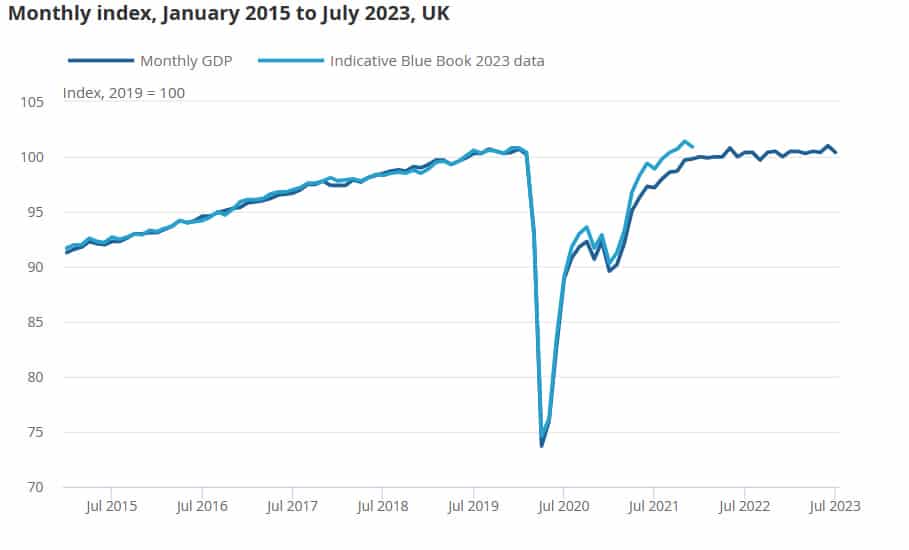

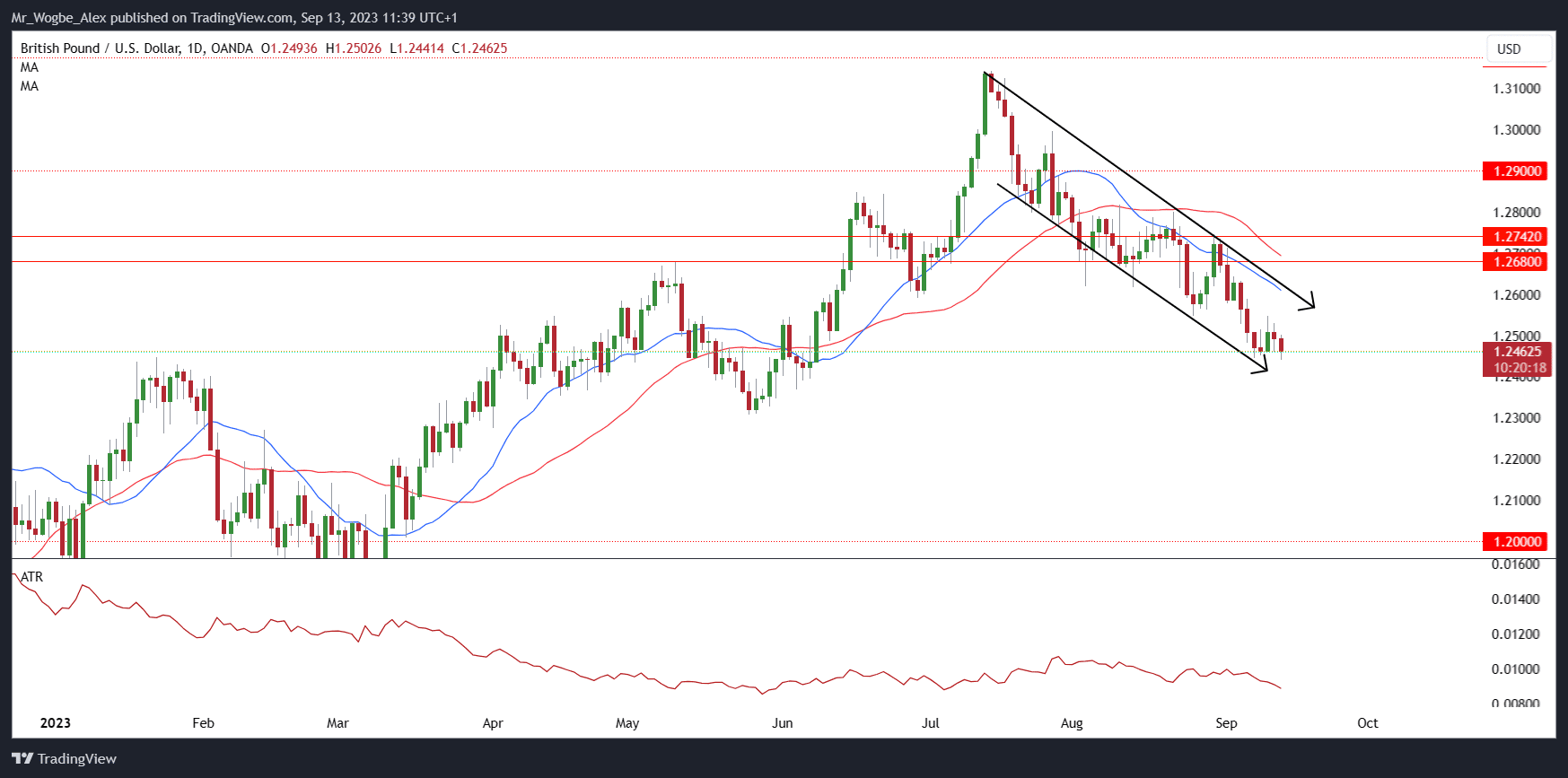

The British pound experienced a sharp decline on Wednesday, bottoming at a fresh three-month low of 1.2441. The catalyst for this tumultuous tumble was the release of official data by the Office for National Statistics (ONS), revealing that the UK economy had contracted by a substantial 0.5% in July. This decline marked the most significant monthly drop since December 2022, surprising analysts who had predicted a milder downturn of 0.2%.

The ONS attributed this disappointing performance to an array of factors, including strikes in vital sectors such as hospitals and schools, along with unfavorable weather conditions that hampered retail and construction activities. The convergence of these factors paints a bleak picture for the UK’s economic health, which has been grappling with the repercussions of elevated interest rates and surging inflation.

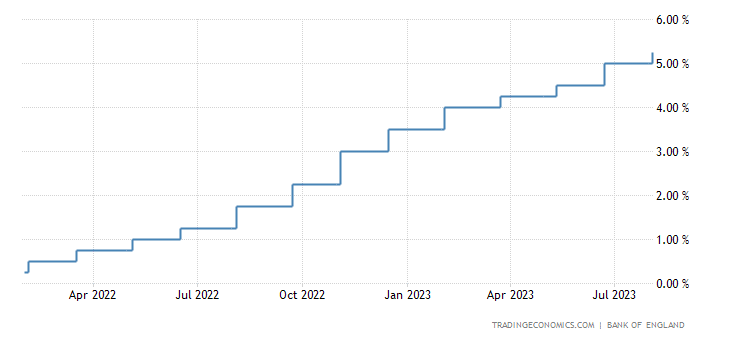

The Bank of England, in an attempt to curb inflation, has raised interest rates 14 times since December 2021, reaching a 15-year pinnacle at 5.25%. The central bank’s next policy decision, set to be announced next week, is a focal point of anticipation. Markets are currently pricing in a 75% probability of another rate hike, while a 25% likelihood of a pause lingers in the air.

Paul Dales, the chief UK economist at Capital Economics, commented on the July data to Reuters, suggesting that “underlying growth has lost momentum since earlier in the year.” He also emphasized that “the dampening effect of higher interest rates should be starting to be felt a bit harder now.”

British Pound Finds Three-Month Bottom

The currency market responded swiftly to these developments. The British pound took a notable hit, slipping by 0.42% against the US dollar and bottoming at $1.2441, marking its most significant daily decline since June 8. Meanwhile, the euro advanced by 0.29% against the pound, reaching 86.30 pence, a month-high level.

These recent events are keeping financial analysts and investors on high alert, with the fate of the British pound intricately intertwined with the UK’s economic trajectory and the Bank of England’s impending policy decision. The path forward for the pound remains uncertain as the country grapples with economic challenges and strives to regain its fiscal footing.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.