Ethereum ETH) Current Statistics

The current price: $1,860.00

Market Capitalization: $223,570,029,214

Trading Volume: $4,671,653,865

Major supply zones: $3,000, $3,500, $4,000

Major demand zones: $1,700, $1,500, $1,000

Ethereum (ETH) Price Analysis July 10, 2023

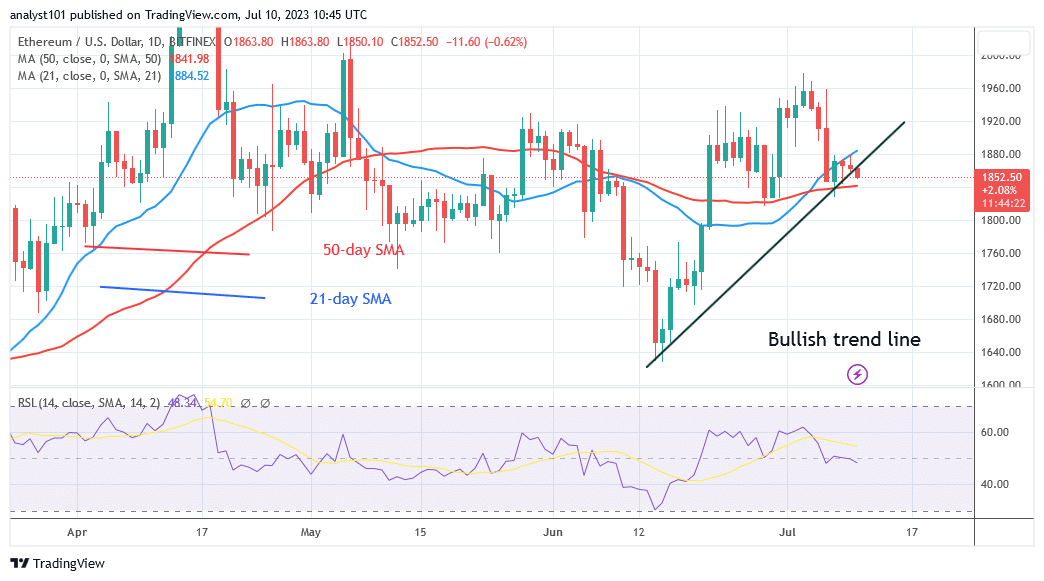

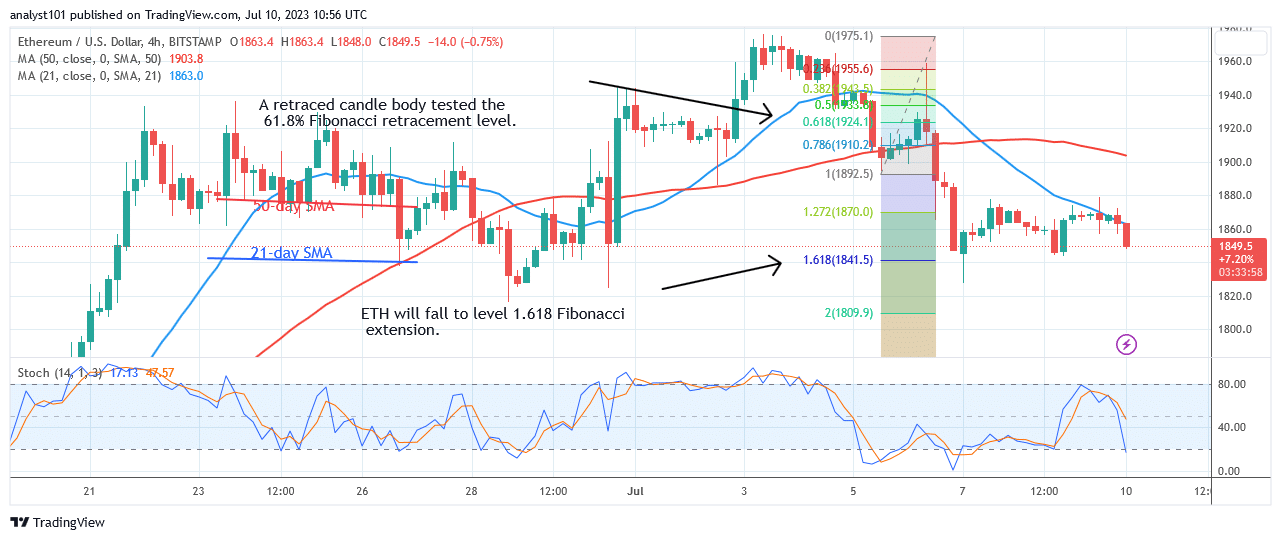

Ethereum (ETH) price pauses above $1,866.30 support, although the bears have repeatedly retested the existing barrier. The current level of support is located between the moving average lines. Ether is oscillating to break through the moving average lines.

If the altcoin falls below the 50-day SMA, Ether will begin selling pressure. Ether will plummet to a low of $1,725 on the downside. If the bulls break through the 21-day SMA, it will mark the start of a new upswing.

The market will return to the former highs of $1,950 and $2,000. Meanwhile, Ether is still caught between the moving average lines.

ETH Technical Indicators Reading

Ether has dropped below the Relative Strength Index level of 48 for period 14. The coin is in a bearish trend zone and is likely to fall to its prior low. The price bars are located between the moving average lines, showing that the coin is moving within its range.

The coin is in a bearish trend below the daily Stochastic threshold of 40.

Conclusion

The most important altcoin is currently trading between the moving average line but pauses above $1,866.30. The coin is prone to returning to past highs or lows. However, because Ether is trading in a bearish trend zone, the bears have an advantage over the bulls.

You can purchase crypto coins here. Buy LBLOCK

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.