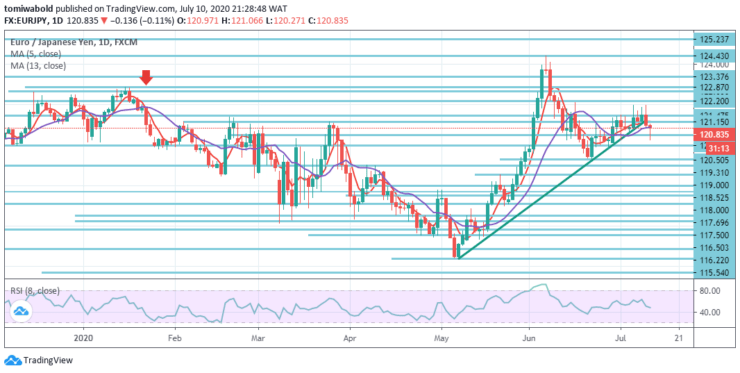

EURJPY Price Analysis – July 10

EURJPY tends to lose the futile effort to enter the range of 122.00, amid rising selling pressure on the back of the Japanese yen’s improve bias. The corrective downside stays under the ascending trendline in the 120.50 regions as the selling bias gets traction.

Key Levels

Resistance Levels: 124.43, 122.87, 121.15

Support Levels: 119.31, 117.50, 114.85

After the prior trading session, the single European currency has fallen to 120.27 levels in the current session by 155 pips or 1.27 percent against the Japanese Yen. A breakout happened during the prior session, through the lower end of the ascending trendline pattern.

The EURJPY exchange rate may well probably continue to drift lower throughout the corresponding trading session, provided that a breakout has emerged. At 120.00 horizontal support level, the potential target may emerge.

EURJPY’s trend has shifted to short-term bearish now that the ascending trendline support line has fallen through at 121.15 level. While the short-term trend is now bearish, experts predict the pair to hit the high level around 122.20 level of mid-June while EURJPY is above 119.31 level.

Firstly, intraday bias is back on the downside for support level 119.31. This area of contention is also strengthened by the lows in the region of 119.31 in June. The breach may start the decline to 118.52 levels from 124.43 to 61.8 percent retracement of 114.42 to 124.43 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.