Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Have you ever wanted to invest in a precious metal like gold, or a valuable liquid commodity such as oil? The thought of taking ownership and safely storing such an asset can be costly and cumbersome for even seasoned investors.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioInstead, you could look to invest in the digital representation of the real-world commodity – in the form of tokens.

With this in mind, today we divulge the best tokenized commodities for 2023. We cover how they work, what the advantages are over traditional investments, and how to sign up and add some to your portfolio today!

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

How to Invest in Tokenized Commodities: In Brief

If you would like to get the ball rolling right now, you can invest in tokenized commodities by signing up with a regulated exchange. We found that Currency.com is the best place in the online domain for accessing this type of financial security.

As such, you will see a four-step sign up below:

- Step 1: Go to the official Currency.com site – Click sign up and fill in a little about who you are – such as your name and home address.

- Step 2: Deposit some money – Before you can purchase tokenized commodities, you will need to add funds to your account. You can opt for Bitcoin, Ethereum, credit and debit cards, or bank wire transfer.

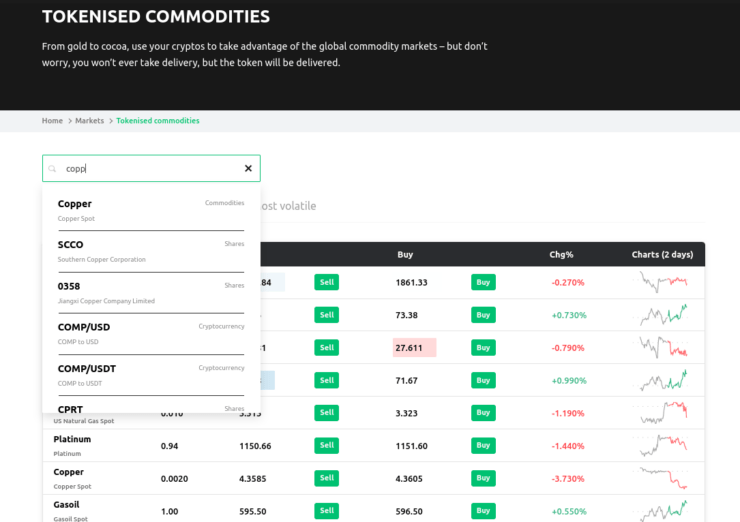

- Step 3: Search for your preferred tokenized commodity – Click ‘Markets’ followed by ‘Tokenized Commodities’

- Step 4: Place an order to invest in commodity tokens – Seal the deal by placing an order. Enter the amount you want to buy and confirm when you are happy.

We talk about the sign-up process and review Currency.com later on. When placing an order, please note that you can also enter the tokenized commodity market with a sell – to short it. We also discuss this later in this guide.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

What are Tokenized Commodities?

Tokenized commodities enable you to invest in the likes of silver and gold using either digital or fiat currencies. You can also buy tokenized shares, currencies, and indices on some platforms.

Back to tokenized commodities. You are merely buying tokens that represent the value of the underlying asset. As such, you will not need to pay the usual charges for a bank to securely store commodities such as gold and silver bullions.

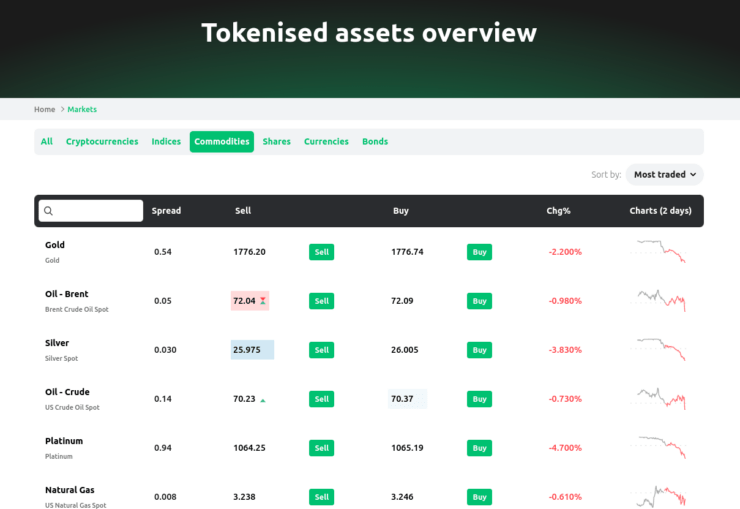

Instead, the token contract monitors the real market value of the underlying commodity – and matches it like-for-like. See below some of the commodity types available as investable tokenized assets.

