Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Traders and investors turn to indices to gain exposure to lots of stocks within a single basket. These days you can purchase an index in the form of digital tokens – which means you are merely trading or investing in a depiction of the underlying asset.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioIntrigued about this fairly new type of derivative investing? If so, today we talk about the best tokenized indices of 2023.

We also discuss how tokenized indices work, the different tools available such as shorting and leverage, and how to make gains. We also offer a comprehensive review of the best platform to access tokenized indices, and how to create an account.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

How to Invest in Tokenized Indices: 4 Step Sign-up

When you are researching the best tokenized indices of 2023 – you might come across unregulated exchanges offering them. The best option, for investors of all skill sets, is to stick with a regulated provider.

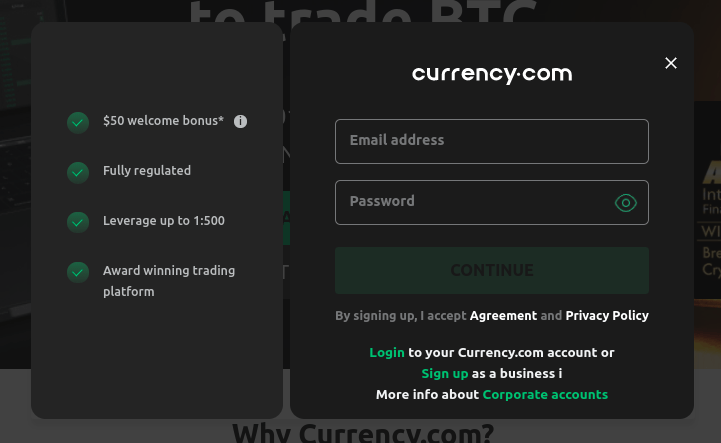

See below a simple four-step sign-up guide, using top-rated regulated exchange Currency.com:

- Step 1: Join a regulated exchange platform – Head over to Currency.com and click ‘Sign Up’ – enter your name and choose a password.

- Step 2: Add funds to the account – After completing the sign-up process including KYC, you can make a deposit using Bitcoin, Ethereum, credit/debit card, or wire transfer.

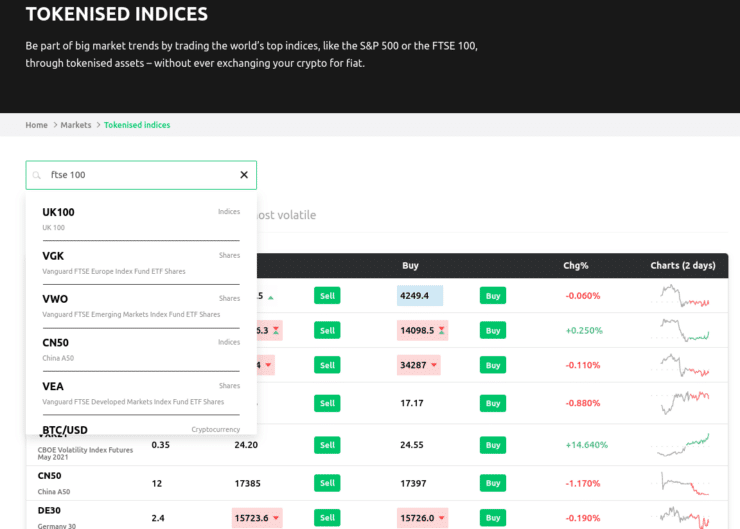

- Step 3: Choose a tokenized index to invest in – You can use the search box to look for specific tokenized indices – or hit ‘Markets’.

- Step 4: Place an Order on Tokenized Indices – Think about how much to invest and place a buy or sell order.

Companies like Currency.com adhere to AML (Anti-Money Laundering) and KYC (Know Your Customer) rules – which are in place to keep the space clean from crime.

Furthermore, your account funds will be kept in a separate bank account for safety and the tokenized asset provider is able to offer super-tight spreads. We review this platform in more detail later.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

What are Tokenized Indices?

Tokenized indices allow you to invest in some of the most popular stocks in the world – whilst holding a single instrument.

You can leverage your positions to increase your investing power, and you can also profit from a bearish market. If you are completely new to this idea – we cover the most important aspects throughout this guide.

So, what exactly are tokenized indices? Much like how index funds or CFDs track the real-world price of top stocks – tokens monitor the underlying value. This enables us to hypothesize about the future value of assets – without owning them.

