The dollar index, which gauges the greenback against six major currencies, dipped marginally on Friday as investors fine-tuned their portfolios to close out the month. Nonetheless, the dollar wrapped up the week on a higher note, underpinned by robust U.S. economic indicators and anticipations of a Federal Reserve rate hike.

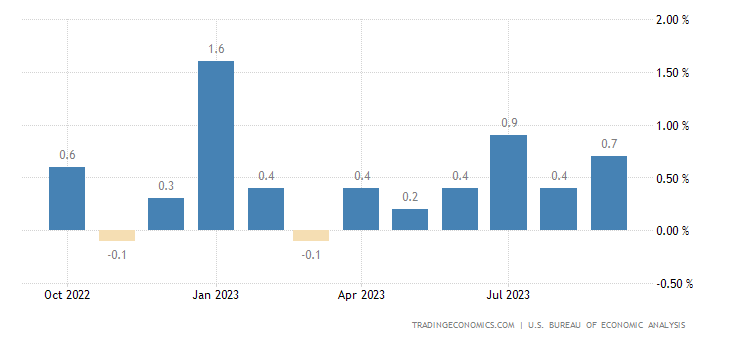

In September, U.S. consumer spending surged beyond expectations, providing a boost to third-quarter economic growth. Although the inflation rate inched up, it failed to sway the Fed from its ‘wait-and-see’ monetary policy stance. Traders are banking on the Fed maintaining steady rates in the short term, with potential increases later in the year if inflation proves persistent.

Meanwhile, the euro managed to regain some ground against the dollar on Friday, rebounding from a two-week low following the European Central Bank’s decision to keep interest rates unchanged and signal no immediate shifts in its stimulus program. Interestingly, business activity in the eurozone unexpectedly worsened in October, adding to the challenges confronting the region’s recovery.

The Australian dollar, often seen as a risk indicator, staged a comeback from a year-low as market sentiment displayed signs of improvement. The Aussie had been grappling with China’s economic slowdown and escalating tensions with Australia, its key trade partner.

The yen, on the other hand, weakened against the dollar, pulling back from the 150 per dollar mark, a level some analysts suggest could trigger intervention by Japan’s authorities. Japan’s Finance Minister conveyed a sense of urgency in responding to currency market developments. The Bank of Japan is set to meet next week, potentially leading to tweaks in its bond-yield control policy.

Dollar Slightly Weaker Across Board on Friday

Closing out the week, the dollar index showed a minor 0.16% decrease, settling at 106.45 on Friday, yet securing a 0.26% gain for the week. The euro managed to edge up by 0.2% to $1.0583. The Australian dollar displayed resilience, with a 0.32% rise to $0.6341.

Meanwhile, the dollar/yen pair dipped by 0.46% to 149.67, signaling market watchfulness ahead of the Bank of Japan meeting next week.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.