Tokenized Commodity Types

Commodities are known for being pretty stable – when compared to forex and cryptocurrencies for example. In fact, many forex traders look to assets such as gold and oil to hedge against inflation rates and such.

See below the most popular tokenized commodities:

- Gold

- Silver

- Aluminum

- Platinum

- Palladium

- Copper

- Brent Crude Oil

- Natural Gas

- Wheat

- Coffee Arabica

- Cocoa

- Cotton

Much like with traditional investing, which commodity you purchase will depend on your appetite for risk, general interests as an investor, and what you already have in your portfolio.

For instance, if you have tokenized shares in your investment basket and these are experiencing hard times – commodities can be a great way to avoid over-exposure to such concentrated risk. Of course, as we said – traditionally, this means having to store and even insure your precious assets.

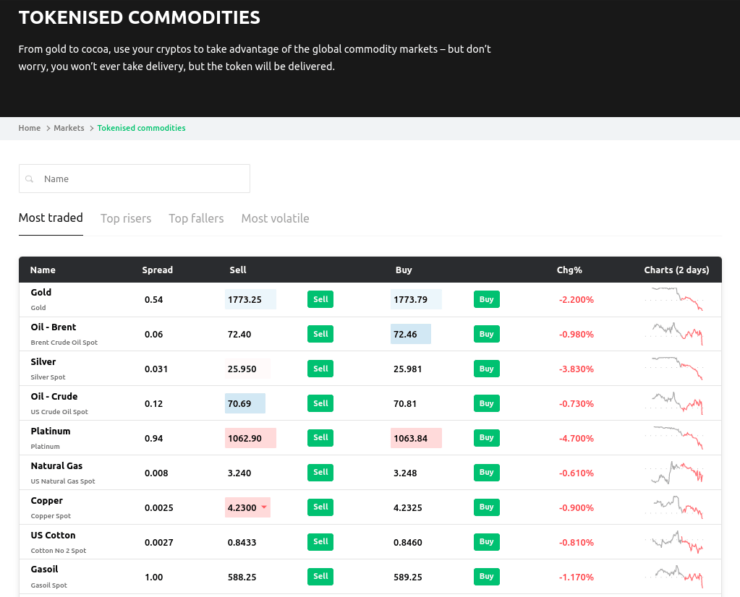

All of the markets listed above are available to be purchased as tokens at Currency.com. We investigated the spread and found this to be competitive across all commodity categories. We talk about this in more detail in our comprehensive review of Currency.com later on.

How do Tokenized Commodities Work?

As we touched on, tokenized commodities track the real market price on whatever it represents.