The best tokenized indices can be found at exchanges such as Currency.com. Such providers create digital derivative products referred to as tokens. Each one will have a name and will track the value of an underlying index (for instance NASDAQ 100).

What Decides the Price of Tokenized Indices?

The simple answer is – the underlying index that the token represents, decides the price of tokenized indices. However, that doesn’t quite explain how the price of the underlying asset itself moves.

The stock markets are notoriously volatile. Major or minor developments experienced by the companies behind the stocks will have a knock-on effect on the indices tracking their performance. True to form, this also alters the course of the tokenized indices.

See an example below for clarification on how tokenized indices work:

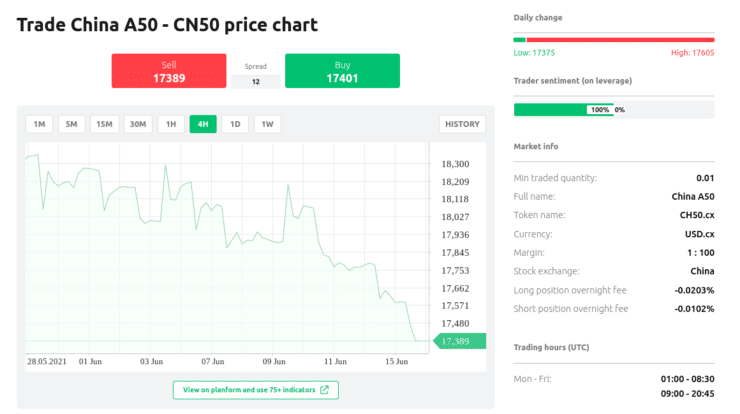

- Let’s say you want to invest in the FTSE China A50 index – which follows 50 of the most liquid shares on the Hong Kong stock exchange

- This index is priced at 18,097 points

- As such, tokenized index CH50.cx (China A50) is also valued at 18,097 points

- After noticing widespread concerns over high valuations on China’s materials and consumer stocks – you think this price will fall

- FTSE China A50 falls in value to 17,401 points – this illustrates a 4% drop

- As such, the tokenized indices instrument mirrors this by also falling by 4% – to 17,401 points

In this scenario, you would be able to capitalize on this foresight by creating a sell order to short the index tokens – before it happens. We talk about this in more detail later.

