The US dollar took a nosedive over the week, reaching new multi-month lows against its global counterparts. This dramatic downward spiral, combined with a breach of crucial support levels, signals a prevailing bearish sentiment towards the once-mighty greenback.

Investors have reacted strongly to the latest jobs report and Consumer Price Index (CPI) data, with an overwhelming belief that the US Federal Reserve is rapidly approaching the end of its tightening cycle.

Rate Hike Expectations

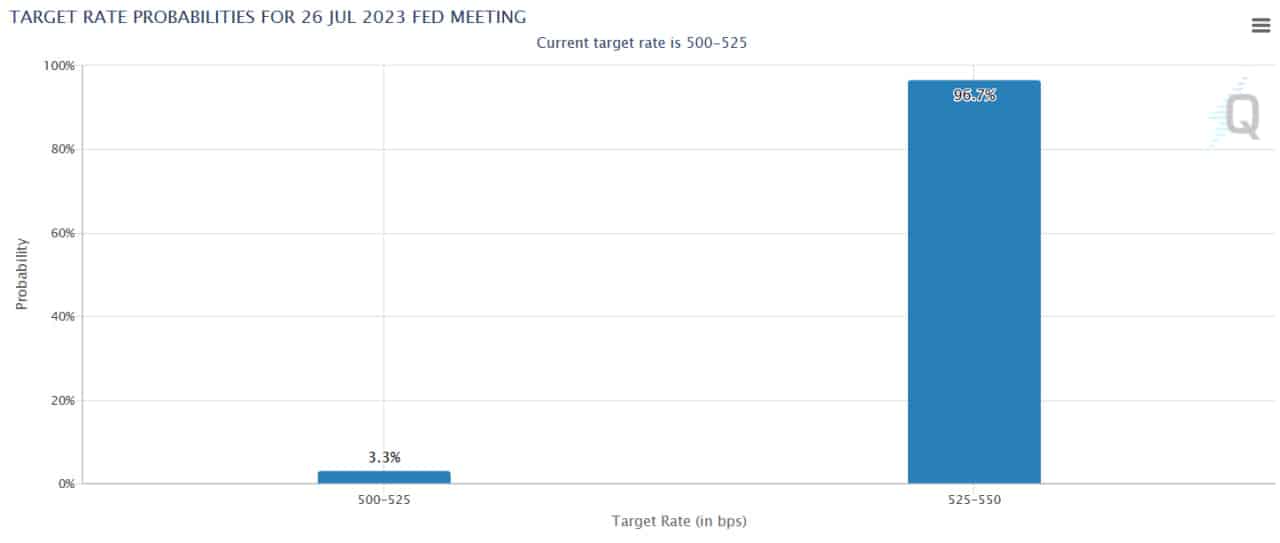

According to the DailyFX, the CME FedWatch tool reveals that rate futures are now pricing in an astonishingly high probability of a final 25-basis point hike at the imminent July 25–26 meeting, followed by an anticipated series of rate cuts commencing in early 2024.

Remarkably, these market expectations starkly contrast the Federal Reserve’s own projections, which foresee two rate hikes before the year’s end and no rate cuts until the distant year of 2025.

While inflation stubbornly remains above the Fed’s target and the labor market displays remarkable resilience, the possibility of a rate hike during the July meeting cannot be dismissed outright. However, the outlook beyond that point remains shrouded in uncertainty, casting doubt on the likelihood and magnitude of future rate hikes.

From a relative monetary policy standpoint, the prevailing consensus suggests that central banks outside the United States continue their ongoing efforts to tighten monetary conditions, placing additional pressure on the US dollar.

Compounding this, the market buzzes with hopes of increased stimulus measures from China, with experts predicting a positive spillover effect on Asian economies as capital flows increase.

Despite the prevailing uncertainty, the sharp decline of the US dollar is a clear reflection of overall market sentiment and the perceived shifts in the global monetary landscape.

In these tumultuous times, it is imperative for investors to closely monitor central bank actions and their potential ripple effects on currency markets.

Looking Ahead for the Dollar

As the US dollar treads uncertain waters, market participants face the challenge of navigating through these turbulent times. Staying attuned to ever-changing developments and closely observing central bank decisions will undoubtedly prove crucial in safeguarding investments and capitalizing on emerging opportunities.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.