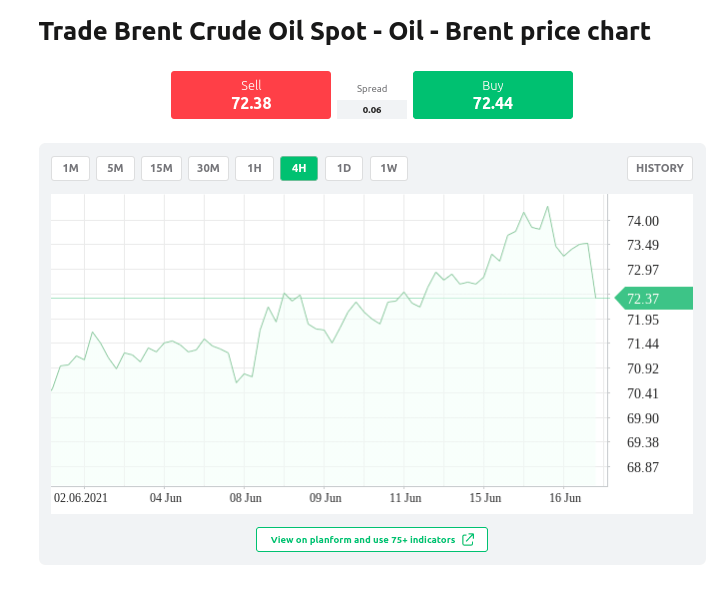

- Let’s say you decide to invest in Brent crude oil which is priced at $70

- As such, the tokenized asset is also valued at $70

- If the price of this commodity moves in either direction – the tokens will too

- Next, let’s say oil increases by 5% to $73.50

- Your tokenized investment will mirror this – rising by 5%

Investing in commodities via tokens has never been easier thanks to crypto exchanges like Currency.com. This enables you to keep commission fees and spreads affordable, whilst having access to small minimum deposit amounts and fractional investments!

How to Make Money From Tokenized Commodities

Purchasing tokenized assets offers a stable and fuss-free way to invest in soft and hard commodities. This also cuts out transaction costs normally associated with gold dealers, for example, as they are all but certain to charge a hefty markup.

So, how do you make money from tokenized commodities? There are a few ways in which you can make gains from this fairly new form of derivative trading – read on.

Predict the Tokenized Commodity Direction

Let’s look at how you can make gains from your tokenized commodities investment in more detail. Like in the case of CFDs (Contracts for Difference), you can make a profit from a rise or fall in the price of an tokenized asset – provided you are correct in your prediction.

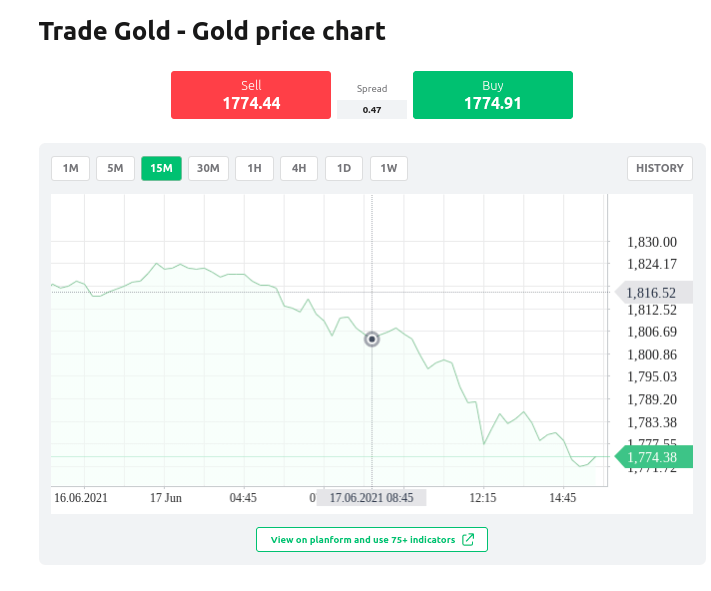

- Gold is priced at $1,864 per ounce

- As such, tokenized gold is valued at $1,864 per ounce

- You think gold will see a decrease in price – so you place a sell order

- Gold falls by 3% – you were correct so made 3% in gains

- Let’s say you next time you instead predict gold will rise

- In this case, place a buy order. – and if gold rises, you make gains

We talk about the ability to speculate on both the rise and fall of tokenized commodities next, for anyone unversed with this phenomenon.

Short Vs Long on Tokenized Commodities

When you are investing in tokenized commodities, you will need to conduct the research needed to predict the markets. This might see you studying fundamental research such as global economic news, or the price charts and indicators found in technical analysis software.

Either way, you can make money by going long or short when buying this type of instrument – as long as you get it right of course. This gives you greater flexibility as an investor – and crucially, more money-making opportunities.

