The euro dropped to a two-month low on Friday amid rising doubts about the European Central Bank’s (ECB) ability to raise interest rates in the near future. The ECB is facing growing pressure from slowing growth and rising inflation in the eurozone, which could force it to pause or even reverse its monetary tightening cycle.

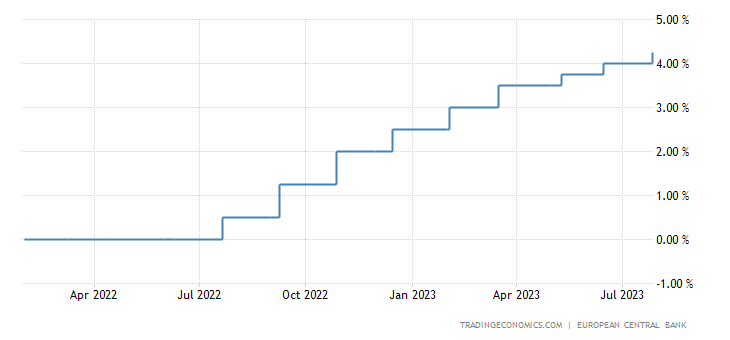

According to Reuters, eight sources with direct knowledge of the ECB’s discussions said that some policymakers are increasingly concerned about the economic outlook and are leaning towards a rate hike pause. The ECB has raised its key interest rate twice this year, from -0.5% to -0.25%, but has signaled that it could hike again before the end of the year.

However, the latest data from the eurozone has been disappointing, showing that business activity contracted for the fourth consecutive month in August. Germany, the bloc’s largest economy, is especially vulnerable to the global slowdown and supply chain disruptions. Some analysts fear that Germany could slip into its second recession in a year.

All Eyes Are on the Jackson Hole Economic Policy Symposium

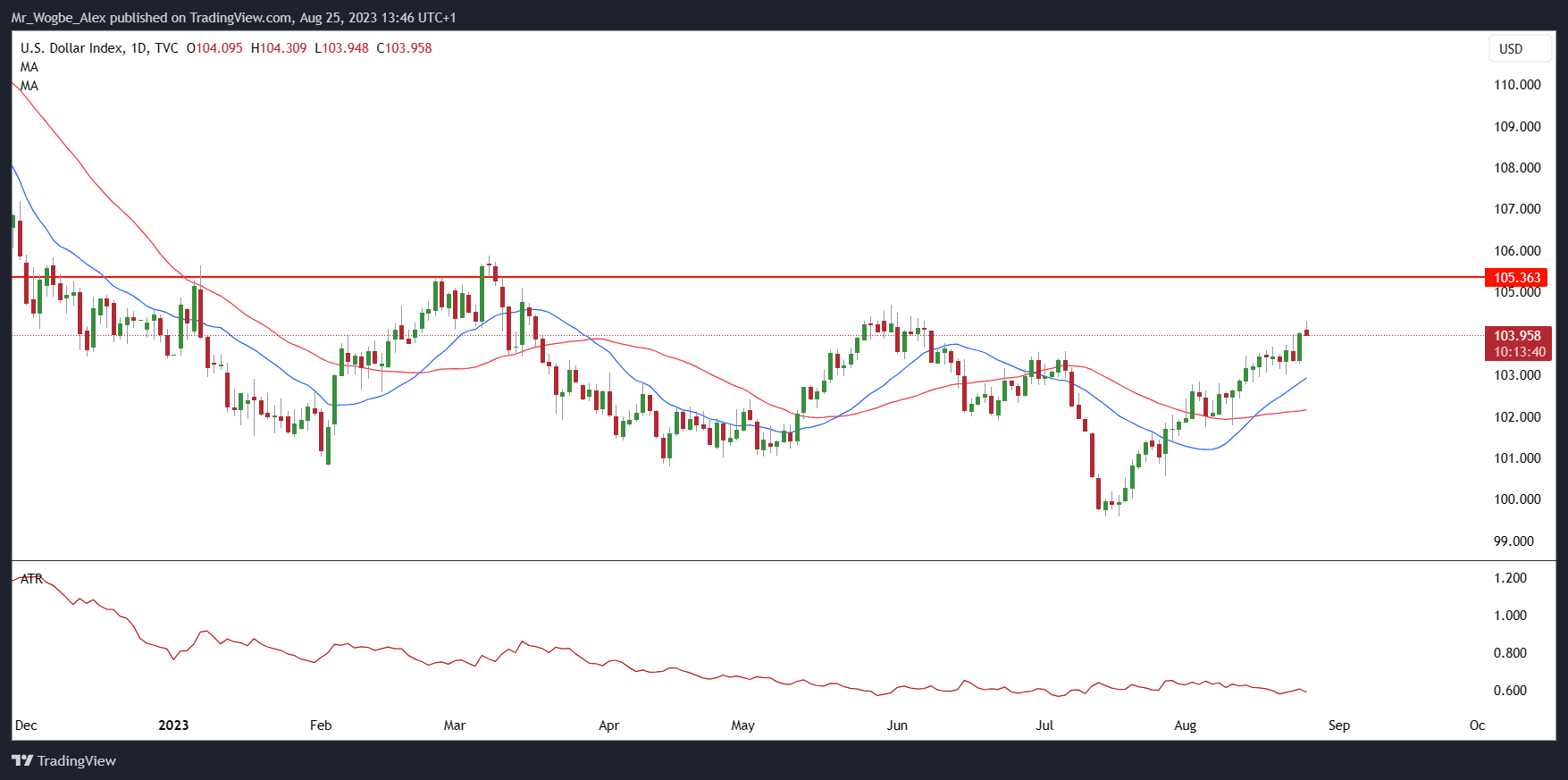

The U.S. dollar index (DXY), which measures the greenback against six other currencies, rose to its highest level since early June on Friday before easing slightly ahead of a speech by Federal Reserve Chair Jerome Powell. As of the time of writing, the DXY trades at 103.69 after peaking at 104.30 earlier today.

Powell is expected to speak at the Jackson Hole Economic Policy Symposium later today, where he could provide clues about the Fed’s plans over the coming months. ECB Chair Christine Lagarde is also expected to speak at the same event later in the day.

Divergence Between Fed and ECB Weighing Heavy on the Euro

The divergence between the ECB and the Fed has weighed on the euro, which fell to around $1.0765 earlier today, its lowest since mid-June. At press time, the euro was down 0.05% on the day against the dollar.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.