The US dollar took a significant hit on Wednesday, tumbling to a two-month low. This sudden decline comes as traders brace themselves for the release of June’s US consumer price inflation data, with expectations of a slowdown in the figures. As a result, the currency market has been sent into a frenzy, leading to a surge in stock prices and a drop in borrowing costs within the bond market for the third consecutive day.

Economists surveyed by Reuters have painted a cautious picture, predicting a considerable decrease in June’s consumer price inflation to 3.1% from the previous month’s 4%. Should these projections hold true, it could potentially sway the Federal Reserve to reevaluate its current trajectory of aggressive interest rate hikes. Market observers suggest that such a shift in monetary policy may occur as early as this month or in the near future.

Dollar Records Longest Losing Streak Since March as Yen and Pound Extend Gains

Notably, the currency market has been highly dynamic throughout this period. The US dollar Index has experienced its longest losing streak since March, leaving traders and investors grappling with the repercussions.

On the other hand, the Japanese yen has managed to reclaim its strength, surging toward the 139 mark against the dollar for the first time in a month.

Further supporting the yen’s upward trajectory is the decline in US Treasury yields and the growing anticipation of changes to the Bank of Japan’s ultra-low interest-rate policy at its upcoming meeting. These factors have contributed to the yen reaching a one-month high against the dollar.

Meanwhile, the British pound has reached a 15-month high of 1.2969, bolstered by the Bank of England’s statement affirming the UK’s ability to navigate higher interest rates successfully.

Analysts Closely Monitoring CPI

Market analysts have also been closely monitoring the core inflation rate, which is expected to decline for the third consecutive month, dropping to 5% from the previous figure of 5.3%.

source: tradingeconomics.com

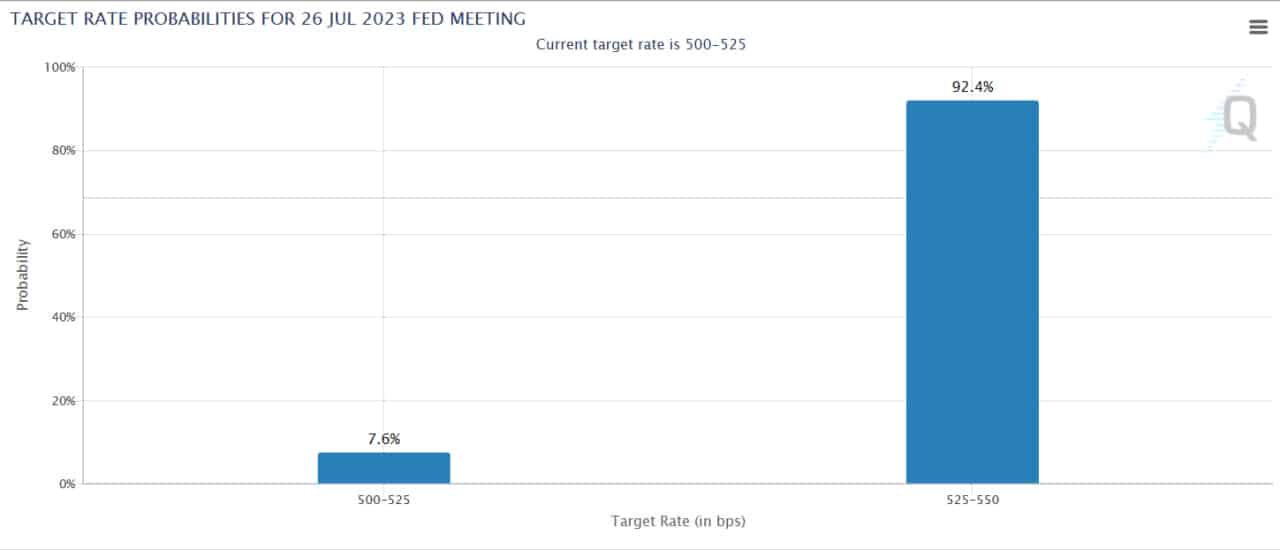

However, it is worth noting that even with this anticipated decline, the core rate still exceeds the Federal Reserve’s targeted 2% inflation rate by more than double. Although the market currently reflects a 92.4% probability of a 25-basis-point Fed hike later this month, there remains a sense of doubt surrounding any future rate increases.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.