ETFs are quickly becoming the most sought-after investment vehicle in the trading space. After all, they offer both retail and institutional traders an affordable way to diversify their portfolios.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Fancy buying or selling a basket of different stocks, currencies, or commodities via one ETF trade? If so, this guide details how to trade ETFs in the most effective way possible.

This covers everything from what ETFs are and how to place trading orders, to tried and tested trading strategies, top-rated brokers, technical analysis tips, and much more!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Understand the Basics of Trading ETFs

Before you can learn how to trade ETFs to the best of your ability, it’s important to have a solid understanding of the basics. As such, in the sections below, we cover the fundamentals of how ETFs work from an investment perspective.

What are ETFs?

Starting with the bare basics – ETFs (Exchange Traded Fund) are financial instruments that comprise a basket of different securities. All stocks or assets within the basket are purchased on your behalf, at a proportional weight. This cuts out the necessity for you to own each of the underlying assets in the index.

As such, ETFs are often seen as a better way to diversify than traditional trading. This is because, if an individual asset is performing poorly, this will likely be countered with a better performing one within the same basket. Not to mention the fact you are able to invest in a much smaller portion of the underlying stocks – which is great for those on a small budget.

ETF Markets

In terms of markets, ETFs come in all shapes and sizes. With that said, the majority of trading platforms offer indices and commodity ETFs – as they are the most popular.

See below a list of commonly traded ETF markets, with a few examples of each:

Stock ETFs

Some of the most popular stocks ETFs are as follows:

- SPDR DOW 30 ETF – reflects the price fluctuations of the Dow Jones Industrial Average

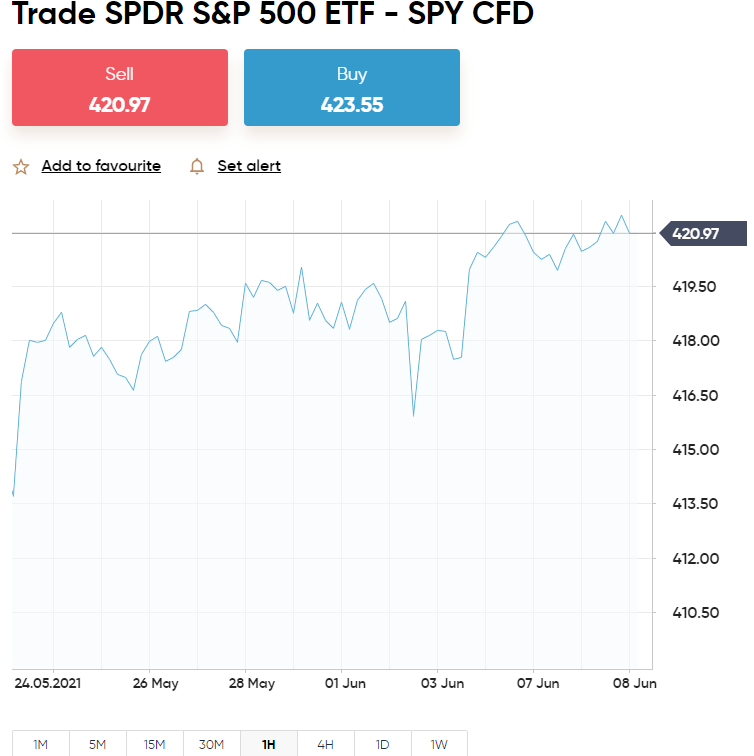

- SPDR S&P 500 ETF – tracks the S&P 500 index

- iShares Core FTSE 100 UCITS ETF – monitors the performance of the FTSE 100 index

Using the most traded ETF globally – the SPDR S&P 500 – in this case, you are quite literally purchasing a stake in each of the 500 stocks within the index. This is inclusive of big company names such as Alphabet, Amazon, Apple, Disney, Tesla, and Walmart.

