Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

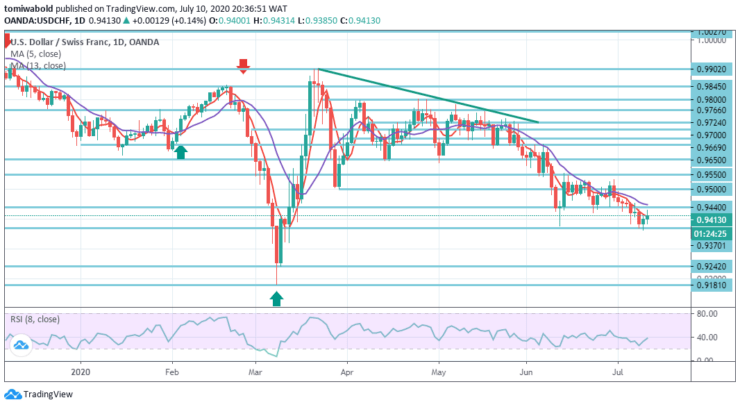

USDCHF Price Analysis – July 10

USDCHF is restoring more gains today after flipping 0.20 percent to 0.9431 level after the pair fell beneath the 0.9370 main level in the prior session. Buyers kept on to the gains on through initial North American session, despite failing to capitalize on the change amid concerns over the ever-growing cases of coronavirus.

Key Levels

Resistance Levels: 1.0027, 0.9766, 0.9500

Support Levels: 0.9370, 0.9242, 0.9181

As observed on the daily, USDCHF dropped marginally beneath the level of 0.9370 in the prior session eventually stabilizing in the current session beyond the level of 0.9400.

Since this new low for July was followed by positive divergence on the daily RSI we anticipate seeing a medium to long consolidation taking place at least. The fall from 1.0231 is seen in the wider context as the third phase of the trend.

The USDCHF intraday bias appears initially neutral. As long as the resistance level of 0.9440 remains, a further decline is still anticipated. The breach of 0.9370 immediate low level may broaden the decline from 0.9902 to 100 percent forecast from 0.9724 to 0.9500 at 0.9242 levels.

The continuous breach there may open the path for low-level retests of 0.9181. That being said, a strong breach of 0.9440 level may revert bias to the upside for 0.9550 resistance level instead.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus