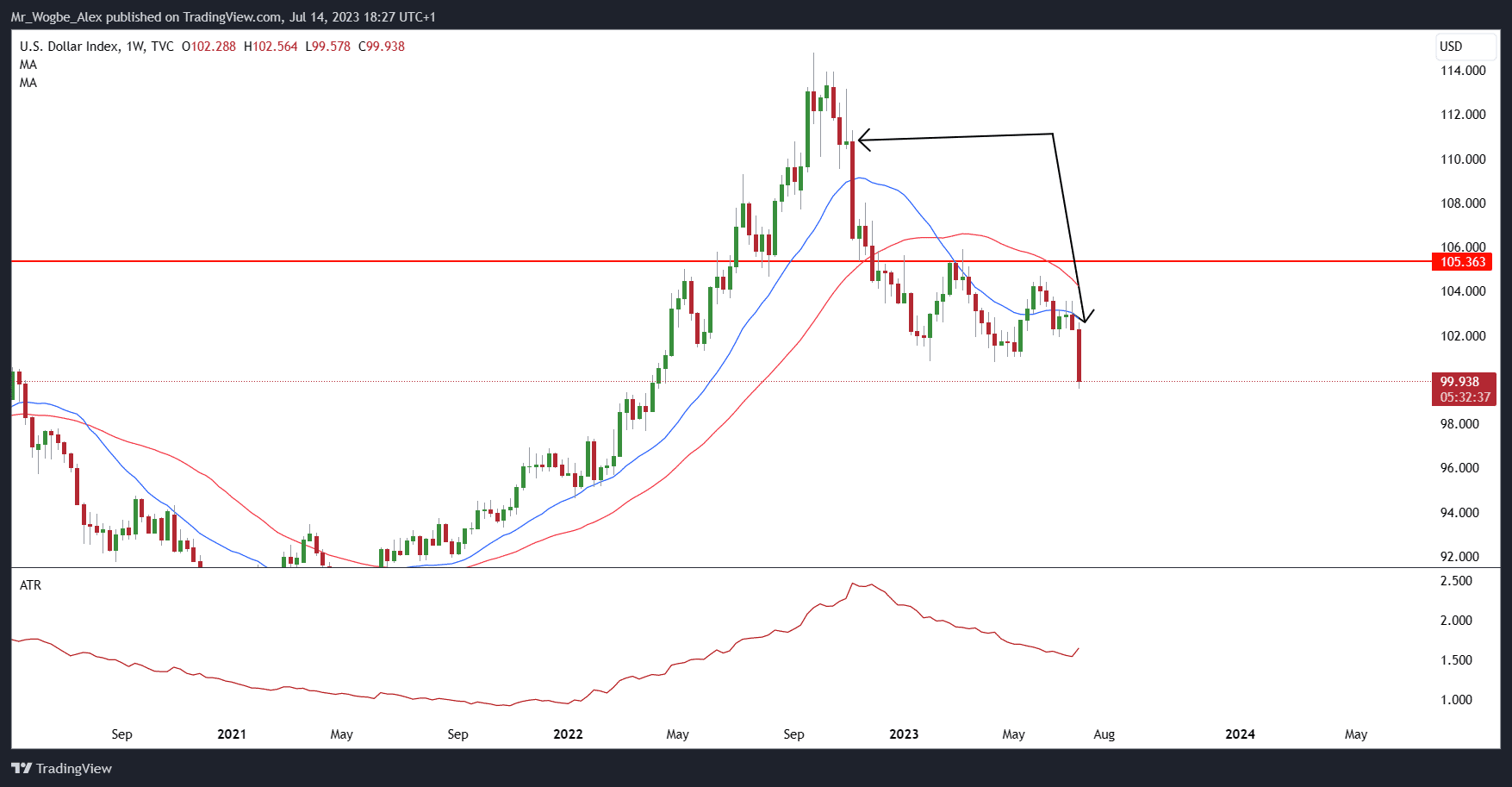

In a bid to regain some lost ground, the US dollar showed signs of recovery on Friday after taking a beating in the past few days. Investors took the opportunity to consolidate their losses before heading into the weekend. However, despite this modest rebound, the dollar’s overall trajectory remains tilted downward, mainly due to the Federal Reserve nearing the end of its rate hike cycle and facing softening inflation.