Commodities

Many people also opt to trade commodity ETFs such as the following:

- SPDR S&P Oil & Gas Exploration & Production ETF – tracks US companies based in the oil and gas production and exploration industries

- VanEck Vectors Gold Miners ETF – reflects the gold market and mining industry

- United States Oil Fund – West Texas Intermediate crude oil.

- Teucrium Wheat Fund ETF – provides non-leveraged exposure to the wheat market

- The United States Natural Gas ETF – tracks natural gas futures contracts.

See below for alternative ETF markets.

International

- Vanguard Total International Bond ETF – monitors the performance of the Bloomberg Barclays Global Aggregate

- iShares MSCI EZU – this Blackrock ETF tracks Morgan Stanley’s MSCI EU index. The ETF concentrates on companies in Germany and France with a medium or large market cap

Sectors

- Healthcare Staples Select Sector SPDR Fund – follows the performance of healthcare stocks from the S&P 500

- iShares 7-10 Year Treasury Bond ETF – focussing on bonds with a 7 to 10-year maturity and provides access to US Treasury bonds

- ARK Fintech Innovation ETF – this New York-based ETF invests 80% of assets in fin-tech companies

- Fidelity MSCI Information Technology Index ETF – tries to mimic the performance of the MSCI USA IMI Information Technology Index, based in the US

As you can see, just about every asset can be traded using this vehicle. Ultimately, ETFs simply track the real-world price of the underlying assets and enable you easy access to the marketplace – via a single trade.

Example of How ETF Trading Works

To clear the mist, see further clarification of ETFs below, using the S&P 500 index as an example:

- In terms of weighting amongst the top 5 companies in the index – let’s say Apple is weighted at 6%, Microsoft at 5%, Amazon at 4%, Facebook at 2%, and Telsa at 1%

- If you invest $1,000 in the SPDR S&P 500 ETF – you own $60 of Apple shares, $50 in Microsoft, $40 in Amazon, $20 in Facebook, and $10 in Tesla

- The other $820 will be invested in the other companies within the index – in proportion to the underlying indices ranking

This means any change in these companies will likely have a bigger impact on the price of the SPDR S&P 500 ETF.

Let’s take a look at a practical example of how this particular ETF trade might look:

- Let’s say the SPDR S&P 500 ETF is priced at $350.00

- You believe the ETF is undervalued and will see a price increase – so you place a $500 buy order

- Sure enough, two months later, the SPDR S&P 500 ETF rises to $385.00

- This illustrates a price increase of 10%

- Happy with your gains, you decide to cash out

- From your initial $500 stake, you made a profit of $50

Had you believed the price of the ETF would fall in value in the above scenario – you would elect to ‘go short’ by placing a sell order. This way, had the ETF fallen by 10%, you would have made the same gains.

It is also important to note that many S&P 500 stocks pay dividends.

As such, see an example of ETF dividends for those unaware of how this works:

- In the above example, you invested $500 into the S&P 500

- Let’s say the S&P 500 pays out a 5% dividend yield at the end of year one

- As such, you are entitled to dividends totaling $25 (5% of your initial $500 investment.)

Any returns will likely be added to your trading account quarterly by your broker, as companies from within the ETF will pay out at different times of the month or year.

How to Pick an ETF

Baring in mind there are thousands of ETFs in the market, you’ll need to do lots of homework to find one that meets your needs.

With this in mind, we are now going to divulge key metrics to consider when looking for the perfect ETF for your specific interests.

Type of Asset

Before you are able to learn how to trade ETFs, you are going to need to think about your interests. In other words, what kind of asset class do you wish to trade or invest in? We listed the most commonly traded ETF markets above, so this should give you a clearer idea of what might be most attractive to you.

For instance, if you are looking to gain exposure to the biggest stock markets in the world, you will likely want to invest in ETFs that track the Dow Jones, S&P 500, and FTSE 100.

At top-rated trading platform eToro, you can access no less than 255 different ETFs from various sectors. This is a great way to diversify your portfolio, whilst avoiding overexposure to one marketplace. Plus, the broker is commission-free!

