In anticipation of the Federal Reserve’s policy meeting outcome, the dollar remained relatively stable on Wednesday. Meanwhile, the pound faced a notable setback, plunging to its lowest point in four months due to an unexpected deceleration in UK inflation.

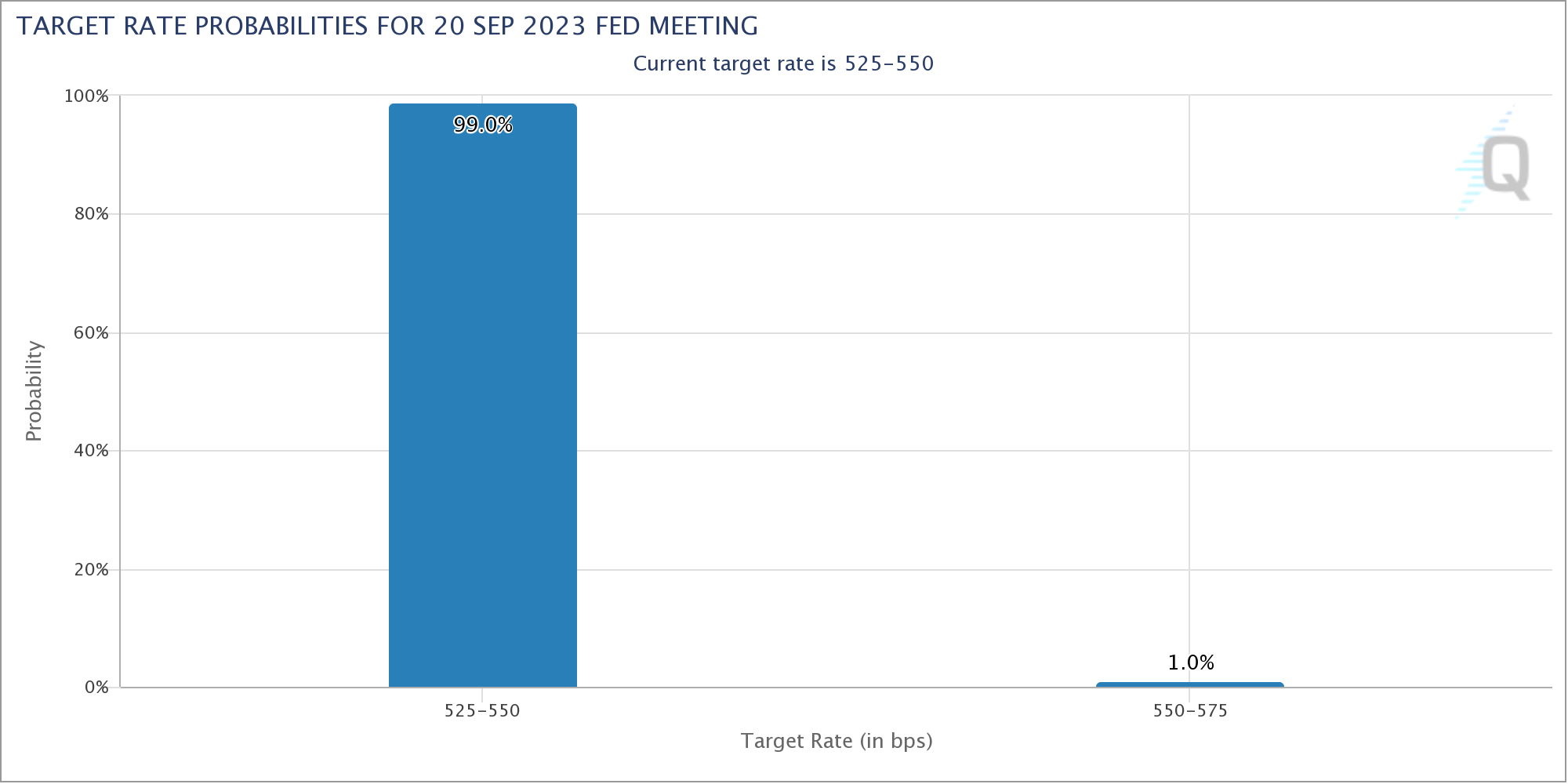

The Federal Reserve is widely anticipated to maintain its current interest rates, resting between 5.25% and 5.50%. However, market observers are eagerly awaiting any indications regarding the central bank’s future plans. The Fed has raised rates four times since December 2021, but with signs of global growth slowing and trade tensions brewing, some analysts predict a potential pause in the tightening cycle.