See another example below, this time with a short order on tokenized silver:

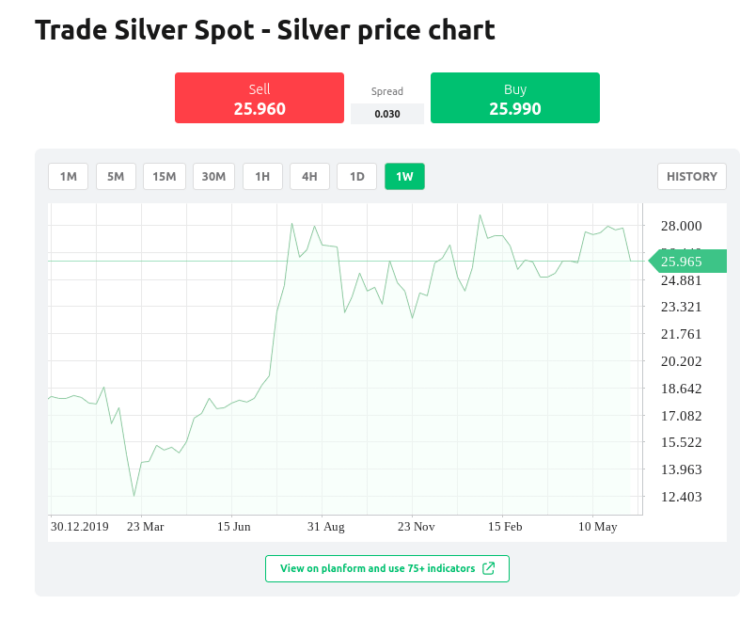

- You head over to your exchange platform and tokenized silver is priced at $29 ounce

- After much research, you think its value will fall in the short term

- You go short on tokenized silver with a $200 sell order

- Sure enough, silver falls to $27.26 – indicating a 6% price drop

- You speculated correctly so cash out your gains with a sell order – so you made $12

As you can see, unlike with traditional stocks and such – you can also make money from an asset falling in value. At Currency.com, you will be able to leverage this position to increase your take-home profit. We talk about that shortly.

- You are looking to invest in tokenized platinum – priced at $1,255 per ounce

- After performing some analysis you think that economic uncertainty is around the corner

- As such, this is likely to cause platinum to fall in value so you place a $1,000 sell order

- Your tokenized platinum investment falls by 8% to a value of $1,155

- Pleased with 8% gains, you cash out your investment

- From the $1,000 sell order – you made $80

If you thought that platinum would rise in value – you would simply need to place a buy order instead. Of course, if you are correct and the tokenized asset increases – you will make a profit.

Next, we talk about how you can magnify your commodity buying power via a trusted tokenized asset exchange.

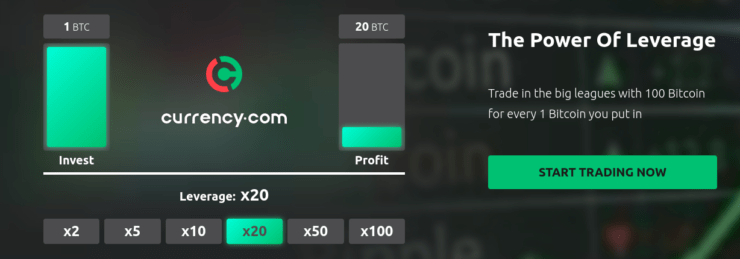

Leverage Tokenized Commodity Investments

Another way to increase your money-making potential when investing in tokenized commodities is by applying leverage. This is a bit like investor jargon for a broker loan and is entirely optional.

Other common leverage ratios are 1:5, 1:10, 1:25, 1:50, 1:100, and 1:200. This guide found that Currency.com offers default leverage of 1:25 on commodities, which means you could potentially open a $2,500 position with just $100. This can be adjusted by going into your account settings and thus – you can obtain even higher limits.