Risk Level

We talk about utilizing risk strategies in more detail later. However, when educating yourself on how to trade ETFs – you will notice different markets come with varying levels of risk. The general rule in this game is the ‘higher the risk, the higher the reward’.

Returns

When you have decided what type of ETF you would like to trade or invest in – you will need to consider your long-term goals.

For instance, if you are looking for huge gains you will be better matched to ETFs that monitor high-yielding bonds. Alternatively, you might consider growth stocks or emerging markets such as the iShares MSCI Emerging Markets ETF.

Growth or Income

When electing to learn how to trade ETFs, you will likely consider how you are going to make money from your investment. As ETFs are listed on public stock exchanges, their value will almost constantly fluctuate – as per supply and demand. As a result, if the ETF’s NAV (Net Asset Value) experiences an increase – you will make capital gains when cashing out on your investment.

As we said, if you are investing in index ETFs and the underlying stocks pay dividends, you will still receive them. When you get it depends on the time your broker of choice distributes the payment amongst investors. With that said, the vast majority of people opt to reinvest dividend payments to keep the ball rolling.

How are ETF Prices Determined?

The price of an ETF is determined by the value of the individual components within the basket. This in itself is mainly affected by supply and demand in the markets.

Take a look at some of the main deciding factors when it comes to the price of ETFs:

- Adjustments in individual stocks within the ETF: This includes finances, mergers, financial losses, changes in management, or gains leading to a change in share value

- A change in the value of commodities: For instance, it goes without saying that if you happen to be trading/investing in an oil ETF – if the price of oil fluctuates, as will your ETF

- Removal or addition of companies in the underlying index: This results in the ETF being re-weighted. As such, the price will be readjusted, according to the updated basket of securities

- Inflation or deflation: If commodity prices are on the rise and this leads to speculation on inflation – commodity-heavy indices will likely see a price fall. As such, so will the ETFs tracking it. In this case, seasoned traders will see this as an opportunity to go short.

Importantly, although ETFs track the value of the asset in question – funds will not always be able to mirror the exact price of the underlying asset or index. For example, there might be a slight variation in the weighting applied by the index and ETF provider. However, the prices will be very closely aligned like-for-like.

Short or Long Term: Trade CFDs or Invest in ETFs?

Two of the most common ways to access the basket of securities offered by ETFs are to trade CFDs or invest in the traditional sense.

See an explanation of both below

Trade ETF CFDs

The bulk of short-term traders opt to trade ETFs via CFDs. Contracts for Differences are a great way to intensify your exposure to the ETF of your choosing. Crucially, without the burden of taking ownership of the instrument in question.

For those unaware, ETF CFDs track the real-world value of the underlying ETF and will mirror that like-for-like.

See an example of ETF CFDs below:

- Imagine you are trading the SPRD Dow 30 ETF – with the price quoted at $315.00

- As such, the respective CFD is also valued at $315.00

- If the ETF sees a rise or fall in price of any amount – the CFD will mirror this

CFDs enable you to go short or long. This means that if you think the fund is about to fall in value – you can reap the rewards by shorting it.

Let’s clear the mist:

- If you have a feeling an ETF is overvalued and will fall in value – you need to create a sell order

- Further, if you enter the market with a sell order – exit with a buy order – and vice versa

Notably, CFDs attract ‘overnight financing fees’, also called ‘rollover’ or ‘swap’ fees. This is a small charge for every day your ETF CFD position is left open overnight. ETF provider eToro displays the daily rate as you enter information into the trading order box. This is because the fee changes depending on the ETF, leverage, and stake.

Invest in ETFs

If you like the idea of investing in ETFs, you will be automatically purchasing the basket of stocks or assets. In the traditional sense – but on an indirect basis.

Furthermore, unlike CFDs, traditional ETFs don’t come with overnight financing fees when leaving trades open overnight. As such, if you see yourself as a long-term trader, this is also highly conducive to a ‘buy and hold’ strategy. For those unaware, this is a strategy where trades are kept open for many years.

