In a surprising turn of events, the U.S. dollar skyrocketed to its highest point in over half a year, hitting a robust 105.68 on the dollar index. This dramatic surge came in the wake of the U.S. Federal Reserve’s announcement that it plans to maintain its tight monetary policy even with no changes to interest rates.

While the Fed stood firm, other major central banks took different paths. The Swiss National Bank left rates untouched, sending the Swiss franc into a tailspin. The euro enjoyed its largest one-day gain since March, climbing by 1.01% against the franc, and the dollar followed suit, rising 1.03% against the Swiss currency.

Across the pond, the British pound dipped to its lowest level since March versus the dollar, a casualty of the Bank of England’s pending policy announcement and persistent economic uncertainties. Simultaneously, the Japanese yen faced a slump to its lowest point since November as traders anticipated the Bank of Japan’s commitment to its ultra-loose policy.

Dollar Enjoys Support from Flourishing U.S. Economy

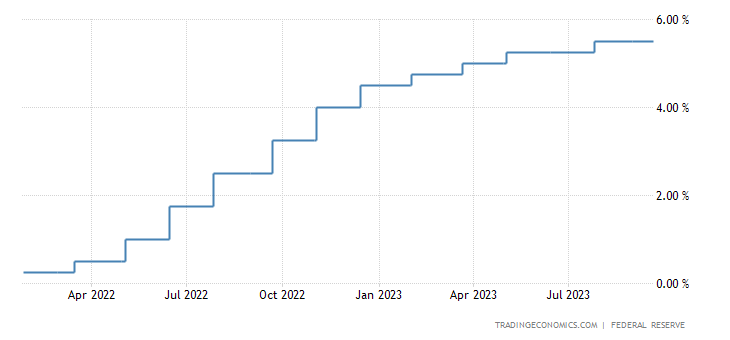

The Fed’s newfound hawkish stance reveals a strong belief in its ability to curb inflation without causing severe economic repercussions. Their revised projections unveil intentions to raise rates by 25 basis points this year and a whopping 50 basis points in 2024, defying prior expectations.

Backing the dollar’s resurgence are robust U.S. economic indicators. August’s retail sales surpassed expectations, and initial jobless claims plunged to a near 18-year low, reinforcing the perception of a flourishing American economy.

In summary, the dollar’s remarkable ascent stands as a testament to the Federal Reserve’s unwavering confidence in its economic strategies. As global central banks navigate uncertain terrain, the dollar emerges as a beacon of strength, fueled by solid economic data and a steadfast monetary policy.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.