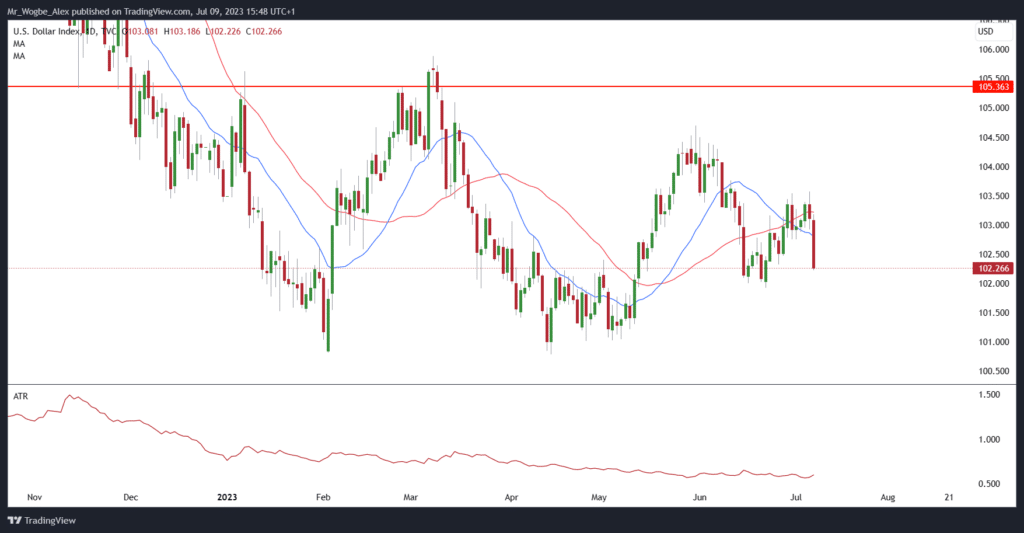

The U.S. dollar tumbled on Friday, falling to its lowest point since June 22, following the release of government data revealing a slowdown in job growth. This unexpected twist has given investors a breather, easing worries about the Federal Reserve’s plans for interest rate hikes.

In a surprise turn of events, the official U.S. nonfarm payrolls report showed that employers added 209,000 new hires in June, falling short of economists’ expectations. Furthermore, May’s figures took a tumble, with a revision down by 33,000 to 306,000.

source: tradingeconomics.com

However, it wasn’t all doom and gloom, as the unemployment rate managed to hold its ground, dipping from 3.7% in May to 3.6% in June. Additionally, average hourly earnings remained perky with a 0.4% rise, maintaining the same stride as May.

Fed Rate Hike Forecasts: Tweaked but Still on Track

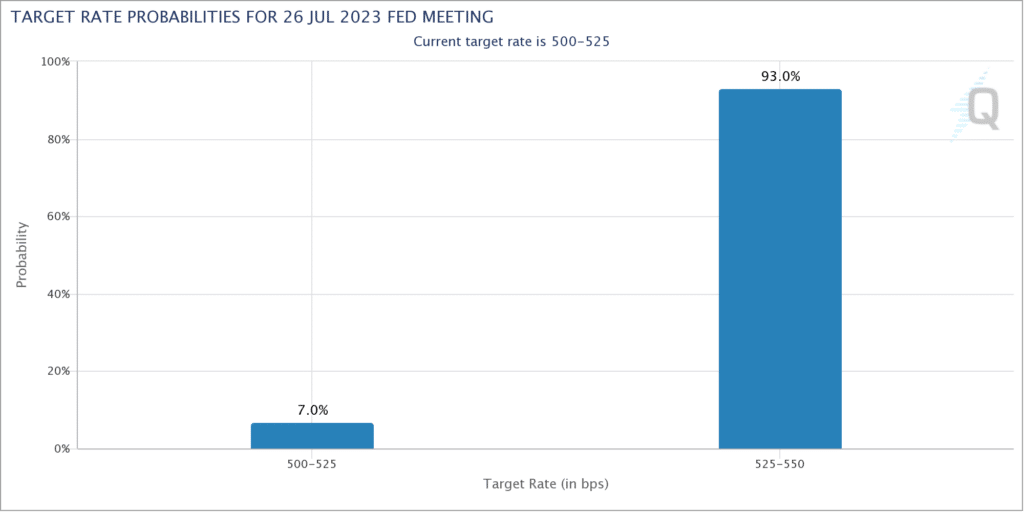

While traders are betting their hats on a more than 90% chance of a quarter-percentage-point rate hike by the Fed in late July, expectations for another hike in September took a slight stumble, according to the ever-watchful CME Group’s FedWatch tool.

Dollar Drops, Yen Pops

The dollar stumbled and fumbled after the labor market data was revealed, leaving some traders wondering if the Fed might consider an earlier rate cut than previously anticipated. As a result, the yen swooped in, jumping sharply against the dollar. The dollar index took a punch, falling 0.82%.

Despite the temporary respite from Fed rate hike concerns, investors remain cautious as they cast their gaze toward the horizon. The week ahead promises a double serving of economic delicacies, with key U.S. inflation readings set to tantalize the market’s taste buds alongside the grand opening of the second-quarter earnings season.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.