If it’s stocks you are interested in and you are still learning the ropes, you will likely choose an ETF that tracks the biggest companies on the respective exchange. For example, this would include the previously mentioned SPDR S&P 500 or iShares Core FTSE 100 UCITS ETF. If you were interested in gold ETFs, a popular long-term investment is the VanEck Vectors Gold Miners ETF – which monitors the Arca Gold Miners Index.

Part 2: Learn ETF Orders

To learn how to trade ETFs effectively, you need to have a good grasp of orders.

Buy Orders and Sell Orders

Starting with the most simple – ‘buy’ and ‘sell’ – this is as rudimentary as it gets. As we touched on, you can go long or short when trading ETFs. Depending on your prediction, this is the point where you choose between a buy or sell order – which lets your broker know where you stand.

To recap:

- If you think the price of the ETF you are trading will rise – place a buy order with your broker to go long

- If you think the opposite – place a sell order to go short

Market Orders and Limit Orders

Whilst you could be forgiven for thinking that’s your entry into the ETF market sorted – you also need to choose between a ‘market’ and ‘limit’ order.

Market Order

If you are happy with the price quoted on your ETF – you will stick with a ‘market’ order. Notably, there is going to be a slight disparity between the price you see upon actioning your ETF order, and the one you see later.

For instance, you might confirm the order at $310.00, but see $310.05 upon checking your portfolio. This is due to second-by-second price fluctuations in the ETF market and is unavoidable.

Limit Order

If you want to be price specific when entering your chosen market – use a limit order.

See an example below:

- Let’s say you are trading a Dow Jones 30 ETF via CFDs

- The trading platform quotes $310.00

- However, you do not want to enter your position until the ETF reaches $325.00

- As such, you need to select ‘limit’ order and set the value to $325.00

- The broker will execute your order as soon as Dow 30 hits $325.00

Crucially, this order will remain in place until either the price is reached, or you cancel the order manually.

Stop-Loss Orders and Take-Profit Orders

As you look to learn how to trade ETFs, you should think about your exit from the market as well as entry. With that in mind, see an example of ‘stop-loss’ and ‘take-profit’ orders below.

Stop-Loss Orders

As the name suggests, a stop-loss order will stop your losses from getting out of control.

See a quick example:

- This time, you are trading the iShares Dow Jones Select Dividend ETF – priced at $108.00

- You want to go short, and do not want to lose more than 4%

- As such, you need to set a stop-loss order at 4% above $108.00 – which equates to $112.00

- On the other hand, if you want to go long – set a stop-loss order at 4% below – which in this case, would be $104.00

Take Profit-Orders

Moving onto take-profit orders – instead of stopping your losses on ETF positions, this one will lock in your gains.

- Let’s say you want to make 6% on your ETF position

- If you are going short – set the take-profit order to 6% below the initial price

- As such, if you are going long – you should set the value to 6% above the initial price

The aforementioned orders are executed automatically by your broker of choice. This means you don’t have to worry about timing the ETF markets yourself.

Part 3: Learn ETF Risk-Management

In order to learn how to trade ETFs safely – you need to familiarize yourself with ETF risk management strategies.

Bankroll Management on ETFs

Most risk-management strategies are easy to implement, no matter what level of trading experience you have. Percentage-based bankroll management works as well on ETFs as any other instrument.

In a nutshell, this strategy entails setting yourself a limit for each and every trade – which is easier to work out as a percentage. This means that no matter whether you are having a bad week or a good week – you never stake more than that percentage. The vast majority of people learning to trade ETFs adopt a 1% or 2% strategy.

To clarify, if you have $10,000 in your trading account and decide on a 2% strategy, don’t stake more than $200 per ETF order. If your balance is $1,000 – don’t risk more than $20 – and so forth

Trading ETFs via a Risk and Reward Ratio

The risk-reward ratio needs very little explaining. Simply consider how much you are prepared to risk and for what reward.