Let’s explain further with a quick example:

- You have $100 you want to allocate to tokenized wheat – valued at $185

- You think that this commodity is undervalued and will see an increase

- As such, you place a $100 buy order and apply leverage 1:50 leverage

- The underlying asset rises by 12% – you were correct

- Without leverage you made $12 (100 x 12%)

- As you applied the offered leverage of 1:50 – your gains are multiplied to $600

Your gains were boosted from $12 to $600 because with the added leverage you were able to multiply your initial stake by 50. This means instead of entering your investment with $100, you were able to increase this to $5,000.

As you can see, leverage can make a huge difference to your tokenized commodity investment! It’s very important that you realize the consequences of using this purchasing power. If wheat instead dropped in price, and you had placed a buy order – your loss is also magnified by 50x. This can lead to account liquidation so do proceed with caution.

Best Tokenized Commodities: The Advantages

In this part of our best tokenized commodities guide, we are going to run through some of the biggest advantages of investing in this type of instrument.

Invest in the Best Tokenized Commodities With Cryptocurrencies

One of the biggest bonuses of tokenized commodities has to be the fact you can buy them using digital currencies as well as fiat – it’s your choice. For instance, you might be someone who already has some Ethereum or Bitcoin investments sitting in your portfolio.

You can now use these cryptocurrencies to invest in commodities, rather than having to go through the hassle of first exchanging them to say dollars or euros.

Of course, this is only the case if the provider in question accepts this payment type to invest. At Currency.com, you can buy tokenized commodities with a plethora of payment types. We divulge which methods will be available in our review shortly.

Small Scale Tokenized Commodity Investments

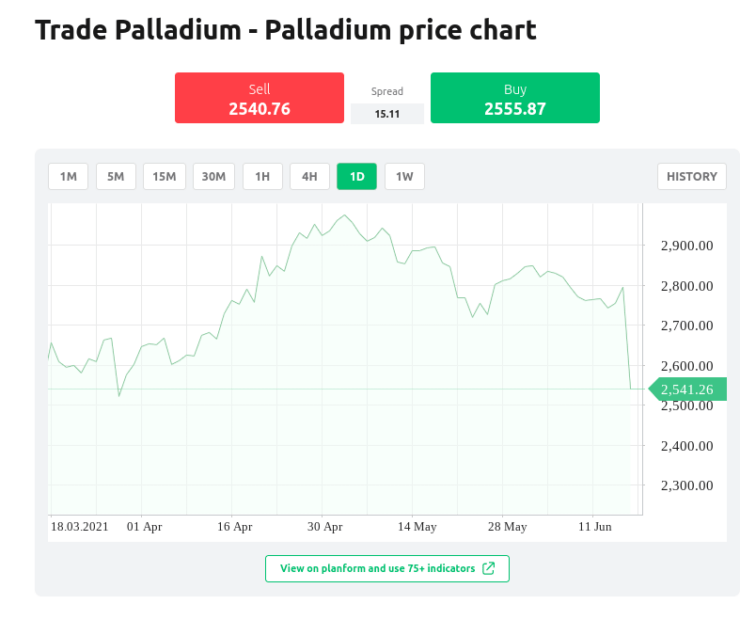

Let’s say you would like to invest in palladium, but don’t have the $2,740 needed to buy an ounce. This is where fractional investments come in – let us explain.

Sounds good right? See an example below:

- Palladium is priced at $2,740 per ounce

- Imagine you invest $100 in a buy order on the tokenized asset

- As such, you are actually investing in 3.64% of an ounce

- Weeks later palladium has increased to $3,288

- This shows a price increase of 20%

- You cash out your investment of $100 with a $20 profit

As you can see, you don’t need to be in the wealthy top 1% to invest in commodities. Furthermore, you can deposit from as little as $10 at Currency.com and spreads are super tight, which keeps costs down.

Tokenized Diversification

This brings us smoothly onto tokenized diversification. With the aforementioned option of fractional investments, you can create a mixed bag of commodities with a much tighter account balance.

Tokenized Commodities Vs Traditional Investing

Throughout this guide, we have mentioned the advantages of tokenized commodities. Next, we are going to clarify some major contrasts between conventional investing and the derivatives we are talking about today.

