The U.S. Dollar Index (DXY) continues its impressive ascent, marking an eight-week winning streak with a recent surge past the 105.00 mark, its highest level since March. This remarkable run, not seen since 2014, is propelled by the steadfast rise in U.S. Treasury yields and the Federal Reserve’s resolute stance.

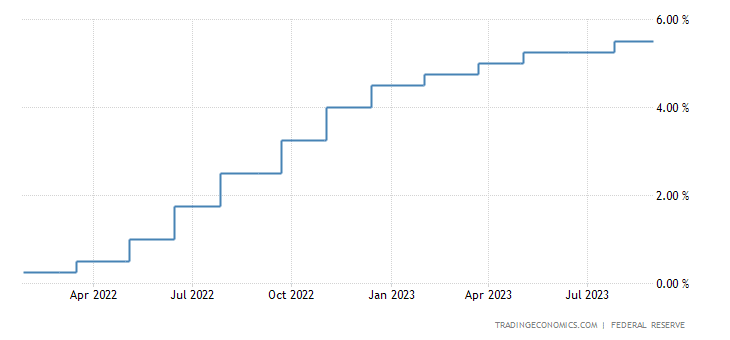

The Federal Reserve has embarked on an extraordinary journey, raising interest rates 11 times since 2022, now resting at 5.25% to 5.50%, the highest in over two decades. This unyielding approach aims to combat surging inflation, which has persistently outpaced the 2% target. And there are hints that this tightening cycle might not be at its conclusion, as the U.S. economy exhibits unexpected vigor and resilience.

Recent data unveils a summer resurgence in the U.S. economy, defying the headwinds from elevated interest rates. Consumer spending, which constitutes a significant chunk of GDP, remains robust, buoyed by tight labor markets and ascending wages. This potential inflationary dynamo may coerce the Federal Reserve to further flex its rate-hiking muscle later this year.

U.S. Dollar Traders Brace for Market-Moving Economic Events

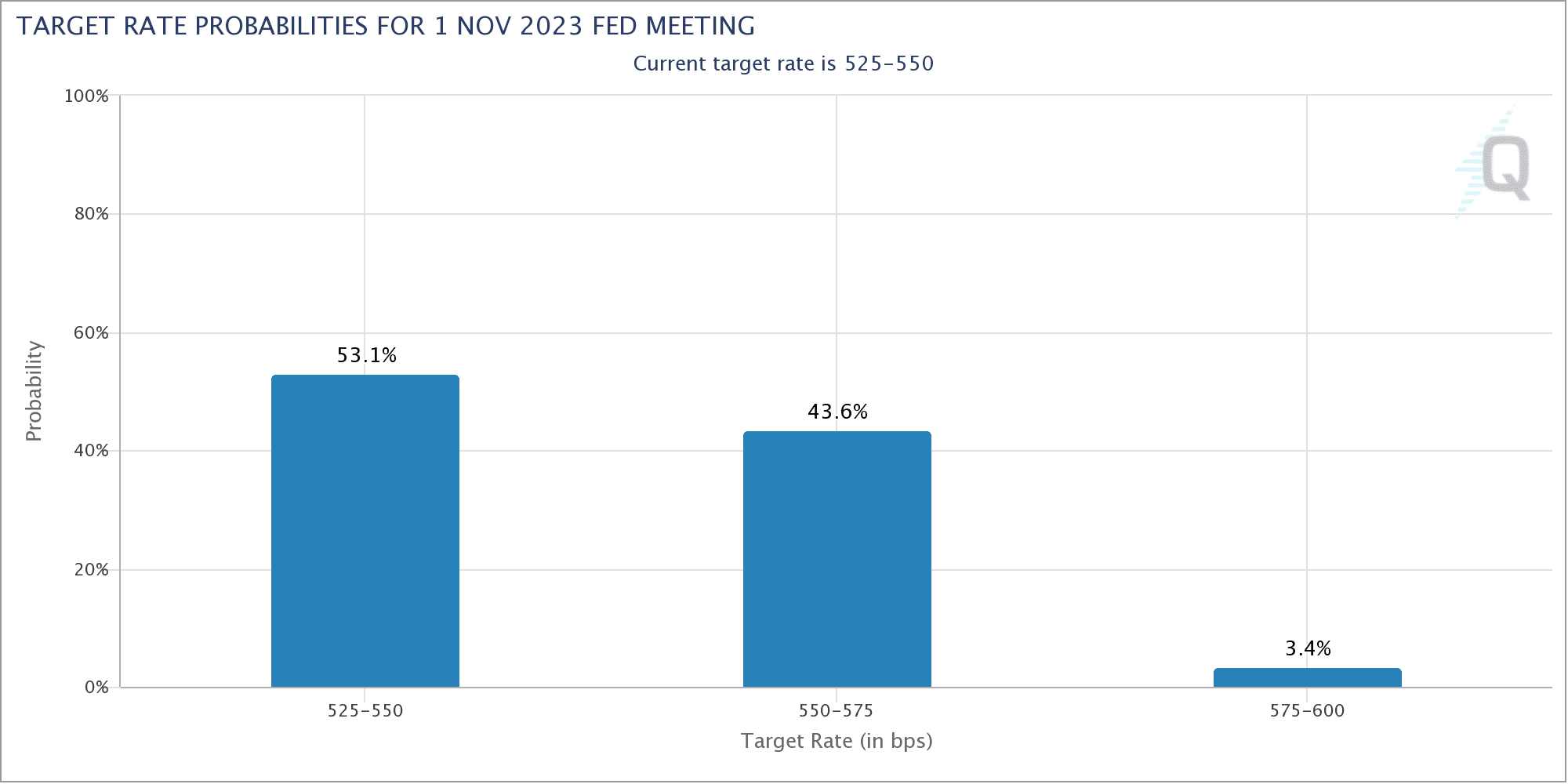

The next Federal Open Market Committee (FOMC) meeting is slated for September, with no policy shifts anticipated. However, the November meeting looms as a potential stage for another quarter-point rate hike, with markets pricing in a 43.6% probability. This likelihood could amplify if the upcoming U.S. inflation report unfurls higher-than-expected price surges.

All eyes are on the U.S. Bureau of Labor Statistics as it prepares to unveil the August consumer price data this Wednesday. Analysts are predicting a 0.6% monthly and 3.6% yearly rise in the headline Consumer Price Index (CPI), while the core CPI is expected to nudge up by 0.2% monthly and 4.3% yearly.

A favorable deviation from these forecasts would fortify the U.S. dollar’s position, further solidifying the case for additional policy tightening. Conversely, a contrary outcome may exert downward pressure on the greenback, prompting a correction after its remarkable rally.

The U.S. dollar’s ascent remains a compelling narrative, driven by the Fed’s hawkish posture and the nation’s resilient economic performance. As the world watches, all eyes are on the forthcoming inflation data and the Federal Reserve’s impending decisions, which will undoubtedly continue to shape the trajectory of the greenback.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.