- Let’s say that for every $1 spent on your chosen ETF, you expect to see $2 in return. – This is a risk/reward of 1:2

- Other popular strategies are 1:3, and 1:4

You can easily keep on top of this, and the previous strategy by performing a quick calculation before each trade. You may have also noticed that stop-loss and take-profit orders are ideal for making the most of this trading discipline!

Part 4: Learn How to Analyze ETF Prices

Learning how to analyze ETF prices is going to aid you in predicting the markets – and therefore making a profit.

Fundamental Analysis in ETFs

As we said, many factors can affect the supply and demand and therefore the price of ETFs. Carrying out fundamental analysis in ETFs involves keeping up to date with the latest global news, amongst other things.

This might include:

- Signing up for news subscription services, where you receive the latest economic and financial news in your inbox

- Studying macro-economic calendars and indicators

- Following changes in central bank policies

- Frequently visiting reliable financial platforms

Of course, unlike in the case of traditional stocks – there is no need for you to analyze each and every company’s earnings, profit margins return on equity, revenues – and so on and so forth. Instead, you simply invest in or trade a basket of securities and the ETF tracks them for you.

Technical Analysis in ETFs

Technical analysis when trading ETFs entails looking at price charts of past and present, trading indicators, and more. This gives you a much better idea of wider market sentiment, and therefore where the price of an ETF could be heading.

Below we have listed some of the most utilized technical indicators to consider when trading ETFs online:

- 50 and 200-Day Lines

- Up-Down Volume Ratio

- Trading Volume

- Relative Strength Rating

- Accumulation-Distribution

If you are a novice and have never traded before, you will find heaps of online resources to learn how to trade ETFs using technical and fundamental analysis here on our website!

Part 5: Learn How to Choose a Good ETF Broker

When you learn how to trade ETFs, you need a broker on your side to provide you with access to your chosen market and execute your orders.

If you are unaware of what makes a great ETF platform, see some key considerations below.

Regulation

Regulation should be one of the first things you look for when researching how to trade ETFs at an online broker. After all, there are so many shady platforms operating online, and so regulation keeps the industry clean and safe for all.

When a trading platform is regulated, you know that it must submit regular audits, have a transparent fee structure, follow KYC, and put your money in a separate bank account to that of company funds.

If a platform you are interested in holds a license from one or more of the following bodies – you are likely in good hands:

- ASIC – Australia

- FCA – UK

- CySEC – Cyprus

There are more in other locations, but the above mentioned are the most commonly used by ETF brokers.

Fees and Commissions

No two ETF brokers are the same. As such, it’s super important that when you are looking for a safe place to trade you also think about what fees and commissions you might be expected to pay. Any fees will affect potential profits.

Commissions are usually charged as a variable percentage. See an example of this below:

- The trading platform charges a 0.4% commission for each ETF trade

- You place a $1,000 buy order on an ETF that tracks the Dow Jones

- Now you must pay 0.4% to enter the market, which is $4

- A few weeks later, with your ETF position worth $1,700 – you decide to cash out

- Again, you need to pay 0.4% – only this time, that equates to $6.80

If you had carried out this trade at eToro, you would have saved $10.80 – as the broker charges 0% commission to trade ETFs

Spreads

As you likely know, the spread is the gap between the buy price and sell price of an ETF. This is a small fee charged by your broker to ensure the company turns a profit.

Put simply:

- The buy price is the highest value the market is willing to pay for the ETF

- The sell price is the lowest value the market is willing to accept for the ETF

See an example:

- If the buy price is $108.00

- And the sell price is $108.90

- The spread on the ETF is 90 cents

In the example above, your position must make gains of 90 cents per ETF stock to break even. Anything above and beyond that amount is profit from the trade.

Payments

It’s also a good idea to check out what payment methods will be available when looking for a good broker. If you want to learn how to trade ETFs sooner rather than later, a bank transfer is probably going to be the least attractive option. This is largely due to the number of days such deposits take to clear in your trading account.

