In a setback for the British economy, the British pound experienced further declines on Wednesday as disappointing economic data cast a shadow over prospects for a rate hike by the Bank of England (BoE) in the upcoming week.

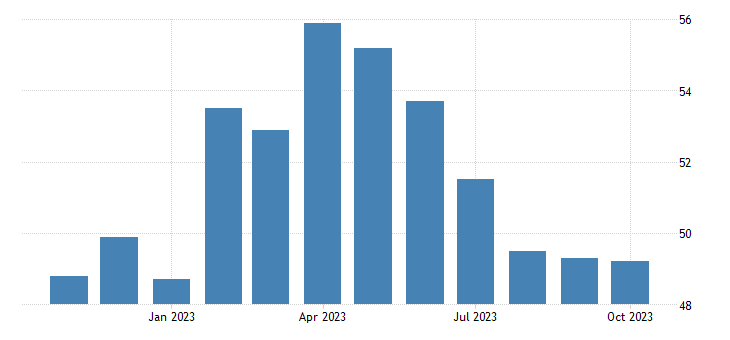

The most recent data from S&P Global’s UK Purchasing Managers’ Index (PMI) revealed that the services sector, a major contributor to the UK economy, contracted in October to record its lowest reading since January. The PMI fell to 49.2, slipping below the critical 50-point threshold that signifies economic contraction.

This concerning data follows a lackluster labor market report released on Tuesday, indicating rising unemployment and decelerated wage growth in September.

British Pound Declines Across the Board

On Wednesday, the British pound saw a 0.3% dip against the US dollar, settling at $1.2120, following a 0.7% drop on Tuesday. Additionally, it recorded a 0.18% slide against the euro, reaching 87.23 pence, teetering close to a 5.5-month low of 87.40 pence observed just last Friday.

BoE Policy Outlook

As the Bank of England prepares to announce its policy decision on November 2, expectations are that it will maintain its bank rate at 5.25%, according to a Reuters poll of economists. Money market traders have also shelved any projections of rate hikes for the remainder of this year and the next, given the easing of inflation pressures and a decelerating growth rate.

Nevertheless, certain analysts caution that the BoE may still need to consider tightening policy in the future. This is driven by the persistent inflation levels, which exceeded the 2% target and stood at 6.7% in September.

The Bank of England has even suggested that inflation could soar to 11.1% in October, marking the highest rate in 41 years. The path forward for the British pound and the country’s economic recovery remains closely tied to these critical indicators.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.