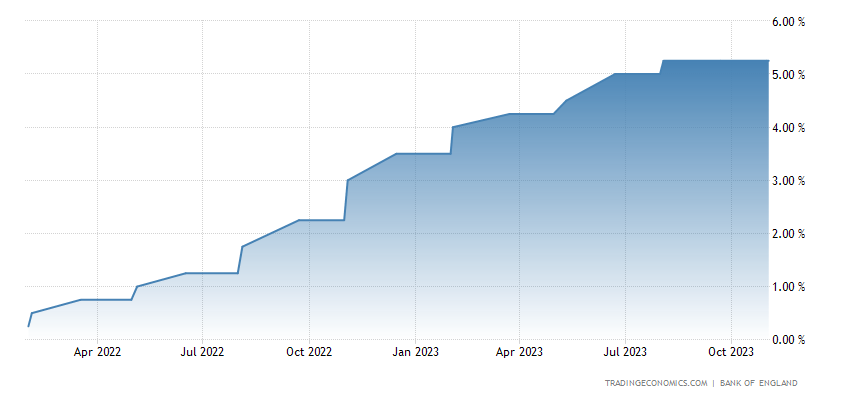

The British pound showed resilience on Thursday as the Bank of England (BoE) maintained its benchmark interest rates at 5.25%, marking the highest level in 15 years. This move was in stark contrast to the Federal Reserve’s recent stance, making waves in the global financial markets.

The BoE’s decision to keep rates steady was widely anticipated and came with a clear message: they were not inclined to cut rates in the near future, even amid a somewhat gloomy economic outlook for the United Kingdom. The Monetary Policy Committee (MPC) voted 6-3 in favor of maintaining the bank rate, reinforcing the central bank’s commitment to tight monetary policy as a means to control inflation. A poll by Reuters already forecasted this outcome.

In its official statement, the BoE indicated that the need for restrictive monetary policy would persist over an extended period. Moreover, they did not shy away from the possibility of further rate hikes if inflationary pressures persisted.

Pound Rebounds from $1.2095

As a result of this news, the pound surged, gaining 0.63% against the dollar, reaching $1.2225. This was a notable shift from its pre-announcement value of $1.2190. This rally marks a second consecutive bullish day as it pulls itself from the holds of the $1.2095 floor.

Meanwhile, the yield on the 10-year UK bond, or gilt, fell by 14 basis points to 4.393%, reflecting diminished expectations of imminent rate increases.

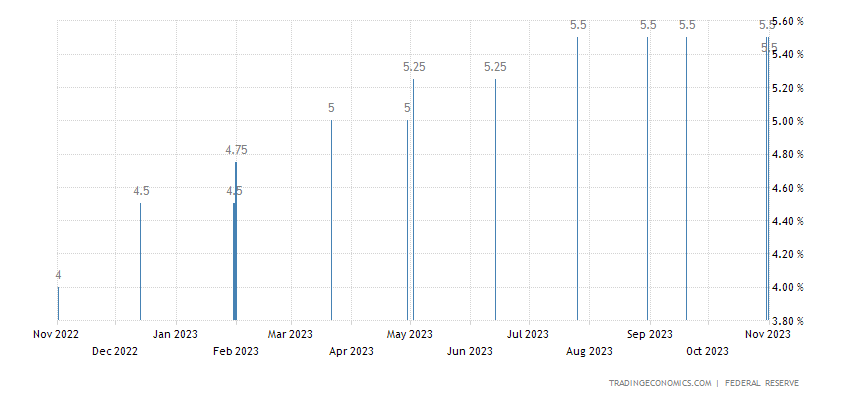

It’s important to highlight the divergence in monetary policies between the BoE and the Federal Reserve. While the BoE is maintaining its firm stance on interest rates, the Fed, in a recent announcement, held rates at 5.5% but kept the possibility of a December rate hike open. This divergence impacted the global financial landscape.

The Fed’s more dovish tone led to a weaker US dollar, causing a drop in US bond yields and propelling global stock markets, along with risk-sensitive currencies. The 10-year Treasury note yield fell by 24 basis points from its recent high, while the S&P 500 index saw a notable rise of 1.9%.

The BoE’s resolute approach in the face of economic uncertainties is an indicator of their commitment to keeping inflation in check, setting the stage for potential further rate adjustments if the need arises. This development is likely to influence currency markets and economic outlook discussions in the coming months.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.