The best ETF providers offer modern and convenient alternatives such as credit/debit cards and e-wallets. Social trading platform eToro accepts Visa, Mastercard, PayPal, Skrill, Neteller, and more depending on where you live.

Best Brokers to Trade ETFs Online

After intensive research, covering all previously mentioned metrics – see our top 3 brokers for trading and investing in ETFs below.

1. AvaTrade – Various ETFs and Heaps of Techincal Analysis Tools

AvaTrade offers access to various markets, including ETFs on a variety of assets, indices, and commodities. This includes the likes of the iShares NASDAQ Biotechnology, MSCI Europe, SPDR S&P Metals and Mining, and the iShares Russell 2000. All of which can be traded without paying a cent in commission fees.

This popular online broker is authorized by multiple jurisdictions -including the UK, Australia, South Africa, Japan, and more. Furthermore, if you like the option of trading on the move - there is the 'AvaTradeGO' app, which is free to download. The application also provides access to plenty of advanced trading tools and features to enable you to partake in 'social trading'.

If you like to keep things simple and would rather not download an app, you will still find heaps of useful features on the AvaTrade platform itself. This includes risk-management tools, multiple guides, demo portfolios, and trading simulations.

You can start trading ETFs by depositing as little as $100, and the online broker accepts a good amount of payment types. This includes credit and debit cards, bank transfers - and for many parts of the world e-wallets like Skrill, WebMoney, or Neteller.

- Minimum deposit $100 to trade ETFs

- Regulated in various juresdictions including the EU, UK, and Australia

- 0% commission all ETFs

- Pricy fee after 12 months without trading

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade ETFs Today – Walkthrough

By now, you are probably feeling clued up enough to begin to trade ETFs.

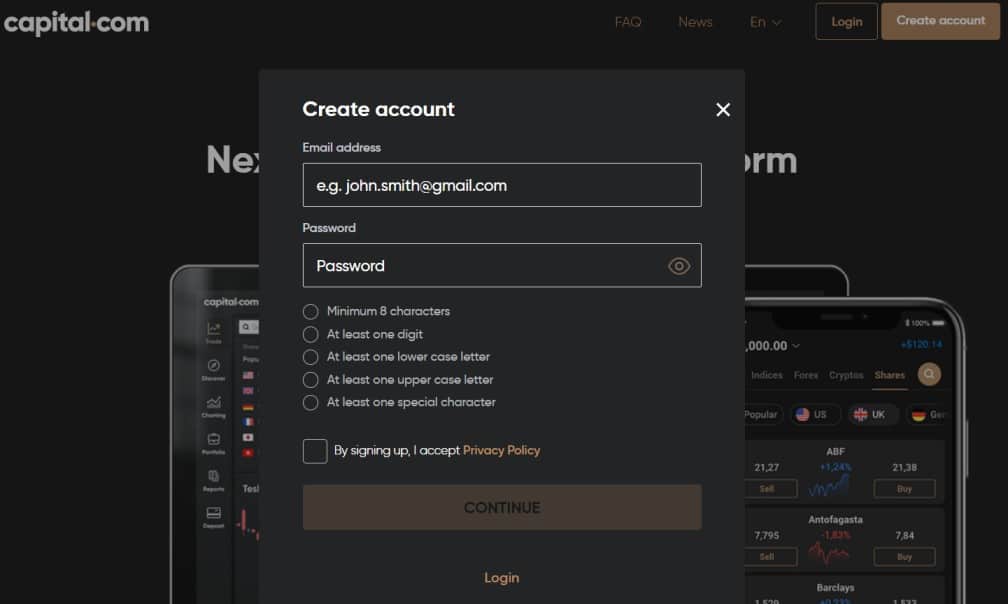

At this point, you will need to sign up with a regulated and reputable online broker to facilitate your ETF trades and investments. For our walkthrough, we are using commission-free ETF broker Capital.com

.

Step 1: Open an Account & Upload ID

Go to the Capital.com website and click ‘Create account’. The sign-up box you see below will appear. When it does, fill in the required details.