- Unlike traditional investing – tokenized commodities enable you to go short on your chosen asset. As we said, this means you can make gains from temporary decreases in value with a simple sell order.

- Tokenized commodities offer a wider scope of investors the chance to gain exposure to their chosen markets. This is more achievable thanks to fractional investments. As such, you no longer need to have thousands of dollars in the bank to buy commodities.

- When you are investing in a tokenized commodity- there is no need to worry about where you might safely store barrels or oil, or bars of gold. This is because instead of investing in physical gold online – you are simply buying the tokens that represent their value.

Before you can begin your journey into the world of tokenized commodities – you will need to find a credible platform to buy them from. We cover this in the section below.

Best Tokenized Commodities Platform 2023

When searching for the best place to invest in tokenized commodities, we have a strict list of criteria to follow:

- The platform must be regulated and take KYC and AMC rules seriously

- Low spreads and commission fees are a priority

- The platform should provide the option of fractional tokenized commodity investments

- Variety of payment types accepted

- A good selection of alternative tokenized markets to invest in

- Leverage offered on tokenized commodity purchases

We scoured the top providers in the space and found that the best tokenized commodities platform is Currency.com – not least because the broker excels in every point listed above.

See our full review next:

Currency.com – Best All-Round Tokenized Commodities Platform

Currency.com is the best all-round platform for various reasons. The provider has more than 2,000 tokenized markets. This includes forex, cryptocurrencies, indices, bonds - and of course commodities. The commission fees charged are super competitive here. Next, we checked out the spread on the most popular tokenized commodities. See our findings to give you an idea of what to expect.

Although, please note that spread is subject to change - gold 0.02%, Brent crude oil 0.04%, natural gas, 0.1% cocoa 0.3%, and wheat 0.7%. As you can see this is tight across both soft and hard assets. Furthermore, there are no worries about legitimacy at this exchange. Currency.com is regulated by the HTP of Belarus.

For those unaware, this jurisdiction regulates companies that base their business on blockchain technology. As such, you are in safe hands and your funds will be kept in a separate bank account to that of Currency.com. You can also rely on two-factor authentication here across payments, personal log-in details, and investment transactions carried out using API keys.

Notably, the vast majority of digital coins used to deposit will be stored in a cold wallet for safety. Furthermore, you can leverage your investments by as much as 1:500 on some markets such as forex - this will also depend on your level of experience. This platform accepts a whole host of different payment methods. This includes debit and credit cards such as Visa and MasterCard. You may also deposit and invest using bank transfer, Faster Payments, Bitcoin, Ethereum, and Yandex.

- Thousands of tokenized markets and accepts fractional investments

- Leverage of up to 1:500

- Resonable 0.05% exchange fee

- 3.5% deposit fee charged on credit and debit card payments

How to Invest in the Best Tokenized Commodities Today!

As we said before diving into the above review – you will need to sign up before you can access tokenized commodities.

See below a simple 5-walkthrough to buy tokenized commodities at using Currency.com.

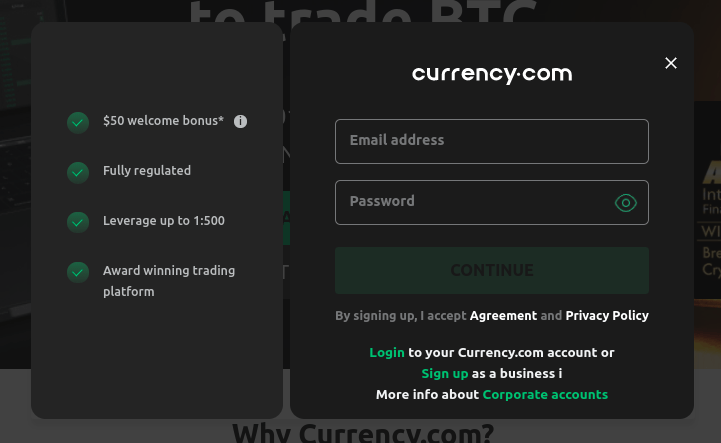

Step 1: Sign up at Currency.com

Go to Currency.com and look for the sign up button. This will bring up a box as seen below.

