The U.S. dollar has experienced a sharp decline, reaching its lowest level in six weeks. This downward spiral was triggered by underwhelming U.S. job data, which has subsequently dampened expectations of a Federal Reserve (Fed) rate hike in December.

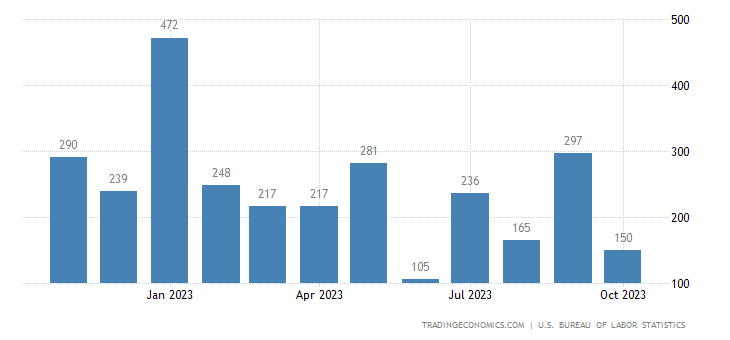

According to the latest statistics, the U.S. economy added only 150,000 jobs in October, falling significantly short of the market’s forecast of 200,000. Furthermore, the September job figures were revised downward from 336,000 to 297,000. This data suggests that the U.S. labor market recovery is losing momentum, a trend attributed to ongoing pandemic challenges and persistent supply chain disruptions.

The Dollar Falls Across Board

The dollar index, measuring the greenback against a basket of six major currencies, plunged by 1.04% to 105.05, marking its lowest point since September 20.

In contrast, the euro and pound surged against the dollar, gaining 1.04% and 1.35%, respectively, reaching six-week highs. The yen, which had recently hit one-year and 15-year lows against the dollar and euro, showed signs of recovery with a 0.7% increase to 149.36 per dollar.

The yen’s initial decline had been spurred by the Bank of Japan’s policy adjustments, perceived as less aggressive than anticipated. However, recent reports suggest that the BOJ governor, Kazuo Ueda, is planning to exit the ultra-easy monetary policy next year, adding a layer of uncertainty to the currency’s trajectory.

Furthermore, the dollar’s decline can be attributed to a drop in U.S. Treasury yields, which hit a five-week low of 4.484%. The U.S. Treasury Department announced smaller-than-expected increases in longer-dated bond supply. Fed Chair Jerome Powell’s recent statements were also less hawkish than initially expected, leaving room for a potential rate hike in December while acknowledging the economy’s resilience.

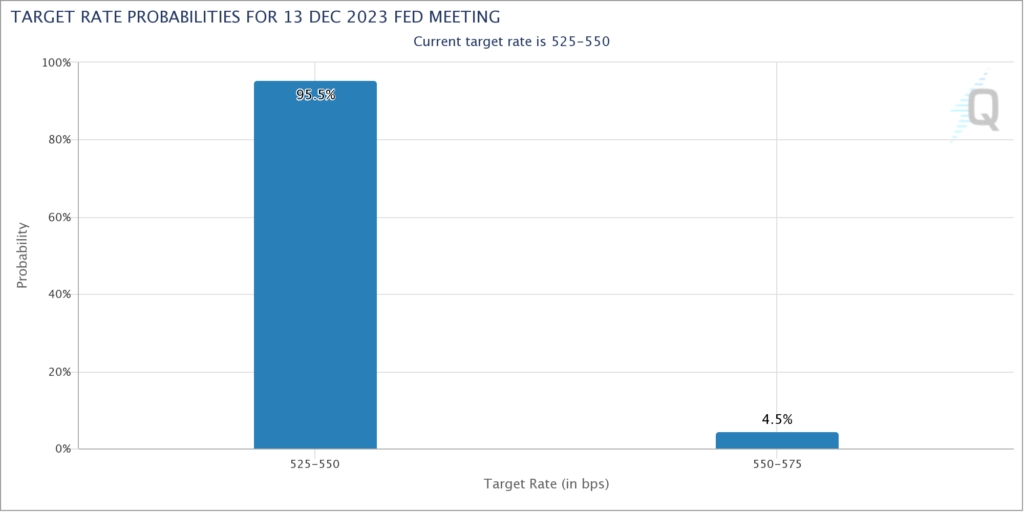

As a result, market sentiment has shifted, with the likelihood of a Fed rate hike in December dropping to less than 4.5%, down from nearly 20% just a day earlier, according to the CME’s FedWatch tool.

These developments highlight the growing influence of economic data and central bank decisions on currency markets, with investors closely monitoring these factors as they navigate the evolving financial landscape.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.