In the world of currency markets, the U.S. dollar stands tall, poised for a remarkable sixth consecutive week of ascension. Last week, all eyes were on Federal Reserve Chair Jerome Powell, who delivered a keynote speech at the Jackson Hole, Wyoming, gathering.

Powell’s words resonated deeply, hinting at the potential necessity of forthcoming interest rate hikes to combat persistent inflation. He underscored the Fed’s commitment to a measured and cautious approach to maintaining economic equilibrium.

Powell’s address carried a dual message: a call for prudence and a subtle suggestion that the current interest rates might not be robust enough to secure the coveted 2% inflation target.

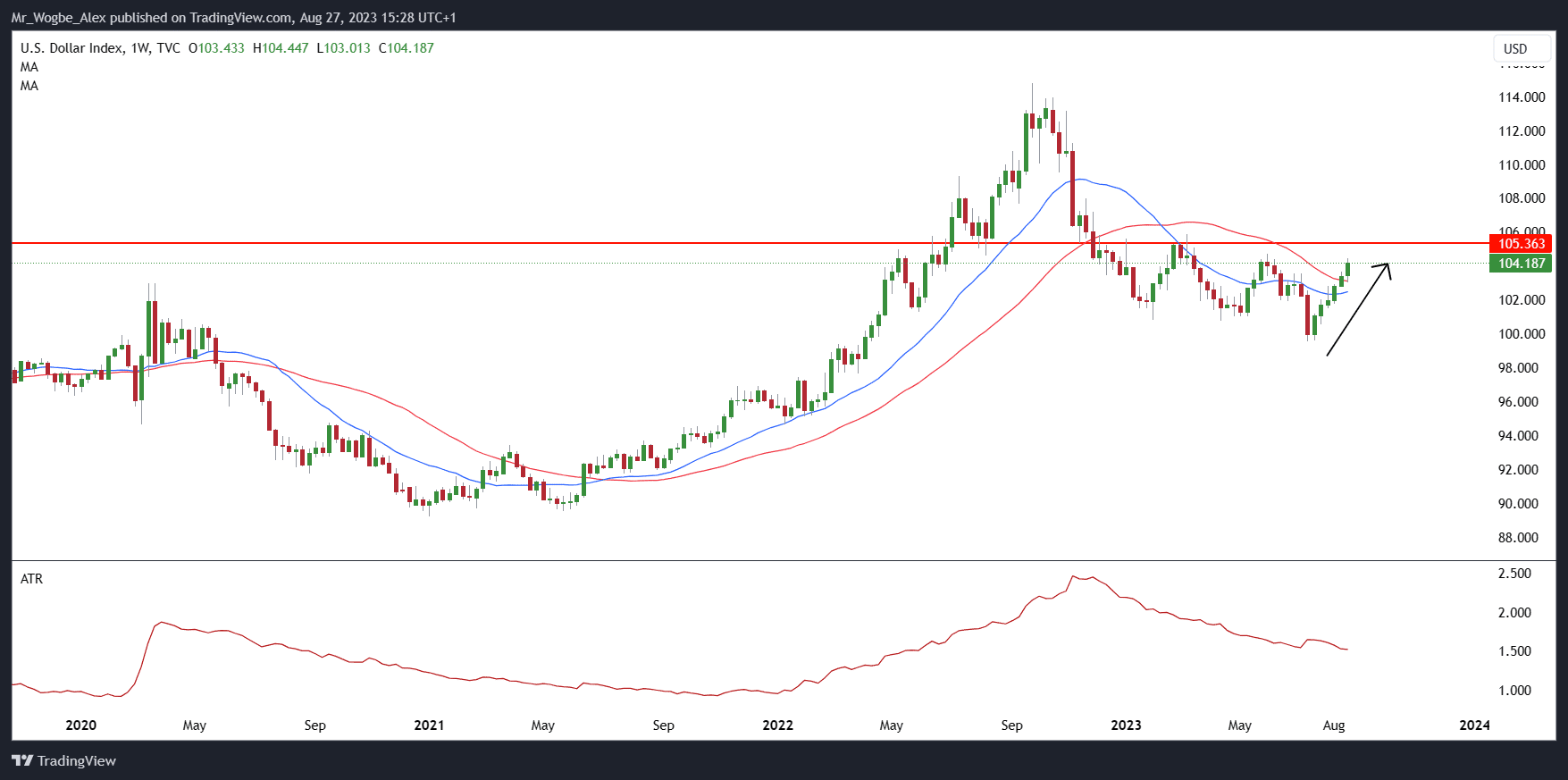

U.S. Dollar Index Peaks at 12-Week High

The Dollar Index, a yardstick gauging the dollar’s prowess against six major global currencies, closed the week at $104.18. Earlier on Friday, the single currency peaked at a near three-month high of 104.44. This uptrend was propelled by an underlying vigor in the U.S. economy, resulting in a noteworthy 0.73% uptick over the week.

Market sentiment now leans towards a greater than 50% probability of a rate hike either in November or December, as deduced from interest rate futures.

The Euro and Sterling Flopped

Conversely, due to feeble business activity data, it’s been a testing week for the euro and sterling. The U.S. data served to douse enthusiasm for potential rate hikes in both the eurozone and the U.K.

The euro, in particular, grappled with escalating concerns among European Central Bank (ECB) policymakers regarding dwindling growth prospects. Informal channels have hinted at the ECB considering a temporary pause in rate hikes due to mounting uncertainties.

August saw the German business climate index plummet beyond expectations for the fourth consecutive month. This trend is a harbinger of anxieties that Europe’s economic powerhouse could be teetering on the brink of another recession.

As it stands, the euro is in a tight spot, trading at $1.0794, reflecting a 0.66% slump over the week. Sterling has faced a similarly challenging scenario, resting at $1.2577, marking a 1.26% decline for the week and etching a new bottom since early June.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.