Enter your email address, desired password, and any other details required by the platform. Confirm once you are satisfied all information entered is correct.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

Step 2: Upload Some ID for Verification

As we said, Currency.com adheres to KYC for your protection. With this in mind, you will need to provide some proof of identity. When it comes to your name, you can upload a clear copy of your driving license or passport.

For proof of address, you can use an official tax letter, a bank statement, or a utility bill. Please note that this document must include a date of issue and your full address.

Step 3: Make a Deposit

If you want to start by using the free demo account at Currency.com, you will not need to make a deposit right away.

Of course, if you want to start investing in tokenized commodities as soon as you sign up – you will need to make a deposit. As we mentioned in our review, Currency.com accepts a multitude of payment types including Bitcoin and credit/debit cards.

Step 4: Find Your Preferred Tokenized Commodity

By this point, you should have a new account at Currency.com that is funded and ready to facilitate your new tokenized commodity investment.

Step 5: Place a Tokenized Commodities Order

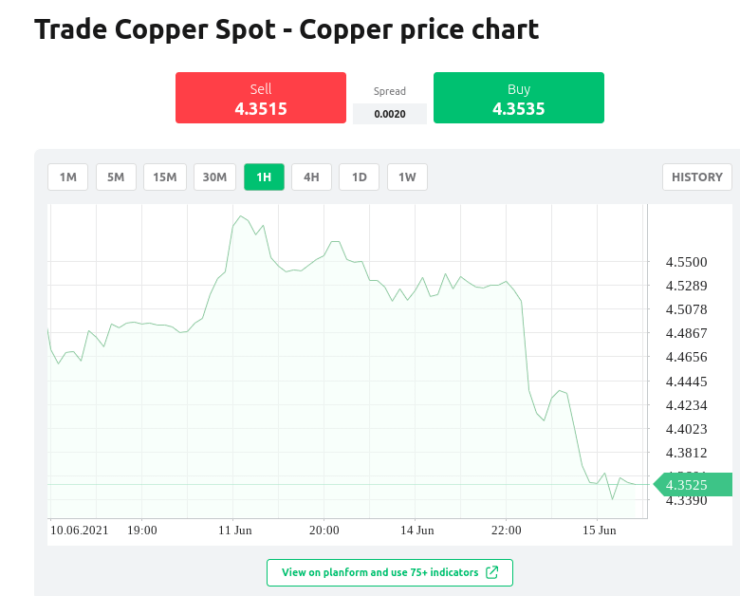

When you see the tokenized commodity you were looking for, click on it. This will take you to the asset’s dedicated trading page – as seen below.

Step 6: Sell Your Tokenized Commodities

When you feel like it’s the right time to cash out for a noteworthy profit – you can close your position with ease at Currency.com. Please note that whichever order you use to enter your tokenized commodity investment – the opposite will be required to cash out.

For instance – if you enter the tokenized copper market with a sell order – you will close that position with a buy.

Best Tokenized Commodities 2023: Full Conclusion

When it comes to investing, tokenized commodities seem to be the way forward. Rather than taking delivery of troy ounces of silver or gold – you can simply speculate on the future value of the asset.

Such derivatives also enable you to short your chosen asset, if you foresee a decline in value. Furthermore, at regulated exchanges such as Currency.com, you can apply as much as 1:100 leverage to tokenized commodities.

This means if you are correct, you can multiply your gains by up to one hundred times! Overall, we found Currency.com to be the best provider. The company is safe, offers super-tight spreads, thousands of tokenized assets, and low commissions across all markets.

Currency.com - Trade Tokenized Assets With Leverage of up to 1:500

- Thousands of tokenized assets supported - from stocks and forex to crypto and bonds

- Leverage of up to 1:500 - even for retail client accounts

- Super low fees and tight spreads

- Regulated and safe