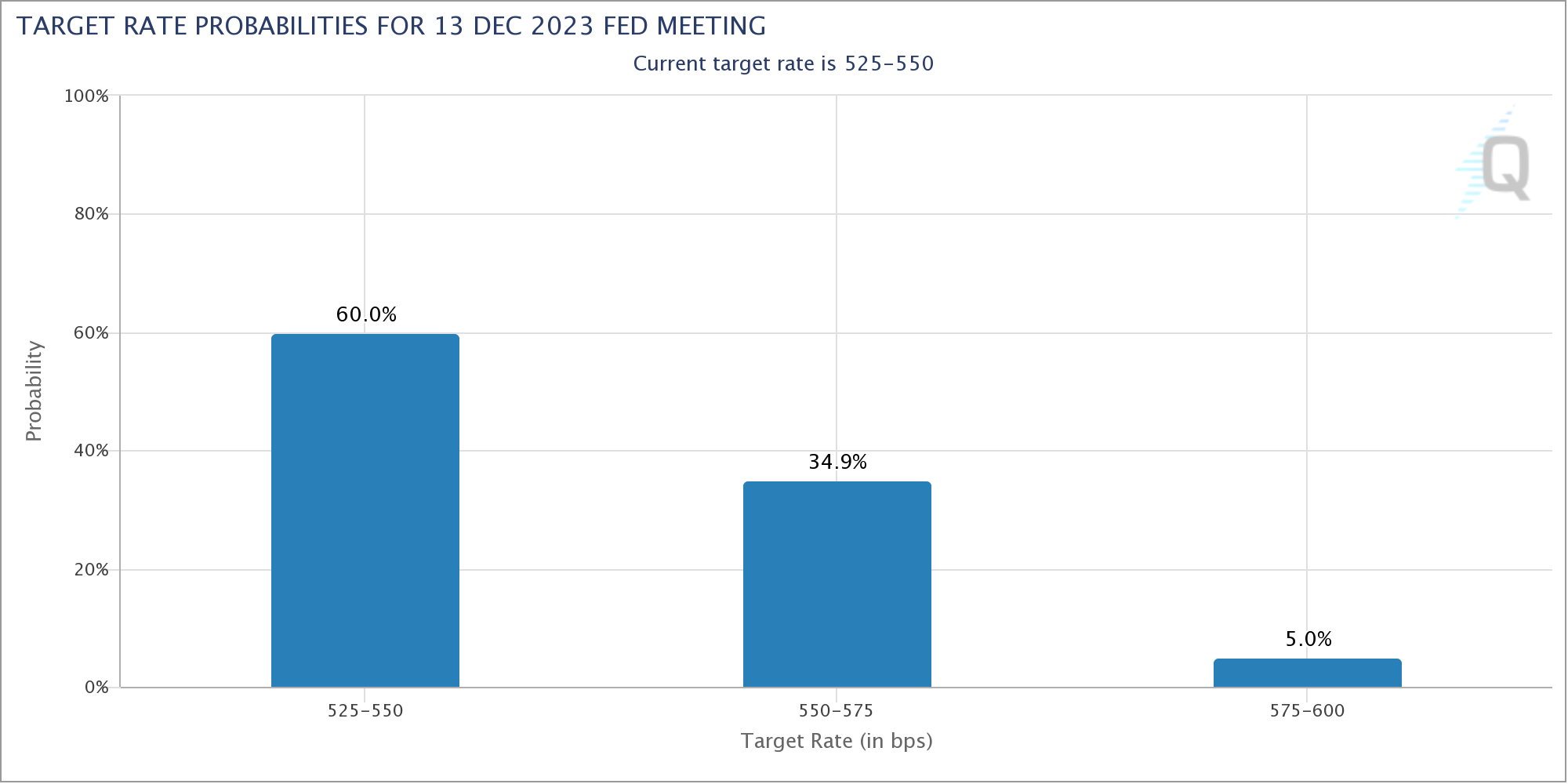

According to the CME FedWatch tool, futures markets are currently pricing in a 30% likelihood of a rate hike in November or a slightly higher 35% chance in December.

Dollar Index Holds Above 105 as Sterling Slumps to Multi-month Low

The dollar index, which gauges the greenback’s performance against a basket of six major currencies, held steady at 105.00, hovering near its highest point since July.

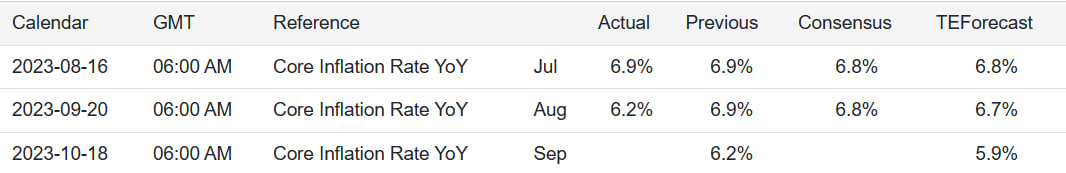

Conversely, the pound slipped by 0.24% to $1.2363, marking its lowest value since May 30. This decline followed the release of data revealing a more significant-than-expected ease in UK inflation during August.

In August, the annual Consumer Price Index (CPI) dropped to 6.2%, down from July’s 6.9%, falling below the anticipated consensus forecast of 6.8%.

This lower inflation figure has cast uncertainty over whether the Bank of England (BoE) will proceed with its expected rate hike on Thursday. The BoE has executed 14 consecutive rate hikes since December 2021, propelling rates to 4.75%, the highest level witnessed since 2009.

Currently, money markets are nearly evenly split, estimating a roughly 50-50 chance that the BoE will opt to maintain current rates this week, compared to a mere 20% chance on Tuesday.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.