The Japanese yen encountered a challenging week, experiencing losses against both the euro and the US dollar. The upcoming Bank of Japan (BoJ) meeting and its uncertain stance on the Yield Curve Control (YCC) policy have left the currency on uncertain ground.

Japanese officials are closely monitoring the foreign exchange (FX) markets and making data-driven decisions. The week ahead will be dominated by crucial central bank meetings, including those of the European Central Bank (ECB), the US Federal Reserve (Fed), and the Bank of Japan (BoJ).

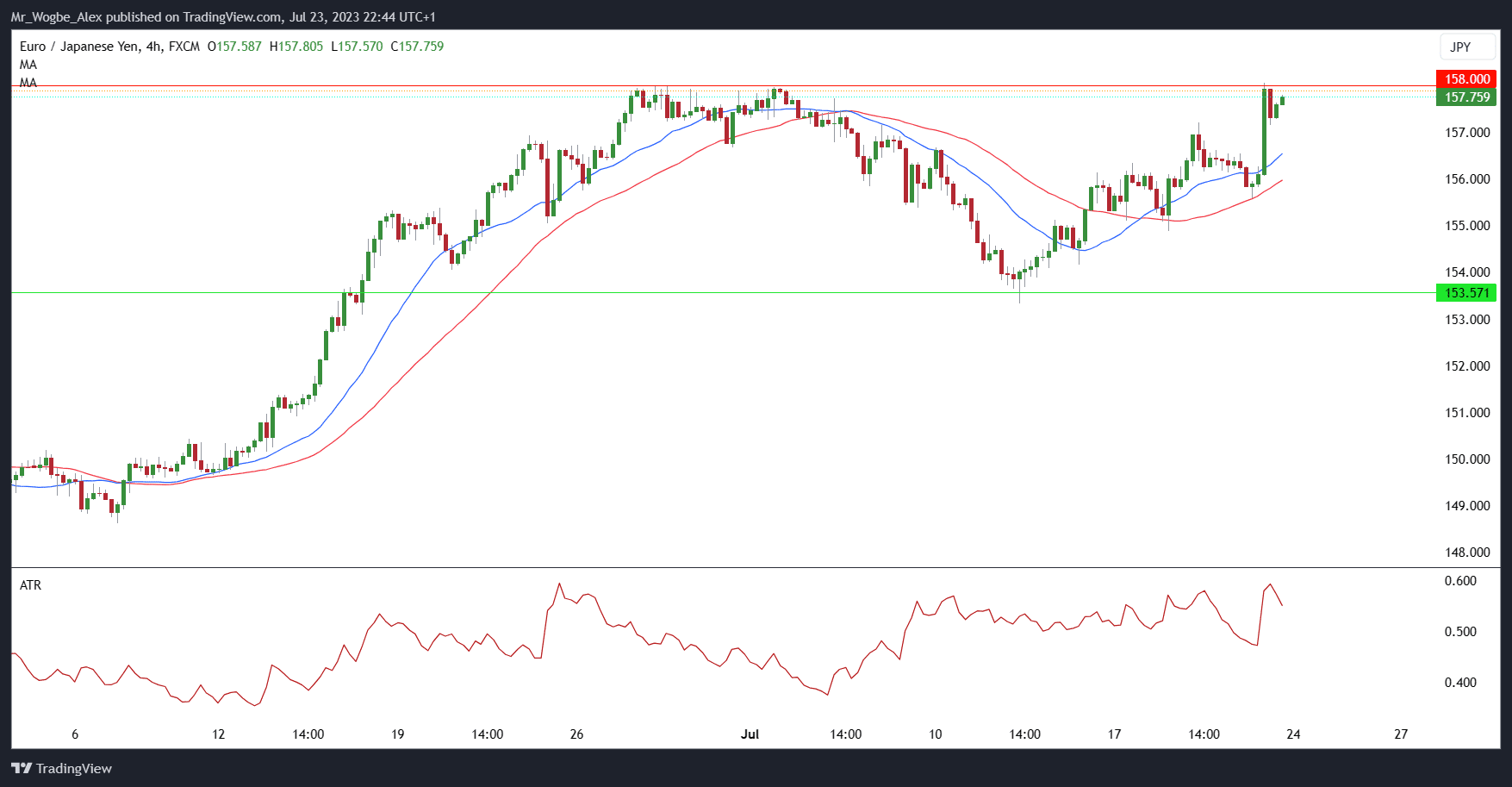

Yen Reaches YTD Highs Against Euro as BoJ Maintains YCC Policy

EUR/JPY soared to its previous year-to-date (YTD) highs of around 158.048 as the BoJ signaled its intent to retain the Yield Curve Control policy at the upcoming meeting. This development contributed to the yen’s struggles against the euro, leaving market participants pondering potential policy shifts.

According to Reuters, Japanese authorities have kept a watchful eye on the FX markets, emphasizing the urgency of the situation. While Governor Ueda’s dovish rhetoric hinted at possible policy normalization, the current focus is on an ongoing policy review, expected to conclude within 12–18 months. The lack of clarity from BoJ officials has left analysts uncertain about the future direction.

Crucial Central Bank Meetings Ahead

As the ECB, Fed, and BoJ gear up for their respective meetings, market participants brace for potential developments. The projections and rate decisions from these central banks will be pivotal for the yen’s performance in the days to come.

In the meantime, debates persist among market participants regarding whether the Fed has reached its peak rate. Similarly, recent comments from ECB officials indicate uncertainty about the need for further rate hikes this year. A perceived pause or peak rate from these central banks could impact the yen favorably and influence the euro and US dollar.

With the BoJ’s policy direction uncertain, the only hope for yen bulls lies in the possibility of FX intervention measures. The central bank’s cautious approach has left investors guessing about potential currency movements.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.