As per KYC, you will need to upload a clear copy of your passport or driver’s license. To prove your address, you can send a digital copy or photo of a recent bank statement or utility bill (such as a gas or electricity bill).

You may upload your proof of identification later, but if you have it handy you may as well complete this step now. If you don’t, you will be unable to make a withdrawal request or deposit more than $2,250.

Step 2: Deposit Some Trading Funds

You should now have your Capital.com account set up and confirmed. Now you can add some funds to trade ETFs.

Enter the amount you wish to deposit in the ‘Amount’ field and choose your preferred payment method from the drop-down list. Check over all of the information before hitting ‘Deposit’.

Step 3: Search for ETFs

Now that you have a new account with funds to trade with, you can search for an ETF. This couldn’t be easier at Capital.com, as if you know what you want to trade or invest in already – type it in the search bar.

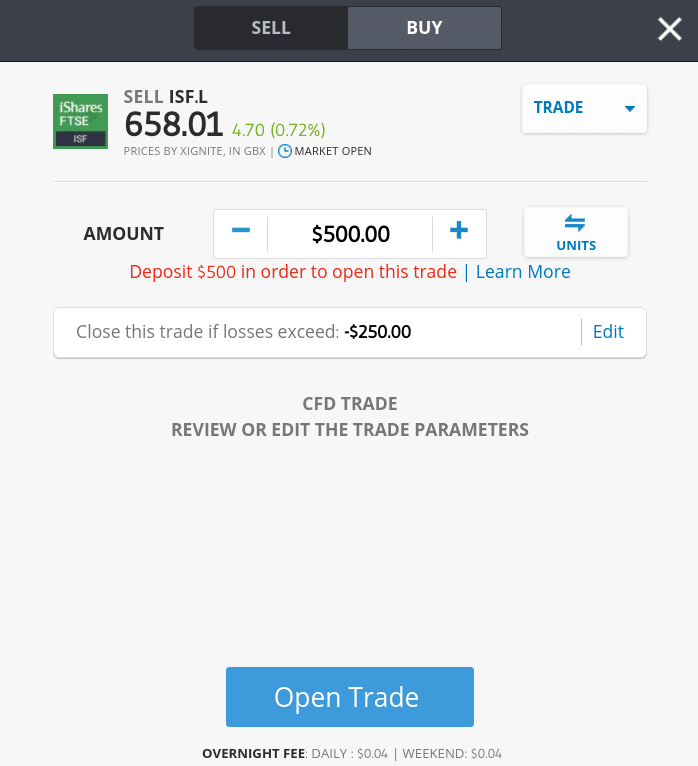

Here we are searching for the iShares Core FTSE 100 UCITS ETF, which tracks the FTSE 100 index.

If you are in need of inspiration, you can hit ‘Trade Markets’ on the left hand of your screen to reveal what markets are on offer. You will be able to narrow down your search from there.

Step 4: Start Trading ETFs

As soon as you see the ETF you wish to trade, click ‘Trade’ to place an order.

- Buy or sell: will the ETF rise or fall in value?

- Stake: how much are you willing to risk?

- Market or limit order: Stick with the market price, or choose your own?

- Stop-loss price: How much are you willing to lose before cutting your losses?

- Take-profit price: At what price should the broker lock in your gains?

Double-check all of the information in the order box and click ‘Open Trade’. Capital.com will execute your commission-free ETF order!

Learn How to Trade ETFs – The Verdict?

All in all, ETFs are a great way to diversify your trading portfolio. Without them, we wouldn’t have such easy access to huge baskets of blue-chip stocks, bonds, commodities, and other asset classes – from one single manageable investment.

When looking to learn how to trade ETFs, it’s crucial you do so via a regulated and well-respected broker. Capital.com

is a great all-rounder. Here you can buy and sell ETFs in a user-friendly and safe environment, thanks to licenses from ASIC, FCA, CySEC, and NBRB. The platform accepts heaps of payment methods and charges ZERO commission fees.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts