In a continuation of its six-week winning streak, the U.S. dollar made modest gains on Tuesday, bolstered by expectations of pivotal economic data set to shape decisions regarding the Federal Reserve’s interest rates.

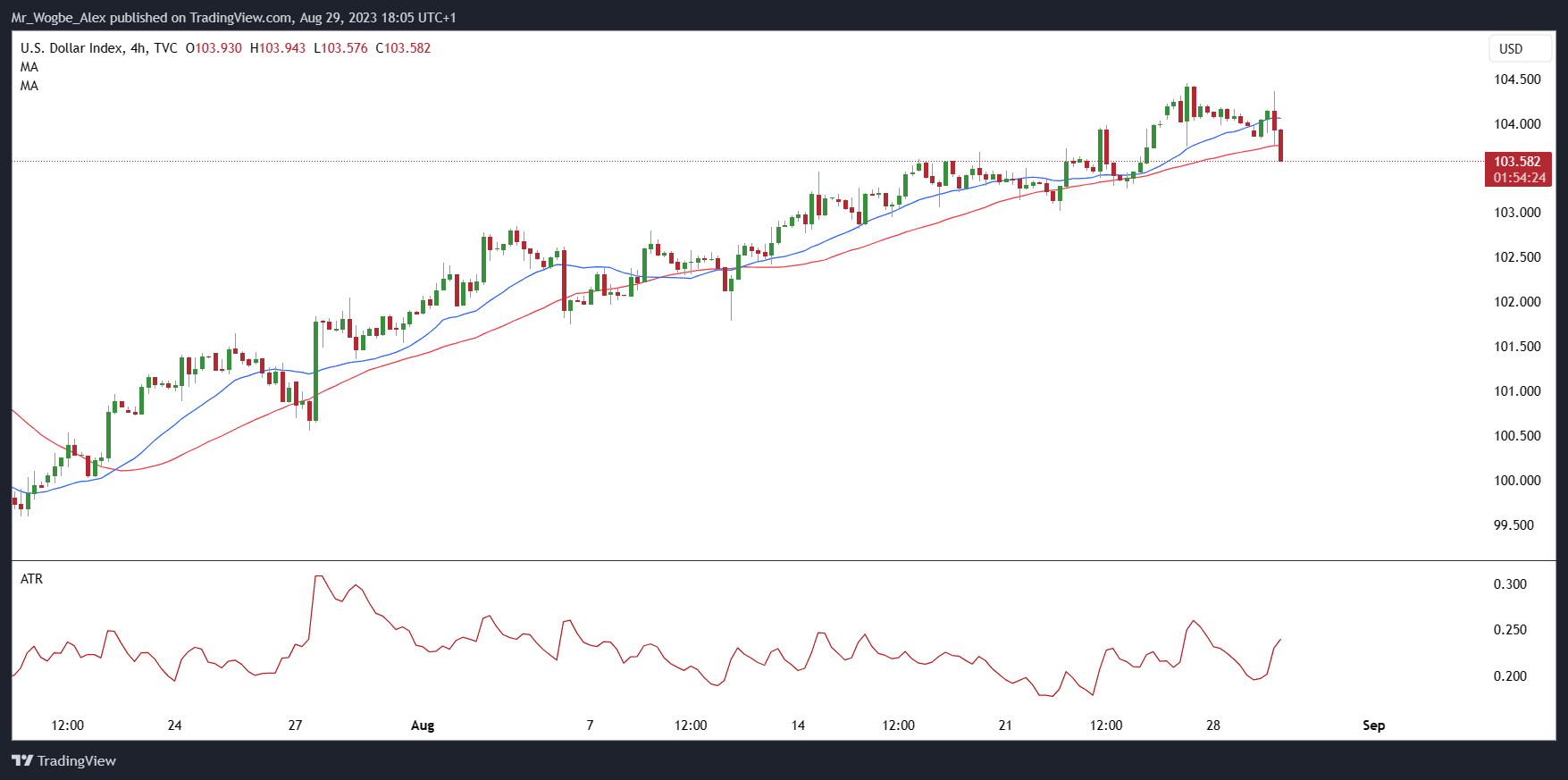

The dollar index, a gauge of the dollar against a basket of global currencies, recorded a 0.44% uptick earlier today to reach 104.35, following a minor setback of 0.22% on Monday. This month, the index has surged by over 2%, riding on the back of robust U.S. economic indicators, which have prompted speculation that the Federal Reserve might lean toward maintaining higher rates for an extended period.

Federal Reserve Chairman Jerome Powell hinted at this prospect last Friday at the Jackson Hole Symposium, alluding to the potential requirement for further rate hikes to rein in persistently elevated inflation levels. However, Powell also emphasized the central bank’s intention to exercise prudent and cautious decision-making in upcoming meetings, leaving room for an element of uncertainty.