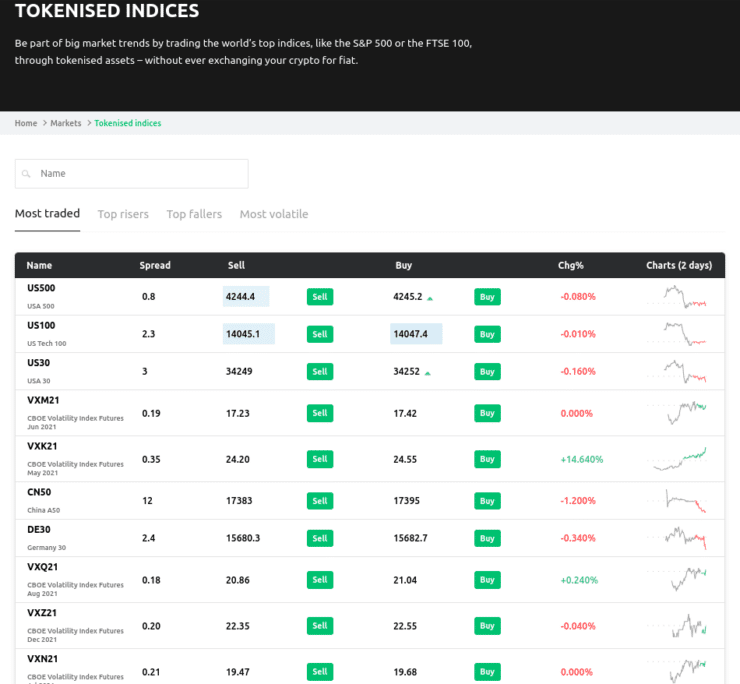

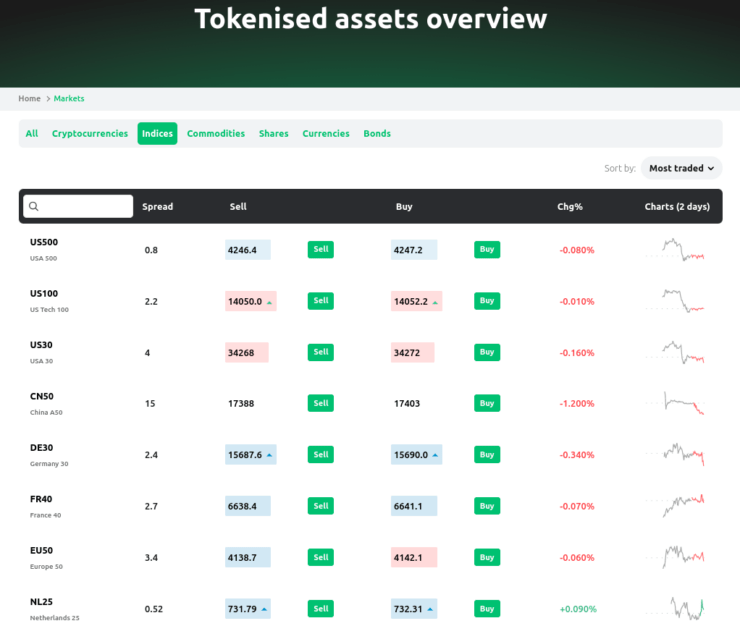

What Tokenized Indices are Available?

As we have said, tokenized indices track the market value of the underlying index. For example, the token ‘WS30.cx’ is tasked with tracking the price of The Dow Jones 30 index.

There are heaps of global tokenized indices available, depending on what the platform you choose is able to offer. Some may only be able to provide access to UK or US indices, while others have multiple index tokens to invest in.

Below, you will see some of the other indices which have been tokenized, listed alongside their token names:

- NASDAQ 100 index (US) – Token name NDXm.cx

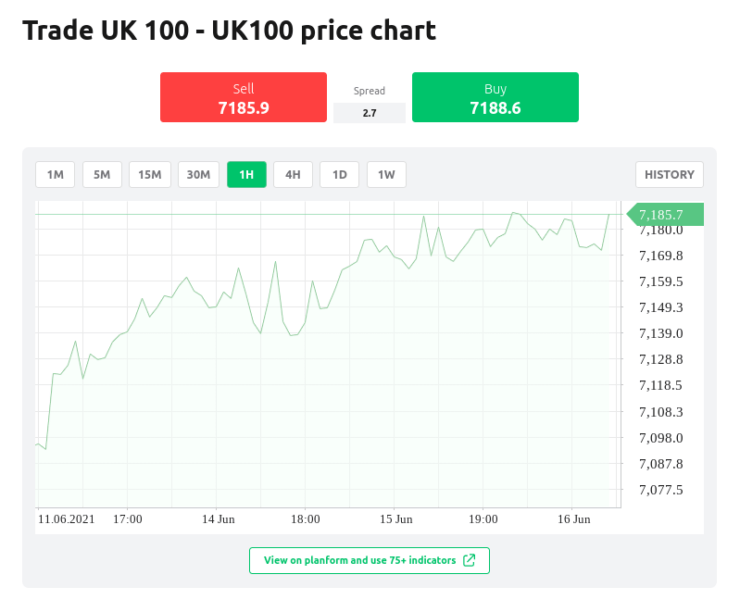

- FTSE100 index (UK) – Token name UK10.cx

- DAX 30 index (Germany)- GDAX.cx

- CAC 40 index (France) – FCHI.cx

- S&P 500 index (US) – Token name SPXm.cx

- The Euro Stoxx index – Token name EU50.cx

- FTSE China A50 index – Token CH50.cx

- Italy 40 index – Token name IT40.cx

You can usually just search by name, rather than its official token title. As you can see, some well-known indexes have been tokenized, so you shouldn’t struggle to find one you’re interested in. For instance, one of the most popular options is the S&P500.

This monitors the success rate of 500 large-cap stocks that are traded across US marketplaces – such as the NYSE and NASDAQ. This index is often used as a performance benchmark to give traders a better idea of the health of the stock markets across the board.

At Currency.com, you can trade or invest in all the above tokenized indices with ease. This provider is also compatible with fractionalized investing – which we talk about in further detail later.

How Can I Make Gains From Tokenized Indices

There are many ways to make gains from tokenized indices. We talk about the three most noteworthy methods below.

Study Analysis: Correctly Predict and Time the Markets

Whilst this sounds like an obvious point – one way in which you can make gains when investing in tokenized indices is to predict and time the markets – correctly. If you walk away with more than you initially put in – you’ve made a profit.

