The British pound finds itself in a challenging position as the UK economy exhibits signs of deceleration while grappling with persistently high inflation.

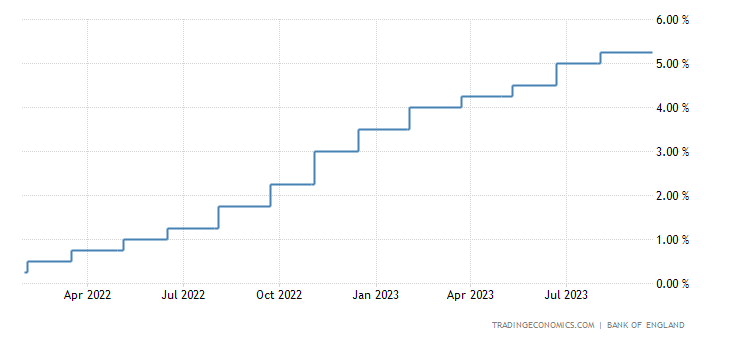

On September 21, the Bank of England (BoE) made a surprising move by maintaining its interest rate at 5.25%, marking a departure from a series of rate hikes initiated in November 2021. This decision came in light of consumer price inflation showing a three-month consecutive decline in August, contrary to expectations of a rebound.

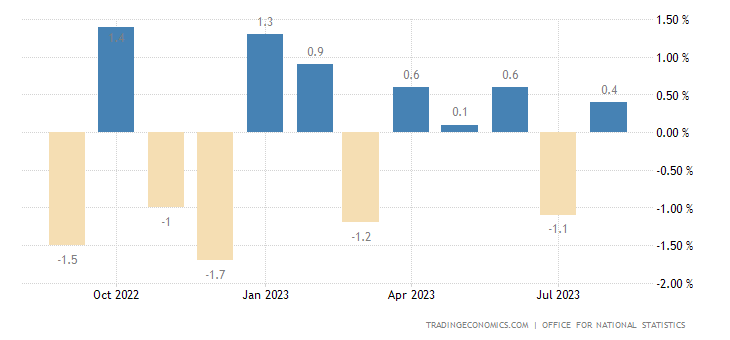

However, recent economic indicators paint a less optimistic picture. September saw a concerning 1.4% year-on-year drop in retail sales, while the Purchasing Managers Index (PMI) for all sectors contracted during the same month.

Consequently, the BoE has revised its GDP growth forecast for the third quarter of 2023 from 0.4% to a meager 0.1%, raising concerns about the looming threat of a recession—a scenario deemed improbable earlier this year when the UK outperformed some European counterparts.

What Does the Coming Week Hold for the Pound?

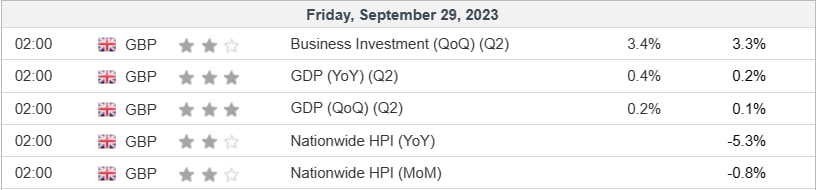

Regrettably, the forthcoming week offers little solace for the pound. The only major data release on September 29 is the final GDP estimate for Q2 2023, expected to reveal a modest 0.2% quarterly increase, unlikely to alter the currency’s bearish outlook.

Some analysts argue that the market may be underestimating the possibility of the BoE resuming rate hikes to combat inflation, which currently stands at a lofty 6.7%, the highest among major developed economies. However, this perspective is fraught with uncertainty and is unlikely to provide immediate support for the pound.

The pound’s prolonged depreciation seems poised to persist into the next trading week as it forfeits its interest rate advantage and confronts a bleak economic panorama. The BoE’s rate decision, underpinned by a split 4/4 vote, underscores the central bank’s policy uncertainty, potentially implying a prolonged rate-holding stance.

Notably, the pound has slumped to its lowest level against the US dollar since March 27, 2023, and the coming days may see further testing of lower depths.

Find out more about Learn2Trade with our FAQ. Click here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.