Dollar Hangs in the Balance Ahead of Market-Moving Economic Data this Week

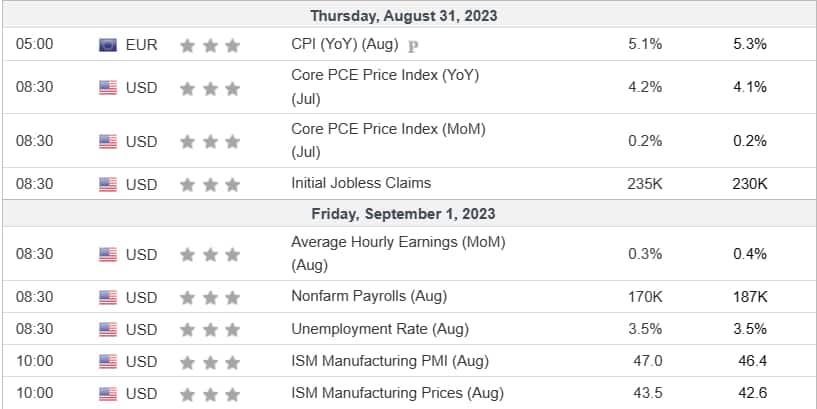

Market participants are eagerly anticipating the unveiling of crucial economic metrics this week, including personal consumption expenditure data, the Federal Reserve’s preferred measure of inflation, scheduled for release on Thursday. Additionally, nonfarm payroll data, slated for publication on Friday, promises to offer deeper insights into the state of the U.S. economy and the central bank’s policy trajectory.

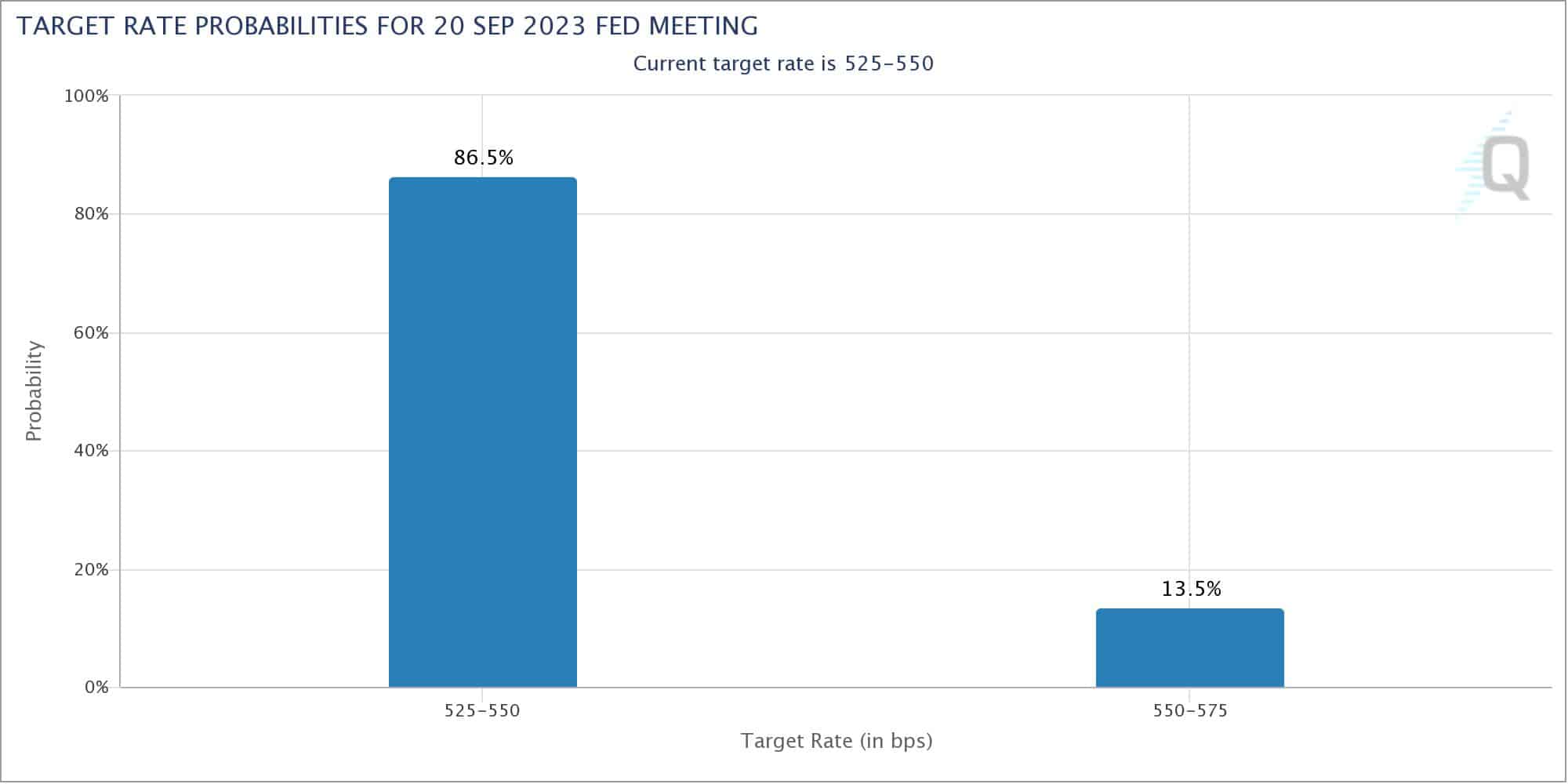

According to the CME FedWatch tool, market sentiment currently factors in an 86.5% probability of the Federal Reserve maintaining rates in the coming month. At the same time, the odds of an interest rate hike by November have also surged, hovering around 54% at the time of this report.

As investors gear up for the unveiling of critical economic data, the trajectory of the U.S. dollar remains an area of keen interest. Its recent ascent, buoyed by strong economic indicators and nuanced statements from the Federal Reserve, has set the stage for an eventful week in the financial markets.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.