See a simple example below:

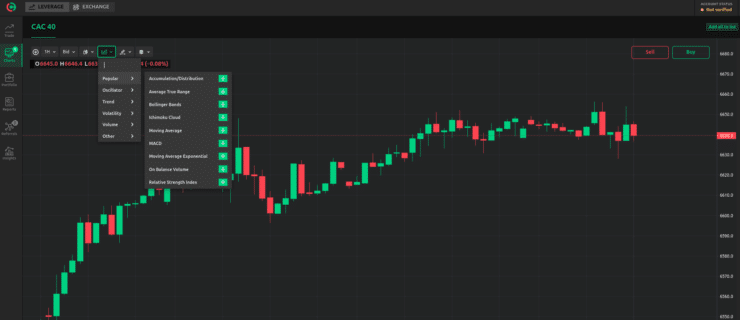

- You want to purchase tokenized index CAC 40 – priced at 6,640 points

- After a macroeconomic release, you believe France’s stock market index will rise in value – so you place a buy order

- CAC 40 climbs to a value of 6,806 points – which shows a 2.5% increase

- You place a sell order to exit this position

- You were correct to go long – and you made a 2.5% profit

Had you gone short on this position, you would have experienced a 2.5% loss. We talk about the ability to short tokenized indices shortly. However, whether you decide to invest in tokenized assets or trade in the short term – it’s imperative that you study analysis relating to the market.

This guide found that Currency.com has heaps of indicators and customizable drawing tools available – allowing you to use a range of oscillator, trend, volume, and volatility indicators and draw various patterns such as the Fibonacci, trend angles, and more.

Best Tokenized Indices: Long or Short?

We have mentioned a few times now that you can go long or short on tokenized indices. This is a major benefit of this type of investment vehicle.

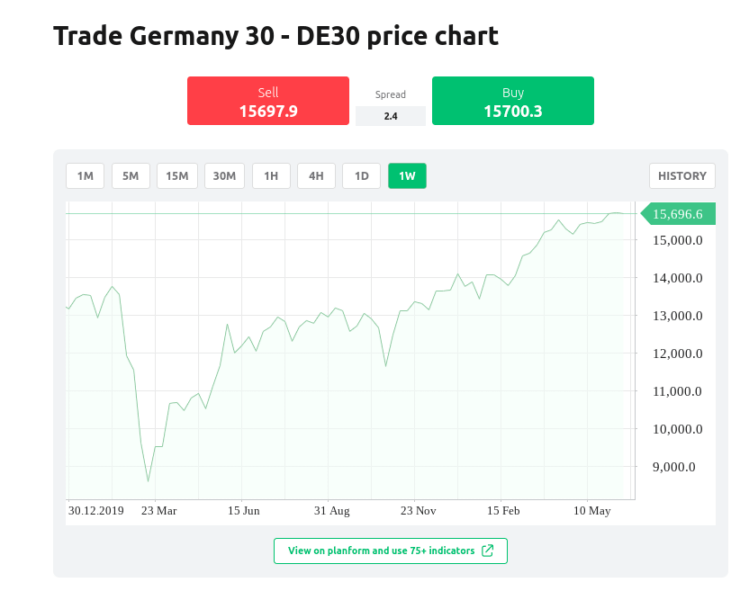

- You want to invest in the DAX 30, covering the Frankfurt Stock Exchange’s 30 biggest stocks

- You think this will see a price increase

- As such, you place a $300 buy order to go long

- The index rises in value by 5%

- Next, you place a sell order to close this position with 5% gains

- From your initial investment of $300 – this equates to a profit of $15

Next, let’s take a look at gains made from a ‘short’ position on tokenized indices:

- You want to trade the NASDAQ 100 – valued at 15,033 points

- After performing some research you think the tokenized index will see a price decline

- With this in mind, you short it with a $1,000 sell order at your chosen platform

- Within days, the NASDAQ 100 index has seen a 7% drop in value – now priced at 14,050 points

- Your hypothesis was right – you made $70 gains from your initial $1,000 short order

As you can see – you can make gains from rising or falling tokenized indices. This is a much more flexible way to trade and also enables to you add leverage – which we talk about next.

