The British pound experienced a surge in value on Friday, driven by robust economic data indicating a faster-than-expected recovery from the COVID-19 pandemic. Despite this positive development, the pound remains on course for its weakest quarterly performance against the U.S. dollar in a year.

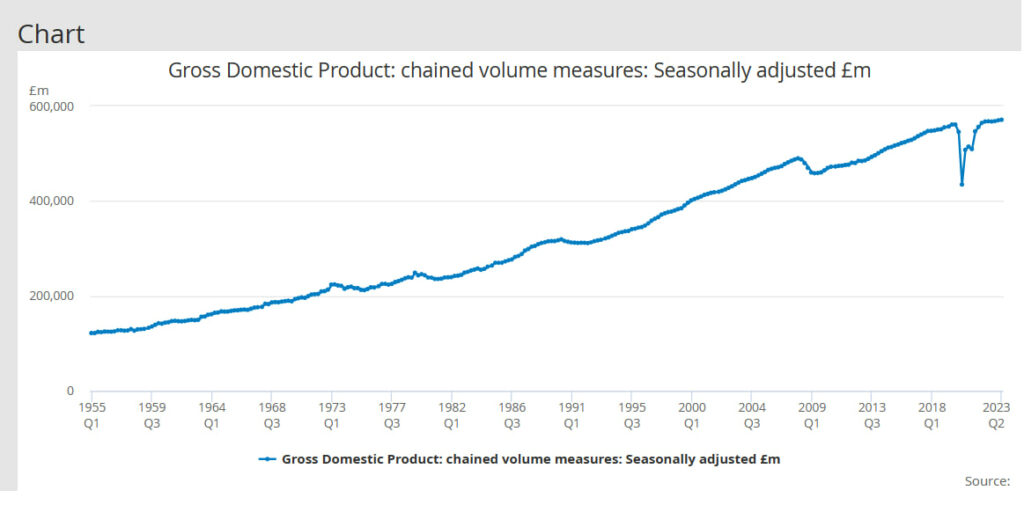

Data released by the Office for National Statistics (ONS) revealed that the U.K. economy expanded by a remarkable 1.8% during the second quarter of 2023. This growth not only exceeded expectations but also propelled the economy beyond its pre-pandemic size, achieving levels last seen in the final quarter of 2019.

Interestingly, this contrasted with the ONS’s previous estimate on August 11, which indicated that the U.K. economy remained 0.2% smaller than its pre-pandemic size, placing it at the bottom of the rankings among major advanced economies.

Pound Taps Four-Day High

In response to this encouraging news, the pound exhibited a bullish trend, reaching a session high of $1.2271, representing a 0.53% increase. However, over the course of the quarter, the currency witnessed a 3.3% decline in value. Earlier this week, the pound had dipped to a six-month low of $1.2110, largely due to the prevailing strength of the U.S. dollar, which was poised to record its strongest quarterly performance in a year.

The U.S. dollar’s resurgence can be attributed to a substantial uptick in U.S. Treasury yields, reflecting investors’ confidence that U.S. interest rates will remain stable for the foreseeable future. The 10-year U.S. Treasury note experienced a notable 45 basis point increase this month, dwarfing the eight basis point increase in 10-year U.K. gilt yields. This discrepancy diminishes the pound’s appeal to non-UK investors, who are enticed by higher returns available elsewhere.

Market analysis suggests that traders have not completely discounted the possibility of another interest rate hike from the Bank of England this year, assigning a 33% probability of an increase at the upcoming November meeting. Only a few weeks ago, traders were factoring in the likelihood of U.K. rates peaking at around 6% next year.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.