US Dollar Index: Worst Weekly Performance Since November

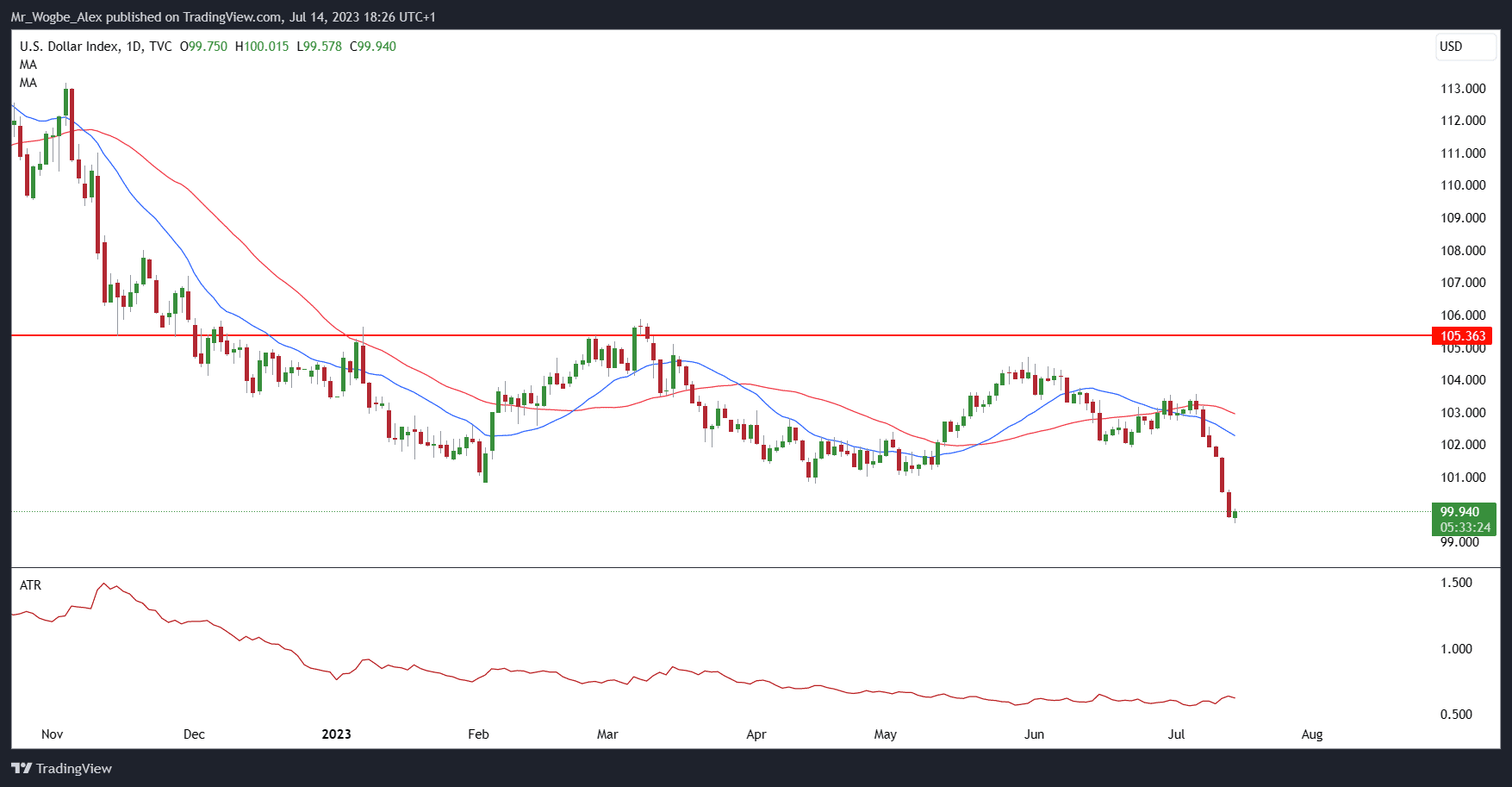

The dollar index, which serves as a gauge for the currency’s performance against a basket of six major counterparts, managed to inch up 0.16% to 99.94. Earlier, it had touched a 15-month low of 99.57, signaling the dollar’s vulnerability.

Nevertheless, the index recorded a noteworthy decline of 2.27% for the week, marking its most substantial weekly drop since November 2022.

According to Reuters, recent data revealed that US producer prices experienced minimal growth in June. Furthermore, the annual increase in producer inflation was the smallest witnessed in nearly three years.

source: tradingeconomics.com