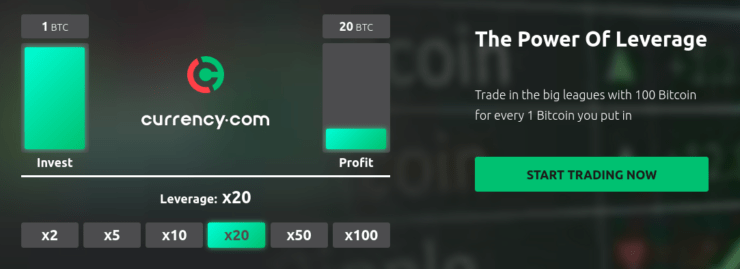

Utilize Leverage on Tokenized Indices

For those unaware of the power of leverage – this is like getting a loan to boost your tokenized indices stake. Theoretically, this should make for more impressive profits when the time comes to cash out your investment.

In a nutshell – leverage multiplies your position value to enable you to enter the tokenized market with more money than you have in your trading account. This might be shown as x2, x10, x50, or 1:2, 1:10, 1:50, etc. The latter increases your buying power by 50. Currency.com offers leverage of up to x100 on indices, which is huge.

- In the above short sell order example, the NASDAQ 100 fell in value

- You placed a $1,000 sell order and your prediction was correct

- This gave you a profit of 7% – which equated to $70

- Let’s say you added leverage of x10

- This boosts your stake to $10,000

- As such, your gains would be magnified from $70 to $700

As you can see, leverage can make a huge difference to your gains when investing in or trading tokenized indices. If the NASDAQ 100 instead experienced an increase in value – you would have also amplified any loss incurred.

Importantly, please be mindful that adding more leverage than you can realistically afford to loan can lead to a ‘stop out’. This means the platform begins closing your open positions to cover the financial loss.

What is Beneficial About Tokenized Indices?

We have talked about the advantages of tokenized indices throughout this guide.

However, let’s take a deeper look at some of the main reasons this tokenized form of trading and investing is becoming so popular.

No Need to Exchange Crypto

Have you already dipped your toes into the world of cryptocurrency trading? If so, it may interest you to know that tokenized indices don’t require you to first change digital cash into fiat!

Top-rated exchange platform Currency.com enables tokenized trading and investing with Ethereum and Bitcoin. Those who prefer fiat money like euros or British pounds can also use more traditional deposit cards like Visa and MasterCard.

Small Investment Minimums

Most of us have thought about investing in some of the biggest stocks in the world, like Tesla or Facebook – but either lack the time to track individual companies, or can’t afford the cost of a full share.

When it comes to tokenized indices, as well as high liquidity – tangible benefits also include the option of fractional investments. This means that if you wanted to invest in the FTSE 100, but don’t have a lot of money to spare, you could still gain exposure to this market.

To give you an example, at Currency.com, you can invest as little as $10. This means with a budget of just $100, you could potentially invest in 10 different tokenized indices. This is super useful for diversification purposes.

Explore Alternative Tokenized Investments

Diversification is a word you will see all over the place when looking into the best tokenized indices, or investing in general.

As such, it’s good to be aware that it’s also possible to buy and sell tokens that represent the real-world price of currencies, ETFs, commodities, shares, bonds, and crypto-assets too.

People diversify because many tokenized markets will behave differently at different times. This might depend on the economic situation of the US dollar, a change in inflation and interest rates, earnings reports of major blue chips stocks, and more.

For instance, you might look to invest in some of the best tokenized commodities – such as oil, or gold. The latter particularly has been used to hedge against inflation for years.

What’s Best – Tokenized Indices or Traditional?

Traditional indices are considered relatively low maintenance, as you have a basket of securities under one vehicle. With that said, many investors still opt for tokenized indices as they offer more flexibility.

As we said, tokenized indices enable you to expose yourself to a much wider pool of markets than traditional investments. This is because you are able to invest a fraction of the full cost – and can therefore allocate your money to more than one index.

This might include smaller portions of tokenized indices like the NASDAQ, S&P 500, and Dow Jones, as well as a European exchange such as the GER 30 – for example. Furthermore, to reiterate – tokenized indices offer another benefit that traditional markets don’t – the ability to go short.

As we said – this means you can still make money from a falling market – with a sell order and good timing. Tokenized indices are also becoming the preference over the conventional way due to the fact you can usually access high leverage to boost your investment.

Best Tokenized Indices Platform 2023

As we said, in order to buy tokenized indices you will need to sign up with a suitable platform. Ideally, you should be looking for a trading platform with heaps of tokenized markets on offer, low spreads and commissions, regulation, and fractional investment options.

