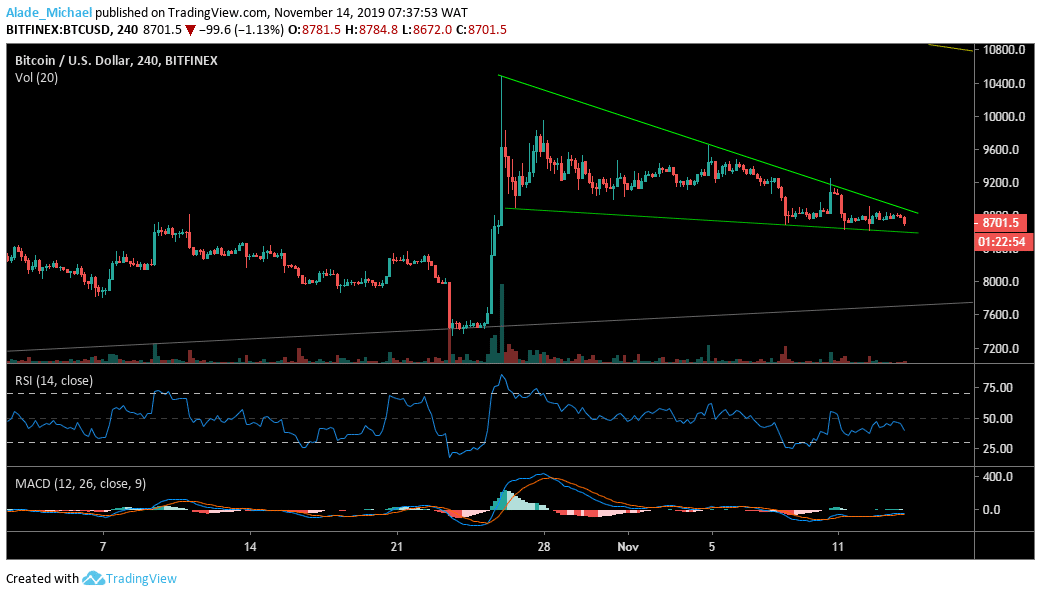

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Key resistance levels: $8880, $9000, $9200

Key support levels: $8500, $8300, $8100

Looking at the current bearish setup, Bitcoin’s price could seriously collapse on the 4-hour chart. The BTC bears are gaining dominance and currently regrouping for lower prices. Meanwhile, the $8600 support is still bolstering well for the BTC/USD pair. Driving beneath this support could make the market to extend bearishness a bit to $8500 support. The $8300 and $8100 support may follow if BTC keeps supplying.

However, the $8880 remains a tough resistance for now. A successful climb may allow the bulls to reclaim $9000, followed by $9200 and above. The RSI for Bitcoin is in a downward direction to show that sellers are still in the market. Also, the MACD has tested the zero level but now appeared that trading may resume bearish swing.

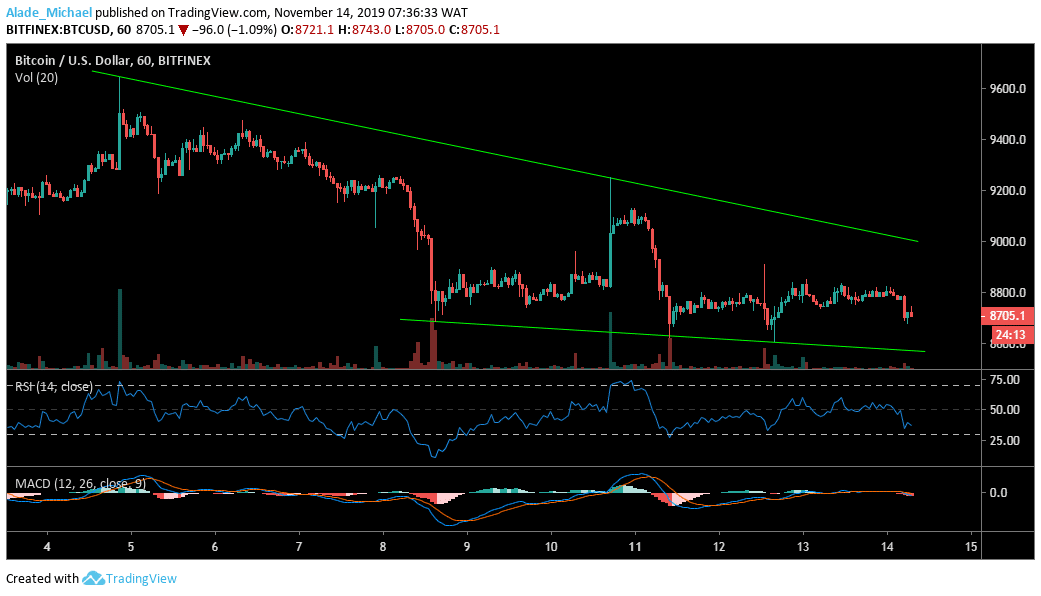

Bitcoin (BTC) Price Analysis: Hourly Chart – Bearish

Bitcoin has continued to stay quiet and calm for a while now, especially trading between the range of $8800 on the upside and $8600 on the downside. On top of that, the descending wedge is keeping BTC under bearish control. While waiting for the price to surge, a bullish rally may take us to $9000 after clearing the $8880 resistance.

Once the $9000 resistance resurfaces, the $9125 would be the next buy target for Bitcoin. In the opposite direction, Bitcoin may roll back to the closest support at $8600. If this support breaks, $8500 and $8400 could further function as support for the market. At the moment, the technical indicators are suggesting a potential sell.

BITCOIN SELL SIGNAL

Sell Entry: $8703

TP: $8550

SL: 8942

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.