These figures came on the heels of modest consumer price increases reported the day prior. The combination of lackluster price growth and the Federal Reserve’s cautious stance on inflation has put downward pressure on the dollar.

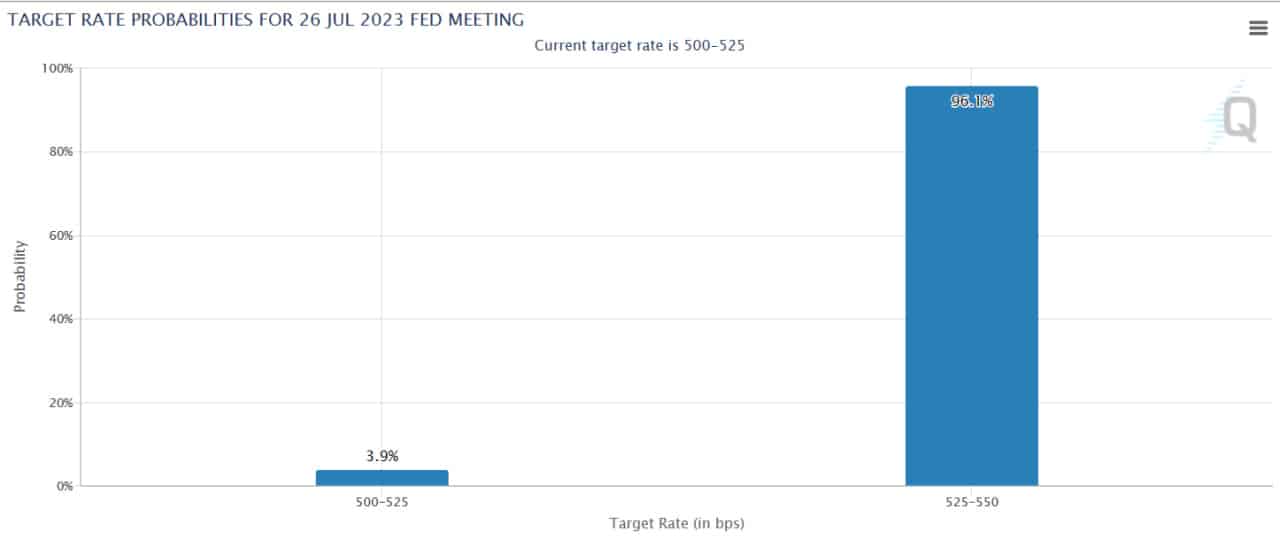

Traders Price in a 96% Chance of a 25-Bp Rate Hike by the Fed

Despite the dollar’s struggles, market expectations still suggest a 96.1% likelihood of a 25 basis point hike from the Federal Reserve later this month, according to CME’s FedWatch tool. However, investors seem skeptical about the prospects of any additional rate hikes for the rest of the year.

This sentiment is reflected in the doubling of short positions between June and July 7, as reported by the Commodity Futures Trading Commission. Although these positions have increased, they remain significantly below the levels observed in 2021.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.