We checked out heaps of platforms able to offer the above key metrics and found that the aforementioned platform Currency.com ticked all boxes. See a full review below.

Currency.com – Best Platform for Tokenized Indices

As we said, Currency.com came out on top in our list of contenders we considered for the best tokenized indices platform. This provider is regulated and complies with client fund segregation, as well as AML and KYC rules. This means you are able to invest in a safe environment. Furthermore, there are in excess of 2,000 tokenized assets to trade or invest in here - covering forex, crypto, commodities, bonds, and indices.

This guide found the commission fees to be minimal, and the spread to be tight. In terms of the latter, a tokenized NASDAQ 100 instrument comes in at a spread of just 0.01%, The FSTE 100 averages 0.03%, and GER 30 is 0.01%.

We also checked out the spread on some of the more volatile tokenized indices and found the following - SP 35 at 0.14%, China A50 at 0.06%, CAC 40 at 0.04%, and EU 50 averages 0.08%. This is competitive for index tokens. We also like that you can invest using Bitcoin and Ethereum, as well as the more conventional option of credit and debit cards, and bank wire transfer.

The minimum deposit is also very manageable at just $10. Currency.com offers leverage on all tokenized indices, which could be as much as 1:100. Meaning - with $10 you could potentially purchase $1,000 worth of tokens. Some markets can be leveraged by as much as 1:500, depending on whether you are a retail or professional client.

- Over 2,000 tokenized markets and allows fractional investments

- Leverage of up to 1:500

- Managable 0.05% exchange fee

- 3.5% deposit fee charged on debit and credit card deposits

Step-by-Step: Invest in the Best Tokenized Indices Today!

For those who have no experience in investing or trading, you will see a step-by-step walk-through of how to sign up with a suitable platform below.

We are using Currency.com for this as the platform came out as the best tokenized indices broker for 2023.

Step 1: Create an Account at Currency.com

Type Currency.com into your browser and click the ‘Sign Up’ button when you get there.

As is standard practice at tokenized indices providers – you will need to adhere to KYC rules by supplying your name, home address, date of birth, and such.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

Step 2: Upload Proof of ID

Next, you will be asked to validate the information you’ve given. This can be done by providing a copy of your passport or driving license.

You can also use a bank statement or utility bill to clarify your home address. This document must include the date of issue, your name, and your address.

Step 3: Add Funds to Your Account

As we said, Currency.com accepts cryptocurrency payments, as well as fiat. This includes ETH and BTC coins, Visa, Mastercard, and bank wire transfer.

Please note that the latter is often the slowest payment method to process and thus could delay your tokenized investment endeavors by some days. You can deposit funds later if you want to start with a free demo account.

Step 4: Choose the Best Tokenized Indices

Now that your account is up and running, you can choose the best tokenized indices for your investment goals.

Step 5: Invest in Tokenized Indices

Once you have found the tokenized indices you want to trade, you can click it to place an order.

Next, you need to decide between a buy order (in green) – indicating you think the price will rise, or a sell order (in red) if you beleive it will fall.

Step 6: Cash Out Your Investment

There will come a time when you see a profitable opportunity and want to cash out your investment. The good news is, this is stress-free at Curency.com.

If you entered your position with a sell order – you need to place a buy order to exit. As such, if you were short to start with, you can cash out with a buy order.

Best Tokenized Indices 2023: To Summarize

If you like the idea of speculating on the market based purely on the value of indices – tokenized assets could be the way forward. A big advantage of derivative investing is that instead of relying on the underlying index performing well – you can still profit by short-selling it.

Many platforms will also offer you fractional investment options, low fees, and leverage to enhance your gains. We scoured the space looking for the best tokenized indices of 2023 and Currency.com came out number one.

Currency.com offers up to 1:100 leverage on tokenized indices and only requires a deposit of $10 to get started. The provider offers access to over 2,000 markets with competitive spreads and is watched over by a regulator that specializes in blockchain technology.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

- Thousands of tokenized assets supported - from stocks and forex to crypto and bonds

- Leverage of up to 1:500 - even for retail client accounts

- Super low fees and tight spreads

- Regulated and safe

FAQs

What are tokenized indices?

How can I make money from tokenized indices?

Where is the best place to invest in tokenized indices in 2023?

Can I add leverage tokenized indices?

Will I be able to invest in multiple tokenized assets?