The British pound faced a downward spiral against the US dollar and the euro on Tuesday, driven by disheartening labor market statistics signaling a slowdown in the UK economy. This unsettling data casts shadows on the likelihood of the Bank of England (BoE) opting for interest rate hikes anytime soon.

Official reports unveiled a concerning decline, with average earnings (excluding bonuses) growing by a marginal 7.8% year-on-year in the three months leading up to August. This marked the first dip since January, casting doubt on the health of the labor market. The number of job vacancies also receded, further signifying a loss of momentum.

However, some key data, like the unemployment rate, has been deferred until next week, adding an air of uncertainty. The Bank of England remains a vigilant observer of the labor market, particularly focusing on wage trends, as it ponders the course of its rate hike cycle, which was paused in September following 14 consecutive increments.

Nomura, a global financial services powerhouse, has opined that the disappointing labor market figures may influence the BoE’s Monetary Policy Committee when deciding on interest rates, according to a Reuters report. They anticipate the possibility of a rate cut in the third quarter of the coming year, contending that the era of rate hikes has concluded.

Currently, money markets are pricing in a 77% probability that the BoE will maintain its existing rates at the forthcoming meeting in November.

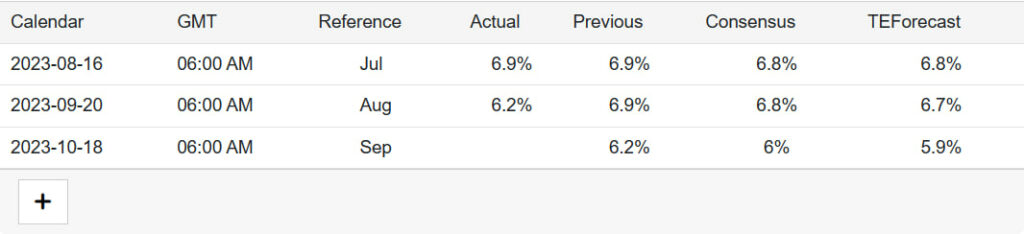

This week also bears significance for the UK economy with the impending release of the Consumer Price Index (CPI) data, a crucial gauge of inflation trends, scheduled for Wednesday.

British Pound Drops Across Board

As of the time of this article, the pound was down by 0.65% against the dollar, surpassing its low from the previous day and pushing below the 1.2140 mark. Against the euro, Sterling weakened towards the October 3 low of 0.8691 as the EUR/GBP pair rose by 0.47% in the London session.

As uncertainty clouds the British pound, market participants are keenly watching economic indicators and central bank moves, all of which may have a profound impact on the currency’s trajectory in the near future.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.