In a tumultuous turn of events, the British pound witnessed a sharp and worrisome decline against the euro and other major currencies on Friday. The catalyst for this precipitous drop can be attributed to a trifecta of concerns: disappointing retail sales figures, the ongoing Middle East conflict, and the impending U.S. interest rate hike.

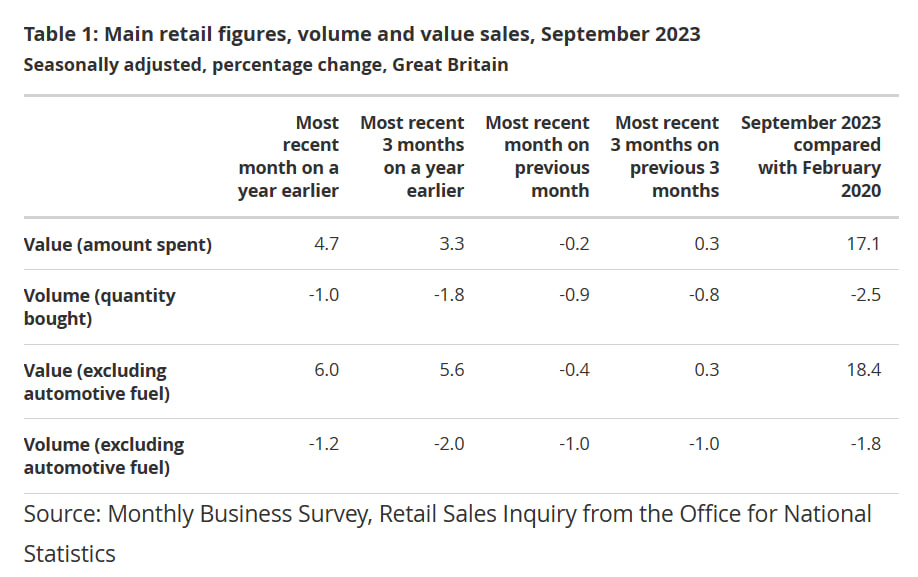

The Office for National Statistics (ONS) unveiled that retail sales volumes in the UK slumped by 0.9% in September, a stark contrast to the 0.4% increase registered in August. Economists had been cautiously optimistic, forecasting a modest dip of 0.2%. Alas, the ONS asserted that surging prices and pesky supply chain disruptions had decisively smothered consumer spending.

The ramifications of these dismal retail sales statistics have been profound. A looming specter of economic contraction now looms large over the UK as inflation and surging energy costs inexorably tighten household budgets. The UK’s second-quarter growth of 4.8% now appears as a fleeting triumph, as some experts brace for a potential 0.1% shrinkage in the third quarter.

British Pound Getting Smothered By the Franc

The embattled pound, unable to stave off the onslaught, has seen its value dwindle to its lowest point against the euro since May, reaching an unsettling 87.40 pence per euro. In tandem, the euro celebrated its most triumphant week against the beleaguered pound in a month.

The pound’s tribulations did not halt at the Eurozone’s doorstep; its struggles also extended across the Atlantic. Against the mighty dollar, the pound remained stagnant at $1.2148 on Friday, albeit above its six-month nadir of $1.2037, witnessed earlier in the month. Nevertheless, it lingers as a prey to the whims of global risk sentiment.

The ongoing Middle East conflict and rising U.S. yields have precipitated an intensified demand for safe-haven assets such as the dollar and the Swiss franc.

Furthermore, the pound faced a particularly bruising contest with the Swiss franc, sinking to 1.0782 francs per pound on Friday, marking its most feeble performance since September 2022. The pound, battered and beleaguered, has now incurred a 3% decline against the franc in October. This could potentially be recorded as its most adverse monthly performance since the bitter financial climate of June.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.