In a week marked by anticipation and economic scrutiny, the U.S. dollar is poised for its first weekly loss in six weeks. Investors across the globe are currently digesting the recently released U.S. jobs report for August, which is expected to wield substantial influence over the Federal Reserve’s decision regarding the timeline for tapering its stimulus measures.

Throughout the week, the greenback displayed a mixed performance against key currencies, weakening against the Japanese yen and the Chinese yuan but gaining ground against the euro and the pound. The nuanced shifts in its value mirrored the cautious tone emanating from central bankers in Europe and Britain, who expressed reservations about tightening their respective monetary policies. Learn2Trade already covered these topics in previous reports.

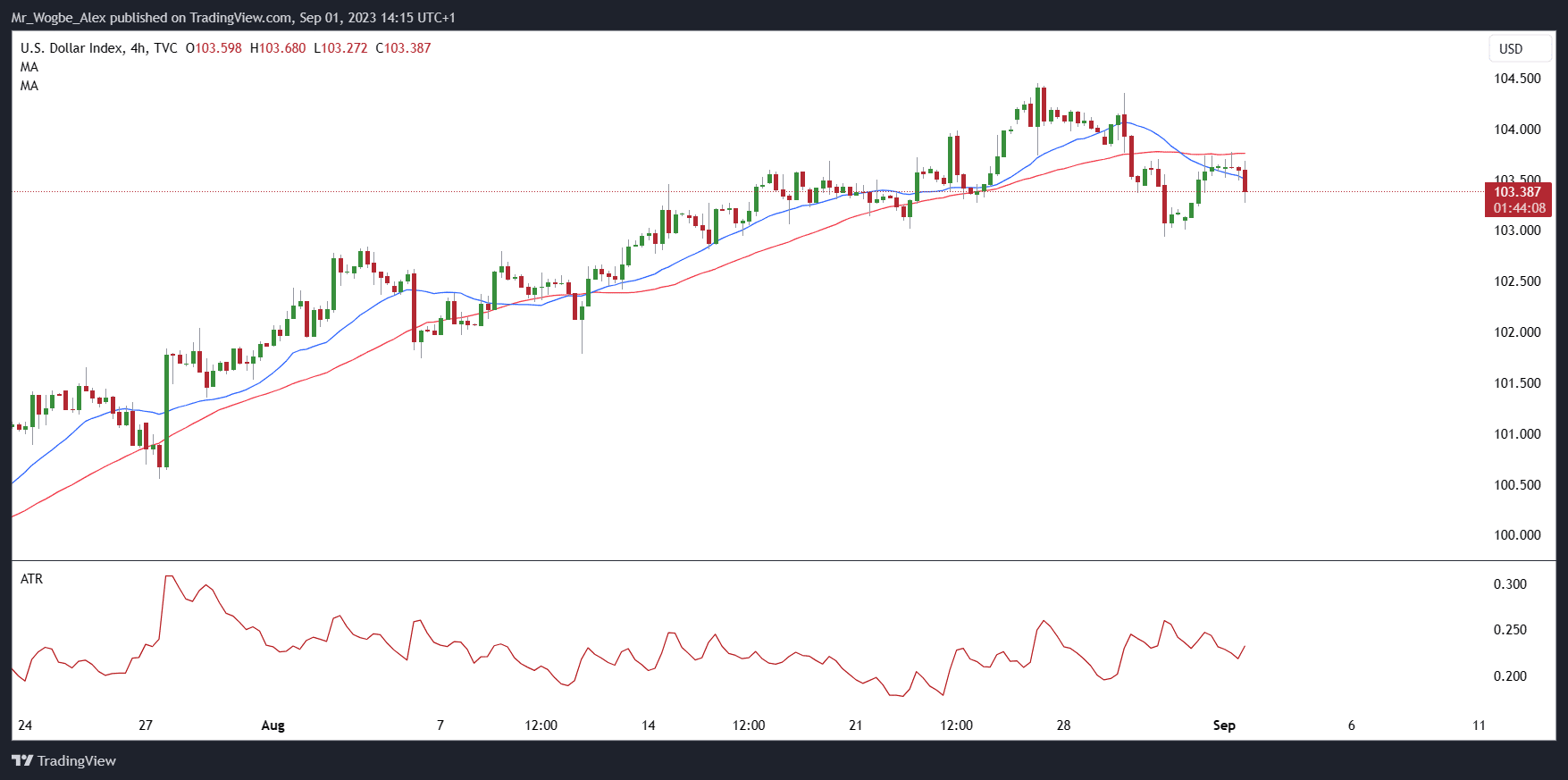

The U.S. dollar index, which assesses the currency against six major counterparts, held steady at 103.50 by the week’s end, following a 0.72% dip this week. Despite this week’s setback, it demonstrated an impressive 1.86% upswing in August, marking its most robust monthly performance in three months.

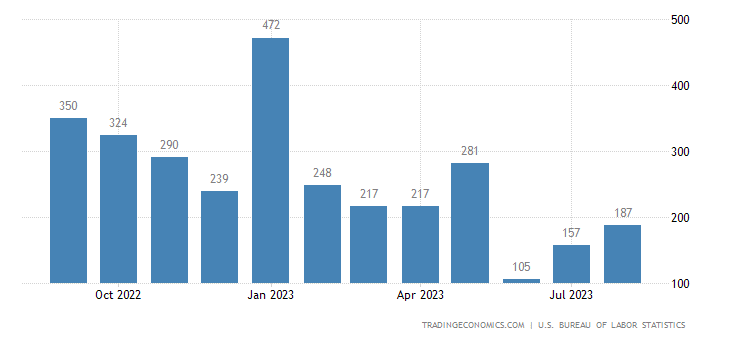

U.S. Economy Adds 187K New Nonfarm Jobs

The pivotal U.S. jobs report showed an increase in U.S. jobs, with 187,000 new jobs added to the labor force. This beat economists’ expectations of 170,000 new nonfarm payrolls in August.

The better-than-expected job numbers suggest that the U.S. Federal Reserve could go ahead with its plans to commence the reduction of its $120 billion monthly bond purchase later this year.

Top Asian Currencies Trump the Dollar

The Chinese yuan surged to its highest value since August 14, bolstered by China’s central bank’s decision to reduce the required foreign exchange reserves held by banks. This move injects additional liquidity into the system, fostering increased lending and economic growth. Consequently, the dollar edged down by 0.2% to 7.2464 yuan.

The Japanese yen also reaped benefits from reduced U.S. Treasury yields, diminishing the dollar’s allure as a safe-haven asset. On Friday, the dollar had fallen to its lowest point against the yen since August 11 at 144.44, down by 0.5% on the day.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.